Both Roth IRA and Roth 401(k) are funded with after-tax money, so there is no immediate tax advantage to contributing. However, when you reach retirement age, you can withdraw the contributions and gains completely tax-free. After-tax means that your contributions are not deducted from your taxable income when you file your taxes. A Roth 401(k) is a retirement account that is employer-sponsored that combines the advantages of a Roth IRA with that of a traditional 401(k). You can put after-tax contributions to a Roth 401(k) and then receive tax-free withdrawals when you retire. A Roth IRA is an individual retirement account (IRA) in which you pay taxes on money that goes into the account. However, you will benefit much in the long run because earnings can be withdrawn tax-free upon retirement. Roth accounts give individuals access to tax-advantaged retirement savings while not immediately causing a significant drop in tax revenue. The Roth 401(k) differs significantly from the Roth IRA. You need to know these differences before choosing the appropriate plan.

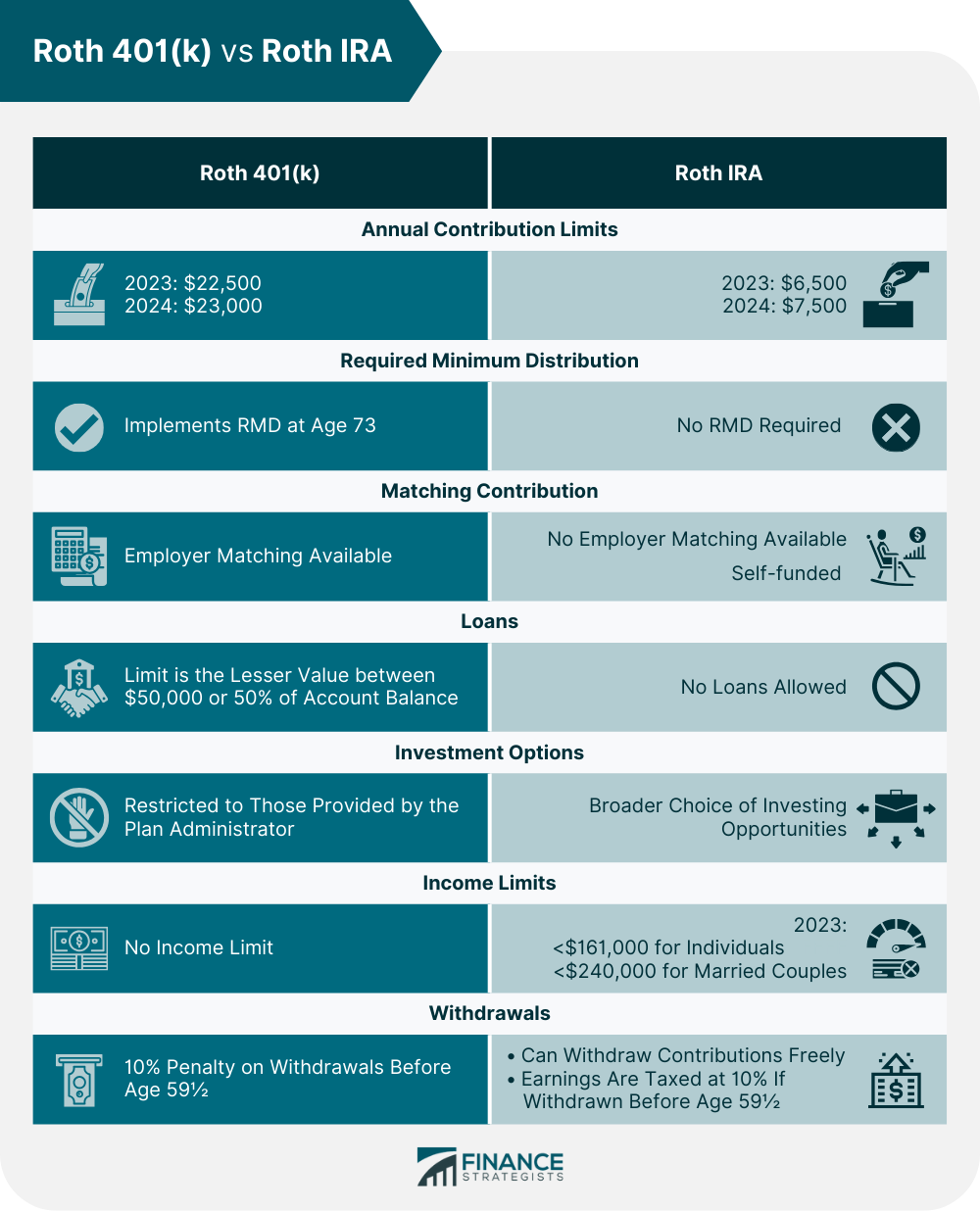

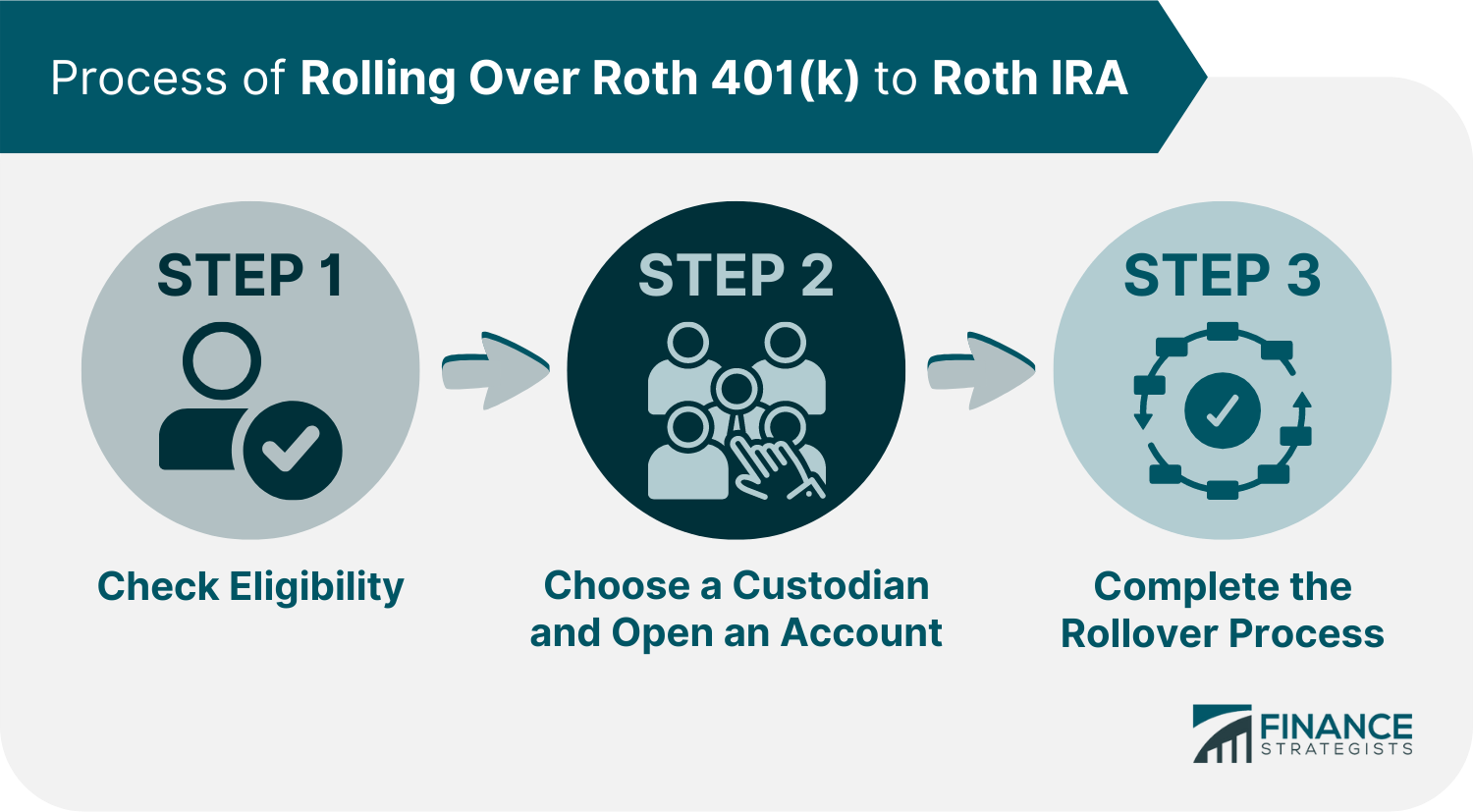

Members under the Roth 401(k) plan can contribute a maximum of $22,500 per year in 2023 and $23,000 in 2024. Additionally, individuals turning 50 by the end of the year can take advantage of the catch-up contribution and pay an extra $7,500. Roth IRA contributions are considerably lower at $6,500 per year in 2023 and $7,000 in 2024. Catch-up contributions are also available for those 50 years old and above but are capped at an extra $1,000 per year. Roth 401(k) requires you to withdraw the RMD at age 73. Otherwise, you will be penalized. You can avoid getting RMD if you are still employed and are not a 5% owner of the company that sponsors the plan. Roth IRA does not oblige you to take RMD at any time. That flexibility allows you to continue contributing to your account and lets the assets grow indefinitely. Contributions to a Roth 401(k) are matched similarly to contributions to a traditional 401(k). In most cases, the employer will match 100% of your contributions to a specified proportion of your salary. If you choose to contribute 6% of your salary to a 401(k), your employer will match that amount exactly. They can only allocate your designated Roth contributions to your designated Roth account. On the other hand, Roth IRAs are self-funded and do not offer employer-matching contributions. You can take out loans from your Roth 401(k) balance. The loan amount is limited to the lesser value between $50,000 or 50% of your vested account balance. The vested balance is the sum of money you are entitled to and that, even if you are fired, an employer cannot take away from you when you quit your work. According to IRS regulations, borrowing from a Roth IRA is not permitted. However, you can still access your money through other means, like initiating a Roth IRA rollover. You have 60 days to transfer funds from one account to another. As long as you return the money to it or to another Roth IRA within 60 days, you are receiving a 0% interest loan. With a Roth 401(k), you are limited to the investment choices the plan administrator offers. In many cases, they are as straightforward as a selection of basic mutual funds. A Roth IRA provides a much better range of investment options. Aside from mutual funds, the investor can choose index funds, stocks, bonds, exchange-traded funds and others. You can also compare rates for the most affordable transaction and administrative expenses. A Roth 401(k) allows everyone to contribute regardless of income