Rolling over a 401(k) to a Gold IRA is a process that offers the potential for diversification and protection against economic volatility. Start by understanding the specifics of your current 401(k) plan and checking if it allows for such rollovers. Next, select a reputable Gold IRA provider to guide you through the process. Then, initiate the rollover process, which ideally should be a direct trustee-to-trustee transfer to avoid tax penalties. Once funds are in the new Gold IRA, purchase IRS-approved gold or other precious metals. Finally, arrange for your gold to be stored in an IRS-approved depository. Always consult with a financial advisor before making any substantial changes to your retirement planning.

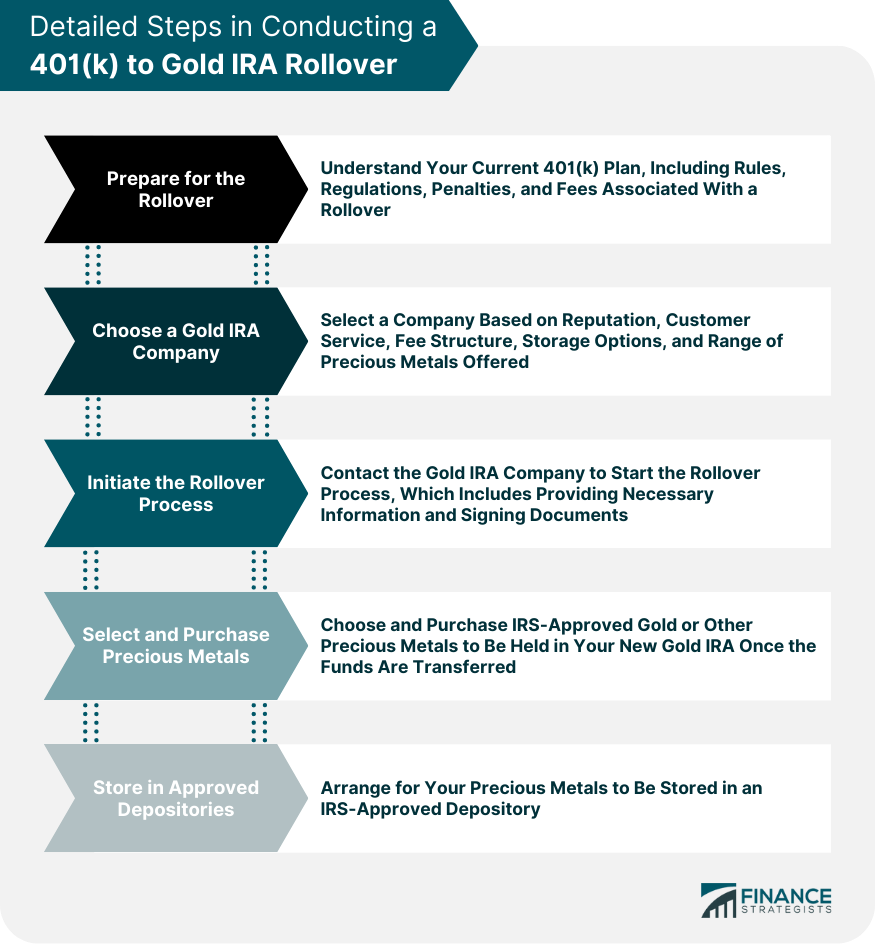

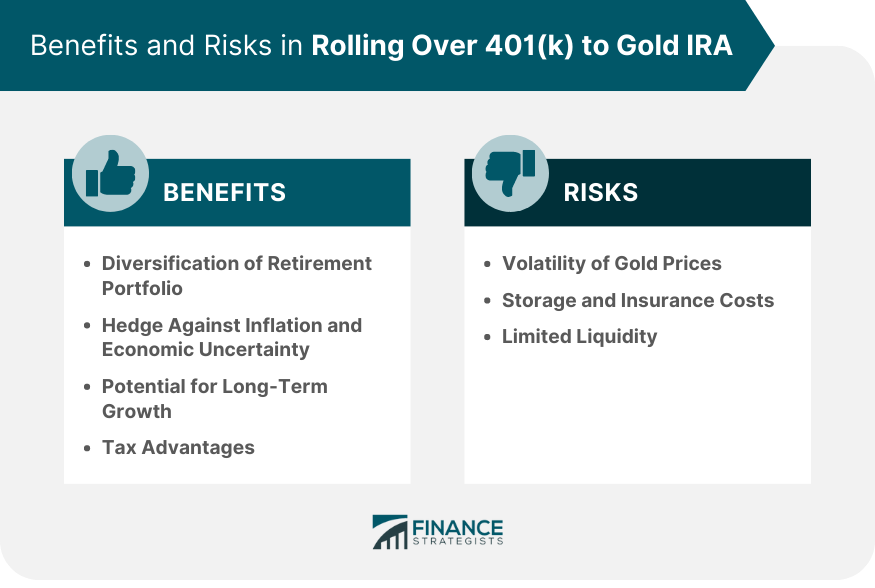

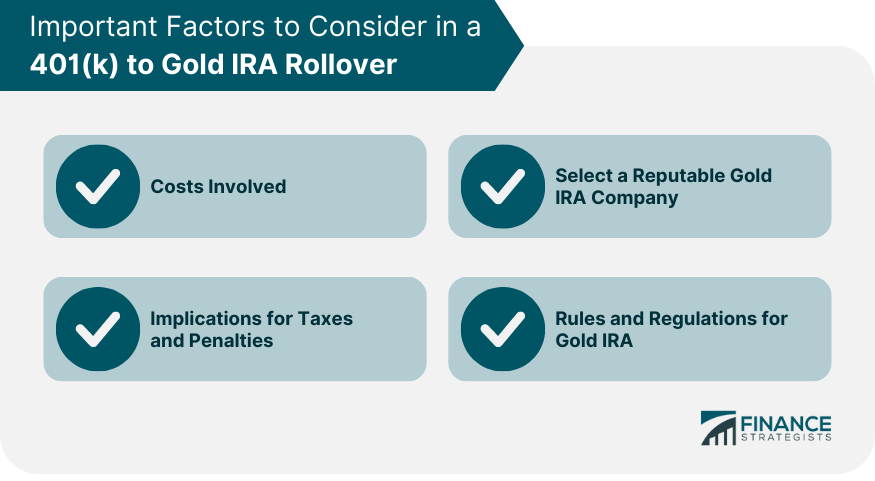

The main purpose of a 401(k) to Gold IRA rollover is to diversify one’s retirement portfolio beyond traditional stocks, bonds, and mutual funds. Precious metals like gold have inherent value that can provide a safety net against economic instability and inflation. It offers a balance in a portfolio, hedging against market volatility. The first step in initiating a rollover is to understand your current 401(k) plan thoroughly. Check the plan's rules and regulations, find out about any penalties or fees associated with a rollover, and decide whether it's the right move for you based on your financial goals and risk tolerance. Once you're ready to proceed, it's time to select a Gold IRA company. This decision should be based on factors such as the company's reputation, customer service, fee structure, storage options, and the range of precious metals they offer. Next, contact the Gold IRA company and initiate the rollover process. The company will typically handle most of the paperwork, but you'll need to provide some information and sign a few documents. After the funds from your 401(k) are transferred, you can start choosing the gold or other precious metals to be held in your new Gold IRA. The company you choose will likely have a selection of IRS-approved gold and other precious metals from which you can choose. Your precious metals will need to be stored in an IRS-approved depository. Most Gold IRA companies will handle the details of this for you, including arranging secure transportation of your precious metals to the depository. Rolling over a 401(k) to a Gold IRA allows for a more diverse retirement portfolio. Gold has a negative correlation with stocks and bonds, meaning it often performs well when