The Mega Backdoor Roth 401(k) refers to a financial strategy that allows you to contribute a significant amount of money, more than the standard limit, to a Roth 401(k). This method involves making after-tax contributions to your traditional 401(k) plan and then rolling these amounts into your Roth 401(k) or Roth IRA. The Mega Backdoor Roth 401(k) strategy is crucial for high-income earners who want to maximize their retirement savings. It is especially beneficial for those who have already reached their yearly pre-tax or Roth 401(k) contribution limits. This strategy provides a legal loophole to save more money in a Roth account, where it can grow and be withdrawn tax-free in retirement.

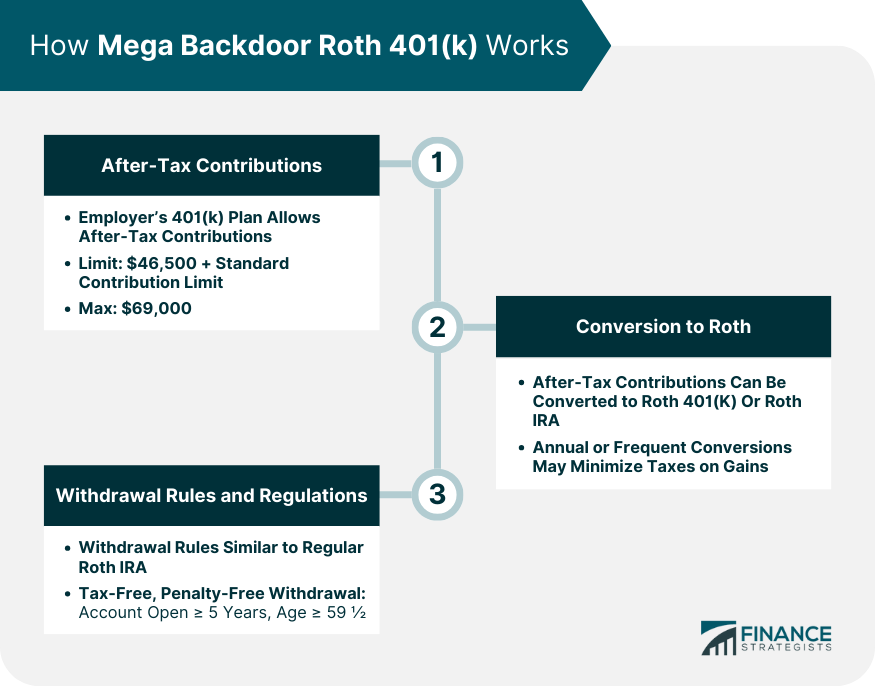

To take advantage of the Mega Backdoor Roth 401(k), your employer's 401(k) plan must allow after-tax contributions over and above the standard contribution limit. In 2024, the limit for after-tax contributions to a Mega Backdoor Roth 401(k) stands at $46,000 ($46,500 in 2025). This amount is on top of the standard 401(k) contribution limit, which is $23,000 ($23,500 in 2025) or $30,500 ($31,000 for 2025) for individuals aged 50 and above. Therefore, the highest possible contribution to your 401(k) in 2024 is $69,000 ($70,000 in 2025) or $76,500 ($77,500 in 2025) for individuals aged 50 and above. Once you've made the after-tax contributions, you can then convert them into your Roth 401(k) or Roth IRA. This conversion is typically done at least once a year. However, it can be advantageous to do it more frequently to minimize the tax on any gains that occur between the time of contribution and conversion. Withdrawal rules for a Mega Backdoor Roth 401(k) generally follow the same rules as a regular Roth IRA. That is, earnings can be withdrawn tax-free and penalty-free as long as the account has been open for at least five years and you are at least 59 ½ years old. The most significant advantage of the Mega Backdoor Roth 401(k) is the ability to save substantially more in a Roth account than the standard contribution limits would typically allow. Like other Roth accounts, the Mega Backdoor Roth 401(k) offers tax-free growth and withdrawals in retirement. This feature can be a massive benefit for high-income earners who expect to be in a high tax bracket in retirement. The Mega Backdoor Roth 401(k) allows for a diversified tax strategy in retirement. By having funds in both traditional and Roth accounts, you can strategically decide when and how much to withdraw from each account type based on your tax situation in any given year. Mega Backdoor Roth 401(k) allows you to bypass income limits for regular Roth IRA contributions. High earners who might not typically qualify for Roth IRA contributions can leverage this strategy to amass Roth savings. The Mega Backdoor Roth strategy allows you to convert after-tax 401(k) contributions to a Roth IRA, which doesn't require minimum distributions at a certain age, unlike traditional 401(k) and Roth 401(k) accounts. This flexibility can be a significant advantage for retirement planning. One significant drawback is that not all 401(k) plans allow after-tax contributions or in-plan Roth conversions, which are required to implement this strategy. If the conversion from the after-tax 401(k) to the Roth account isn't completed promptly, any growth in the after-tax account before the conversion will be subject to tax. The Mega Backdoor Roth 401(k) is more complex than