To properly manage a 401(k) loan, you must first understand the terms of the loan. A loan term is a legally binding contract that describes the agreement between you and your loan provider. This is the timetable agreed upon at the inception of the loan. It will specify when payments are due and the amount to be paid. It is essential to understand this schedule to avoid late payments or default, which could lead to severe consequences. The interest rate is the cost of borrowing. This rate is typically expressed as a percentage of the loan amount and is included in your monthly payments. Before deciding to pay back your loan early, it's vital to check if there are any prepayment penalties. Some 401(k) plans may charge a fee if you pay off your loan earlier than the scheduled term. Initiating the prepayment of your 401(k) loan starts with reaching out to your 401(k) plan administrator. This entity or individual is in the best position to guide you through the specifics of the prepayment process for your plan. By making contact with your administrator, you can gain information about how to structure additional payments or even pay off your entire loan prematurely. It's an essential first step to set your early repayment plan into motion. Next, request the total payoff amount for your loan. This amount is a critical piece of information that the plan administrator should provide. The payoff sum comprises the remaining principal you owe, in addition to the accrued interest up until the payoff date. Having a clear figure aids in effective financial planning, enabling you to prepare adequately for the prepayment. Once armed with the precise payoff amount, you're set to make the payment. This step is crucial, and accuracy is paramount. When making the payment, it's essential to confirm that it's correctly applied towards reducing the principal of your loan, which effectively brings down your outstanding balance. This ensures your prepayment is accurately reflected, putting you on the path to financial freedom. By paying back your 401(k) loan early, you can prevent loan default. A default can lead to severe tax implications because the IRS treats defaulted 401(k) loans as a distribution, subject to income tax and potentially an additional 10% early withdrawal penalty if you're under 59 ½. When you take a loan from your 401(k), those funds are no longer invested in the market, potentially missing out on significant growth. Paying your loan back early allows these funds to return to the market sooner, giving them more time to potentially grow. Debt can be a significant source of financial stress. Paying off a 401(k) loan early can provide relief from this stress, allowing you to focus on other aspects of your financial plan. While it's beneficial to pay off your loan early, doing so might strain your cash flow. Make sure that paying off your 401(k) loan won't leave you short of cash for other important expenses or emergency savings. As mentioned before, some 401(k) plans might have prepayment penalties. Ensure you understand these potential costs before deciding to pay off your loan early. Consider your broader financial goals before deciding to repay your 401(k) loan early. It might not be the best move if it interferes with more pressing financial priorities, like paying off high-interest debt. If a 401(k) loan doesn't quite align with your financial needs or long-term plans, there are a handful of viable borrowing alternatives you may want to explore. These options include dipping into personal savings, securing a personal loan, or using a credit card. If you've been disciplined in setting money aside, utilizing your personal savings might be a reasonable route to take instead of resorting to a 401(k) loan. Using your own savings can be less hazardous, as it doesn't involve borrowing costs. However, it's imperative to strategize about how to replenish your savings after usage, ensuring you maintain a safety net for future needs. Personal loans are another viable option. Generally, these are unsecured loans, meaning they don't require any form of collateral. Interest rates associated with personal loans are usually more favorable compared to credit cards, albeit typically higher than those on 401(k) loans. Personal loans provide flexibility in terms of usage and can be a fitting alternative depending on your specific financial circumstances. Credit cards, known for their convenience, serve as a swift source of funds. However, they come with a significant caveat - high-interest rates. Due to these rates, they might not be the ideal choice for borrowing considerable amounts or covering long-term financial needs. While credit cards provide immediacy, their associated costs need careful consideration before use. Navigating a 401(k) loan requires a thorough understanding of its terms, which include the payment schedule, interest rates, and potential prepayment penalties. An informed approach to early repayment can prevent defaults, allowing your 401(k) to grow and reducing financial stress. However, be mindful of the impact on your cash flow and current financial goals, as well as possible prepayment penalties. In weighing the option of a 401(k) loan, consider alternatives such as personal savings, personal loans, and credit cards. Each has its merits and drawbacks; your decision should align with your financial situation and long-term plan. In all, maintaining a keen eye on the balance of your immediate needs and long-term financial health is crucial. Decisions on 401(k) loans and their early repayment require careful deliberation, keeping the potential implications on your financial future in clear view.Understand the Terms of the Loan

