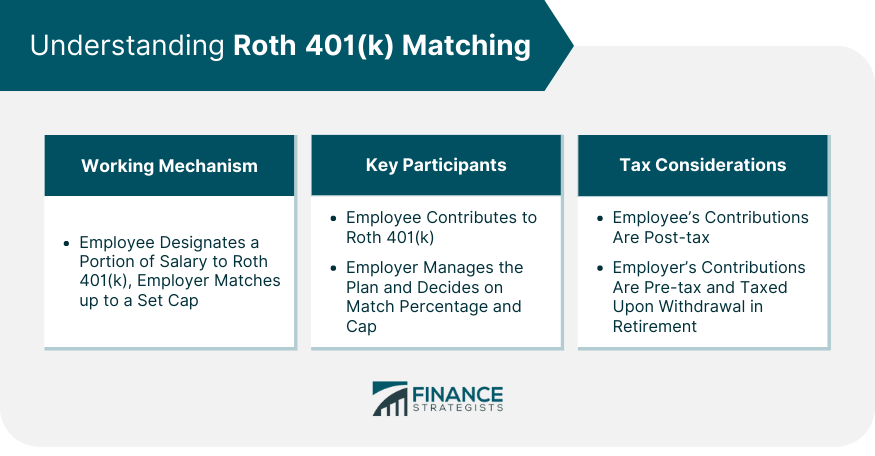

Roth 401(k) matching is a retirement savings strategy where an employer matches the contributions an employee makes to their Roth 401(k) account. The employee designates a portion of their salary to contribute, and the employer matches it, effectively doubling the contribution. However, the employer's contribution is usually capped at a certain percentage of the employee's salary. Notably, while the employee's contributions are made with post-tax dollars, the employer's matching contributions are pre-tax and placed into a separate account. Therefore, the employer's contributions and their subsequent earnings are taxable upon withdrawal during retirement. The goal of Roth 401(k) matching is to incentivize employees to save more for retirement. In a Roth 401(k) matching scheme, the employee designates a certain percentage of their salary for the Roth 401(k) account, and the employer contributes an equal amount. The contribution by the employer essentially doubles the total amount saved. However, it's important to note that the employer's contributions are typically capped at a certain percentage of the employee's salary. The two key players in a Roth 401(k) matching scenario are the employers and the employee. The employer is responsible for setting up and managing the 401(k) plan, including deciding on the match percentage and cap. The employee, on the other hand, decides how much of their salary they wish to contribute, up to the allowed maximum. Roth 401(k) matching carries unique tax implications. While the employee's contributions are made post-tax, the employer's matching contributions are pre-tax and are placed into a separate account within the 401(k) plan. The employee will not owe taxes on the employer contributions until they begin making withdrawals during retirement. Perhaps the most obvious benefit of Roth 401(k) matching is the significant boost it provides to an employee's retirement savings. The employer's matching contributions can help the employee accumulate a larger retirement fund than they could on their own. Roth 401(k) accounts offer the advantage of tax-free withdrawals during retirement. Although the initial contributions are made with post-tax dollars, the growth and earnings can be withdrawn tax-free, provided certain conditions are met. Roth 401(k) matching can also be a powerful incentive tool for employers. It can help attract and retain skilled employees, thereby reducing turnover and enhancing productivity. By encouraging employees to contribute to their retirement savings, Roth 401(k) matching promotes better financial planning and instills a culture of savings within the organization. While Roth 401(k) matching can be an excellent retirement savings tool, there are restrictions. The employer's matching contributions are generally capped at a certain percentage of the employee's salary, which means there's a limit to how much can be received in matched funds each year. Unlike traditional 401(k) contributions, which are made with pre-tax dollars, Roth 401(k) contributions are made with after-tax income. This can lead to a higher tax bill in the year the contributions are made, which may pose a financial strain for some employees. Roth 401(k) accounts have certain withdrawal restrictions that employees must be aware of. Although the employee contributions can be withdrawn tax-free and penalty-free at any time, the same doesn't apply to the employer's contributions and the earnings on them, which have to meet certain criteria before they can be withdrawn tax-free. Given that Roth 401(k) contributions are made with after-tax dollars, they can reduce an employee's net take-home