Individual Retirement Accounts (IRAs) stand as a staple in the financial planning toolbox. As flexible, tax-advantaged vehicles, IRAs have become synonymous with retirement savings, allowing individuals to either defer taxes until withdrawal or grow investments tax-free, depending on the type. By design, these accounts aim to provide cushioned financial support during retirement, when steady income might diminish or cease entirely. But while retirement savings remain their primary intent, IRAs house other potentialities. Beyond the realm of individual financial comfort, they weave into the broader tapestry of societal good, illustrating their dexterity in the financial landscape. Charitable donations, while altruistic, can offer tax benefits to donors. When aligned with IRA distributions, strategic giving can reduce taxable income, benefiting both the cause and the donor. Diving into the specifics, the Qualified Charitable Distribution (QCD) emerges as a standout mechanism. A QCD is a direct transfer of funds from your IRA custodian to a qualified charity. Interestingly, these distributions, up to a certain limit, won't count as taxable income. This feature distinctively sets QCDs apart from regular IRA distributions. The allure of the QCD lies not just in its tax benefits but in its simplicity. The funds never touch your hands, they move seamlessly from your IRA to your chosen charity. This clean transfer ensures that the distribution remains untainted by potential tax implications. However, as with any tax-related strategy, there are rules to the game. For starters, QCDs are exclusively available to those aged 70½ or older. This age requirement aligns with the age at which traditional IRA owners must start taking required minimum distributions (RMDs). Another stipulation revolves around the IRA itself. Only distributions from individual IRAs, including rollover IRAs, qualify for QCDs. Workplace retirement accounts, such as 401(k)s or 403(b)s, don’t fit the bill. As always, diving into the specifics reveals the nuances that dictate eligibility. The first step in executing a QCD is reaching out to your IRA custodian. These institutions hold the keys, facilitating the direct transfer from your IRA to the charity. Most custodians are familiar with the QCD process, having ushered countless clients through it. However, the onus remains on the account holder to initiate the process. This proactive step ensures that the distribution aligns with the individual’s charitable intent and tax planning objectives. Precision is paramount. After contacting the custodian, it's time to specify the receiving charity and the donation amount. Given the stipulations around eligible charities, it's prudent to conduct due diligence, ensuring that the chosen organization qualifies for QCDs. This step isn't just procedural. It's an expression of intent, a concrete manifestation of one's desire to contribute to a greater good. In specifying details, donors breathe life into their philanthropic ambitions. Paper trails are crucial, more so in the realm of financial transactions. Once the transfer to the charity is complete, it’s essential to obtain an acknowledgment. This documentation serves as proof of the donation, a vital component when filing taxes. Moreover, this acknowledgment reinforces the bond between donor and recipient. It's a testament to a shared vision, one that’s etched in ink, a reminder of the generosity that unfolded. One of the premier benefits of QCDs is how they circumnavigate the taxable income pitfall. Traditional IRA distributions typically count as taxable income. However, a correctly executed QCD avoids this. By directly transferring to a charity, the distribution never enters your taxable income, despite it counting towards your RMD. This direct transfer not only satiates philanthropic endeavors but also skilfully sidesteps tax implications. It’s a strategy that intertwines generosity with shrewd tax planning. For many IRA owners, the specter of the RMD looms large. From age 73, traditional IRA owners must withdraw a certain amount annually – the RMD. Any misstep here could incur hefty penalties. The beauty of the QCD is that it counts toward fulfilling this RMD mandate without bloating your taxable income. While the RMD is unavoidable, how it impacts your tax situation isn’t. The QCD offers a viable strategy, ensuring compliance without the associated tax burden. At their heart, charitable donations, irrespective of their source, fuel noble causes. But IRA-based donations, given their larger potential amounts, can significantly boost a charity's resources. By leveraging assets from IRAs, donors can make profound impacts, potentially changing the trajectories of the organizations they support. A charity receiving funds directly from an IRA can harness these resources immediately without the usual administrative or processing delays. It’s a direct lifeline, one that can invigorate missions and visions. When compared