Payment Schedule

Interest Rates

Prepayment Penalties

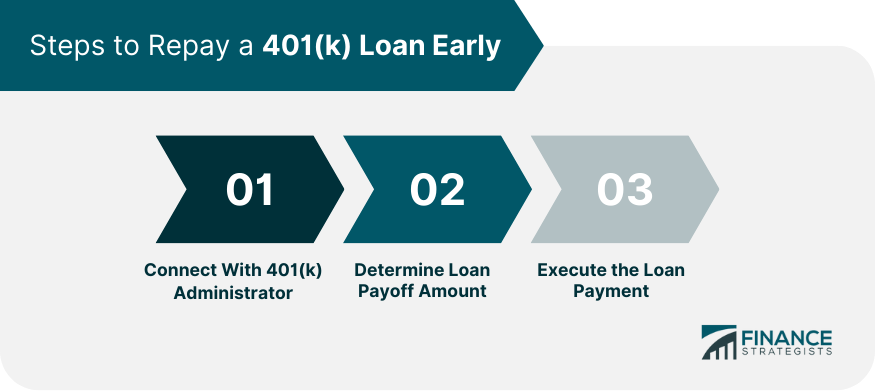

Steps to Repay a 401(k) Loan Early

Step 1: Connect With 401(k) Administrator

Step 2: Determine Loan Payoff Amount

Step 3: Execute the Loan Payment

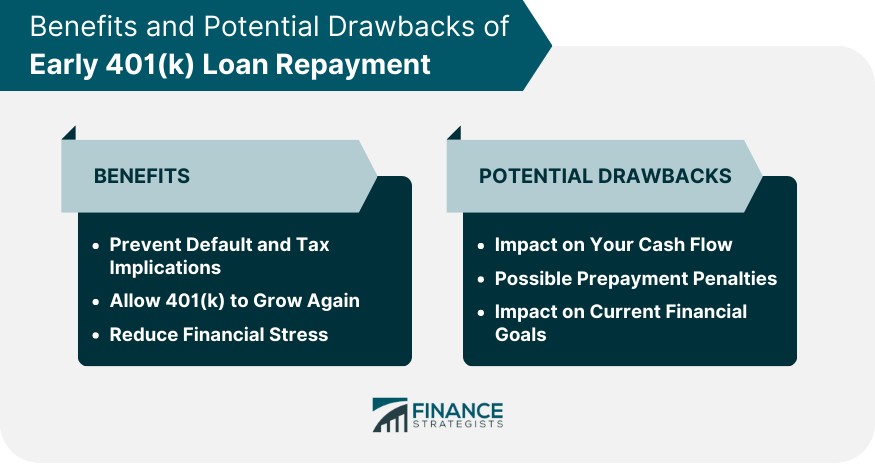

Benefits of Early 401(k) Loan Repayment

Prevent Default and Potential Tax Implications

Allow 401(k) to Grow Again

Reduce Financial Stress

Potential Drawbacks of Early 401(k) Loan Repayment

Impact on Your Cash Flow

Possible Prepayment Penalties

Impact on Current Financial Goals

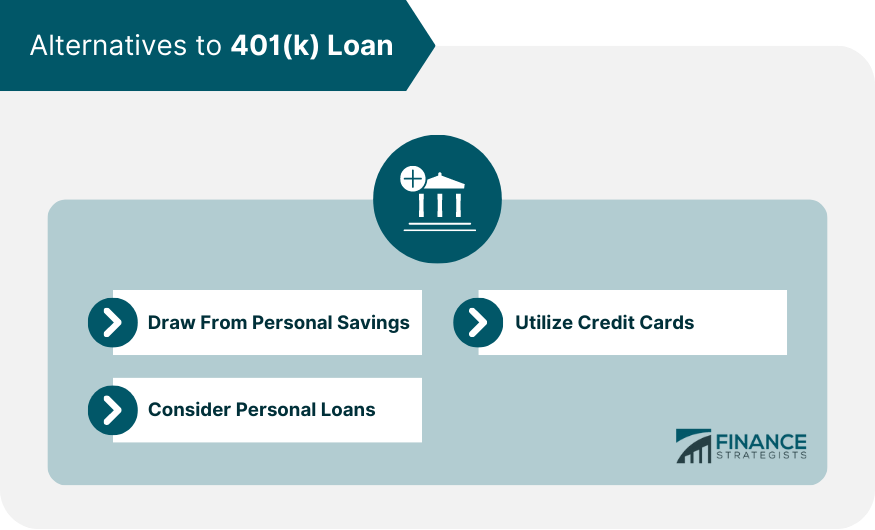

Alternatives to 401(k) Loan

Draw From Personal Savings

Consider Personal Loans

Utilize Credit Cards

Bottom Line

How to Pay Back 401(k) Loan Early FAQs

If you default on a 401(k) loan, the IRS treats the unpaid balance as a distribution, which is subject to income tax. If you're under 59 ½ years old, you may also have to pay an additional 10% early withdrawal penalty.

Some 401(k) plans might charge a prepayment penalty if you pay off your loan early. It's important to understand your specific plan's rules before deciding to make early repayments.

Yes. When you take a loan from your 401(k), those funds are not invested in the market. By paying back your loan early, these funds can return to the market sooner, potentially benefitting from growth over time.

While paying back your loan early can be beneficial, it might strain your cash flow. You should ensure that early repayment doesn't leave you short on cash for essential expenses or savings for emergencies.

Alternatives to a 401(k) loan include borrowing from personal savings, seeking a personal loan, or using a credit card. Each of these options has its own benefits and drawbacks, and the best choice will depend on your specific financial situation and needs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.