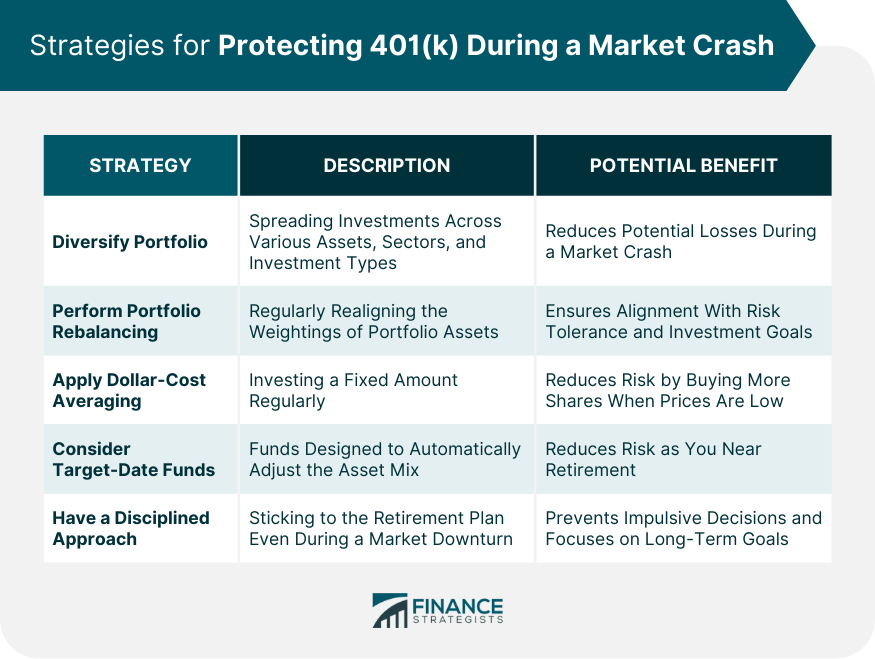

A 401(k) account is a type of retirement account that allows an employee to save and invest money for retirement on a tax-deferred basis. The impact of a stock market crash on a 401(k) depends on various factors, including the portfolio's level of diversification, the individual's investment horizon, and the recovery time of the market. Market crashes are not isolated events but are a part of market cycles that include periods of expansion and contraction. Over the long term, the market has shown a tendency to recover from downturns. However, in the short term, market crashes can significantly reduce the value of a 401(k). Protecting your 401(k) from a market crash involves using several strategies that can help reduce risk and position your retirement savings for growth over the long term. Diversification is a risk management technique that mixes a wide variety of investments within a portfolio. A diversified portfolio contains a mix of distinct asset types and investment vehicles in an attempt to limit exposure to any single asset or risk. The rationale behind this technique contends that a portfolio constructed of different kinds of investments will, on average, yield higher returns and pose a lower risk than any individual investment found within the portfolio. In terms of a 401(k), diversification means spreading your contributions among different types of investments, such as stocks, bonds, and other assets like real estate or commodities. The exact mix of assets will depend on your risk tolerance and investment horizon. Asset allocation refers to the strategy of dividing your investments among different asset categories, such as stocks, bonds, and cash. The purpose of asset allocation is to reduce risk by diversifying your portfolio. Different sectors of the economy perform differently under various market conditions. By investing in a diverse set of sectors, you can reduce the risk that a single underperforming sector will significantly impact your overall portfolio. Bonds play a crucial role in a diversified portfolio. They tend to be less volatile than stocks, providing a stabilizing influence when the stock market is performing poorly. Bonds are considered a safer investment than stocks. They provide regular interest payments and return the principal when they mature. When the stock market is volatile, bonds can help buffer the losses in your portfolio. Rebalancing is the process of realigning the weightings of your portfolio of assets. Rebalancing involves periodically buying or selling assets in your portfolio to maintain your original or desired level of asset allocation. Market movements can cause your portfolio's asset allocation to drift from its target. For instance, if stocks perform well and bonds perform poorly, your portfolio may end up with a higher proportion of stocks than you initially intended. Regular rebalancing helps ensure your portfolio stays aligned with your risk tolerance and investment goals. Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the price of the investment. This strategy can be particularly useful during times of market volatility. By investing regularly over time, you buy more shares when prices are low and fewer shares when prices are high. This strategy can lower the average cost per share over time, potentially reducing the risk and providing a higher return on your investment. Target-date funds, also known as lifecycle funds, are a type of mutual fund designed to provide a simplified investment strategy through automatic asset allocation. A target-date fund is structured to address a projected retirement date, and its asset allocation becomes more conservative as the target date approaches. They provide diversification and automatically adjust the asset mix, reducing the risk as you near retirement. A disciplined investment approach is essential during a market crash. It's easy to let emotions drive investment decisions during volatile markets, but this can lead to buying high and selling low. Sticking to your retirement plan means staying the course, even when the market is down. This approach involves focusing on your long-term goals rather than reacting to short-term market fluctuations. An emergency fund is a stash of money set aside to cover the financial surprises life throws your way. These unexpected events can be stressful and costly. An emergency fund provides a financial safety net and allows you to handle unexpected expenses without having to withdraw from your 401(k) or other investments. It provides peace of mind knowing that you have a backup plan in case of unexpected expenses or income loss. Withdrawing from your 401(k) during a market crash not only locks in your losses, but you'll also miss out on the potential for rebound growth when the market recovers. Having an emergency fund can prevent this scenario. Building an emergency fund involves setting aside a portion of your income regularly until you have enough to cover several months' worth of living expenses. A good rule of thumb is to aim for an emergency fund that could cover three to six months' worth of expenses. This fund should be kept in a readily accessible account, such as a high-yield savings account. A market crash can cause a lot of stress and anxiety. It's important to manage these emotions and maintain a long-term perspective. Market crashes can trigger strong emotional responses. Feelings of fear and panic can lead to impulsive decisions, such as selling investments at a low point. It's important to remember that market crashes are a normal part of investing. The markets have historically recovered from downturns. Maintaining a long-term perspective can help manage the stress and emotions associated with market volatility. Even during a market crash, it's important to stay focused on your long-term financial goals. Your 401(k) is meant to fund your retirement, which might be several decades away. Remember, investing is a marathon, not a sprint. It's about the overall journey, not the short-term fluctuations. By staying focused on your long-term goals, you can make more rational and effective decisions. While a stock market crash can significantly impact your 401(k), understanding the cycle of market volatility, maintaining a diversified portfolio, and adhering to strategies like portfolio rebalancing, dollar-cost averaging, and disciplined investment can mitigate risks. Using tools like target-date funds can provide automatic asset allocation adjustment, reducing risk as you approach retirement. Additionally, an emergency fund serves as a financial cushion against unexpected expenses, protecting your 401(k) from premature withdrawals during a market downturn. Professional financial advice can also be beneficial, providing personalized guidance based on your unique situation and goals. Lastly, managing the psychological impacts of market crashes is essential to prevent impulsive decisions and stay focused on long-term goals. Remember, your 401(k) is a long-term investment geared towards securing a comfortable retirement. Do not hesitate to seek professional retirement planning services to navigate these complexities and secure your financial future.Understanding the Risk of Stock Market Crashes on 401(k)