traditional securities do not. Gold is renowned as a hedge against inflation and economic uncertainty. This means that in times of economic downturn, gold often retains or increases its value. Gold has a history of long-term growth and has outperformed many other asset classes over time. While past performance is no guarantee of future results, this track record suggests potential for growth over the long term. Gold IRAs come with several tax advantages, such as the ability to defer taxes on gains until retirement. Gold prices can be volatile, and this volatility can impact the value of your Gold IRA. However, it's crucial to remember that Gold IRAs are intended for long-term investing, and short-term price fluctuations should not significantly affect your long-term retirement strategy. Storing and insuring physical gold can be costly. These costs are typically passed on to the investor and can erode the returns on your investment over time. Unlike stocks and bonds, which can be sold and converted to cash relatively quickly, selling gold and other precious metals can take longer, limiting the liquidity of your investment. Before rolling over your 401(k) into a Gold IRA, be sure to fully understand all the costs involved. These may include set-up fees, storage and insurance fees, and transaction fees. The company you choose to manage your Gold IRA will have a significant impact on your investment. It's essential to research various companies thoroughly and choose a reputable, experienced company with transparent fee structures and excellent customer service. There may be tax implications and potential penalties associated with rolling over your 401(k) into a Gold IRA, especially if the rollover is not conducted properly. It's crucial to consult with a tax professional before initiating the process. The IRS has specific rules regarding what types of gold and precious metals can be included in a Gold IRA, how these assets must be stored, and how distributions are taxed. It's essential to familiarize yourself with these rules to ensure compliance. Investing in a Gold IRA can be a strategic move for those looking for diversification in their retirement portfolios. The process of rolling over a 401(k) to a Gold IRA involves a series of critical steps, including selecting a reputable Gold IRA company, initiating the rollover process, and understanding the implications of such an investment decision. The advantages of this investment strategy, including potential for long-term growth, tax advantages, and a hedge against economic uncertainty, often