What Is Nondiscrimination Testing for 401(k) Plans?

Nondiscrimination testing for 401(k) plans is a series of mandatory tests enforced by the Internal Revenue Service (IRS) to ensure that employer-sponsored retirement plans maintain a fair balance.

A nondiscrimination test is required for 401(k) plans to ensure that the plan does not improperly favor highly-paid employees or "key" employees, such as the owners.

The tests establish what percentage of the assets belong to highly-compensated employees and key employees, how much the company contributes, and how much of their income employees defer.

The aim is to prevent highly-paid employees from receiving a disproportionate amount of benefits from the plan.

How Does Nondiscrimination Testing for 401(k) Plans Work?

Nondiscrimination testing involves the calculation and comparison of various contribution and benefit parameters within a 401(k) plan.

The process typically involves detailed examination of plan data, employee deferral rates, employer matching contributions, and overall plan coverage.

The testing is generally performed annually and requires careful attention to IRS guidelines and procedures to ensure accurate results.

If a plan fails the nondiscrimination tests, corrective actions must be taken, which can include refunding contributions to highly compensated employees (HCEs) or making additional contributions on behalf of non-highly compensated employees (NHCEs).

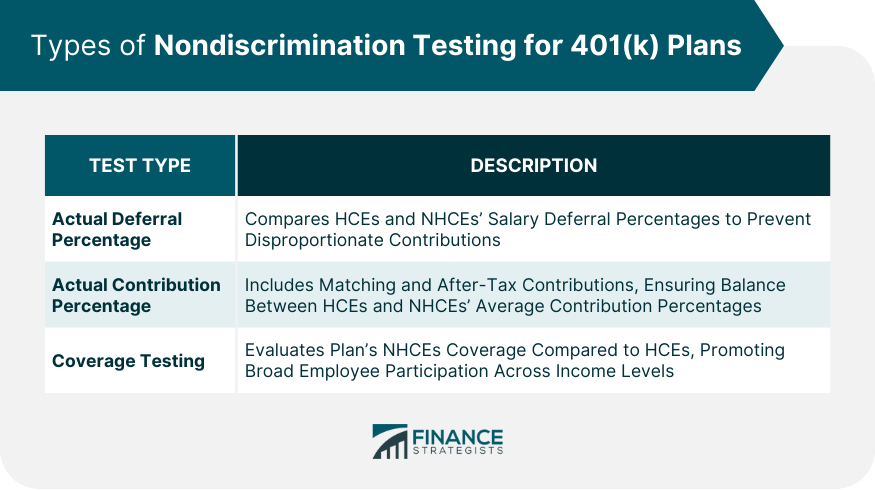

Types of Nondiscrimination Testing

Actual Deferral Percentage (ADP) Test

The Actual Deferral Percentage (ADP) test compares the average salary deferral percentages of HCEs and NHCEs.

The test's purpose is to ensure that HCEs are not deferring a significantly higher percentage of their pay to the 401(k) plan compared to NHCEs. If the contributions of HCEs exceed the allowable limit, the plan fails the test.

Actual Contribution Percentage (ACP) Test

The Actual Contribution Percentage (ACP) test is similar to the ADP test but also includes employer matching contributions and any employee after-tax contributions.

Like the ADP test, the ACP test compares the average contribution percentages of HCEs and NHCEs to ensure balance.

Coverage Testing

Coverage testing evaluates whether the 401(k) plan covers a sufficient proportion of NHCEs in comparison to HCEs.

This test ensures that the retirement plan benefits a broad cross-section of employees and not just the higher earners within an organization.

Consequences of Failing Nondiscrimination Testing

Corrective Actions for Failed Testing

If a 401(k) plan fails nondiscrimination testing, corrective actions must be taken to bring the plan back into compliance.

Corrective measures might include refunding excess contributions to HCEs or making additional contributions on behalf of NHCEs. It's important to note that corrective distributions to HCEs are typically taxable.

Excise Taxes and Penalties

Failure to correct a failed nondiscrimination test in a timely manner can lead to excise taxes and penalties. The IRS could levy a 10% excise tax on excess contributions not corrected by the specified deadline.

Impact on Highly Compensated Employees (HCEs)

For HCEs, the failure of a nondiscrimination test could mean the return of excess contributions, which can impact their retirement savings strategy. These returned contributions are also subject to income tax, further diminishing the intended benefits.

Strategies for Passing Nondiscrimination Testing

Safe Harbor Provisions

Implementing a safe harbor 401(k) plan can help companies bypass the ADP and ACP tests. A safe harbor plan requires employers to make certain mandatory contributions to employees' accounts, either in the form of a match or a non-elective contribution.

Designing Plan Features to Promote Participation

Promoting broader participation among NHCEs can also help in passing nondiscrimination tests.

Offering attractive plan features, providing financial education, and communicating the benefits of participation can encourage NHCEs to contribute more to the 401(k) plan.

Automatic Enrollment and Escalation Features

Adding automatic enrollment features can also boost participation rates. An automatic escalation feature, which gradually increases employee contributions over time, can also help ensure that the plan stays in compliance with nondiscrimination requirements.

Importance of Nondiscrimination Testing for Employers

Compliance With Legal Requirements

Conducting annual nondiscrimination testing is a legal requirement for employers offering 401(k) plans. Staying compliant with these rules is critical to avoiding potential audits, penalties, or legal action.

Retaining Tax Benefits and Qualified Plan Status

Successful nondiscrimination testing is crucial to retaining the tax benefits associated with 401(k) plans. If a plan loses its qualified status due to failed testing, it can result in significant tax consequences for both the employer and employees.

Avoiding Potential Lawsuits and Penalties

By ensuring compliance with nondiscrimination testing, employers can avoid potential lawsuits from employees or penalties from regulatory authorities.

Providing equitable benefits to all employees, regardless of their pay scale, also contributes to a positive work environment.

Conclusion

Nondiscrimination testing for 401(k) plans is a mandatory process enforced by the IRS to ensure fair and equitable distribution of retirement plan benefits among HCEs and NHCEs. It is a critical part of maintaining a compliant 401(k) plan.

Nondiscrimination testing comprises various types of tests including the ADP, ACP, and coverage tests. Each of these tests plays a unique role in ensuring the fair allocation of 401(k) benefits among all employees.

Regular and thorough nondiscrimination testing is vital to ensure that 401(k) plans remain compliant with IRS regulations.

It is instrumental in upholding the plan's qualified status, thereby protecting the associated tax benefits for both employers and employees.

Nondiscrimination Testing for 401(k) Plans FAQs

Nondiscrimination testing is the process of ensuring that the contributions and benefits of a 401(k) plan are distributed fairly among all eligible employees, regardless of their income level or position in the company. This means that highly compensated employees cannot receive more favorable benefits than those who earn lower wages.

Generally, nondiscrimination testing must be performed each year as part of the annual filing requirements associated with a 401(k) plan. However, it’s important to note that if significant changes occur during the year, additional testing may be required.

Nondiscrimination testing is usually conducted by the plan sponsor, often with the help of a professional service provider experienced in administering 401(k) plans.

If a plan fails the test, it may be subject to corrective actions such as reducing or refunding contributions made by highly compensated employees or adjusting benefits available from the plan.

Yes, there are various exceptions and safe-harbor rules that may allow certain plans to pass otherwise difficult nondiscrimination tests. Consulting a professional experienced in administering 401(k) plans is the best way to determine if any of these options are available for your plan.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.