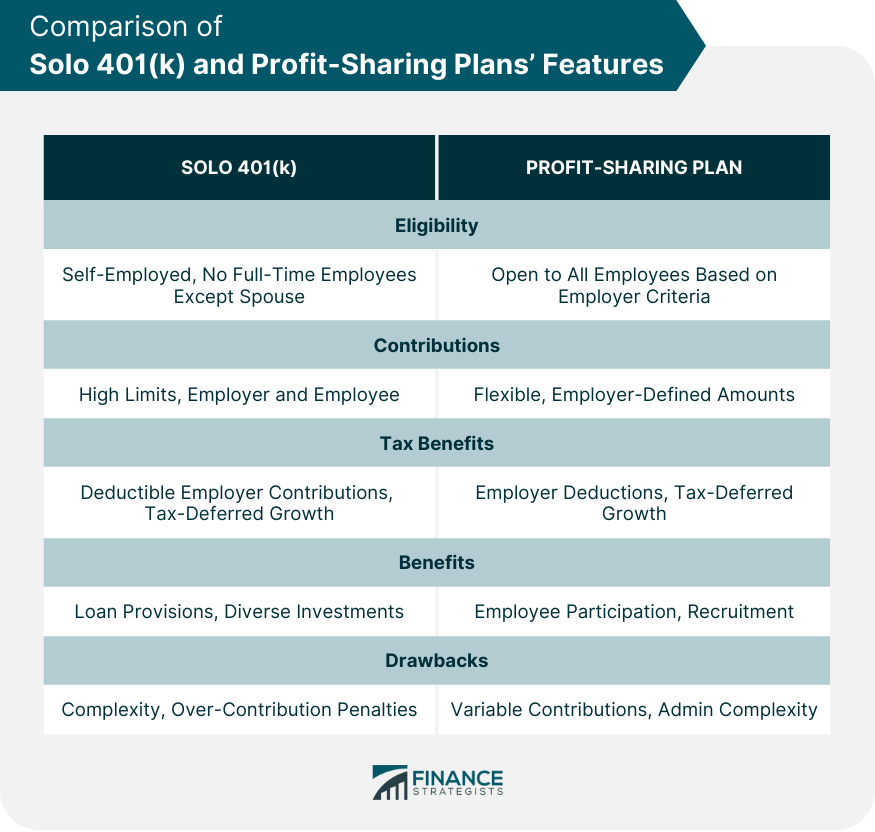

A solo 401(k), also referred to as a one-participant 401(k) or individual 401(k), is a retirement plan designed specifically for self-employed individuals or business owners with no full-time employees, apart from a spouse working for the business. It combines the features of a traditional 401(k) with the flexibility tailored for solo entrepreneurs, allowing them to make contributions both as an employer and an employee. Since it caters to individuals without the typical employer-employee dynamics of larger businesses, it provides a unique opportunity for significant retirement savings. A Profit-Sharing Plan, on the other hand, is a retirement plan that gives employees a share in the profits of a company. The company decides the amount to be contributed to the plan annually, based on its profitability. Each employee's share in the plan is usually determined by their salary or wages, meaning those earning more may receive a larger slice of the profit-sharing pie. It acts as an incentive, aligning the interests of employees with the profitability of the company and encouraging greater productivity and loyalty. A Solo 401(k) combines elements from both traditional 401(k) plans and profit-sharing plans, resulting in a unique retirement savings vehicle. While the Solo 401(k) shares similarities with a standard 401(k) plan, it stands apart due to its incorporation of profit-sharing features. It's important to note that a Solo 401(k) and a Profit-Sharing Plan are not synonymous terms. The Solo 401(k) is particularly advantageous for self-employed individuals, as it enables them to contribute both as an employer through profit-sharing allocations and as an employee through elective deferrals. This dual contribution capacity offers unmatched flexibility, allowing individuals to adjust their contributions based on business profitability and personal financial goals. This comprehensive approach to retirement planning sets the Solo 401(k) apart as a dynamic option for optimizing retirement savings. Eligibility for a Solo 401(k) is primarily centered on two conditions. First, the applicant must have self-employment income. This includes freelancers, consultants, and small business owners. Secondly, the business should not have any full-time employees other than the business owner and their spouse. Part-time employees or contractors who work less than 1,000 hours annually don't impact eligibility. This structure ensures the plan remains streamlined for solo entrepreneurs without the complexities of larger retirement plans. One of the most attractive features of a Solo 401(k) is its generous contribution limits. For 2024, participants can make elective deferrals up to $23,000 annually, with an additional $7,500 if they are aged 50 or older. Moreover, as the employer, a self-employed individual can also make non-elective contributions up to 25% of their compensation. This leads to a combined maximum contribution that is considerably higher than many other retirement plan options. This dual nature provides tremendous flexibility, especially in years of higher earnings. From the employer's perspective (in this case, the self-employed individual), the Solo 401(k) offers tax deductions on contributions, which can be instrumental in reducing taxable income. From the employee standpoint (again, the self-employed person wearing a different hat), the contributions grow tax-deferred. This means that investments within the Solo 401(k) aren't subject to tax until funds are withdrawn during retirement, allowing the power of compound growth to work its magic unencumbered. Beyond the attractive contribution limits and tax advantages, the Solo 401(k) offers numerous other benefits. For instance, many Solo 401(k) plans offer loan provisions, enabling participants to borrow against their account, a flexibility not often found in other retirement plans. Furthermore, there's also the potential to invest in a wider array of options, including real estate or precious metals, depending on the plan provider. For the self-employed, this plan offers a potent mix of flexibility and growth potential. Setting up and maintaining a solo 401(k) plan can sometimes be more complex than other retirement options, with more paperwork and administrative responsibility. Additionally, while the high contribution limits are beneficial, they also come with responsibility. Over-contributing (beyond the allowed limits) can result in penalties. Lastly, as your business grows and you consider hiring more employees, the Solo 401(k) might no longer remain a viable option, necessitating a transition to a different retirement plan. Profit-sharing plans are often open to all employees of a company, provided they meet specific criteria set by the employer. Common requirements include having worked for the company for a certain number of years or a certain number of hours in the past year. Profit-sharing plans typically don't require employee contributions, as allocations are derived solely from company profits. This inclusivity can be a powerful tool in motivating and retaining employees, as they share in the company's success. Profit-sharing plans allow companies to choose how much to contribute to employees' accounts each year. This amount can be a