to conventional out-of-pocket donations, IRA-based gifts might appear more magnanimous. The reason? The absence of immediate tax implications makes it easier for donors to give more generously. For many, this tax efficiency translates to bigger contributions. Furthermore, considering the age bracket most eligible for QCDs, these individuals might find themselves in a position to make more substantial gifts, having accumulated wealth over a lifetime. The combination of accumulated assets and tax benefits paves the way for grander gestures of generosity. The more you have, the more you can give away tax-efficiently. While QCDs brim with potential, they aren’t limitless. An individual can only donate up to $105,000 in 2024 ($108,000 in 2025) annually via QCDs. For couples filing jointly if both are eligible, the total shoots up to $210,000 in 2024 ($216,000 in 2025). But beyond this threshold, the excess doesn’t qualify and might incur regular distribution tax implications. Despite the cap, these amounts are substantial. Yet, as with any financial strategy, it's paramount to be mindful of limits, ensuring adherence and avoiding unexpected fiscal surprises. Not all charities qualify for QCDs. Only those with 501(c)(3) status make the cut. This classification pertains to public charities, excluding private foundations or donor-advised funds. Hence, before initiating a QCD, it's imperative to verify the charity's status. Such verification isn’t just a nod to compliance but an assurance that the donation reaches its intended recipients. By ensuring a charity's eligibility, donors reinforce the very spirit of their generosity. Timing is paramount with QCDs. As touched upon earlier, only those 70½ or older are eligible. This age-based gatekeeping aligns with RMD regulations, but it's a crucial detail to pin down. Initiating a QCD even a day before turning 70½ can lead to unintended tax consequences. Moreover, the age constraint underscores the marriage between retirement planning and charitable inclinations. It’s a union that speaks to mature financial strategies, ones born out of accumulated wisdom and assets. Tread cautiously, for the realm of QCDs isn’t without its pitfalls. An improper distribution, be it due to timing, amount, or charity eligibility, can land donors in a thorny tax situation. If a QCD is mishandled, it could revert to a standard distribution with all the attached tax implications. This potential backslide stresses the importance of meticulous execution. After all, the confluence of retirement assets and philanthropy deserves nothing less than precision. Beyond IRAs, other avenues beckon for those with charitable inclinations. One such strategy revolves around donating appreciated assets from accounts like taxable brokerage accounts. When you donate securities that have appreciated over time, you can potentially avoid capital gains taxes and still claim a charitable deduction. Such a strategy isn't just fiscally astute. It underscores the myriad ways generosity can manifest, each avenue reflecting a unique financial footprint. Another strategy simmers with simplicity. By naming a charity as a beneficiary of your IRA or another retirement account, you ensure that upon your passing, these funds flow seamlessly to causes you championed in life. This bequest remains outside your taxable estate, possibly reducing estate taxes. Such a legacy isn't just about financial transfers. It's an enduring testament to values, to causes championed, and to the desire to make an indelible mark on the world. The Roth IRA, with its tax-free distributions, presents another charitable strategy. While Roth IRAs don't have RMDs during the owner's lifetime, beneficiaries might face these mandatory withdrawals. By designating a charity as a Roth IRA beneficiary, donors ensure that these funds benefit causes close to their heart without the associated tax burdens. Leveraging a Roth IRA in this manner speaks to forward-thinking. It’s a nod to crafting legacies, ensuring that even in their absence, one’s values continue to resonate and make a difference. IRAs have evolved beyond just retirement savings, demonstrating their potential for societal benefits. Through Qualified Charitable Distributions (QCDs), individuals aged 70½ or older can seamlessly transfer funds from their IRA directly to qualified charities. These transfers, uniquely non-taxable up to a point, offer donors dual advantages: they satiate philanthropic intentions while also providing tax relief. While this mechanism allows substantial contributions and aids in meeting the RMD mandates, it is paramount to adhere to stipulated limits, ensure the chosen charity's eligibility, and meticulously execute the transfer to avoid unintended tax implications. Overall, QCDs epitomize the synergy between astute financial planning and altruistic endeavors, enabling donors to make impactful contributions while enjoying tax benefits.Overview of Individual Retirement Accounts (IRAs)

