Gray divorce refers to the growing trend of couples aged 50 or older who decide to end their long-term marriages. These divorces often involve complex financial and emotional implications, particularly when it comes to retirement planning. As gray divorces become more common, it's crucial to understand the challenges they present, especially in terms of retirement planning. Navigating the financial and emotional consequences of gray divorce can be daunting, making it essential for individuals to be well-informed and prepared. In recent decades, the rate of gray divorces has been steadily increasing. This shift is partially due to changing societal attitudes, longer life expectancies, and a growing focus on individual happiness and fulfillment in later life. Advancements in healthcare and lifestyle have led to increased life expectancy. As a result, people may find themselves in marriages that no longer meet their needs or expectations, prompting them to reconsider their relationships in later life. As societal norms around marriage and divorce evolve, there's less stigma associated with ending a long-term marriage. This shift encourages older individuals to prioritize their own happiness and pursue a fulfilling life, even if it means ending a marriage. Throughout their lives, people continue to grow and change, which can lead to different priorities and goals. This personal evolution may cause some older couples to grow apart, ultimately resulting in the decision to divorce. As individuals achieve financial independence, they may feel more empowered to make significant life decisions. This newfound financial freedom can contribute to the decision to pursue a gray divorce, as the potential financial consequences may be less daunting. Once children leave home, couples may experience "empty nest syndrome," causing them to reevaluate their relationships. The absence of children can lead to a newfound focus on the marital relationship, which may reveal issues that were previously overshadowed. When couples divorce later in life, retirement accounts are often a significant part of the marital assets that need to be divided. This division can be complex and may result in reduced retirement savings, requiring individuals to adjust their retirement plans. Real estate, including the marital home, is often a significant asset in gray divorces. Decisions surrounding the division or sale of real estate can have long-lasting financial implications and may require individuals to reassess their housing and living arrangements in retirement. Gray divorce typically involve dividing various investments and savings accounts accumulated throughout the marriage. This division may lead to a reduced nest egg for both parties, making it necessary to reevaluate their retirement goals and strategies. Gray divorce can impact Social Security benefits, as divorced individuals may be entitled to a portion of their former spouse's benefits. Understanding the rules and regulations surrounding these benefits is crucial in order to maximize retirement income. The division of pension plans in a gray divorce can significantly affect retirement income. It's essential to understand the details of the pension plan and how it will be divided to ensure both parties receive a fair share and can plan for their retirement accordingly. Alimony and other support payments may be a factor in gray divorces, which can impact both the payer and the recipient's retirement income. It's important to consider the potential financial implications of these payments when planning for retirement. Gray divorce often brings stress and anxiety, as individuals navigate the financial and emotional challenges of ending a long-term marriage. It's essential to acknowledge and address these feelings, as they can significantly impact one's well-being and ability to plan for retirement effectively. After a gray divorce, individuals must adapt to a new lifestyle, including changes in their living situation, social circles, and daily routines. Adjusting to these changes can be challenging but is crucial for establishing a fulfilling and financially stable life post-divorce. Before proceeding with a gray divorce, it's essential to assess one's current financial situation, including assets, debts, and income. This assessment provides a solid foundation for understanding the potential financial implications of the divorce and helps guide future planning. Establishing realistic retirement goals is crucial when facing a gray divorce. By understanding the potential impact of divorce on one's finances, individuals can adjust their expectations and develop a plan to achieve their revised retirement objectives. Working with an attorney who specializes in gray divorce can be invaluable in navigating the complex financial and legal aspects of the process. A knowledgeable attorney can help protect one's interests and ensure a fair division of assets and income. It's important for individuals going through a gray divorce to familiarize themselves with the laws and regulations that apply to their situation. This knowledge can help them make informed decisions and advocate for their best interests throughout the divorce process. After a gray divorce, it's essential to reevaluate retirement goals and adjust them based on the new financial reality. This reassessment helps individuals develop a revised retirement plan that takes into account the changes resulting from the divorce. Creating a new budget and savings plan post-divorce is crucial for ensuring financial stability in retirement. This plan should account for changes in income, expenses, and assets, as well as any new financial goals that have emerged as a result of the divorce. Consulting with a financial advisor experienced in gray divorce can provide valuable guidance and support in navigating the complex financial landscape of retirement planning post-divorce. An advisor can offer tailored advice and strategies to help individuals achieve their retirement goals. Maintaining a strong support network of friends and family is essential during and after a gray divorce. These connections can provide emotional support, practical assistance, and a sense of belonging as individuals navigate the challenges of their new lives. Participating in support groups or seeking therapy can be beneficial for individuals going through a gray divorce. These resources can offer a safe space to share experiences, gain insights, and develop coping strategies for dealing with the emotional and psychological impact of divorce. Pursuing hobbies and interests can provide a sense of purpose and fulfillment during the transition to a new life after a gray divorce. Engaging in these activities can help improve one's mental and emotional well-being, fostering resilience and personal growth. Taking care of one's physical and mental health is crucial during and after a gray divorce. Prioritizing self-care, including regular exercise, a balanced diet, and adequate sleep, can help individuals manage stress and maintain their overall well-being as they navigate the challenges of divorce and retirement. Gray divorce is the increasing phenomenon of couples aged 50 and above ending their long-term marriages. It presents complicated financial and emotional challenges, especially in relation to retirement planning. Effective planning and support are crucial for individuals navigating the complex landscape of gray divorce and retirement. Gray divorce presents an opportunity for individuals to embrace change and create a fulfilling life in retirement. By focusing on self-care, building a support network, and engaging in effective planning, individuals can successfully navigate the challenges of gray divorce and establish a financially secure and rewarding future. As you consider the implications of gray divorce on your retirement, it's crucial to seek the guidance of professional retirement planning services. Financial advisors and specialized attorneys can provide valuable advice and support, helping you navigate the complexities of gray divorce and develop a plan that ensures a secure and fulfilling retirement.What Is Gray Divorce?