fixed percentage of profits or determined by other factors. In any given year, an employer can decide not to contribute at all if business conditions aren't favorable. This flexibility is an advantage for businesses with variable profits. The maximum contribution an employer can make to an employee's profit-sharing account is limited by the IRS. In 2024, the limit is the lesser of 100% of the employee's compensation or $69,000 (excluding catch-up contributions for those aged 50 or over). It's important for employers to monitor these limits and ensure compliance to avoid tax penalties. One of the key benefits of a profit-sharing plan for employers is the ability to write off contributions as a business expense. This not only reduces taxable income but also serves as an incentive to share profits with employees. For employees, the contributions made on their behalf are tax-deferred, meaning they won't pay taxes on the money until they withdraw it, typically in retirement. Additionally, profit-sharing plans can be used as a tool to recruit and retain high-quality employees. Offering a share in the company's profits can make an employment package more attractive and help foster a culture where employees are invested in the company's success. Employees get the opportunity to participate in the company's success and receive additional income for their retirement. This not only helps in financial planning, but also boosts morale and increases productivity, as employees feel more connected to the company and its success. Employers benefit by being able to write off contributions as a business expense. Profit-sharing plans can also be less expensive to administer than other retirement plans. The flexibility in contributions can be a double-edged sword. In years of low profits or losses, employees might not receive any contributions, which could lead to disappointment or decreased morale. Additionally, profit-sharing plans can be complicated to set up and administer, especially for small businesses without dedicated HR or finance departments. Another drawback is that profit-sharing plans might not be suitable for all employees. Younger employees, who may prioritize current income over future benefits, might not appreciate the value of a profit-sharing plan. Also, because these plans are tied to company profits, they might not be the best fit for businesses with highly volatile earnings. The right choice between a Solo 401(k) and profit-sharing plan depends on the business's size and structure. A Solo 401(k) is specifically designed for self-employed individuals or businesses with no full-time employees other than the owner and their spouse. In contrast, a profit-sharing plan is suitable for companies of any size, including those with many employees. Profit-sharing plans are often used by larger businesses to distribute a portion of their profits among their employees. These plans can be more complex and costly to administer than a Solo 401(k), but they can be a valuable tool for employee recruitment and retention. If you're self-employed or own a business with no employees, your retirement goals and savings objectives might lean more toward maximizing contributions. In this case, a Solo 401(k) would typically allow for higher contribution limits. On the other hand, if your focus is on sharing the company's success with your employees, a profit-sharing plan might be more appropriate. If your business has employees, their needs and preferences should be considered. A profit-sharing plan can serve as an incentive, aligning the interests of employees with the profitability of the company and encouraging greater productivity and loyalty. On the other hand, a Solo 401(k) is not an option if you have employees other than your spouse. A Solo 401(k) is often easier and less expensive to set up and administer than a profit-sharing plan, especially if you're self-employed with no employees. Profit-sharing plans can be more complex, particularly for larger businesses with multiple employees. They require annual testing to ensure compliance with anti-discrimination rules, and they may involve higher administrative costs. A Solo 401(k) is not a profit-sharing plan in the traditional sense. While a Solo 401(k) incorporates elements of both a standard 401(k) and a profit-sharing plan, they are distinct retirement savings vehicles. The Solo 401(k) allows self-employed individuals to contribute as both an employer (through profit-sharing allocations) and an employee (through elective deferrals). This unique feature provides greater flexibility in contribution amounts based on business profitability and personal financial goals. However, a Solo 401(k) is not synonymous with a profit-sharing plan, as it offers a combination of features beyond profit-sharing, making it a distinct retirement planning option. The Solo 401(k) boasts features tailored to solo entrepreneurs, offering higher contribution limits and tax advantages, as well as the option for loans. In contrast, Profit-Sharing Plans are designed to distribute a portion of company profits among employees to incentivize productivity and loyalty. The choice between the two depends on factors like business structure, size, retirement goals, and employee considerations. Solo 401(k)s and Profit-Sharing Plans