traditional retirement savings strategies and requires careful management to ensure compliance with IRS rules and regulations. The Mega Backdoor Roth strategy can potentially complicate your tax situation. Keeping track of pre-tax, after-tax, and Roth contributions can be challenging and might require help from a tax professional. The first step in implementing a Mega Backdoor Roth 401(k) is to verify with your employer or plan administrator that your 401(k) plan allows after-tax contributions and in-plan Roth conversions. Next, you need to decide how much to contribute to your 401(k) after you've reached the standard pre-tax or Roth contribution limit. The remainder of your total contribution limit can be made as an after-tax contribution. After making after-tax contributions, you need to convert these funds to a Roth 401(k) or Roth IRA. This process can usually be done through your plan administrator, but the exact procedure and frequency of allowable conversions can vary by plan. Before implementing a Mega Backdoor Roth 401(k), consider your current and future tax brackets. The strategy is generally more beneficial if you expect to be in a higher tax bracket in retirement than you are currently. It's also crucial to balance your current financial needs with your retirement goals. While the Mega Backdoor Roth 401(k) allows for substantial retirement savings, these funds are locked away until retirement age, barring certain exceptions. Lastly, consider other tax-efficient investment options. While the Mega Backdoor Roth 401(k) can be highly beneficial, it's not the only strategy for efficient retirement savings. Regular contributions to a 401(k), Roth 401(k), or Roth IRA, along with investments in a taxable brokerage account, can also be part of a diversified retirement strategy. It's crucial to consult with a tax advisor or financial planner before implementing the Mega Backdoor Roth strategy. It is a complex financial maneuver that can have significant tax implications, so professional advice is highly recommended. The Mega Backdoor Roth 401(k) strategy is a powerful financial tool that allows high-income earners to save significantly more towards retirement in a tax-advantaged Roth account. In 2024, one can potentially contribute up to $69,000 ($70,000 in 2025) to a 401(k) using this method. The key steps to implement this strategy involve making after-tax contributions and converting these to a Roth account. Benefits include tax-free growth, withdrawal flexibility, diversified tax strategy, and bypassing Roth IRA income limits. However, the strategy requires your employer's plan to allow for after-tax contributions and in-plan conversions. It also introduces complexity and potential tax liabilities. Given the intricacies involved, consulting a tax advisor or financial planner is highly recommended before implementation. The Mega Backdoor Roth 401(k) can be a valuable component of a diversified retirement strategy when used appropriately.What Is Mega Backdoor Roth 401(k)?

How Mega Backdoor Roth 401(k) Works

Process of Making After-Tax Contributions

Conversion of After-Tax Contributions to Roth

Withdrawal Rules and Regulations

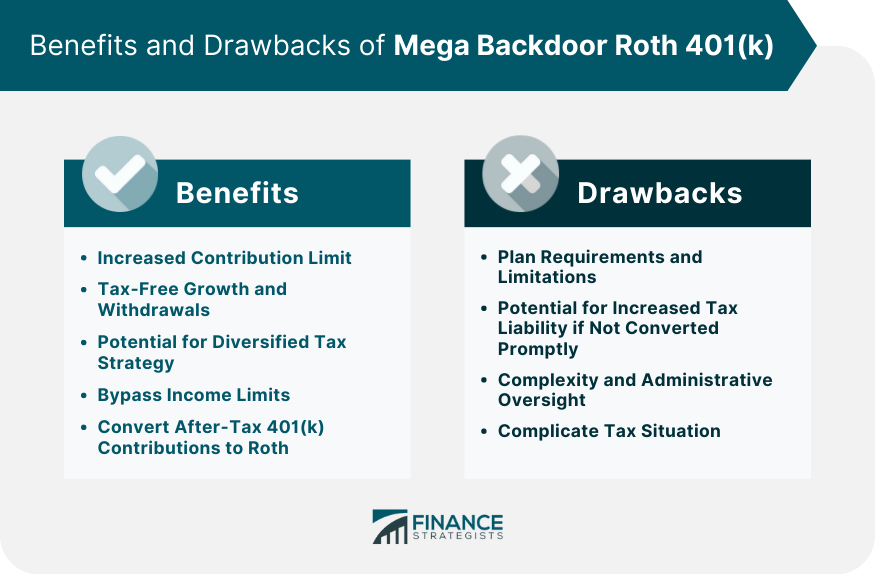

Benefits of Mega Backdoor Roth 401(k)

Increased Contribution Limit

Tax-Free Growth and Withdrawals

Potential for Diversified Tax Strategy

Bypass Income Limits

Convert After-Tax 401(k) Contributions to a Roth IRA

Drawbacks of Mega Backdoor Roth 401(k)

