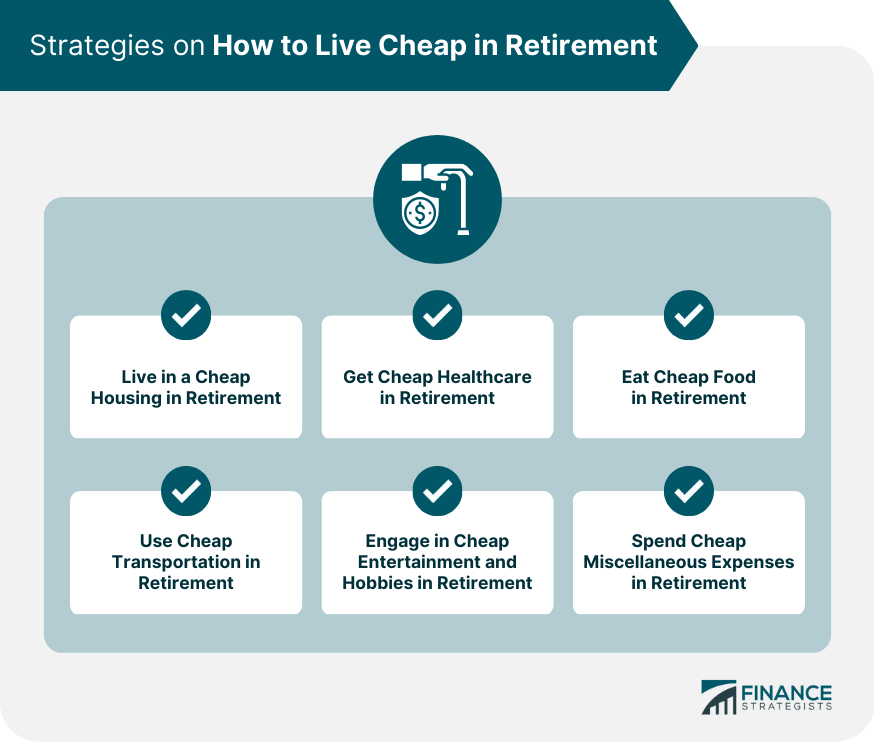

Retirement is a stage of life where people stop working and enter a new phase of their lives. Retirement can be a time of joy and relaxation after years of hard work, but it can also be a time of financial stress. Many people are concerned about whether they will have enough money to live comfortably during their retirement years. This is where the importance of living frugally in retirement comes in. Living frugally in retirement is important because it can help people avoid financial stress and maintain their financial independence. Retirees who have limited retirement savings or income can face challenges in meeting their daily expenses. By living cheaply in retirement, people can reduce their expenses and stretch their income further. This can help retirees avoid tapping into their savings and assets, allowing them to maintain their financial independence and enjoy their retirement years. It is possible to live cheaply in retirement without compromising their quality of life or sacrificing their financial independence. By following these strategies, retirees can enjoy a comfortable and fulfilling retirement without breaking the bank. Housing is one of the biggest expenses in retirement. Retirees who are looking to live cheaply in retirement can explore several housing options that can help them reduce their expenses. Downsizing can help retirees reduce their housing costs. By moving to a smaller home or apartment, retirees can reduce their utility bills, property taxes, and maintenance costs. They can also sell their current home and use the proceeds to pay off debts or invest in their retirement savings. This option can help retirees reduce their housing costs by splitting the rent, utilities, and other expenses with others. It can also provide companionship and social support, which can be beneficial for retirees who are living alone. Moving to an area with lower housing costs can help retirees reduce their overall expenses and stretch their retirement income further. They can also take advantage of other benefits, such as lower taxes, cheaper healthcare, and access to community resources. A Home Equity Conversion Mortgage (HECM) is a type of reverse mortgage that allows retirees to convert their home equity into cash. This can provide retirees with a steady source of income without having to sell their home or move out. However, it is important to note that there are fees and other costs associated with HECMs, and retirees should consult with a financial advisor before taking out a HECM. Retirees who want to live cheaply in retirement can explore several options for getting affordable healthcare. Retirees can shop around for health insurance plans and compare the costs and benefits of each plan. They can also take advantage of subsidies and tax credits that can help them pay for their health insurance premiums. Medicare is a federal health insurance program that provides coverage for people who are 65 years or older. Retirees can enroll in Medicare and take advantage of the various benefits that are available, such as free preventive care services, annual wellness visits, and discounted prescription drugs. Retirees can also take advantage of this service to help them stay healthy and avoid expensive medical treatments. Preventative care services include routine check-ups, screenings, and immunizations. These services are usually covered by health insurance plans, and retirees can take advantage of them to stay healthy and avoid costly medical treatments. Using generic medications instead of brand-name drugs is another way to get cheap healthcare in retirement. Generic medications are less expensive than brand-name drugs but are just as effective. Retirees can talk to their doctors and pharmacists about switching to generic medications to reduce their prescription drug costs. Food is another major expense in retirement, but retirees can explore several options for getting cheap food. This is an effective way to save money on groceries and reduce food expenses in retirement. Retirees can find many affordable food options at discount grocery stores, and they can take advantage of sales and discounts to stretch their food budget further. Retirees can prepare their own meals at home using affordable ingredients and can control the quality and nutritional value of their food. This can help them save money on dining out and improve their overall health and well-being. It is advisable for retirees to grow their own fruits and vegetables in their backyard or on a balcony, which can help them save money and provide them with fresh and healthy produce. They can also grow their own herbs to add flavor to their meals. They can look for coupons and discounts in newspapers, magazines, and online. They can also take advantage of loyalty programs and discount cards that are offered by grocery stores and supermarkets. Retirees who are looking to live cheaply in retirement can explore several transportation options that can help them save money on travel expenses. Retirees can take advantage of public transportation options, such as buses and trains, to save money on gas and reduce wear and tear on their vehicle. They can also carpool with friends or neighbors to split the cost of gas and reduce their carbon footprint. Another option for retirees who want to save money on transportation is to downsize to one car or use a cheaper, more fuel-efficient vehicle. Retirees who own multiple cars can consider selling one of their vehicles to reduce their insurance and maintenance costs. They can also invest in a more fuel-efficient vehicle, such as a hybrid or electric car, to save money on gas and reduce their environmental impact. Retirees can also save money on transportation by walking or biking when possible. Retirees who live in walkable or bike-friendly