The Roth 401(k) is a type of retirement savings account that combines features of the traditional 401(k) and Roth IRA. Like a traditional 401(k), it's typically provided by employers, but it differs in how contributions and withdrawals are taxed. With a Roth 401(k), contributions are made post-tax, meaning they don't reduce taxable income in the year they're made. However, qualified withdrawals in retirement, including earnings, are tax-free, which can be significantly beneficial for those expecting to be in a higher tax bracket in retirement. The plan also allows for higher contribution limits than a Roth IRA. Despite these advantages, there are income limits for contributing to a Roth 401(k), and the account is subject to required minimum distributions (RMDs) at a certain age.

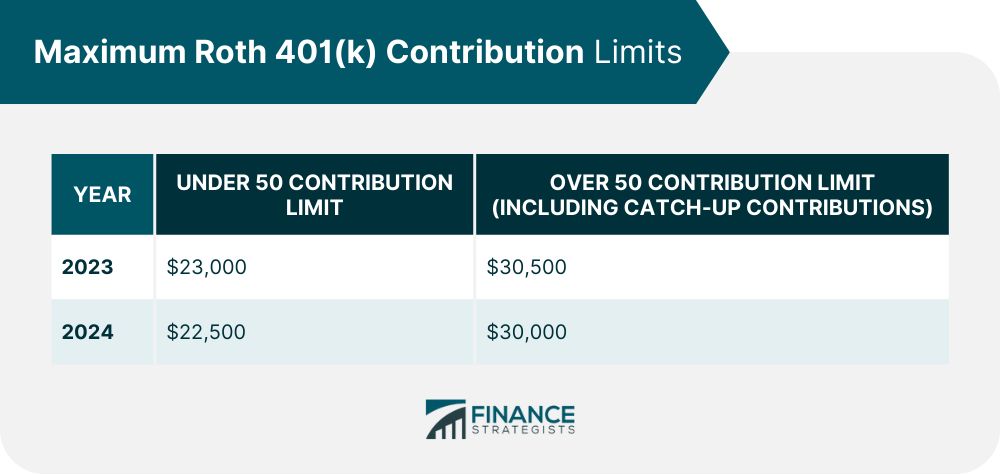

Roth 401(k) contribution limits represent the maximum amount that an individual can contribute to their Roth 401(k) account in a given year. These limits are set annually by the Internal Revenue Service (IRS) and are affected by several factors, such as your age. For 2024, the IRS set the Roth 401(k) contribution limit at $23,000 for those under the age of 50. Individuals aged 50 and above are allowed to make catch-up contributions, increasing their limit to $30,500. Historically, these limits have seen gradual increases, a trend that reflects inflation and the increased cost of living. For instance, in 2023, the contribution limit was $22,500, with a catch-up limit of $30,000 for those over 50. As previously mentioned, the IRS allows individuals aged 50 and above to make additional catch-up contributions. This policy recognizes the increased urgency for individuals nearing retirement age to bolster their retirement savings. The additional $7,500 that can be contributed can make a significant difference when compounded over time. The IRS does not impose income limits for Roth 401(k) contributions, making them an excellent choice for high earners who may be disqualified from making Roth IRA contributions due to income restrictions. However, your income level might influence how much you're able to contribute, especially if you aim to maximize your contributions. Employer contributions to a Roth 401(k) don't count toward the annual contribution limit set by the IRS. This means that if your employer offers a matching program, you could potentially accrue even more in your Roth 401(k). However, these matching contributions are placed in a traditional 401(k) account and are subject to taxes upon withdrawal. It's essential to stay informed about any changes the IRS might make to the rules surrounding Roth 401(k) contributions. For instance, contribution limits tend to increase over time. By keeping abreast of these changes, you can ensure you're taking full advantage of your contribution potential. To maximize your Roth 401(k) contributions, you'll likely need to refine your budgeting and saving strategies. Consider cutting non-essential expenses, automating your contributions, and incrementally increasing your contributions each year or whenever you receive a pay raise. While maximizing your Roth 401(k) contributions is a worthwhile goal, it's also essential to consider how this fits into your broader retirement savings strategy. For some, it may make sense to contribute enough to get the full employer match in your 401(k), then contribute to a Roth IRA (if eligible), and then return to funding the 401(k). Setting up automatic contributions can be a simple and effective way to ensure you're regularly contributing to your Roth 401(k). Not only does this make the process of contributing easier, but it also ensures that saving for retirement is a priority each time you receive income. The more you contribute to your Roth 401(k), the more you stand to benefit from compound interest and tax-free growth. Unlike traditional 401(k) accounts, qualified withdrawals from Roth 