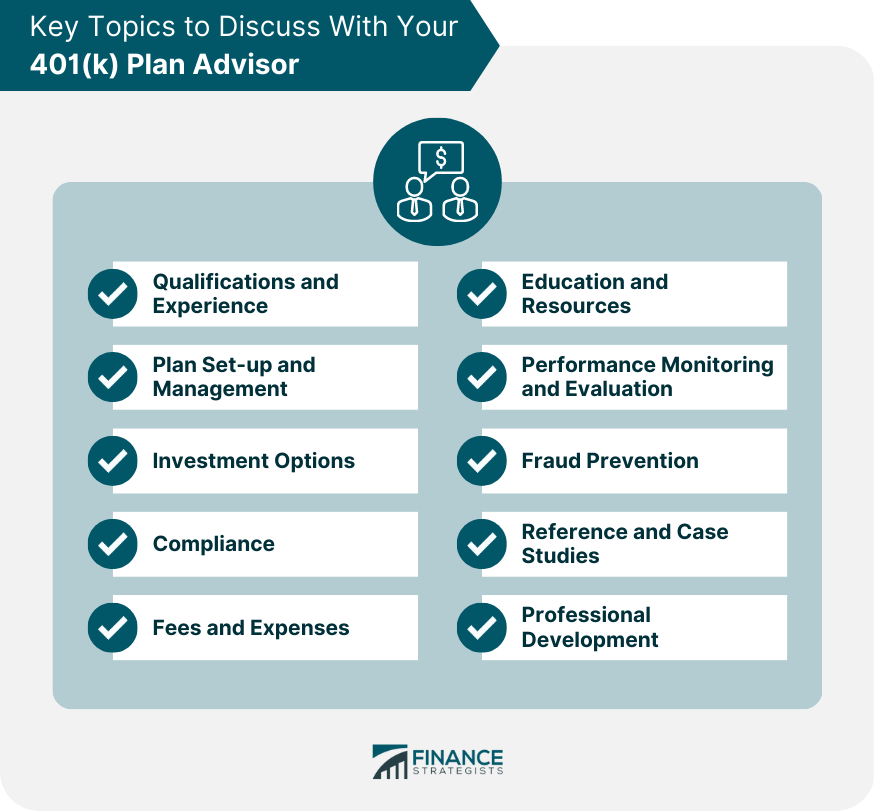

The questions to ask a 401(k) plan advisor should be around topics such as their qualifications and experience, plan set-up and management, investment options, compliance, fees and expenses, and education and resources. Questions about performance monitoring and evaluation, fraud prevention, references and case studies, and professional development are also advised. By asking questions about these topics, you can gain a better understanding of an advisor's approach and determine if they are the right fit for your needs. Have a question for a 401(k) Plan Advisor? Click here. When selecting a 401(k) plan advisor, it is essential to consider their qualifications and experience. Specifically, you will want to ask the advisor about their experience working with 401(k) plans, and what their qualifications are. Ideally, you will want to work with an advisor who has extensive experience working with 401(k) plans, and who holds relevant qualifications such as a Certified Financial Planner (CFP) or Chartered Retirement Plan Specialist (CRPS) designation. Additionally, it is important to ask the advisor about their experience working with employers and employees, and what their approach is to work with both parties. Consider asking the following questions to a 401(k) plan advisor: What are the advisor's qualifications and experience working with 401(k) plans? How can this experience benefit the employer and employees? Another key area to consider when selecting a 401(k) plan advisor is their approach to plan set-up and management. Specifically, you will want to ask the advisor about how they typically work with employers and employees to set up and manage 401(k) plans. This may include questions such as how they handle plan design and implementation, how they handle employee enrollment and communication, and how they monitor and evaluate plan performance over time. Example queries to ask a 401(k) plan advisor include: How does the advisor typically work with employers and employees to set up and manage 401(k) plans? What are some of the key considerations to keep in mind during the set-up and management process? The investment options available within a 401(k) plan can have a significant impact on the plan's performance over time. As such, it is important to work with a 401(k) plan advisor who can provide guidance on the best investment options for your plan. When selecting an advisor, you will want to ask them about the investment options they recommend for your plan, and why they believe these options are the best choice. Additionally, you will want to inquire about the advisor's approach to managing investments within the plan, and how they monitor and adjust the plan's investment options over time. Here are some questions you could ask a 401(k) plan advisor: What investment options does the advisor recommend for a 401(k) plan, and why? How can the employer and employees ensure that they are making the most of their investment options? Ensuring compliance with all relevant laws and regulations is an essential aspect of 401(k) plan management. As such, it is important to work with a 401(k) plan advisor who can help you maintain compliance with all relevant laws and regulations. When selecting an advisor, you will want to ask them about their approach to compliance, and how they help employers ensure that their plans are compliant. This may include questions about the advisor's experience with compliance-related issues, their understanding of relevant laws and regulations, and how they stay up-to-date on changes and developments in this area. Possible inquiries to make to a 401(k) plan advisor are: How does the advisor help employers ensure that their 401(k) plans are compliant with all relevant laws and regulations? What are some of the risks of non-compliance, and how can they be avoided? The fees and expenses associated with managing a 401(k) plan can have a significant impact on the plan's overall performance over time. As such, it is important to work with an advisor who is transparent and reasonable when it comes to fees and expenses. When selecting an advisor, you will want to ask them about the fees and expenses associated with managing your plan, and how they ensure that these fees are reasonable and transparent. Additionally, you will want to ask the advisor about any potential conflicts of interest that may exist, and how they ensure that these conflicts are managed appropriately. The following questions can help you evaluate a 401(k) plan advisor: Can the advisor explain the fees and expenses associated with managing a 401(k) plan, and how they ensure that they are reasonable and transparent? How can the employer and employees evaluate the value of these fees and expenses? Providing education and resources to employees is an essential aspect of 401(k) plan management, as it helps employees better understand their options and make the most of their benefits. When selecting a 401(k) plan advisor, you will want to ask them about the types of educational resources they provide to employees, and how they communicate these resources effectively. This may include questions about the advisor's approach to employee communication, the types of educational materials they provide, and how they measure the effectiveness of these resources over time. When choosing a 401(k) plan advisor, consider asking: What types of educational resources does the advisor provide to help employees understand and make the most of their 401(k) benefits? How can the employer and employees take advantage of these resources? Monitoring and evaluating the performance of a 401(k) plan is essential to ensure that the plan is meeting the needs of employees and employers. When