Is a Solo 401(k) a Profit-Sharing Plan?

Features of a Solo 401(k)

Eligibility and Participation

Contribution Limits and Flexibility

Employer and Employee Benefits

Benefits

Drawbacks

Features of Profit-Sharing Plans

Eligibility and Participation

Contribution Limits and Flexibility

Employer and Employee Benefits

Benefits

Drawbacks

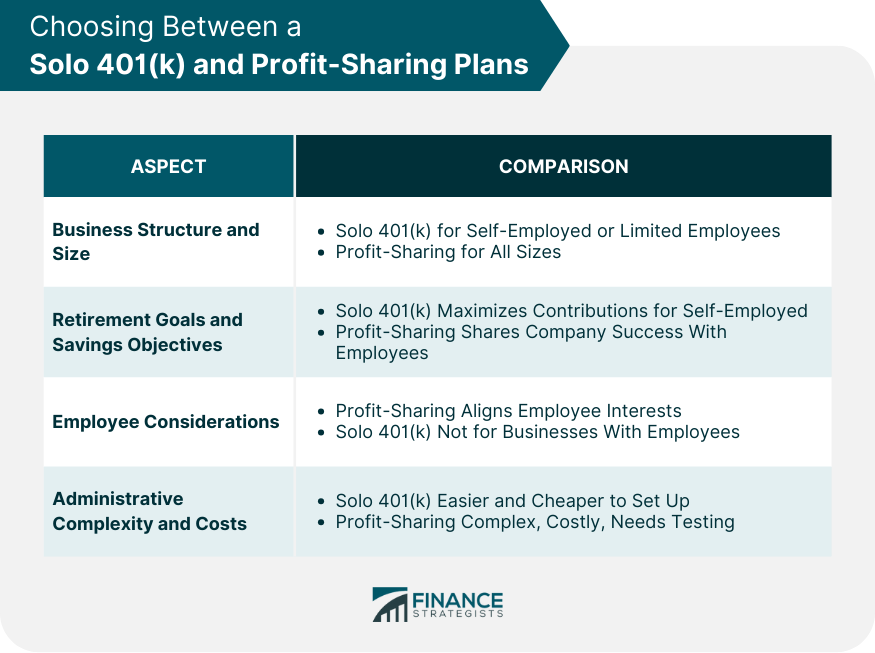

Choosing Between a Solo 401(k) and Profit-Sharing Plans

Business Structure and Size

Retirement Goals and Savings Objectives

Employee Considerations

Administrative Complexity and Costs

Conclusion

Is a Solo 401(k) a Profit-Sharing Plan? FAQs

No, a Solo 401(k) is designed specifically for self-employed individuals or businesses with no full-time employees other than the owner and their spouse.

The company decides the contribution amount based on its profitability. It can be a fixed percentage of profits or determined by other factors.

Yes, if you qualify for both, you can contribute to both types of plans. However, there are specific limits on total contributions across both plans.

A profit-sharing plan may be more suitable for businesses with unpredictable profits, as contributions can be adjusted each year based on company performance.

No, businesses of all sizes can set up profit-sharing plans. They can be especially beneficial for small businesses looking to incentivize and retain employees.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.