level. On the other hand, a Roth IRA will only accept full contributions from individuals who make less than $146,000 or married couples who make less than $230,000 in 2024. Additionally, single filers who earn between $146,001 and $161,000 and married couples who earn between $230,001 and $240,000 can contribute a reduced amount. Individuals and couples with incomes above the stated amounts are disqualified from contributing to Roth IRAs. You can begin making eligible withdrawals from a Roth 401(k) if you meet two conditions: According to this guideline, you must have contributed to the account for at least five years before making your first withdrawal. If you take a Roth 401(k) distribution before turning 59 ½, taxes and a 10% penalty will be due on your earnings. If you decide to leave your job, you either cash out your account or convert it to an IRA. Contributions and earnings make up your Roth IRA. Contributions are the funds you deposit into the account, which are dictated by income limits. On the other hand, earnings are your profits from investments such as dividends, interest, and capital gains. Contributions and earnings in your account grow tax-free. You can withdraw your Roth IRA contributions at any time for any reason, with no taxes or penalties. It does not, however, apply if you withdraw your earnings. If you take them out early, you may owe income taxes and a 10% penalty. The following factors will determine your tax responsibilities for profits withdrawal: You can refer to the five-year rule for more information in the next section of this article. Find below a summary of the differences between Roth 401(k) and Roth IRA. The five-taxable-year period begins on the first day of the taxable year in which you first made designated Roth contributions to the plan. You must wait five years after the first contribution to your Roth accounts before withdrawing earnings without penalty. If you have a Roth 401(k) and a Roth IRA for at least five years, have been actively contributing to both, and are 59 ½ years old, the five-year rule should not be an issue for rollovers. But if you need to open a Roth IRA for the first time to get Roth 401(k) rollover funds, any earnings in the account are subject to the five-year rule. The tax implications of a Roth IRA distribution depend on whether it is qualified or nonqualified. Earnings in qualified distributions are tax-free and penalty-free. The following are the terms: When an amount is accepted before the five-year waiting period has been satisfied, it is considered a nonqualified distribution. Depending on the Roth IRA ordering rules, nonqualified distributions may be taxed and penalized. In the event of disability or death, you may not be required to pay the 10% fee. An exception applies when the money is used to pay for medical insurance after losing a job or when the money is used for disaster recovery. The process of a 401(k) rollover is relatively simple. Your first step should be to contact your company's plan administrator, explain what you want to do, and obtain the relevant documents. Check Eligibility Make sure that the account you are rolling over is eligible. Your employer's Roth 401(k) provider will identify how much of the funds are pre-tax and how much Roth contributions to determine possible tax implications. The IRS establishes an income eligibility range indicating your ability to make maximum, partial to no contribution. Choose a Custodian and Open an Account A few different types of financial institutions can act as custodians for Roth IRA and open a Roth IRA account with them. An IRA trustee, often known as