appeal to investors. However, challenges like the volatility of gold prices, storage, and insurance costs, and limited liquidity must also be considered. Hence, it's imperative for potential investors to comprehensively understand the process and the associated risks, seek professional advice, and proceed with caution to ensure a successful 401(k) to Gold IRA.How to Rollover 401(k) to Gold IRA

Purpose and Importance

Steps in Conducting a 401(k) to Gold IRA Rollover

Preparing for the Rollover

Choosing a Gold IRA Company

Initiating the Rollover Process

Selecting and Purchasing Precious Metals

Storing in Approved Depositories

Advantages of Rolling Over 401(k) to Gold IRA

Diversification of Retirement Portfolio

Hedge Against Inflation and Economic Uncertainty

Potential for Long-Term Growth

Tax Advantages

Risks in Rolling Over 401(k) to Gold IRA

Volatility of Gold Prices

Storage and Insurance Costs

Limited Liquidity

Important Factors to Consider in a 401(k) to Gold IRA Rollover

Costs Involved

Selecting a Reputable Gold IRA Company

Implications for Taxes and Penalties

Rules and Regulations for Gold IRA

Conclusion

How to Rollover 401(k) to Gold IRA FAQs

The process for rolling over a 401(k) to a Gold IRA typically involves several steps, including understanding your current 401(k) plan, selecting a reputable Gold IRA company, initiating the rollover process, choosing and purchasing precious metals, and arranging storage in an IRS-approved depository.

Rolling over a 401(k) to a Gold IRA can provide benefits such as diversifying your retirement portfolio, hedging against inflation and economic uncertainty, offering potential for long-term growth, and allowing you to benefit from the tax advantages of an IRA.

Yes, rolling over a 401(k) to a Gold IRA comes with some challenges. These include the volatility of gold prices, the costs of storage and insurance for the physical gold, and limited liquidity compared to other assets like stocks and bonds.

If done correctly, a 401(k) to Gold IRA rollover can be conducted without immediate tax implications. The rollover should be a direct transfer to avoid withdrawal taxes and penalties. However, there may be tax liabilities when distributions are taken in retirement, so it's best to consult with a tax professional for personalized advice.

Yes, besides gold, you can include other IRS-approved precious metals like silver, platinum, and palladium in a Gold IRA, provided they meet the purity standards outlined by the IRS.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.