IRAs, or Individual Retirement Accounts, are specialized accounts designed to encourage retirement savings, offering tax advantages that differentiate them from other investment vehicles. Predominantly, there are two main categories: Roth IRAs and Traditional IRAs, the latter sometimes manifesting as Rollover IRAs. Rollover IRAs emerge in scenarios when individuals choose to "roll over" assets from employer-sponsored plans, like 401(k)s, into Traditional IRAs. On the other hand, Roth IRAs operate with a completely different taxation approach, drawing many towards its potential long-term benefits. Diversifying retirement savings is crucial to manage risk and maximize growth. A varied portfolio offers resilience against market fluctuations and allows individuals to harness diverse tax benefits, adjusting to personal and economic shifts. Contrary to what many might think, there's no legal restraint preventing someone from holding both a Roth IRA and a Rollover IRA concurrently. The law outlines specific contribution limits for each type, but it doesn't restrict the concurrent possession of these accounts. However, it's crucial to understand that contributing to both could lead to hitting the annual contribution ceiling quicker. It's always wise to familiarize oneself with these limits to make informed decisions. The adage 'don't put all your eggs in one basket' aptly encapsulates the rationale behind having both Roth and Rollover IRAs. Each account type offers unique benefits. With a Roth IRA, contributions are taxed upfront, ensuring tax-free withdrawals in retirement. A Rollover IRA, in contrast, offers tax-deferred growth, meaning you'll only pay taxes upon withdrawal. By possessing both, individuals can create a balanced approach, providing flexibility in withdrawal strategies come retirement and allowing for optimal tax scenarios. There's a misconception that holding multiple IRAs complicates tax filings or attracts higher fees. In reality, tax complications only arise if rules are not properly adhered to. Additionally, fees associated with IRAs are typically contingent on the financial institution or the investment choices, not the mere act of holding multiple accounts. Another myth suggests that possessing multiple IRAs dilutes the growth potential. However, growth is determined by the chosen investments within the IRA, not by the number of IRA accounts. Not everyone can waltz into a financial institution and open a Roth IRA. There are specific income thresholds that determine eligibility. For instance, if an individual's or couple's income exceeds a certain limit, they may be either limited in how much they can contribute or barred from contributing altogether. Yet, these rules shouldn't deter one from considering a Roth IRA. Even if direct contributions are off the table, there are backdoor methods to fund a Roth. Each year, the IRS sets contribution limits for Roth IRAs. These limits can change annually and might be influenced by factors like age. As individuals approach retirement age, catch-up contributions can sometimes allow for larger contributions than the standard limit. Additionally, as income rises, the amount one can contribute begins to phase out, gradually reducing until it reaches a cap, beyond which direct contributions are no longer permissible. Roth IRAs present a tantalizing proposition: tax-free withdrawals. Since contributions are post-tax (taxes are paid when the money is earned), qualified withdrawals during retirement are tax-free. This structure provides a shield against potential future tax hikes. By paying taxes now, at known rates, one can bypass the uncertainty of future taxation, ensuring a more predictable retirement income. A Rollover IRA primarily acts as a receptacle for funds from other retirement accounts, like 401(k)s or 403(b)s, when transitioning between jobs or seeking more investment options. Essentially, it's a Traditional IRA, but its name underscores its purpose – to house "rolled over" funds. The primary allure of a Rollover IRA is continuity. Instead of cashing out a 401(k) when leaving a job – which could attract penalties and immediate taxes – one can preserve the tax-deferred status of those funds by rolling them into a Rollover IRA. The moment to consider a rollover often aligns with career transitions. However, the reason isn't just about preserving