When you pass away, the balance of your 401(k) is passed on to the beneficiary you've designated. If you haven't designated a beneficiary, the fund default to your estate. The SECURE Act of 2019 made significant changes to the distribution rules. Spousal beneficiaries can roll the funds into their own IRA or a beneficiary IRA, maintaining tax-deferred status. Non-spouse beneficiaries, however, are required to withdraw all funds within ten years, potentially increasing their tax liability. Beneficiaries should consult with a financial advisor to understand the tax implications and best distribution strategy. Regularly reviewing and updating your beneficiary designations ensures that your funds are distributed according to your wishes. On a 401(k) plan, the name beneficiary will receive the funds in the event of the account holder's death. This overrides any contrary instructions in a will or trust. Hence, it's essential to update the beneficiaries after significant life events like marriage, divorce, or the birth of a child. Without a designated beneficiary, the 401(k) funds will likely become part of the deceased's estate and be distributed according to the terms of the individual’s will or, in the absence of a will, state intestacy laws. This can lead to delays, additional costs, and potentially unfavorable tax consequences. The Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019 made significant changes to the rules governing distributions from 401(k) plans. Previously, beneficiaries could stretch distributions from inherited 401(k) accounts over their lifetimes, reducing the tax burden. Now, most non-spousal beneficiaries must withdraw all funds within ten years of the account holder's death. The 10-Year rule stipulates that non-spousal beneficiaries of a 401(k) must fully withdraw funds from the account within ten years of the original account holder's death. There are no required minimum distributions within this period, but the entire balance must be distributed by the end of the tenth year. This rule can result in higher tax liability for beneficiaries, particularly those in their peak earning years. Regardless of the type of 401(k) inherited – traditional or Roth – the distributions are generally subject to income tax. The tax rate will depend on the heir's income tax bracket in the year of distribution. This can lead to 'tax bracket creep,' where the extra income from the 401(k) pushes the beneficiary into a higher tax bracket. There are several strategies that beneficiaries can employ to minimize their tax liability. One option is to spread out distributions over the entire ten-year period to prevent a substantial increase in taxable income in a single year. Alternatively, beneficiaries may choose to take distributions in years when their income is lower, minimizing the income tax due. Beneficiary designations should be reviewed regularly and updated following major life events. If the named beneficiary predeceases the account holder and no contingent beneficiary is named, the funds may default to the deceased's estate, complicating distribution and potentially increasing tax liability. Professional financial advisors can play a key role in managing 401(k) plans and other assets to ensure smooth and efficient transfer to heirs. They can provide advice on the tax implications of distributions, potential strategies to reduce tax liability, and the impact of recent legislation like the SECURE Act. 401(k) plan's distribution after death largely depends on the designated beneficiary. The SECURE Act has significantly shifted the landscape, requiring non-spouse beneficiaries to withdraw all funds within a decade, potentially leading to increased tax implications. Regularly reviewing your beneficiary designation is crucial to ensure your assets are dispersed according to your wishes. The absence of a named beneficiary can complicate the process, highlighting the importance of keeping your 401(k) plan updated, especially after life-changing events. Engaging a financial advisor can help navigate these complexities, offering strategies to minimize tax liabilities and effectively manage the distribution of assets. Remember, effective estate planning is essential to secure your loved one's financial future after your demise.What Happens to Your 401(k) When You Die?