selecting a 401(k) plan advisor, you will want to ask them about their approach to plan performance monitoring and evaluation, and what metrics they use to measure success. This may include questions about the advisor's experience with performance monitoring and evaluation, the tools and methods they use to assess plan performance, and how they communicate this information to employers and employees. Some useful queries to pose to a 401(k) plan advisor are: How does the advisor help employers monitor and evaluate the performance of their 401(k) plans? What are some of the key metrics that should be used to evaluate performance? Preventing fraud and misconduct related to 401(k) plans is essential to ensure the integrity and success of the plan over time. When selecting a 401(k) plan advisor, you will want to ask them about their approach to fraud prevention, and what steps they take to minimize the risk of fraud or other misconduct. This may include questions about the advisor's experience with fraud prevention, the tools and methods they use to identify potential fraud, and how they work with employers and employees to prevent fraudulent activity. It can be helpful to ask the following questions of a 401(k) plan advisor: What steps does the advisor take to minimize the risk of fraud or other misconduct related to 401(k) plans? How can the employer and employees help to prevent fraud and misconduct? References and case studies from other employers can be a valuable way to evaluate the effectiveness of a 401(k) plan advisor. When selecting an advisor, you will want to ask them for references or case studies from other employers they have worked with, and how they have helped these employers achieve success with their 401(k) plans. Additionally, you may want to research the advisor online to see what other clients and industry experts have to say about their performance and effectiveness. To ensure you choose the right 401(k) plan advisor, you may want to ask: Can the advisor provide references or case studies from other employers they have worked with on 401(k) plans? How can the employer and employees evaluate the advisor's past performance and success? The 401(k) industry is constantly evolving, and it is important to work with an advisor who stays up-to-date on changes and developments in the field. When selecting an advisor, you will want to ask them about their approach to ongoing professional development and education, and what steps they take to stay current with industry trends and best practices. This may include questions about the advisor's participation in industry associations or continuing education programs, as well as their overall commitment to staying informed and up-to-date on industry developments. Here are some possible questions to ask a 401(k) plan advisor: How does the advisor stay up-to-date on changes and developments in the 401(k) industry? What is their approach to ongoing professional development and education? Choosing the right 401(k) plan advisor is essential to ensuring that your plan is set up and managed effectively over time. By asking the right questions and evaluating an advisor's qualifications and approach to plan management, you can find an advisor who can help you achieve success with your 401(k) plan. Whether you are an employer or employee, taking the time to find the right advisor who specializes in retirement planning can pay off in the long run, helping you achieve your goals and providing peace of mind for all involved. It is important to remember that the questions outlined in this article are not an exhaustive list, and that there may be additional questions or considerations specific to your individual situation. However, by asking these key questions, you can gain a better understanding of an advisor's qualifications, approach, and experience, and make an informed decision about who to work with.Questions to Ask 401(k) Plan Advisor

Qualifications and Experience

Plan Set-up and Management

Investment Options

Compliance

Fees and Expenses

Education and Resources

Performance Monitoring and Evaluation

Fraud Prevention

References and Case Studies

Professional Development

Conclusion

Questions to Ask 401(k) Plan Advisor FAQs

When selecting a 401(k) plan advisor, you should look for someone who has extensive experience working with 401(k) plans and relevant qualifications such as a Certified Financial Planner (CFP) or Chartered Retirement Plan Specialist (CRPS) designation.

A 401(k) plan advisor can help ensure compliance with all relevant laws and regulations by providing guidance on compliance-related issues, staying up-to-date on changes and developments in this area, and working with employers to implement policies and procedures that ensure compliance.

The investment options you choose for your 401(k) plan will depend on a variety of factors, including your investment goals, risk tolerance, and time horizon. It is important to work with a 401(k) plan advisor who can provide guidance on the best investment options for your plan.

A 401(k) plan advisor can help prevent fraud and other misconduct related to 401(k) plans by implementing policies and procedures to identify potential fraud, monitoring plan activity for signs of fraudulent activity, and working with employers and employees to prevent fraudulent activity.

A 401(k) plan advisor should provide a variety of educational resources to employees, including materials that explain the plan's benefits, investment options, and enrollment process. Additionally, the advisor should communicate regularly with employees to ensure they have the information they need to make informed decisions about their benefits.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.