tax advantages. Rolling over can offer a broader range of investment options than typical employer-sponsored plans. Another scenario beckoning a rollover is when consolidating multiple retirement accounts for simplicity. One consolidated account can make it easier to manage asset allocation and track performance. Like Traditional IRAs, contributions to a Rollover IRA are typically pre-tax, meaning one doesn't pay taxes on the money when it's contributed. Instead, taxes are levied upon withdrawal. This tax deferment can be especially advantageous for those anticipating a lower tax bracket in retirement. However, it's essential to strategize withdrawals to minimize potential tax burdens. For many, the age of 59 1/2 is significant when discussing Traditional IRAs. Once an account holder crosses this age threshold, they're free to make withdrawals without incurring the dreaded 10% premature withdrawal penalty imposed by the IRS. Yet, freedom from penalties doesn't translate to freedom from rules. The SECURE 2.0 Act of 2022 introduced nuanced requirements for Required Minimum Distributions (RMDs): If you were born between 1951 and 1959, you'd start RMDs at age 73. For those born in 1960 or later, RMDs commence at age 75. These RMDs aren't merely guidelines; they're mandates. Failing to withdraw the specified minimum amount results in a hefty penalty, often half of the amount that should have been withdrawn. Plus, it's pivotal to remember that these distributions are treated as ordinary income, implying they're taxable. The timeline for these RMDs is equally critical. Your very first RMD must be taken by April 1 of the year following the one in which you reach the stipulated age. From then on, all RMDs should be completed by December 31 of the respective year. If you opt to defer the first RMD to the next year, be prepared for two distributions in that year. And it's not just about individual accounts. If you possess multiple Traditional IRAs, the RMDs apply to the collective value of all accounts. But here's a silver lining: You can withdraw the combined RMD value from just one of the IRAs if that's more convenient. Roth IRAs stand apart in the world of retirement accounts, primarily due to their post-tax contribution structure. This unique feature grants significant withdrawal flexibility. Once past the age of 59 1/2, there's no obligation to make any withdrawals during your lifetime. But things shift upon the death of the account holder. If the beneficiary isn't a spouse, they're required to adhere to RMD rules. The SECURE Act of 2019 stipulates that non-spousal beneficiaries must empty the Roth IRA within ten years of the original account holder's passing. This rule underscores the importance of informed estate planning, ensuring that beneficiaries are well aware of their obligations. An enthusiastic approach to retirement savings, while commendable, can sometimes lead to over-contributions. Exceeding annual contribution limits can attract penalties, essentially nullifying some of the tax advantages these accounts offer. It's crucial to stay updated with annual contribution limits, which can vary based on age and income. Remember, it's the total contribution across all IRA accounts that must remain within limits. The act of rolling over funds, though simple in concept, can get convoluted. An indirect rollover, where funds are first withdrawn and then deposited into the Rollover IRA, has a 60-day completion window. Failing to meet this window can lead to taxes and penalties. Direct rollovers, where funds move directly between financial institutions, bypass this risk. Hence, they are often the preferred method among financial advisors. Starting at a certain age, there's a mandate to start withdrawing from Traditional and Rollover IRAs, termed Required Minimum Distributions (RMDs). Overlooking RMDs isn't a benign oversight; it can result in a penalty, amounting to a significant portion of the missed distribution. Notably, Roth IRAs are exempt from RMDs, offering yet another layer of flexibility for retirement planning. Roth conversions, transferring funds from a Traditional or Rollover IRA to a Roth IRA, have become increasingly popular. However, timing is pivotal. Conversions are treated as taxable income, so a large conversion can inadvertently push one into a higher tax bracket. Strategically staggering