a custodian, is the organization that manages your retirement account. Every individual retirement account is required by law to have either a custodian or a trustee. Complete the Rollover Process Complete the forms required by the Roth IRA provider and your Roth 401(k) plan administrator. The money is moved directly, either electronically or by check. No taxes are due when the money is transferred, and new earnings are generated without tax. There are a few benefits that come with rolling over a Roth 401(k) to a Roth IRA: When you rollover your Roth 401(k) into a Roth IRA, you will have more investment options. It includes mutual funds, stocks, bonds, exchange-traded funds (ETFs), certificates of deposit (CDs), money market funds, and others. Whereas with a Roth 401(k), your investment choices are limited to the options offered by your employer. Compared to cash out the account value, a rollover allows you to avoid tax penalties for early distribution. You do not have to pay taxes on the rollover amount until you withdraw it. Unlike other retirement accounts, Roth IRAs do not have RMDs. You are not required to withdraw money from your account at a certain age. This allows your retirement fund to grow tax-free over time. The following are also some drawbacks of rolling over a Roth 401(k) to a Roth IRA: You cannot access the earnings in your Roth IRA until you have had the account for five years since your first contribution. If you need to take the money before then, you will be subject to taxes and penalties. Another drawback of rolling over a Roth 401(k) to a Roth IRA is that you cannot take out loans from a Roth IRA like you can with a Roth 401(k). So, a Roth IRA may not be the best option if you need money before retirement. Rolling over a Roth 401(k) to a Roth IRA may result in additional expenses. You may be required to pay fees to the new custodian of your Roth IRA, and the costs for the investments available for Roth IRA may be higher. If you consider leaving a job, rolling over a Roth 401(k) to a Roth IRA can be a good idea. This enables you to move money from your old plan straight into your new employer's plan without having to pay taxes or penalties. Roth 401(k) accounts are not quite as common as standard accounts, and your new workplace may not provide a Roth 401(k) into which you can transfer your funds. If you want to explore more investment options and avoid direct taxes, rolling over a Roth 401(k) to a Roth IRA can be advantageous. Doing this gives you more choices without incurring any tax penalties. If you are nearing retirement and do not want to be subject to RMD, rolling over to a Roth IRA can make sense. This is because, with a Roth IRA, there is no mandatory withdrawal age like other retirement plans. Roth 401(k) and Roth IRA are both retirement accounts. It is important to understand their differences if you choose to roll over from Roth 401(k) to a Roth IRA. Check if your Roth 401(k) account is eligible for rolling over. Choose a custodian you can trust to manage your retirement funds. The five-year rule indicates that you must wait five years after the first contribution to your Roth accounts before withdrawing earnings without penalty. Plan to avoid any issues with the five-year rule and enjoy the benefits of rolling over, such as broader investment options and tax advantages. Rolling over a Roth 401(k) to a Roth IRA makes sense when leaving a job, nearing retirement age, and avoiding RMD. Complex tax policies are involved in this rollover. If you are slightly confused and overwhelmed, contact a financial advisor to guide you.Roth 401(k) vs Roth IRA