communities can take advantage of these resources to save money on gas and get exercise. They can also plan trips to save on gas and other travel expenses. For example, they can combine errands into one trip or plan vacations during the off-season to save money on travel expenses. Retirees who want to engage in cheap entertainment and hobbies can explore several options that can help them save money. One option is to take advantage of free or low-cost activities in the community. Retirees can attend free concerts, festivals, and other community events to enjoy entertainment without spending money. Another option for retirees who want to engage in cheap entertainment is to borrow books, movies, and music from the library. Many libraries offer a wide selection of books, movies, and music that retirees can borrow for free. Retirees can also take advantage of ebooks and audiobooks that can be downloaded from the library's website. Retirees can also engage in low-cost hobbies, such as hiking or birdwatching. These hobbies require minimal equipment and can be enjoyed in natural settings. Retirees can also volunteer or participate in community service activities to stay active and engaged in their communities. Miscellaneous expenses can add up quickly in retirement, but retirees can explore several options for reducing their expenses. One option is to cut back on unnecessary expenses, such as cable TV or subscription services. Retirees can review their monthly expenses and eliminate services that they don't use or can do without. Another option for retirees who want to reduce their expenses is to negotiate bills and expenses, such as phone or internet service. Retirees can call their service providers and ask for discounts or lower rates. They can also shop around for better deals and switch providers if necessary. They can also use discounts and coupons for travel, dining out, and other activities to save money. Many businesses offer discounts and coupons to seniors, and retirees can take advantage of these offers to reduce their expenses. Finally, downsizing possessions and adopting a minimalist lifestyle is another way for retirees to live cheaply in retirement. Retirees can reduce their living expenses by downsizing their possessions and living in a smaller home or apartment. They can also adopt a minimalist lifestyle by simplifying their lives and focusing on experiences rather than material possessions. By adopting a frugal lifestyle in retirement, retirees can maintain their financial independence and enjoy a fulfilling retirement without breaking the bank. Retirement is a stage of life that is characterized by a transition from work to leisure. Retirement can be a time of joy and relaxation, but it can also be a time of financial stress. Living cheaply in retirement is a strategy that can help people stretch their retirement savings further and live comfortably with less. This involves finding ways to reduce expenses without compromising quality of life or sacrificing financial independence. Retirees can explore several options for reducing their expenses, such as downsizing their home, utilizing low-cost health insurance options, taking advantage of free or low-cost activities, and adopting a minimalist lifestyle. It is important for retirees to plan for their retirement years and consider their financial needs and goals. Retirement planning can help retirees make informed decisions about their finances and ensure that they have enough money to live comfortably in retirement. Retirement Overview

Live in a Cheap Housing in Retirement

Downsizing to a Smaller Home

Renting a Room or Sharing a Living Space

Relocating to a More Affordable Area

Using a Home Equity Conversion Mortgage (HECM)

Get Cheap Healthcare in Retirement

Find Low-Cost Health Insurance Options

Utilize Medicare Benefits

Preventative Care Services

Using Generic Medications

Eat Cheap Food in Retirement

Shopping at Discount Grocery Stores

Cooking Meals at Home

Growing a Vegetable Garden or Herbs

Using Coupons and Discounts

Use Cheap Transportation in Retirement

Use Public Transportation or Carpooling

Downsize or Use a Fuel-Efficient Vehicle

Walk or Bike

Plan Trips

Engage in Cheap Entertainment and Hobbies in Retirement

Community Activities

Library Resources

Low-Cost Hobbies

Spend Cheap Miscellaneous Expenses in Retirement

Cut Back on Unnecessary Expenses

Shop Around for Better Deals

Use Discount Coupons

Downsize Possessions

Final Thoughts

How to Live Cheap in Retirement FAQs

Living cheaply in retirement involves finding ways to reduce expenses without compromising your lifestyle. You can downsize your home, take advantage of low-cost healthcare options, and engage in free or low-cost hobbies and activities to live cheaply in retirement.

Retirees can save money on transportation by using public transportation or carpooling, downsizing to one car or using a cheaper, more fuel-efficient vehicle, and walking or biking when possible.

Yes, retirees can engage in cheap entertainment and hobbies by taking advantage of free or low-cost activities in the community, borrowing books, movies, and music from the library, pursuing low-cost hobbies, and volunteering or participating in community service activities.

Retirees can reduce their miscellaneous expenses by cutting back on unnecessary expenses, negotiating bills and expenses, using discounts and coupons, and downsizing possessions and adopting a minimalist lifestyle.

Retirement planning is important because it can help retirees make informed decisions about their finances and ensure that they have enough money to live comfortably in retirement. By planning for their financial needs and goals, retirees can maintain their financial independence and enjoy a fulfilling retirement without breaking the bank.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.