AARP, formerly known as the American Association of Retired Persons, is a nonprofit organization that advocates for the interests of individuals aged 50 and above. Founded in 1958, AARP seeks to enhance the quality of life of older Americans by providing resources and support for health, finances, and retirement planning. AARP is one of the largest membership organizations in the United States, with over 38 million members. It offers a wide range of benefits and services to its members, including healthcare and insurance options, travel discounts, and access to educational resources and tools for retirement planning. As the baby boomer generation continues to age, retirement planning has become an increasingly important topic. AARP serves as a valuable resource for individuals looking to plan for retirement, offering access to a range of financial and health-related services, as well as information and resources to support informed decision-making. Through its advocacy efforts, AARP also seeks to influence policy decisions that impact the lives of older Americans. As such, it plays a critical role in ensuring that the interests of seniors are represented at the local, state, and national levels. One of the most significant benefits of AARP membership is access to health insurance options. AARP partners with UnitedHealthcare to provide a range of Medicare Advantage, Medicare Supplement, and Prescription Drug Plans. Members can also access dental, vision, and hearing coverage, as well as long-term care insurance options. AARP's health insurance offerings can provide peace of mind for seniors looking to manage their healthcare costs during retirement. The organization's partnerships with major insurance providers also help ensure that members have access to quality care and services. In addition to health insurance options, AARP also offers life insurance policies through its partnership with New York Life Insurance Company. Members can choose from term, whole, and universal life insurance policies, with coverage amounts ranging from $10,000 to $100,000. AARP's life insurance offerings can provide financial protection for members and their loved ones, helping to cover expenses such as funeral costs and outstanding debts. The organization's partnerships with reputable insurance providers also help ensure that members have access to competitive rates and reliable services. AARP members can also take advantage of a range of discounts on travel and leisure activities. These include discounts on hotels, car rentals, and vacation packages, as well as savings on dining and entertainment options. AARP's travel and leisure discounts can help members save money on their favorite activities and experiences, making it easier to enjoy retirement without breaking the bank. The organization's partnerships with major travel providers also help ensure that members have access to high-quality services and experiences. AARP offers a range of financial products and services to help members manage their finances during retirement. These include credit cards, banking and investment options, and access to financial planning resources. AARP's financial products and services can help members achieve their retirement goals, such as saving for a comfortable retirement or managing expenses during their golden years. The organization's partnerships with major financial institutions also help ensure that members have access to competitive rates and reliable services. AARP offers a range of retirement planning tools and resources, including a retirement calculator that helps members estimate how much they will need to save for retirement. The calculator takes into account factors such as age, income, and expected Social Security benefits to provide a personalized estimate of retirement expenses. AARP's retirement calculator can help members better understand their retirement needs and plan for a financially secure future. The organization's commitment to providing reliable, user-friendly resources makes it easier for members to navigate the complexities of retirement planning and make informed decisions about their financial future. AARP also offers a Social Security benefits calculator that helps members estimate their monthly Social Security benefit based on their earnings history. This can help individuals better understand their retirement income and plan for a financially secure future. AARP's Social Security benefits calculator can be a valuable tool for members, especially as Social Security plays an important role in many individuals' retirement planning. By providing accurate estimates of Social Security benefits, AARP helps members make informed decisions about when to retire and how to maximize their benefits. AARP's retirement planning guide provides a comprehensive overview of retirement planning, including topics such as savings strategies, investment options, and healthcare planning. The guide also includes tips for managing debt, working during retirement, and maintaining a healthy lifestyle. AARP's retirement planning guide can be a valuable resource for members looking to build a successful retirement plan. By providing detailed information on a wide range of retirement-related topics, AARP helps members make informed decisions about their future and achieve their retirement goals. AARP is a leading advocate for Social Security reform, working to ensure that the program remains strong and sustainable for future generations. The organization advocates for measures such as increasing the payroll tax cap, implementing means testing for high-income earners, and strengthening the program's funding sources. AARP's advocacy efforts on Social Security reform play a critical role in ensuring that the program remains a reliable source of income for retirees. The organization's commitment to protecting Social Security benefits and advocating for sustainable funding sources helps ensure that older Americans can enjoy a financially secure retirement. AARP also advocates for reform and improvements to the Medicare program, which provides health insurance to millions of older Americans. The organization supports measures such as expanding Medicare coverage to include dental, vision, and hearing services, and reducing out-of-pocket costs for beneficiaries. AARP's advocacy efforts on Medicare reform help ensure that older Americans have access to quality healthcare services and can afford necessary medical treatments. By advocating for improvements to the Medicare program, AARP plays a critical role in promoting the health and well-being of older Americans. AARP also advocates for the protection of pensions and retirement savings, working to ensure that employers and financial institutions act in the best interests of retirees. The organization supports measures such as strengthening pension funding requirements, increasing transparency in pension plan management, and improving access to retirement savings options. AARP's advocacy efforts on pension protection help ensure that retirees have access to secure and reliable sources of retirement income. By advocating for measures to protect pensions and retirement savings, AARP helps ensure that older Americans can enjoy a financially secure retirement. AARP is also a leading advocate for consumer protection, working to ensure that older Americans are protected from scams, fraud, and other forms of financial exploitation. The organization supports measures such as strengthening consumer protection laws, increasing consumer education and outreach, and improving enforcement efforts. AARP's advocacy efforts on consumer protection help ensure that older Americans can make informed decisions about their finances and avoid falling victim to financial scams and fraud. By advocating for stronger consumer protection laws and enforcement efforts, AARP plays a critical role in promoting the financial security and well-being of older Americans. AARP's volunteer workforce is an essential part of the organization's mission to enhance the quality of life of older Americans. AARP volunteers contribute their time and skills to a range of programs and initiatives, including advocacy efforts, community outreach, and educational activities. AARP's volunteer opportunities provide members with the chance to give back to their communities, connect with others who share their interests, and make a positive impact on the lives of older Americans. By harnessing the power of its volunteer workforce, AARP is able to amplify its impact and make a meaningful difference in the lives of millions of people. AARP also offers opportunities for members to take on leadership roles within the organization. These roles include serving as state and local chapter leaders, committee members, and advocates for AARP's policy and advocacy efforts. AARP's volunteer leadership opportunities provide members with the chance to develop new skills, build relationships with other members, and play a direct role in shaping the organization's priorities and initiatives. By offering a range of leadership roles, AARP helps ensure that members of all backgrounds and skill sets can make a meaningful contribution to the organization. In addition to the satisfaction of making a difference in their communities, AARP volunteers also receive a range of benefits and rewards. These include access to exclusive volunteer training and development programs, discounts on AARP products and services, and recognition for their contributions to the organization. AARP's volunteer benefits help ensure that members feel valued and appreciated for their contributions to the organization. By offering a range of rewards and recognition opportunities, AARP helps ensure that its volunteers are motivated to continue their service and make an ongoing impact in their communities. AARP is a nonprofit organization that advocates for the rights and interests of individuals aged 50 and above. It provides a variety of benefits and services to its members, including health and life insurance, travel discounts, financial products, and retirement planning resources. AARP also supports various advocacy efforts, such as social security and Medicare reform, pension protection, and consumer protection. AARP plays a critical role in retirement planning, offering a range of benefits and services to its members, as well as resources and tools for retirement planning. Their advocacy and policy efforts also help ensure that the interests of older Americans are represented at the local, state, and national levels. For those looking to get involved, AARP offers a range of volunteer opportunities, including opportunities for leadership and recognition. By joining AARP and getting involved in its volunteer programs, members can make a meaningful contribution to the organization's mission and enhance the quality of life of older Americans.What Is AARP?