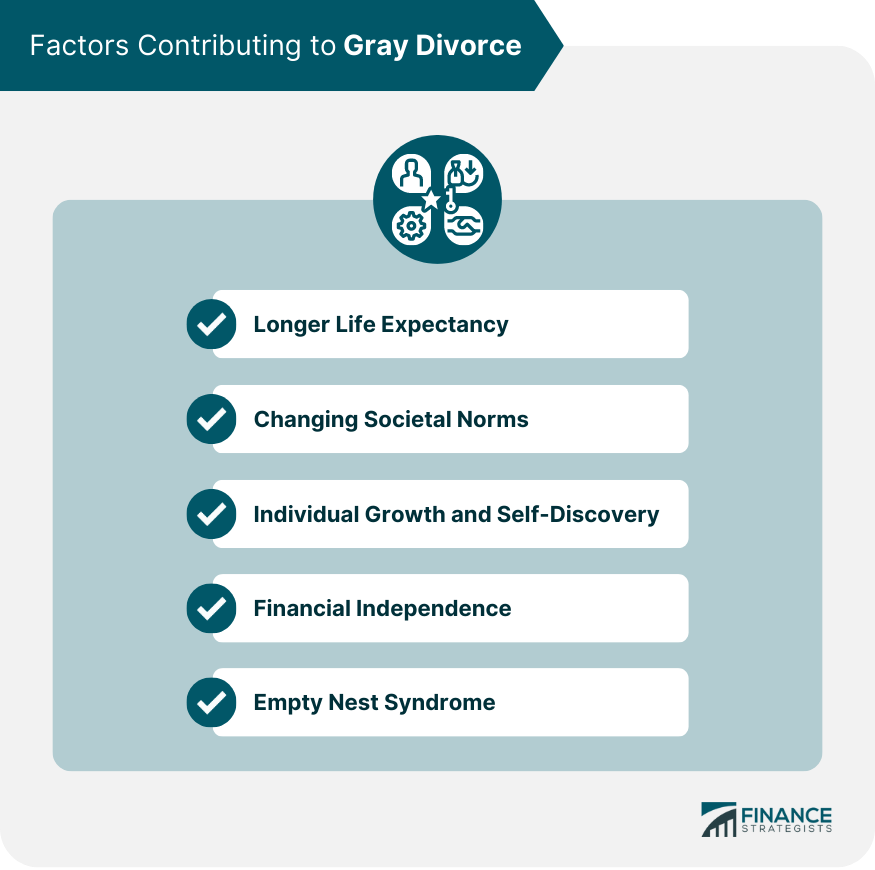

Factors Contributing to Gray Divorce

Longer Life Expectancy

Changing Societal Norms

Individual Growth and Self-Discovery

Financial Independence

Empty Nest Syndrome

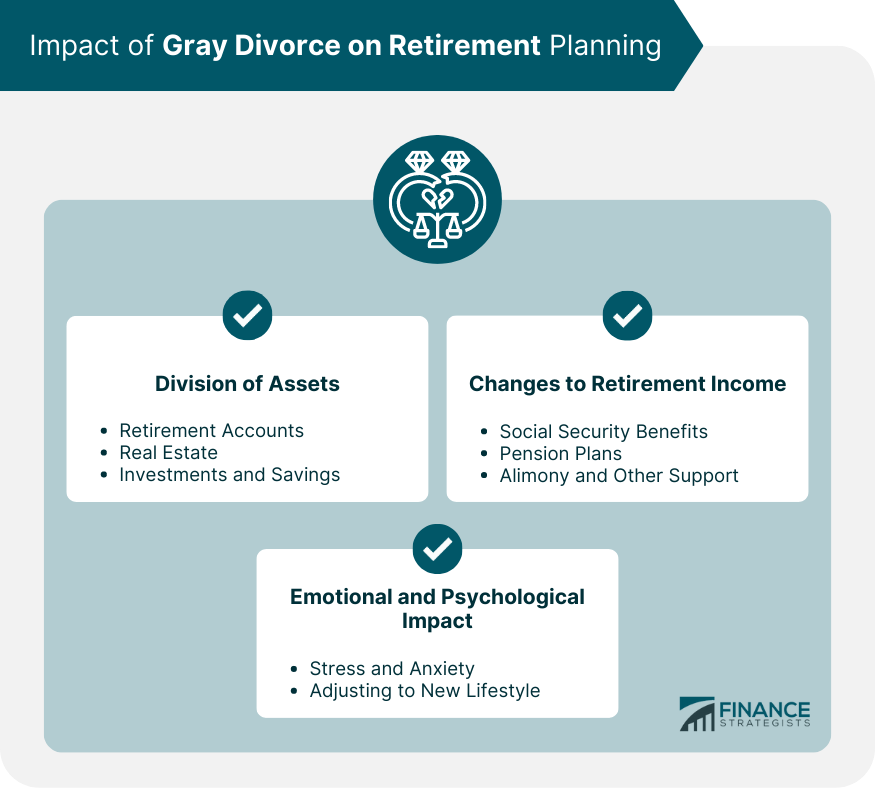

Impact of Gray Divorce on Retirement Planning

Division of Assets

Retirement Accounts

Real Estate

Investments and Savings

Changes to Retirement Income

Social Security Benefits

Pension Plans

Alimony and Other Support Payments

Emotional and Psychological Impact

Stress and Anxiety

Adjusting to a New Lifestyle

Strategies for Navigating Gray Divorce and Retirement

Pre-Divorce Financial Planning

Assessing Current Financial Situation

Setting Realistic Retirement Goals

Legal Considerations

Hiring a Specialized Attorney

Understanding Relevant Laws and Regulations

Post-Divorce Financial Planning

Reevaluating Retirement Goals

Developing a New Budget and Savings Plan

Seeking Professional Financial Advice

Importance of Emotional Support and Self-Care

Building a Support Network

Friends and Family

Support Groups and Therapy

Focusing on Personal Well-Being

Engaging in Hobbies and Interests

Prioritizing Physical and Mental Health

Final Thoughts

Gray Divorce and Retirement FAQs

Gray divorce refers to the growing trend of couples aged 50 or older ending their long-term marriages. It's important to consider its impact on retirement because these divorces often involve complex financial and emotional implications that can significantly affect retirement planning and overall well-being.

Factors contributing to the increasing prevalence of gray divorce include longer life expectancy, changing societal norms, individual growth and self-discovery, financial independence, and empty nest syndrome. These factors can create unique retirement planning challenges for individuals navigating a gray divorce.

Gray divorce can significantly impact the division of assets, such as retirement accounts, real estate, and investments. It can also lead to changes in retirement income, including adjustments to Social Security benefits, pension plans, and potential alimony or support payments. These changes can affect an individual's financial stability in retirement.

Strategies for navigating gray divorce and retirement planning include pre-divorce financial planning (assessing the current financial situation and setting realistic retirement goals), understanding legal considerations (hiring a specialized attorney and familiarizing oneself with relevant laws), and post-divorce financial planning (reevaluating retirement goals, developing a new budget and savings plan, and seeking professional financial advice).

To find emotional support and prioritize self-care during and after a gray divorce, individuals can build a support network of friends and family, participate in support groups or therapy, engage in hobbies and interests, and prioritize physical and mental health. These strategies can help individuals cope with the challenges of a gray divorce and move forward in retirement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.