How Beneficiary Designations Impact Your 401(k) After Death

Named Beneficiary

No Designation Beneficiary

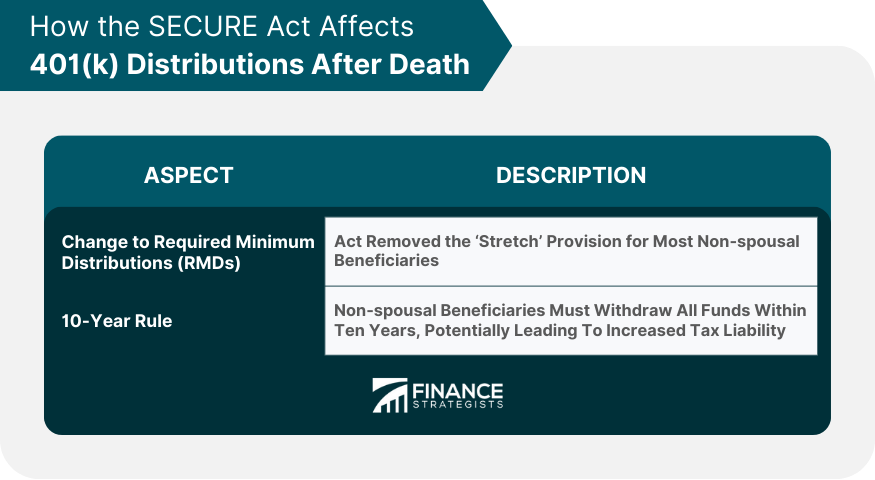

How the SECURE Act Affects 401(k) Distributions After Death

Changes to Required Minimum Distributions (RMDs)

10-Year Rule for Non-Spousal Beneficiaries

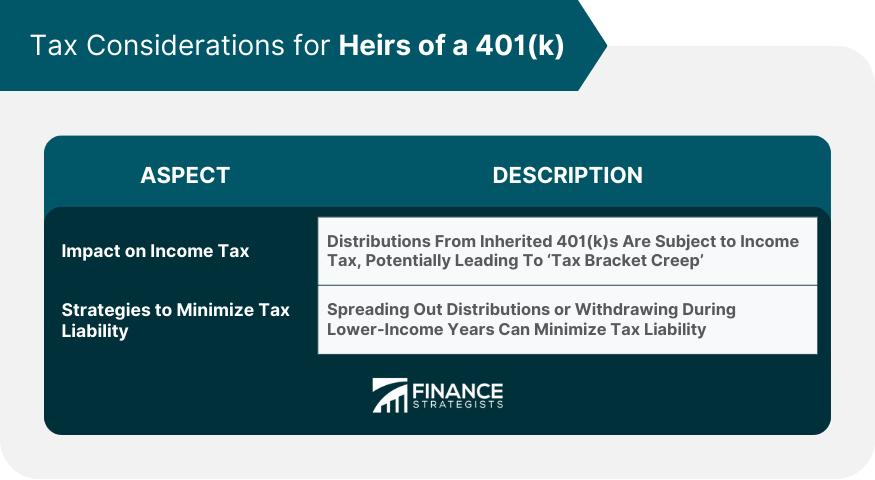

Tax Considerations for Heirs of a 401(k)

Impact on Income Tax for Heirs

Strategies to Minimize Tax Liability

Key Steps to Take for Smooth 401(k) Distribution After Death

Regularly Update Beneficiaries

Financial Advisors in Estate Plan

Conclusion

What Happens to Your 401(k) When You Die? FAQs

When you die, the funds in your 401(k) plan pass to the beneficiary or beneficiaries you have designated with your plan's administrator. If no beneficiary has been specified, the funds may go to your estate and be distributed according to your will or state law.

Your heirs will generally have to pay income tax on distributions they take from your 401(k). The rate at which they are taxed depends on their income bracket. Non-spouse beneficiaries must withdraw all funds within ten years due to the SECURE Act's 10-Year rule, potentially leading to higher tax liability.

The SECURE Act implemented a 10-Year rule requiring most non-spouse beneficiaries to withdraw all funds from the 401(k) account within ten years of the original account holder's death. This rule eliminated the "stretch" provision, which allowed beneficiaries to take distributions over their lifetime, thereby potentially increasing the tax burden.

One strategy to minimize tax liability for your beneficiaries is to spread out distributions over the ten-year period allowed by the SECURE Act. This can prevent a substantial increase in taxable income in a single year. Another strategy is to consider Roth conversions during your lifetime, which can provide tax-free income to your heirs.

The named beneficiaries on your 401(k) plan will inherit the funds in the event of your death, superseding any instructions in your will. Regularly updating your beneficiary designations, especially after significant life events like marriage or the birth of a child, is crucial to ensure the funds are distributed according to your wishes.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.