pay. Employees must carefully evaluate their budget and financial goals before deciding the amount they wish to contribute to a Roth 401(k). One of the key distinctions between Roth 401(k) and traditional 401(k) matching lies in their tax implications. In a Roth 401(k), the employee's contributions are taxed upfront, whereas in a traditional 401(k), the contributions are pre-tax, and the taxes are deferred until retirement. The choice between Roth 401(k) and traditional 401(k) can also impact the retiree's income. With Roth 401(k) plans, the withdrawals during retirement are tax-free. In contrast, withdrawals from a traditional 401(k) are taxed as ordinary income. The choice between Roth and traditional 401(k) may also hinge on an individual's current and projected future income. High earners who anticipate being in a lower tax bracket during retirement may benefit more from a traditional 401(k), while those expecting to be in a higher or similar tax bracket during retirement might prefer a Roth 401(k). Maximizing the benefits of Roth 401(k) matching involves strategic planning. Ideally, employees should aim to contribute at least up to the maximum percentage that their employer is willing to match. Failing to do so essentially means leaving free money on the table. It's also essential to regularly review and adjust contributions. Life events like a raise, a new job, or changes in financial goals may warrant a revision of the contribution amount. A yearly review of your Roth 401(k) and other retirement accounts can be a good practice. Understanding the specifics of the employer's matching scheme is also crucial. This includes knowing the match percentage, the maximum match cap, and the vesting schedule if any. Some employers, for example, may require employees to work for a certain number of years before they are fully vested in the employer's contributions. Employer's Ability to Match Roth 401(k) Contributions Yes, employers can match contributions to a Roth 401(k). However, it's important to note that employer contributions are made on a pre-tax basis and are kept in a separate account, which will be taxed upon withdrawal. If withdrawals are made from the employer's portion of the Roth 401(k) before the age of 59½ and without meeting certain exceptions, they may be subject to a 10% early withdrawal penalty as well as income taxes. Yes, employees can split their contributions between traditional and Roth 401(k) accounts if their employer offers both. However, the total combined contribution must still be within the annual maximum limit set by the IRS. While the employee's contributions to a Roth 401(k) are made with after-tax dollars, the employer's match is made with pre-tax dollars. This means that the matching funds and their earnings will be taxable upon withdrawal in retirement. Roth 401(k) matching can be a powerful tool for boosting retirement savings, offering potential tax-free withdrawals in retirement, and serving as a strong incentive for employees. However, like all financial decisions, it comes with its own set of challenges, such as immediate tax liabilities and potential impacts on take-home pay. As such, it's crucial to understand its mechanisms thoroughly, including the tax implications, withdrawal rules, and how it differs from traditional 401(k) matching. By effectively strategizing contributions, regularly monitoring and adjusting contributions, and comprehending the employer's matching scheme, employees can optimize the benefits of Roth 401(k) matching. Thorough knowledge of this retirement savings tool can help employees make informed decisions that align with their long-term financial goals.What Is Roth 401(k) Matching?