Understanding the Qualified Charitable Distribution (QCD) From IRAs

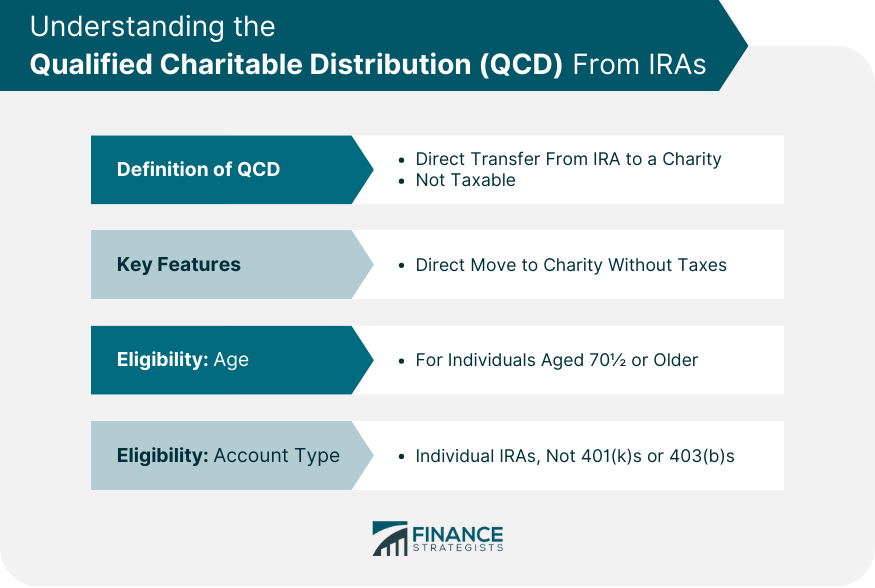

Definition and Key Features of QCD

Eligibility Criteria for Making a QCD

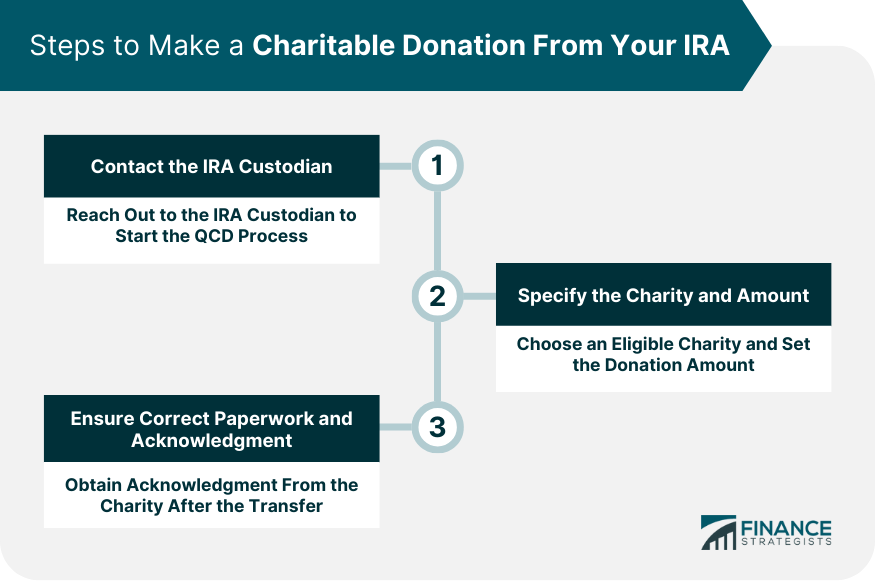

Steps to Make a Charitable Donation From Your IRA

Contact the IRA Custodian

Specify the Charity and Amount

Ensure Correct Paperwork and Acknowledgment From the Charity

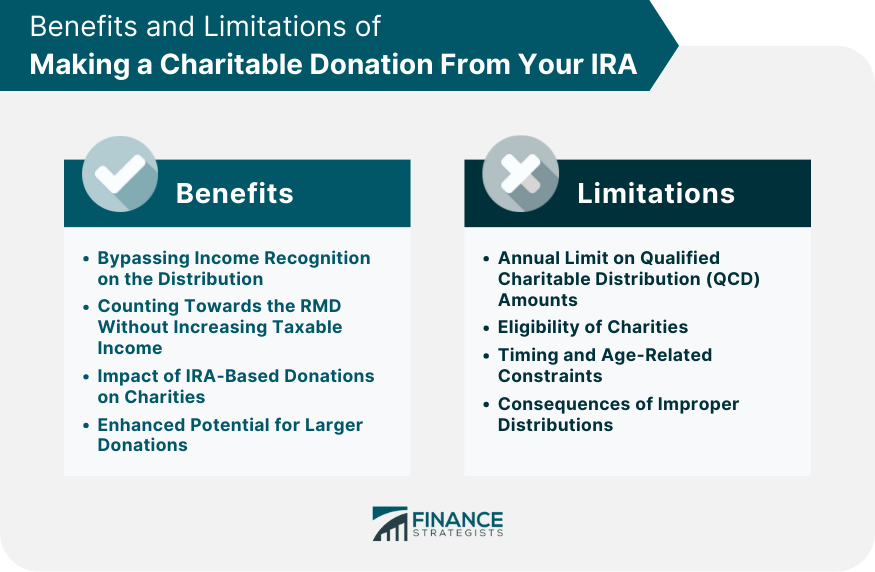

Benefits of Making a Charitable Donation From Your IRA

Tax Advantages

Bypassing Income Recognition on the Distribution

Counting Towards the RMD Without Increasing Taxable Income

Supporting Charitable Causes

Impact of IRA-Based Donations on Charities

Enhanced Potential for Larger Donations Compared to Out-Of-Pocket Giving

Limitations and Restrictions of Making a Charitable Donation From Your IRA

Annual Limit on QCD Amounts

Eligibility of Charities

Timing and Age-Related Constraints

Consequences of Improper Distributions

Alternative Strategies for Charitable Giving Using Retirement Funds

Donate Appreciated Assets From Other Accounts

Name a Charity as a Beneficiary

Use a Roth IRA for Charitable Purposes

Bottom Line

Can You Make a Charitable Donation From Your IRA? FAQs

Yes, using the Qualified Charitable Distribution (QCD), you can directly transfer funds from your IRA to eligible charities.

Donations bypass income recognition, count towards the Required Minimum Distribution (RMD), and do not increase taxable income.

The charity should have a 501(c)(3) status, excluding private foundations and donor-advised funds.

Individuals must be 70½ or older to make a Qualified Charitable Distribution from their IRA.

Yes, you can donate appreciated assets, name a charity as a beneficiary, or use a Roth IRA for charitable purposes.