Defined Contribution Plans are retirement plans in which the employee, and sometimes the employer, contribute a specified amount to the employee's individual retirement account. The final benefits received at retirement depend on the total contributions made and the investment returns on those contributions. Unlike its counterpart, the defined benefit plan, where retirees receive a fixed amount periodically, the defined contribution plan’s benefits hinge on the performance of the investments chosen by the employee. A 401(k) is a type of defined contribution plan that allows employees to contribute a portion of their wages to individual accounts. Cultivated for the benefit of those in the workforce, a 401(k) is an essential pillar of retirement savings in the U.S. It’s named after a section of the Internal Revenue Code, and these plans are financially supported primarily through pretax payroll deductions. Employers, to sweeten the deal, can also contribute to an employee’s 401(k) by matching a certain percentage of the contributions. This acts as an incentive, almost like free money, urging employees to maximize their savings. Defined Contribution Plans are revered for their flexibility. Employees can decide how much they wish to contribute, within federal limits, based on their financial situation and retirement goals. Whether opting to save aggressively or taking a more conservative approach, the choice rests with the contributor. In many scenarios, employers will also contribute, but unlike defined benefit plans, there’s no guaranteed sum waiting at retirement. The future nest egg will be a direct reflection of the contributions made and their investment performance. Every participant in a defined contribution plan owns an individual account. It's personal. This account holds the contributions made by the employee and possibly the employer, and any investment gains or losses are contained within it. Over time, as contributions accumulate and investments hopefully flourish, this account grows, setting the stage for retirement. Within defined contribution plans, employees often have the autonomy to choose where their contributions are invested. They can select from a menu of investment options, usually mutual funds, that cater to different risk appetites and goals. From stocks and bonds to money market funds, employees craft a portfolio that aligns with their retirement vision and risk tolerance. In a 401(k) plan, employees decide the chunk of their paycheck they wish to contribute. This decision isn't just about personal savings. Many employers offer a match. By contributing a certain percentage, employees can unlock additional funds from their employer, amplifying their savings. 401(k) contributions come with significant tax benefits. Funds directed into a traditional 401(k) are made with pre-tax dollars, reducing an individual's taxable income. While these contributions and their subsequent growth are taxed upon withdrawal, this deferral allows the investments to grow tax-free for years, possibly decades. A 401(k) offers a range of investment options. While choices might be more limited than a personal brokerage account, they usually encompass a diverse array of mutual funds, including stock funds, bond funds, and money market funds. Employees can tailor their portfolios, adjusting allocations as they inch closer to retirement or as financial goals shift. The 401(k) serves as a tax-efficient vessel for retirement savings. The upfront tax deduction for contributions can lead to significant savings, and the power of tax-deferred growth can compound these savings over time. By the time retirement rolls around, this can translate into a sizable nest egg, all thanks to the tax shield provided by the 401(k). Perhaps one of the most enticing features of the 401(k) is employer matching. It's a motivator, urging employees to contribute enough to unlock this free money. By doing so, they amplify their savings, essentially earning a return on their contributions even before any investment gains. The 401(k) isn't just a savings account; it's a growth engine. Through the power of compound interest, where earnings generate their own earnings, the 401(k) can transform modest contributions into substantial savings. Given time, and a disciplined approach to contributions, the 401(k) can be a formidable force for retirement readiness. 401(k) funds are meant for retirement, and the IRS enforces this. Withdraw before the age of 59½, and you could face a 10% penalty on the amount withdrawn, not to mention the tax implications. Such penalties discourage premature withdrawals, ensuring the funds remain earmarked for retirement. While a 401(k) offers a range of investment choices, it's not boundless. Employees might find themselves wishing for more diversity or specific investment vehicles. The menu of options is usually curated by the plan provider, limiting the avenues for portfolio customization. Like any investment, 401(k)s are subject to market risks. Economic downturns, interest rate hikes, or geopolitical events can sway the market, impacting 401(k) balances. While long-term investments usually recover and grow, short-term fluctuations can be disheartening, especially if retirement looms on the horizon. IRAs are tax-advantaged retirement accounts that individuals can open outside of employer-sponsored plans. They come in various flavors, including the Traditional IRA and Roth IRA, each with its own tax implications and benefits. The primary allure of an IRA is the flexibility in investments and a broader range of options compared to many 401(k) plans. Designed primarily for employees of public schools and certain tax-exempt organizations, the 403(b) plan is akin to the 401(k) in structure and benefits. These plans allow employees to contribute pre-tax dollars, enjoy tax-deferred growth, and sometimes benefit from employer contributions. Tailored for self-employed individuals and small business owners, SEP plans offer a way to contribute towards retirement with higher limits than traditional IRAs. Contributions are tax-deductible, and the investment grows tax-deferred until retirement. A 401(k) is a Defined Contribution Plan crucial for retirement savings in the U.S. It allows employees to contribute part of their wages into individual accounts, while employers may offer matching contributions. The plan offers tax advantages, deferred taxation, and investment flexibility. However, early withdrawal penalties, limited investment options, and market risks are drawbacks. Nevertheless, the benefits of tax efficiency, employer matching, and compound growth make it an appealing retirement vehicle. Additionally, other Defined Contribution Plans like IRAs, 403(b)s, and SEP Plans provide alternative options with distinct advantages. These plans empower individuals to take charge of their financial future and secure a comfortable retirement.What Are Defined Contribution Plans?

