Early retirement penalties are fees and reductions in benefits imposed on individuals who access certain retirement funds or benefits before a specified age. Understanding these penalties is crucial when planning for early retirement to avoid unexpected financial consequences. Being aware of early retirement penalties can help individuals make informed decisions about accessing retirement funds, claiming Social Security benefits, and coordinating pension benefits, thus preserving their financial well-being during retirement. Early withdrawal penalties may apply to various retirement accounts, such as traditional IRAs, Roth IRAs, and employer-sponsored plans like 401(k), 403(b), and 457 plans. Claiming Social Security benefits before full retirement age can result in permanently reduced monthly benefits. Some pension plans may impose penalties or reduced benefits if distributions are taken before a specified age or service requirement. The early withdrawal penalty rate for most retirement accounts is 10% of the amount withdrawn. For example, if you withdraw $10,000 from your 401(k) before age 59 1/2, you will be subject to a $1,000 early withdrawal penalty. In addition, you will also need to pay income taxes on the amount withdrawn. However, there are several exceptions to the early withdrawal penalty. One exception is if you have a qualifying disability. If you are disabled, you can withdraw funds from your retirement account without incurring the penalty. Another exception is if you are using the funds to pay for medical expenses that exceed a certain percentage of your adjusted gross income (AGI). Withdrawing funds from a retirement account before the age of 59 1/2 can result in significant tax implications. In addition to the early withdrawal penalty, individuals will also need to pay income taxes on the amount withdrawn, which can further reduce their retirement savings. The amount of income tax owed on an early withdrawal depends on several factors, including the type of account and the individual's tax bracket. For example, withdrawals from traditional 401(k)s and IRAs are taxed as ordinary income, which means that the amount withdrawn is added to the individual's taxable income for the year and taxed at their marginal tax rate. Understanding the rules surrounding penalty-free withdrawals and utilizing various strategies can help individuals avoid early retirement penalties on their retirement accounts. One strategy to avoid these penalties is to delay withdrawing funds until reaching the age of 59 1/2 or older. This can allow the account to grow tax-deferred for a longer period, increasing the amount of retirement savings available. Another strategy is to consider alternative sources of income, such as part-time work or accessing other retirement accounts, such as Roth IRAs or taxable investment accounts, which may have different withdrawal rules and penalties. Claiming Social Security benefits early can have a significant impact on your retirement income. In general, you can start claiming Social Security benefits as early as age 62, but your monthly benefit amount will be reduced if you claim before your full retirement age. For example, if your FRA is 66 and you claim benefits at age 62, your monthly benefit will be reduced by 25%. This means that if your full retirement benefit is $2,000 per month, you will receive only $1,500 per month if you claim at age 62. One strategy is to delay claiming benefits until reaching the full retirement age or beyond. By waiting, retirees can avoid the reduction in benefits that comes with claiming early. Another strategy is to coordinate your Social Security benefits with your spouse's benefits. Married couples can potentially increase their overall retirement income by coordinating when they claim their benefits. In addition, it is important to consider the impact of taxation on Social Security benefits. Retirees with a significant amount of retirement income may need to pay taxes on a portion of their Social Security benefits, reducing their overall retirement income. To minimize the impact of taxes, retirees can consider strategies such as withdrawing from tax-advantaged accounts or utilizing tax-efficient investments. One of the many benefits of a pension plan is the ability to retire with a steady stream of income. However, if you choose to retire early, you may face penalties in the form of reduced pension benefits. The reduction in benefits can vary depending on several factors such as age, years of service, and the terms of the plan. For instance, some plans may reduce benefits by a certain percentage for every year you retire before reaching the full retirement age. Additionally, the amount of the pension reduction can also be affected by other factors such as the type of plan you have, whether it is a defined benefit or a defined contribution plan. In a defined benefit plan, your pension is calculated based on a formula that takes into account your years of service and your salary. Thus, retiring early would result in a lower pension benefit since you would have fewer years of service and a lower salary. It is also important to consider how your pension benefits will coordinate with other retirement income sources, such as Social Security or individual retirement accounts. Depending on the terms of your plan, receiving benefits from other sources may also affect the amount of your pension. Understanding and using penalty-free withdrawal exceptions can help individuals minimize early retirement penalties on their retirement accounts. Converting funds to a Roth IRA can provide more flexibility for penalty-free withdrawals in certain situations. The SEPP method allows individuals to withdraw funds from their retirement accounts without incurring penalties by taking a series of substantially equal payments over their life expectancy. The Rule of 55 allows penalty-free withdrawals from employer-sponsored plans, such as 401(k)s, for individuals who leave their job during or after the year they turn 55. Working with financial planners and advisors can help individuals navigate the complexities of early retirement penalties and develop strategies to minimize their impact. Consulting with tax professionals can provide valuable insights into the tax implications of early retirement decisions and help individuals develop tax-efficient strategies. Communicating with retirement plan administrators can provide essential information about the specific rules and penalties associated with an individual's retirement accounts. Early retirement penalties can have a significant impact on an individual's financial well-being during retirement. These penalties can arise from accessing retirement accounts too soon, claiming Social Security benefits early, or taking pension distributions before meeting specific requirements. It is crucial for those planning to retire early to understand these penalties and develop strategies to minimize their impact on retirement income. Proper planning and seeking professional guidance from financial advisor, tax professionals, and retirement plan administrators are essential in navigating early retirement penalties. By working with these professionals, individuals can make informed decisions about accessing retirement funds, claiming Social Security benefits, and coordinating pension benefits to ensure a stable financial situation during early retirement. This proactive approach allows early retirees to enjoy the freedom and opportunities that come with leaving the workforce ahead of schedule while maintaining financial security.What Is an Early Retirement Penalty?

