The Financial Independence, Retire Early (FIRE) movement is a lifestyle approach focused on achieving financial freedom and retiring early from traditional careers. Adherents prioritize aggressive saving, wise investing, and reducing expenses to become financially independent, allowing them to pursue personal passions and interests without relying on a job for income. The primary goal of the FIRE movement is to accumulate enough wealth to cover living expenses indefinitely, thereby achieving financial independence. The movement encourages individuals to save a substantial portion of their income, invest it wisely, and retire early, allowing them to enjoy life without the constraints of a traditional 9-to-5 job. The FIRE movement emerged in the 1990s, with the publication of "Your Money or Your Life" by Vicki Robin and Joe Dominguez. This book introduced the concept of achieving financial independence through frugal living and smart investing. Since then, the movement has gained traction, with numerous blogs, podcasts, and forums dedicated to discussing FIRE strategies and success stories. A cornerstone of the FIRE movement is maintaining a high savings rate, typically 50% or more of one's income. This aggressive saving enables individuals to accumulate wealth quickly, accelerating the path to financial independence and early retirement. Reducing expenses is another key principle in the FIRE movement. By cutting unnecessary spending and adopting a frugal lifestyle, individuals can minimize their expenses, making it easier to achieve a high savings rate and progress toward financial independence. Increasing income through career advancement or side hustles is another tactic employed by FIRE adherents. Higher-income levels allow for increased savings and investments, further accelerating the journey to financial independence. FIRE proponents often advocate for investing in low-cost index funds, which track the performance of a specific market index. These investments typically have lower fees and provide broad market exposure, offering a cost-effective and diversified approach to long-term investing. Diversification is an essential principle in the FIRE movement, as it reduces investment risk by spreading money across various asset classes. By diversifying investments, individuals can protect their portfolios from market fluctuations, ensuring more stable returns over time. The FIRE movement emphasizes passive investing, a strategy that involves buying and holding a diversified portfolio without attempting to time the market or outperform it actively. This approach is often simpler, more cost-effective, and less time-consuming than active investing, making it an attractive option for FIRE adherents. Tax-advantaged accounts, such as 401(k)s, IRAs, and Health Savings Accounts (HSAs), provide significant tax benefits and are crucial for optimizing taxes within the FIRE movement. These accounts allow for tax-deferred or tax-free growth of investments, depending on the account type, contributing to long-term wealth accumulation. Investing in tax-efficient assets is another method of optimizing taxes within the FIRE movement. Tax-efficient investments, such as municipal bonds or exchange-traded funds (ETFs), can help minimize the overall tax burden, maximizing after-tax returns and facilitating wealth growth. Tax-loss harvesting involves strategically selling investments at a loss to offset capital gains taxes, reducing the overall tax burden. This strategy can be beneficial for FIRE adherents looking to optimize taxes and maximize their investment returns. Lean FIRE refers to a minimalist approach to financial independence, with individuals focusing on reducing expenses and living on a lean budget. Adherents of Lean FIRE prioritize frugality, often living well below their means, in order to retire early and maintain a modest lifestyle during retirement. Fat FIRE is a version of the FIRE movement that allows for a more comfortable and luxurious lifestyle during retirement. Individuals pursuing Fat FIRE save and invest more aggressively to accumulate a larger nest egg, enabling them to maintain a higher standard of living in retirement without compromising their financial independence. Barista FIRE is a semi-retirement approach where individuals achieve partial financial independence and continue to work part-time or in a lower-stress job to supplement their investment income. This approach allows for more flexibility and work-life balance while still enjoying the benefits of financial independence. Coast FIRE refers to a stage of financial independence where individuals have saved enough money to cover their future retirement expenses, assuming they continue to invest and let their savings grow without making additional contributions. At this point, individuals can "coast" through their careers, working only enough to cover their current living expenses without worrying about saving for retirement. Creating a budget and tracking expenses are crucial strategies for achieving FIRE. By understanding where money is being spent and identifying areas for improvement, individuals can make informed decisions about their spending habits, reduce expenses, and increase their savings rate. Pursuing side hustles or freelance work is a popular strategy for increasing income among FIRE adherents. By generating additional income streams, individuals can boost their savings rate, invest more aggressively, and achieve financial independence more quickly. Frugal living is a key aspect of the FIRE movement, as it enables individuals to minimize expenses and save a larger portion of their income. Adopting a frugal lifestyle often involves cutting discretionary spending, shopping smartly, and reducing housing, transportation, and other major expenses. Early career planning is an essential strategy for achieving FIRE, as it helps individuals to maximize their earning potential and optimize their savings rate from the beginning of their careers. By pursuing higher education, developing marketable skills, and strategically navigating the job market, individuals can set themselves up for long-term financial success. Real estate investing is a popular strategy among FIRE adherents, as it can provide passive income streams, tax benefits, and potential appreciation in property values. By investing in rental properties, house hacking, or real estate crowdfunding platforms, individuals can diversify their investment portfolios and accelerate their journey to financial independence. Some critics of the FIRE movement question its long-term sustainability, arguing that living on a reduced budget may be difficult to maintain over the course of a lengthy retirement. Additionally, unforeseen expenses, such as healthcare costs or major life events, may strain an individual's financial resources, potentially compromising their financial independence. Early retirement may also have implications for social security benefits, as individuals who retire early may receive reduced benefits due to fewer years of contributions. Similarly, early retirees may face challenges in accessing other benefits, such as employer-sponsored healthcare or retirement plans, which may not be available to those who leave the workforce early. Pursuing FIRE often requires significant lifestyle sacrifices, as adherents must prioritize saving and investing over discretionary spending. Critics argue that this extreme frugality can lead to a diminished quality of life and may not be sustainable or enjoyable for everyone. Market volatility and sequence of returns risk are significant concerns for early retirees, as a market downturn at the beginning of retirement can significantly impact the sustainability of an individual's nest egg. To mitigate this risk, FIRE adherents must carefully plan their investment strategies and withdrawal rates to ensure that their savings last throughout their retirement. The Financial Independence, Retire Early (FIRE) movement is a lifestyle approach that focuses on achieving financial freedom and retiring early from traditional careers. Adherents prioritize aggressive saving, wise investing, and reducing expenses to become financially independent, allowing them to pursue personal passions and interests without relying on a job for income. The movement has several principles, types, and strategies for achieving financial independence, such as maintaining a high savings rate, reducing expenses, increasing income, and investing wisely. However, the movement also faces challenges and criticisms, including sustainability concerns, the impact on social security and other benefits, lifestyle sacrifices, and market volatility and sequence of returns risk. Despite these challenges, the FIRE movement continues to gain traction, inspiring individuals to pursue financial independence and retire early to achieve a fulfilling and fulfilling life.What Is the Financial Independence, Retire Early (FIRE) Movement?