Plan Requirements and Limitations

Potential for Increased Tax Liability if Not Converted Promptly

Complexity and Administrative Oversight

Complicate Tax Situation

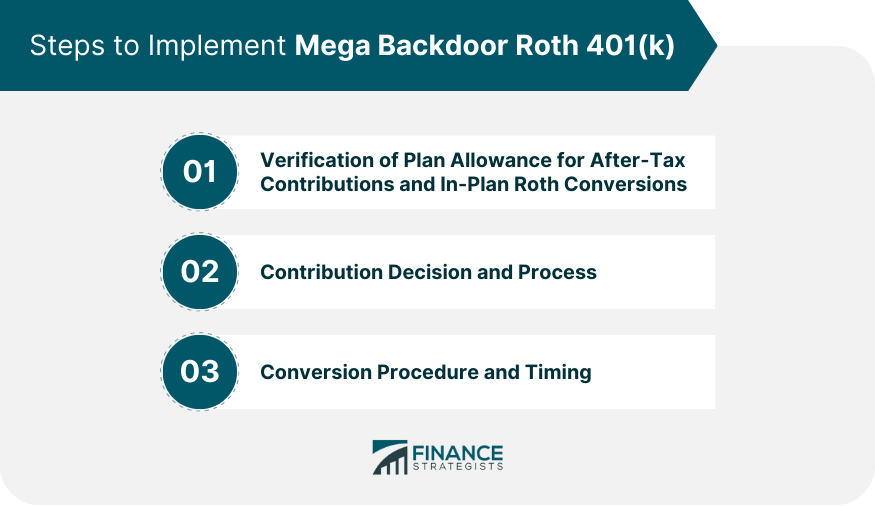

Steps to Implement Mega Backdoor Roth 401(k)

Verification of Plan Allowance for After-Tax Contributions and In-Plan Roth Conversions

Contribution Decision and Process

Conversion Procedure and Timing

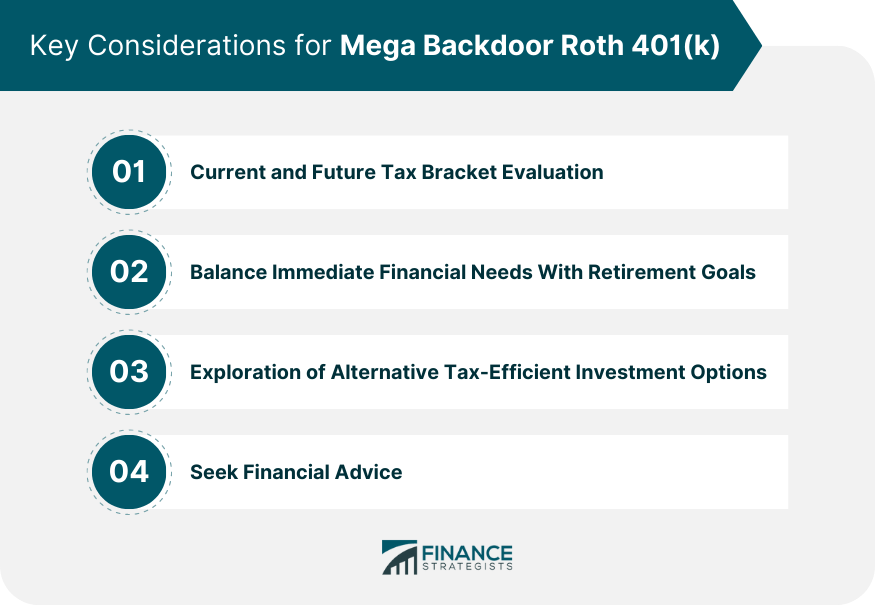

Key Considerations for Mega Backdoor Roth 401(k)

Current and Future Tax Bracket Evaluation

Balance Immediate Financial Needs With Retirement Goals

Exploration of Alternative Tax-Efficient Investment Options

Seek Financial Advice

Final Thoughts

Mega Backdoor Roth 401(k) FAQs

A Mega Backdoor Roth 401(k) is a strategy that allows individuals to contribute significantly more to their Roth 401(k) than the standard limit by making after-tax contributions to their traditional 401(k) and then converting these amounts to their Roth account.

The Mega Backdoor Roth 401(k) involves making after-tax contributions to a 401(k) plan over and above the standard contribution limit. Once you've made these contributions, you can convert them to your Roth 401(k) or Roth IRA, where they can grow and be withdrawn tax-free in retirement.

The Mega Backdoor Roth 401(k) allows for significantly higher contributions to a Roth account than the standard limit. It offers tax-free growth and withdrawals in retirement, provides a diversified tax strategy, and enables high earners to bypass income limits for regular Roth IRA contributions.

The Mega Backdoor Roth 401(k) is not permitted by all 401(k) plans, and it requires careful management to ensure compliance with IRS rules. It also carries the potential for increased tax liability if the conversion to the Roth account isn't completed promptly. Additionally, it can complicate your tax situation, and if you leave your job, the strategy might no longer be viable.

To implement a Mega Backdoor Roth 401(k), verify with your employer or plan administrator that your 401(k) plan allows after-tax contributions and in-plan Roth conversions. Once you've confirmed this, you can decide how much to contribute and start the conversion process. Consulting with a tax advisor or financial planner is highly recommended due to the complexity of this strategy.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.