conversions across multiple years can help in optimizing the tax impact. Before diving headfirst into multiple IRA accounts, a holistic evaluation of one's financial landscape is paramount. Factors like current income, projected retirement expenses, existing investments, and risk tolerance play pivotal roles in guiding decisions. Each IRA type offers different benefits, and based on individual financial goals – be it aggressive growth, tax optimization, or a blend of both – the weightage given to each account can differ. The act of diversifying isn't limited to holding various stocks or bonds; it extends to how one allocates funds between Roth and Rollover IRAs. Think of it as creating a retirement portfolio, where each IRA type represents a different asset class. For instance, those wary of future tax hikes might lean heavily into Roth IRAs, while those forecasting a lower retirement income might balance between both. Imagine a scenario where federal tax rates soar in the future. In such a landscape, the Roth IRA, with its tax-free withdrawals, shines. Conversely, if future tax rates plummet, the Rollover IRA's deferred tax structure becomes more appealing. While predicting tax landscapes is akin to crystal ball gazing, understanding potential scenarios can aid in crafting a balanced, flexible retirement strategy. Juggling multiple IRA accounts can be overwhelming. Yet, with a slew of financial software and apps available, tracking investments, contributions, and distributions can be streamlined. Many of these tools offer integrated views of all accounts, ensuring a consolidated perspective on retirement savings. These digital aids not only simplify tracking but also offer insights, analytics, and recommendations to optimize returns. The financial world isn't static; it's a dynamic, ever-evolving entity. As such, a once-optimized IRA portfolio can drift from its target allocation over time. Periodic reviews, at least annually, can help in identifying these drifts. Rebalancing, the act of realigning the weightage of one's portfolio back to its target allocation, ensures that the portfolio stays in line with the original risk and reward parameters. There's a fine line between diversification and over-complication. While having multiple IRA accounts offers diversification, it can also lead to scattered investments, making management arduous. In such scenarios, consolidation – merging multiple accounts into fewer accounts – can simplify management. But it's pivotal to weigh the benefits of consolidation against potential costs or tax implications. Beneficiary designations on IRA accounts bypass wills. This means upon the account holder's demise, funds will be directed to the named beneficiaries, regardless of other estate planning documents. Given the gravity of this, it's crucial to ensure that beneficiaries are not only updated but also consistent across all IRA accounts, preventing potential posthumous disputes. The world of IRAs, with its myriad rules, limits, and strategies, can sometimes resemble a labyrinth. In complex situations or when in doubt, seeking the counsel of a financial advisor can be invaluable. These professionals can offer tailored advice, ensuring that one's retirement strategy is not only optimized but also compliant. Having both a Roth IRA and a Rollover IRA is not only legally permissible but also provides strategic advantages for retirement planning. Roth IRAs, with their post-tax contributions, allow for tax-free withdrawals in retirement, offering a safeguard against potential future tax increases. Rollover IRAs, on the other hand, provide a continuous tax-deferred shelter for funds from employer-sponsored plans, aiding in tax deferment and broader investment choices. Together, they offer a diversified approach to retirement savings, enabling individuals to harness the unique benefits of each, thereby optimizing tax scenarios and managing financial risks. However, managing multiple IRAs requires vigilance. It's essential to stay informed about contribution limits, conduct periodic account reviews, and utilize digital tools for streamlined tracking. In the dynamic financial landscape, professional advice can ensure optimal and compliant retirement strategies. Balancing both accounts, when done prudently, can pave the way for a financially secure retirement.Overview of IRA