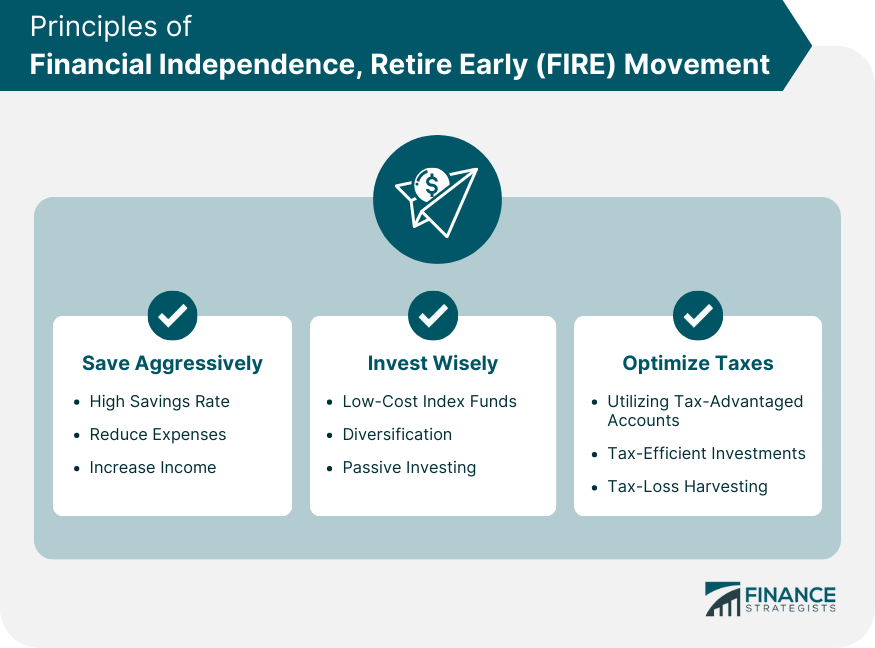

Principles of FIRE

Saving Aggressively

High Savings Rate

Reducing Expenses

Increasing Income

Investing Wisely

Low-Cost Index Funds

Diversification

Passive Investing

Optimizing Taxes

Utilizing Tax-Advantaged Accounts

Tax-Efficient Investments

Tax-Loss Harvesting

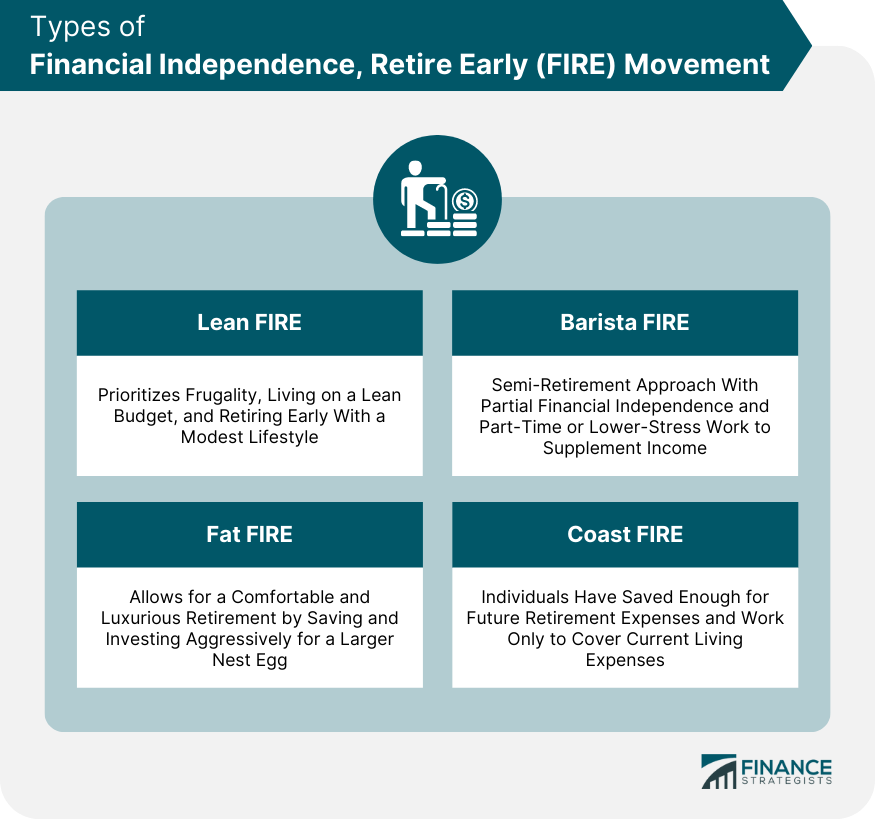

Types of FIRE

Lean FIRE

Fat FIRE

Barista FIRE

Coast FIRE

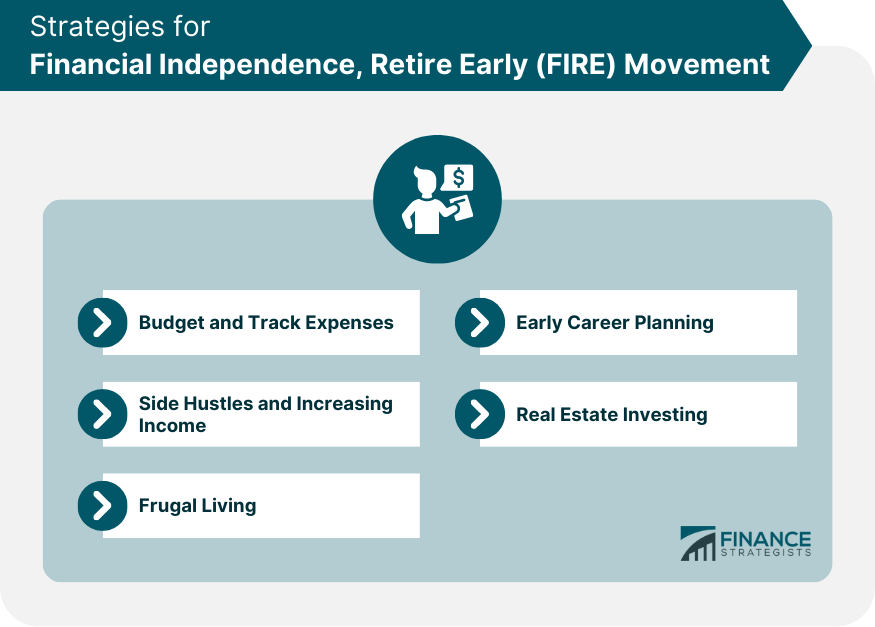

Strategies for Achieving FIRE

Budgeting and Tracking Expenses

Side Hustles and Increasing Income

Frugal Living

Early Career Planning

Real Estate Investing

Challenges and Criticisms on FIRE Movement

Sustainability Concerns

Impact on Social Security and Other Benefits

Lifestyle Sacrifices

Market Volatility and Sequence of Returns Risk

Final Thoughts

Financial Independence, Retire Early (FIRE) Movement FAQs

The Financial Independence and Early Retirement (FIRE) movement is a lifestyle approach that aims to achieve financial freedom and retire early from traditional careers. Its main goals are to accumulate enough wealth to cover living expenses indefinitely and to enable individuals to pursue personal interests and passions without relying on a job for income.

The core principles of the Financial Independence and Early Retirement (FIRE) movement are saving aggressively, investing wisely, and optimizing taxes. This involves maintaining a high savings rate, reducing expenses, increasing income, diversifying investments, utilizing tax-advantaged accounts, and employing tax-efficient strategies.

Yes, there are several types of FIRE approaches, including Lean FIRE, Fat FIRE, Barista FIRE, and Coast FIRE. These approaches differ in terms of the desired retirement lifestyle, the level of frugality, and the amount of work involved after achieving financial independence.

Common challenges and criticisms of the FIRE movement include sustainability concerns, the impact on social security and other benefits, lifestyle sacrifices, and market volatility with the sequence of returns risk. Critics argue that the movement's extreme frugality may not be sustainable or enjoyable for everyone and that early retirement could have negative implications for social security benefits.

To get started with the FIRE movement, individuals should focus on financial education and literacy, develop a budget, track expenses, and begin saving aggressively. Additionally, they should explore investment strategies, optimize taxes, and engage with the FIRE community through books, blogs, forums, podcasts, and YouTube channels to gain knowledge and support. Consulting with a financial advisor or retirement planning service can also be beneficial.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.