401(k) accounts are tax-free in retirement, providing you with more disposable income when you're likely to need it most. Roth 401(k)s are funded with after-tax dollars. While this means you won't receive a tax deduction for your contributions now, it does mean you can take tax-free withdrawals in retirement. This could be particularly advantageous if you expect to be in a higher tax bracket when you retire. Maximizing your contributions leads to a larger nest egg in retirement, offering increased financial security. Considering the rising costs of healthcare and longer life expectancies, having a robust retirement savings plan is becoming increasingly important. Unlike contributions to a traditional 401(k), Roth 401(k) contributions are not tax-deductible in the year they're made. This could lead to a higher tax bill in the short term. However, the ability to make tax-free withdrawals in retirement may outweigh this immediate drawback. Since Roth 401(k) contributions are made with after-tax dollars, maximizing your contributions will decrease your take-home pay more than if you were contributing to a traditional 401(k). It's essential to consider this when determining whether or not maximizing your Roth 401(k) contributions is the right strategy for you. While Roth 401(k) accounts allow for tax-free withdrawals in retirement, withdrawing funds before the age of 59½ can lead to taxes and penalties. However, there are exceptions for certain circumstances, such as disability or a first-time home purchase. Understanding the rules can help you avoid unexpected costs. High-income earners face unique challenges and opportunities when it comes to retirement planning. They often exceed the income limits for Roth IRA contributions, making the Roth 401(k) an attractive alternative since it does not have income limits. However, they might also be in a higher current tax bracket and could benefit from the immediate tax deductions offered by a traditional 401(k). High-income earners are likely in a higher tax bracket than they will be during retirement, making the upfront tax deductions of a traditional 401(k) potentially more advantageous. On the other hand, they could also stand to benefit substantially from tax-free withdrawals during retirement with a Roth 401(k), particularly if tax rates rise in the future. For high earners, a useful strategy could be to contribute enough to a traditional 401(k) to reduce their taxable income and possibly their tax bracket and then contribute the remainder to a Roth 401(k). This approach offers both upfront tax savings and tax-free income during retirement. Since Roth 401(k)s don't have income restrictions, high earners can use them similarly to a backdoor Roth IRA. This involves making post-tax contributions to the Roth 401(k) and taking advantage of tax-free growth and withdrawals during retirement, circumventing the income limits placed on Roth IRA contributions. Understanding and leveraging Roth 401(k) contributions can be a valuable part of your retirement planning strategy. While contributing post-tax may result in a higher short-term tax bill, the promise of tax-free withdrawals in retirement, especially for those expecting to be in a higher tax bracket, is a compelling advantage. Each year's contribution limit, influenced by factors like age and income, allows for strategic budgeting and savings plans. Maximizing contributions isn't without drawbacks, such as a potential decrease in take-home pay, but the benefits of compound interest, tax-free growth, and increased financial security in retirement often outweigh these. For high-income earners, the Roth 401(k) offers an attractive alternative with no income limits and the potential for upfront tax savings and tax-free retirement income. Retirement planning is a complex but crucial task. For personalized strategies and guidance, seek the services of a retirement planning expert today.Overview of Roth 401(k)