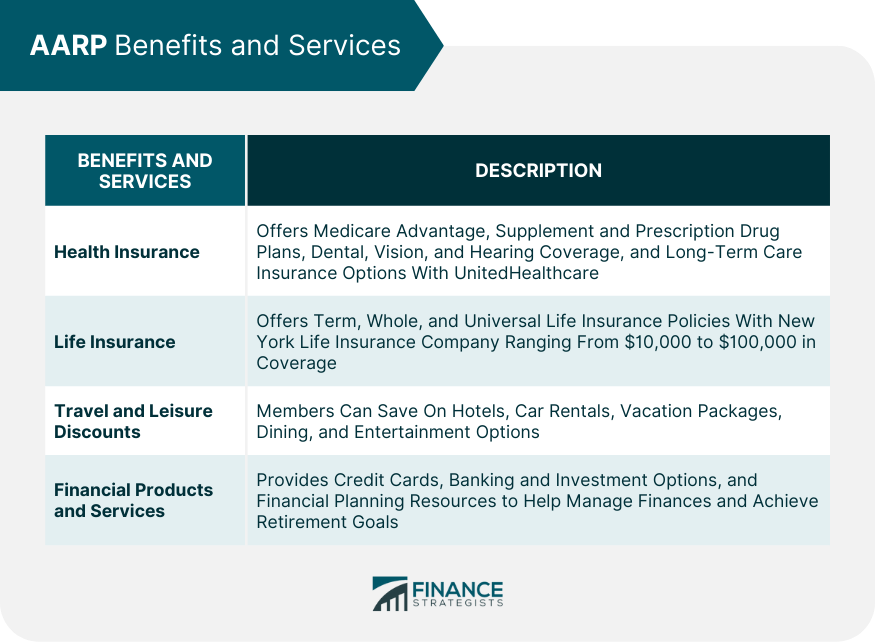

AARP Benefits and Services

Health Insurance

Life Insurance

Travel and Leisure Discounts

Financial Products and Services

AARP Retirement Planning Resources

Retirement Calculator

Social Security Benefits Calculator

Retirement Planning Guide

AARP Advocacy and Policy Efforts

Social Security Reform

Medicare Reform

Pension Protection

Consumer Protection

AARP Volunteer Opportunities

Volunteer Workforce

Volunteer Leadership

Volunteer Benefits

Bottom Line

AARP FAQs

AARP is a nonprofit organization that advocates for the rights and interests of people aged 50 and above. It provides various benefits and services to its members.

AARP offers various benefits, including health insurance, life insurance, travel discounts, financial products, and services. It also provides resources for retirement planning.

To join AARP, you must be at least 50 years old and pay an annual membership fee. You can join online or by mail, and you will receive a membership card and benefits information.

Yes, AARP offers retirement planning resources, such as a retirement calculator, Social Security benefits calculator, and retirement planning guide, to help you plan for your future.

AARP advocates for social security reform, Medicare reform, pension protection, and consumer protection, among other issues. It also provides volunteer opportunities for members to get involved in advocacy efforts.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.