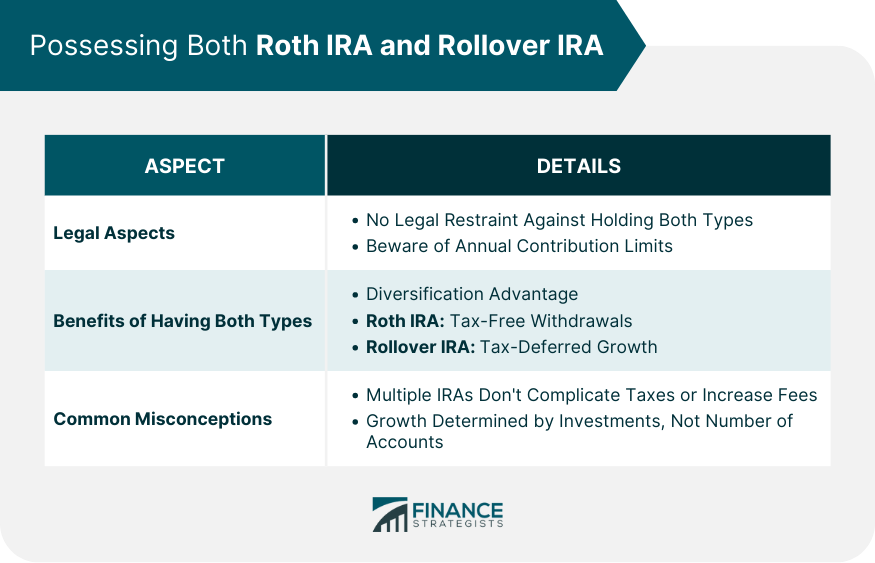

Possessing Both Roth IRA and Rollover IRA

Legal Aspects

Benefits of Having Both Types

Common Misconceptions About Holding Multiple IRAs

Understanding Roth IRAs

Eligibility Requirements for Roth IRAs

Contribution Limits and Phase Outs

Tax Implications: Post-Tax Contributions and Tax-Free Withdrawals

Understanding Rollover IRAs

What Is a Rollover IRA?