Maximum Roth 401(k) Contribution Limits

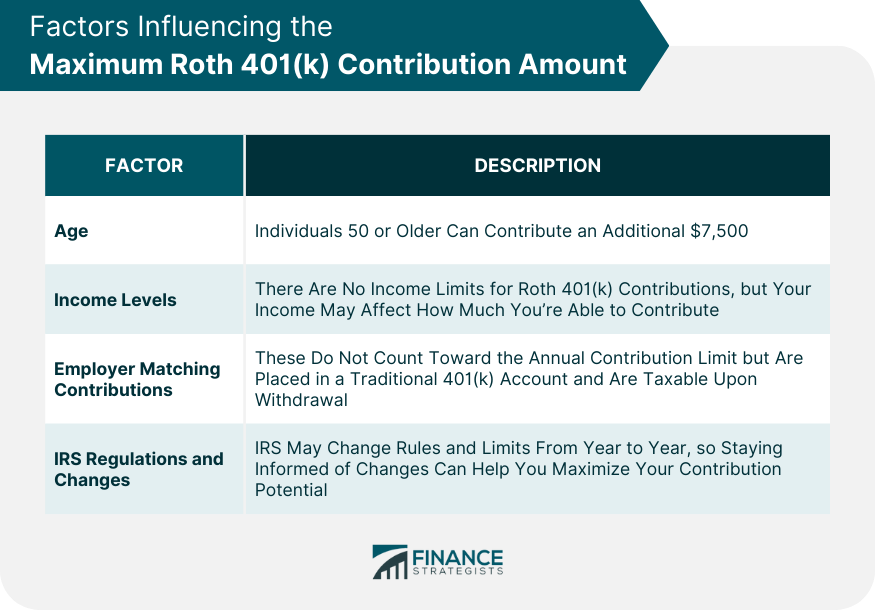

Factors Influencing the Maximum Roth 401(k) Contribution Amount

Age

Income Levels

Employer Matching Contributions

IRS Regulations and Changes

Strategies for Maximizing Roth 401(k) Contributions

Saving and Budgeting Tips

Balancing Other Retirement Accounts

Utilizing Automatic Contributions

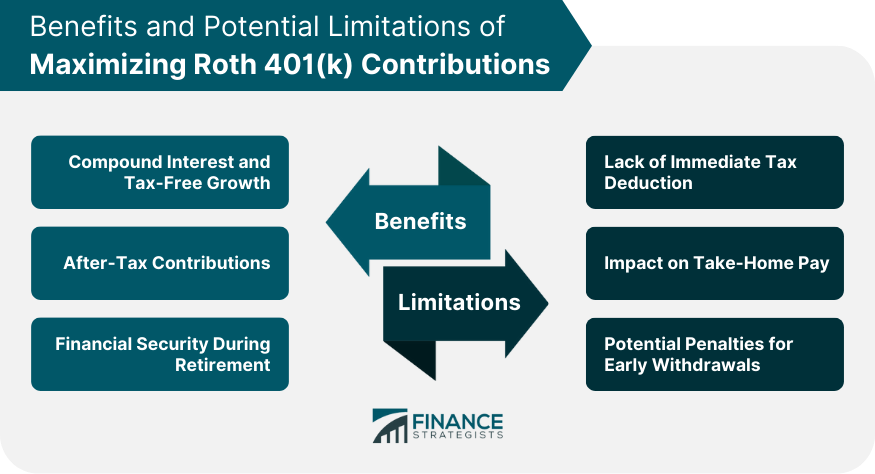

Benefits of Maximizing Roth 401(k) Contributions

Compound Interest and Tax-Free Growth

After-Tax Contributions

Financial Security During Retirement

Potential Limitations and Drawbacks of Maximizing Roth 401(k) Contributions

Lack of Immediate Tax Deduction

Impact on Take-Home Pay

Potential Penalties for Early Withdrawals

Considerations for High-Income Earners

Tax Considerations

Contribution Strategies

Roth 401(k) as a Backdoor Roth IRA

Bottom Line

Understanding and Maximizing Your Roth 401(k) Contributions FAQs

The contribution limit for Roth 401(k) for those under 50 is $22,500, and for those over 50, it's $30,000.

Individuals aged 50 and above are allowed to make additional catch-up contributions of $7,500 to their Roth 401(k).

Yes, high-income earners can contribute to a Roth 401(k) as it doesn't have income restrictions, unlike the Roth IRA.

Strategies include effective saving and budgeting, balancing other retirement accounts, and setting up automatic contributions.

Benefits include enjoying the power of compound interest, tax-free growth, and improved financial security during retirement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.