Strategies for Protecting 401(k) During a Market Crash

Diversify Portfolio

Asset Allocation in Different Sectors

Bonds and Their Role in a Diversified Portfolio

Perform Portfolio Rebalancing

Apply Dollar-Cost Averaging

Consider Target-Date Funds

Have a Disciplined Approach

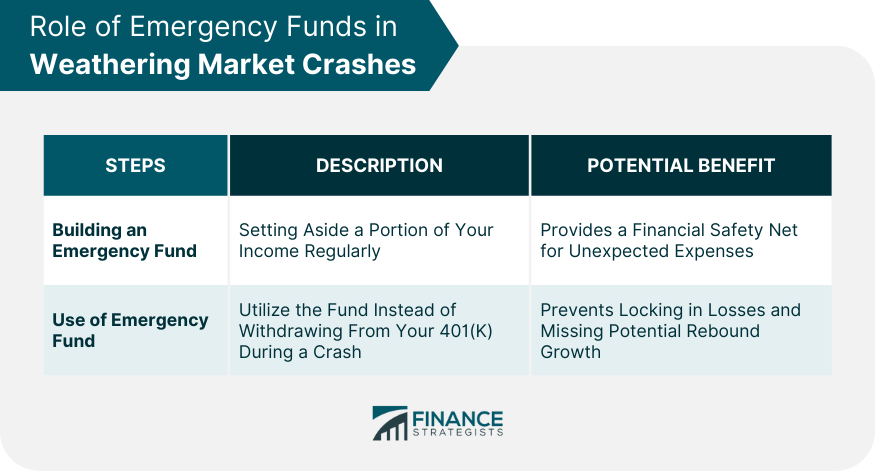

Role of Emergency Funds in Weathering Market Crashes

How an Emergency Fund Can Provide Financial Stability

Building an Emergency Fund: Tips and Tricks

Psychological Aspects of Dealing With a Market Crash

Managing the Stress and Emotions

Staying Focused on Long-Term Financial Goals

Bottom Line

How to Protect Your 401(k) During a Stock Market Crash FAQs

Diversification helps mitigate risk by spreading investments across various assets, sectors, and investment types, reducing potential losses.

Regular portfolio rebalancing ensures your asset allocation aligns with your risk tolerance and investment goals, which can mitigate the impact of a market crash.

Dollar-cost averaging involves investing a fixed amount regularly, allowing you to buy more shares when prices are low and fewer when prices are high, which can reduce risk.

An emergency fund provides a financial safety net for unexpected expenses, preventing premature withdrawal from your 401(k), which could lock in losses during a market crash.

If you're feeling overwhelmed, unsure about retirement planning, or facing a significant life change such as a new job or a growing family, it might be the right time to seek professional advice. A financial advisor can provide clarity, guidance, and personalized advice based on your unique financial situation and goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.