When and Why to Consider a Rollover

Tax Implications: Pre-Tax Contributions and Taxable Withdrawals

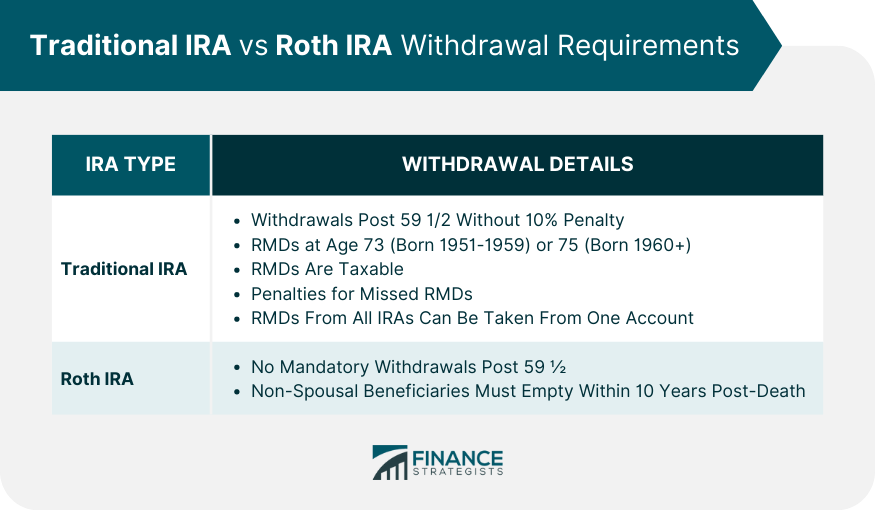

Traditional IRA and Roth IRA Withdrawal Requirements

Traditional IRA: Mandatory Distributions Post Retirement

Roth IRA: Flexibility in Withdrawals, but Not Without Caveats

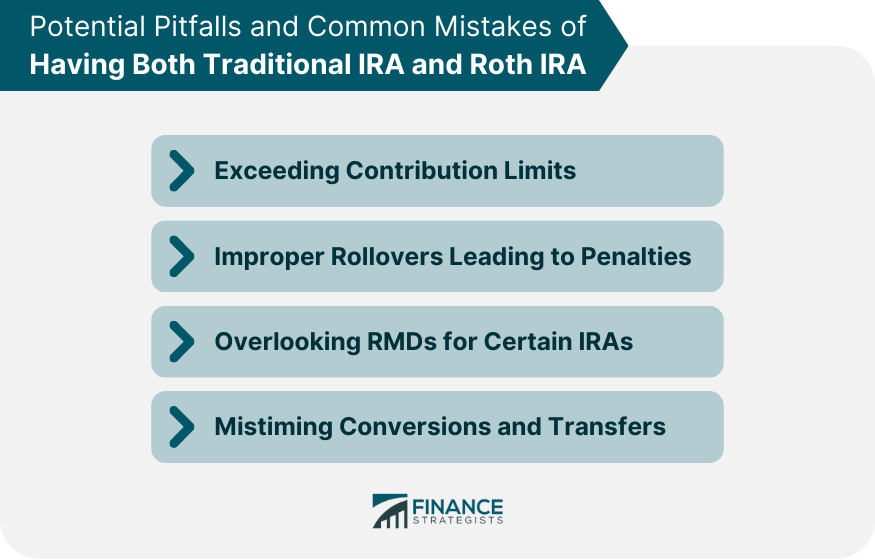

Potential Pitfalls and Common Mistakes of Having Both Traditional IRA and Roth IRA

Exceeding Contribution Limits

Improper Rollovers Leading to Penalties

Overlooking RMDs for Certain IRAs

Mistiming Conversions and Transfers

Strategic Considerations: Balancing Both Accounts

Assessing Your Financial Situation and Goals

Allocation Strategies Between the Two IRAs

Potential Scenarios Where One May Be Favored Over the Other

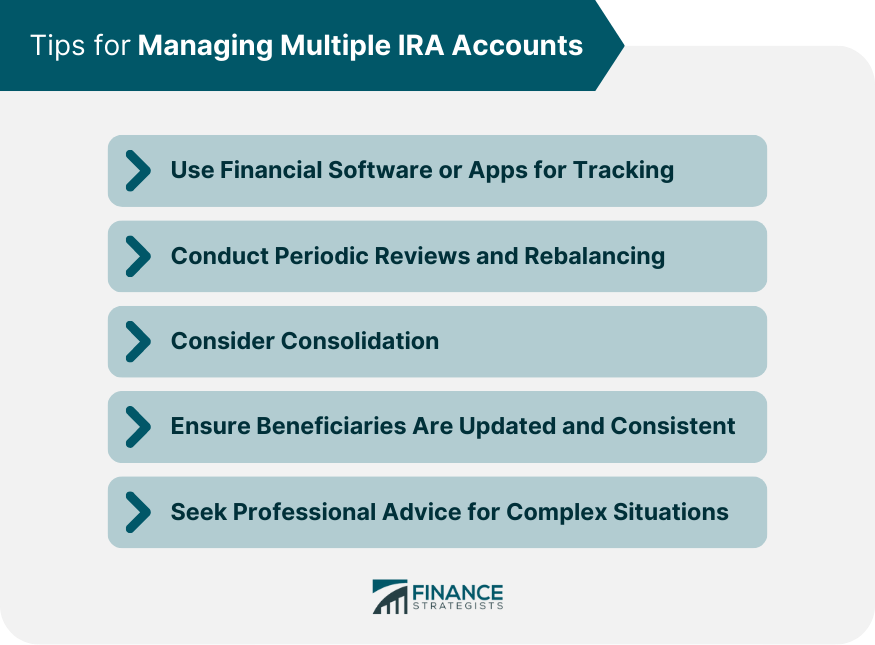

Tips for Managing Multiple IRA Accounts

Use Financial Software or Apps for Tracking

Conduct Periodic Reviews and Rebalancing

Consider Consolidation

Ensure Beneficiaries Are Updated and Consistent

Seek Professional Advice for Complex Situations

Bottom Line

Can I Have a Roth IRA and a Rollover IRA? FAQs

Yes, there's no legal restriction against holding both concurrently, but be mindful of individual contribution limits.

Roth IRAs have post-tax contributions with tax-free withdrawals, while Rollover IRAs offer tax-deferred growth with taxable withdrawals.

Having both offers diversified tax benefits, flexibility in withdrawal strategies, and protection against future tax uncertainties.

Over-contributing, improper rollovers, overlooking required minimum distributions, and mistiming conversions can be pitfalls.

Use financial software, conduct periodic reviews, consider consolidation, ensure beneficiaries are updated, and seek professional advice when needed.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.