Is a 401k Plan a Defined Contribution Plan?

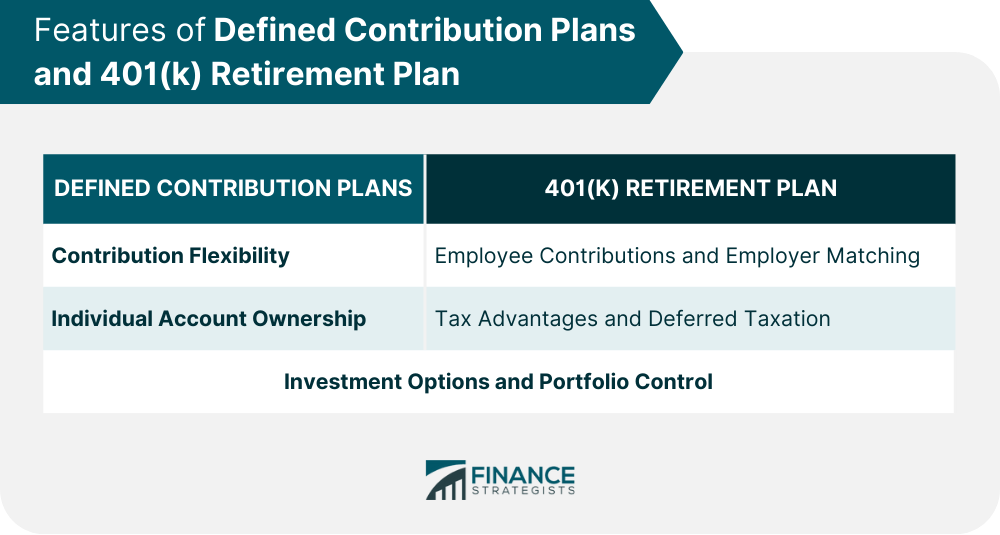

Features of Defined Contribution Plans

Contribution Flexibility

Individual Account Ownership

Investment Options and Control

Features of a 401(k) Retirement Plan

Employee Contributions and Employer Matching

Tax Advantages and Deferred Taxation

Investment Options and Portfolio Control

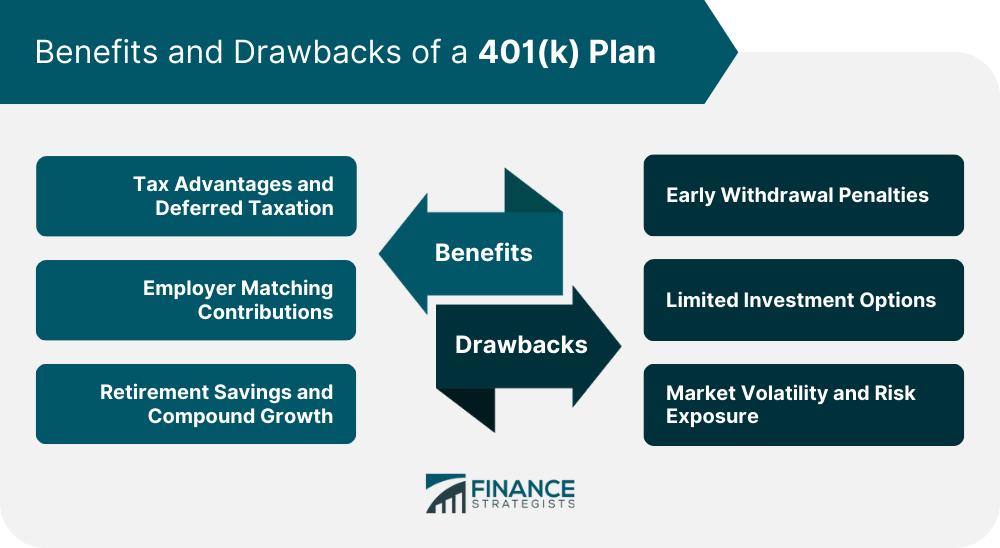

Benefits of a 401(k) Plan

Tax Advantages and Deferred Taxation

Employer Matching Contributions

Retirement Savings and Compound Growth

Drawbacks of a 401(k) Plan

Early Withdrawal Penalties

Limited Investment Options

Market Volatility and Risk Exposure

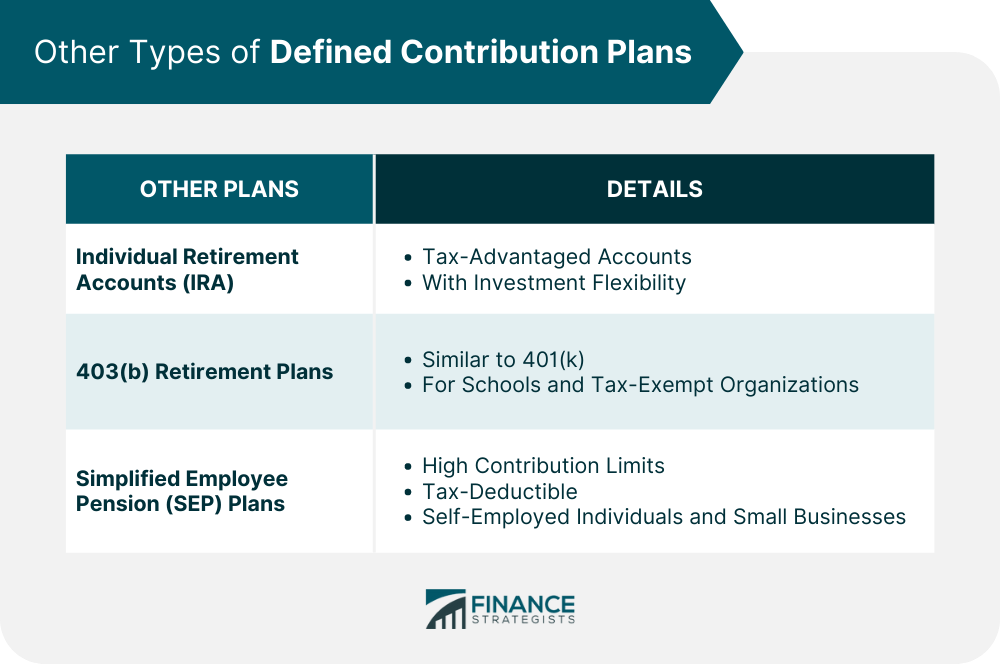

Other Defined Contribution Plans

Individual Retirement Accounts (IRA)

403(b) Retirement Plans

Simplified Employee Pension (SEP) Plans

Conclusion

Is a 401(k) a Defined Contribution Plan? FAQs

Yes, a 401(k) is a type of Defined Contribution Plan. In a 401(k) plan, employees can contribute a portion of their pre-tax salary, and employers may also offer matching contributions. The funds in the account grow tax-deferred until retirement.

With a Traditional IRA, contributions might be tax-deductible, and the investments grow tax-deferred. Upon withdrawal in retirement, the distributions are taxed. With a Roth IRA, contributions are made with post-tax dollars, but withdrawals in retirement are tax-free.

Yes, if you leave your job or wish to move your retirement savings, you can roll over your 401(k) into an IRA without incurring any penalties.

You typically have several options: leave it with your former employer, roll it over into your new employer's plan, roll it into an IRA, or cash out (which might incur penalties and taxes).

Yes, there are certain hardship scenarios, like medical emergencies or purchasing a first home, where you might be able to withdraw without the 10% penalty, though taxes will still apply. Always consult with a financial advisor before making such decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.