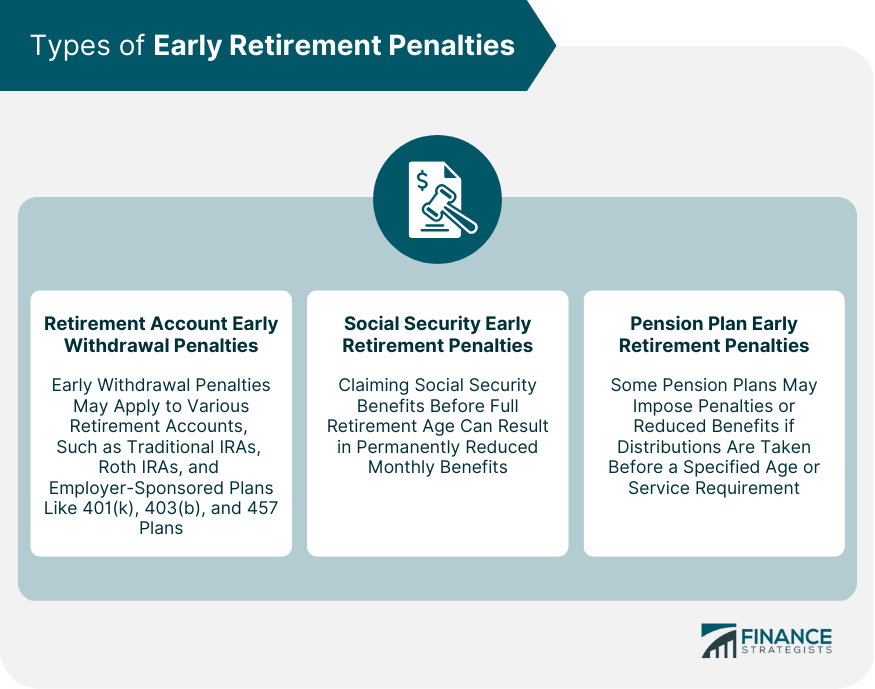

Types of Early Retirement Penalties

Retirement Account Early Withdrawal Penalties

Social Security Early Retirement Penalties

Pension Plan Early Retirement Penalties

Retirement Account Early Withdrawal Penalties

Penalty Rates and Exceptions

Tax Implications of Early Withdrawals

Strategies to Avoid Penalties

Social Security Early Retirement Penalties

Impact of Claiming Benefits Early

Strategies for Maximizing Benefits

Pension Plan Early Retirement Penalties

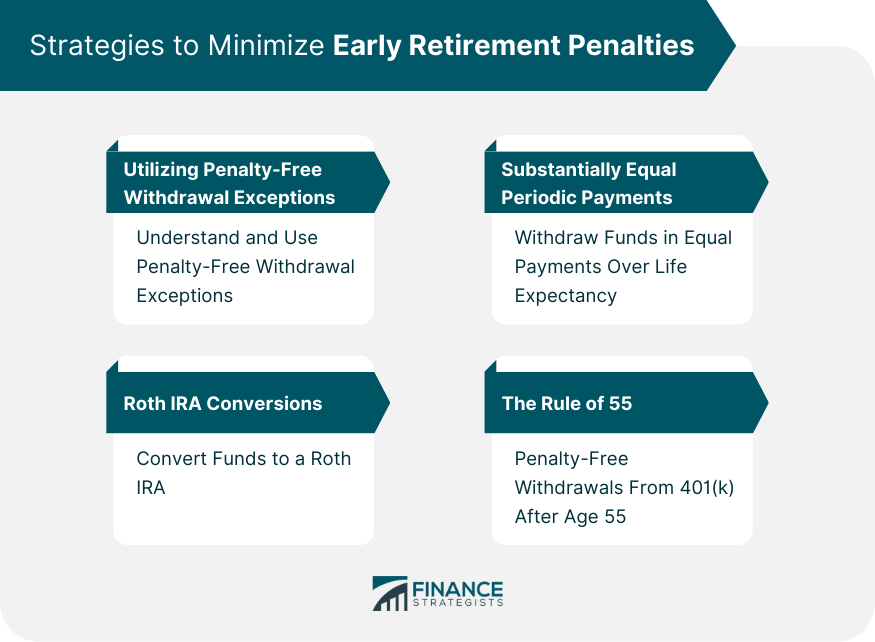

Strategies to Minimize Early Retirement Penalty

Utilizing Penalty-Free Withdrawal Exceptions

Roth IRA Conversions

Substantially Equal Periodic Payments (SEPP)

The Rule of 55

Importance of Professional Guidance

Financial Planners and Advisors

Tax Planning and Consulting

Retirement Plan Administrators

Conclusion

Early Retirement Penalty FAQs

The most common early retirement penalties include a 10% early withdrawal penalty on certain retirement accounts (such as traditional IRAs, Roth IRAs, 401(k), 403(b), and 457 plans), reduced Social Security benefits if claimed before full retirement age, and reduced pension benefits for early distributions.

Yes, there are several exceptions to the 10% early withdrawal penalty, including withdrawals due to disability, qualified first-time home purchases, qualified education expenses, and unreimbursed medical expenses exceeding a specific percentage of adjusted gross income. Additionally, the Rule of 55 and Substantially Equal Periodic Payments (SEPP) provide other ways to avoid the penalty in certain situations.

Claiming Social Security benefits before your full retirement age results in permanently reduced monthly benefits. The reduction depends on the number of months you claim benefits before reaching full retirement age. The earlier you claim, the greater the reduction.

You might be able to avoid early retirement penalties if you meet specific requirements, such as utilizing the Rule of 55 for employer-sponsored plans or following the Substantially Equal Periodic Payments (SEPP) method for IRA withdrawals. However, it's essential to consult with a financial advisor or tax professional to determine the best course of action based on your specific situation.

A financial planner or tax professional can help you understand the rules and penalties associated with early retirement, develop tax-efficient strategies, and coordinate your retirement income sources to minimize penalties. They can also help you navigate penalty-free withdrawal exceptions and recommend the best approach to accessing retirement funds based on your unique circumstances.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.