Need help with a Roth 401(k) rollover? Click here.Contribution Limits

Required Minimum Distributions (RMDs)

Matching Contributions

Loans

Investment Options

Income limits

Withdrawals

The Five-Year Rule

The Process of Rolling Over a Roth 401(k) To a Roth IRA

Benefits of Roth 401(k) To Roth IRA Rollovers

Wider Investment Options

Avoidance of Immediate Taxes

Tax-Deferred Growth of Retirement Savings

Drawbacks of Roth 401(k) To Roth IRA Rollovers

Five-Year Rule

No Loan Options

More Fees

When Is Rolling Over Your Roth 401(k) To a Roth IRA a Good Idea?

The Bottom Line

Rollover Roth 401(k) to Roth IRA FAQs

It makes sense if you are considering leaving a job, if you want more investment options, or if you are nearing retirement and want to avoid RMD.

You will satisfy the five-year rule after a rollover if you have a Roth 401(k) and a Roth IRA for at least five years and have been actively contributing to both. You cannot withdraw earnings tax-free until you have contributed to a Roth IRA account for at least five years.

No, a Roth IRA's contribution limit is separate from a 401(k) contribution limit. You can put up to $23,000 into a Roth 401(k) in 2024, plus an extra $7,500 if you are 50 or older. Additionally, you can put up to $7,000 into a Roth IRA, plus an additional $1,000 if you are 50 or older. All of these savings add up to a reasonable sum.

You should not undertake a Roth conversion if you were in a lower tax band after retirement and if the costs and taxes involved will outweigh the benefits. A rollover is not advised if you require access to the money before the five-year period.

The five-year rule for Roth IRA states that you cannot access the earnings in your Roth IRA until you have had the account for five years since your first contribution. If you need to take the money before then, you will be subject to taxes and penalties.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.