How Roth 401(k) Matching Works

Key Participants

Tax Considerations Involved

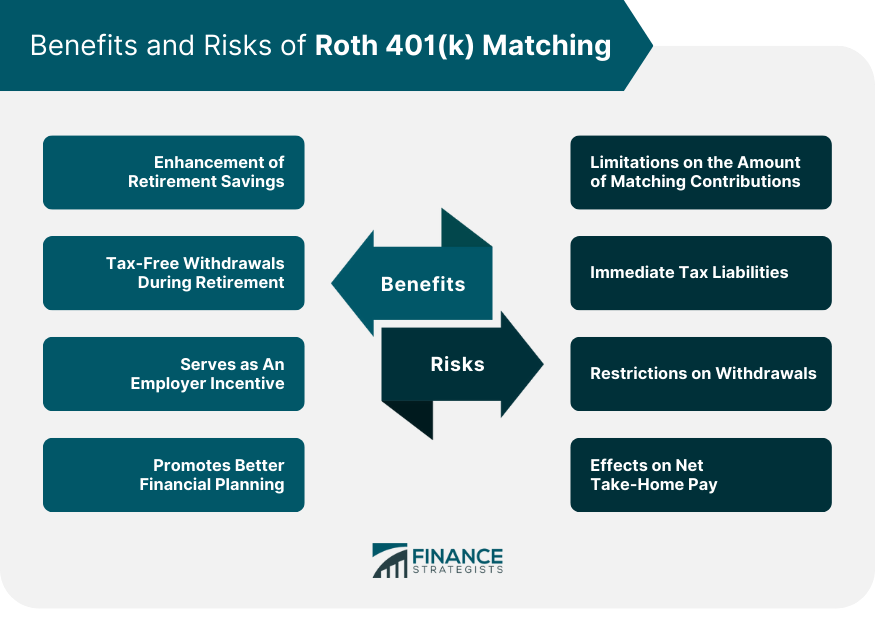

Benefits of Roth 401(k) Matching

Enhancement of Retirement Savings

Tax-Free Withdrawals During Retirement

Serves as an Employer Incentive

Promotes Better Financial Planning

Risks of Roth 401(k) Matching

Limitations on the Amount of Matching Contributions

Immediate Tax Liabilities

Restrictions on Withdrawals

Effects on Net Take-Home Pay

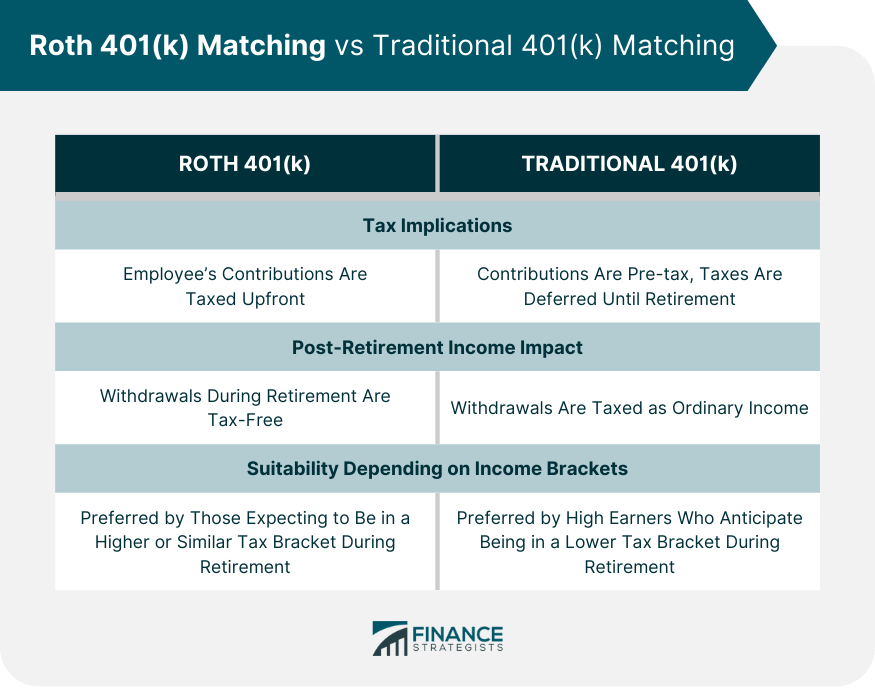

Roth 401(k) Matching vs Traditional 401(k) Matching

Tax Implications

Potential Impact on Post-Retirement Income

Suitability Depending on Income Brackets

Strategies to Optimize the Benefits of Roth 401(k) Matching

Effective Contribution Strategies

Regular Monitoring and Adjusting of Contributions

In-Depth Understanding of Employer's Matching Scheme

Common Questions About Roth 401(k) Matching

Penalties for Early Withdrawal From Roth 401(k)

Possibility of Contributing to Both Traditional 401(k) and Roth 401(k)

Taxation on Employer's Match in a Roth 401(k)

Conclusion

Roth 401(k) Matching FAQs

The main difference lies in the tax treatment. With Roth 401(k) matching, employee contributions are made with after-tax dollars and qualified withdrawals are tax-free. However, employer matches are pre-tax and taxed upon withdrawal. In contrast, both employee and employer contributions in traditional 401(k) matching are pre-tax and taxed upon withdrawal.

The employer matches a percentage of the employee's contributions to their Roth 401(k), up to a certain limit. While the employee's contributions are made with after-tax dollars, the employer's match is made with pre-tax dollars and is kept in a separate account, which will be taxed upon withdrawal.

Yes, you can contribute to both a Roth 401(k) and a traditional 401(k) if your employer offers both options. However, the total contributions to both accounts must still fall within the annual contribution limits set by the IRS. The employer's matching contributions can be applied to either or both, depending on the employer's policy.

Yes, if you make withdrawals from the employer's matching portion of the Roth 401(k) before you reach the age of 59½ and without meeting certain exceptions, those withdrawals may be subject to a 10% early withdrawal penalty as well as income taxes.

To maximize the benefits of Roth 401(k) matching, you should aim to contribute at least up to the maximum percentage that your employer matches. Regularly review and adjust your contributions, understand your employer's matching scheme, and consider your current and future tax situation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.