An annuity is a financial product designed to provide a guaranteed stream of income to an individual during retirement. The annuity is typically purchased with a lump sum of money and is designed to last for a specific period or the remainder of one's life. Annuities can provide a stable and predictable source of income, making them a popular option for those looking to secure their financial future. There are several types of annuities available, each with unique features and benefits. A fixed annuity is a category of annuity that provides a certain interest rate that is guaranteed for a particular period, typically ranging from one to ten years. Another type is the variable annuity, which allows individuals to invest in a portfolio of stocks, bonds, and other securities. Variable annuities, on the other hand, offer the potential for higher returns but also come with more risk. Indexed annuities are another type of annuity that combines the features of fixed and variable annuities. They provide a guaranteed minimum interest rate. These annuities also allow individuals to earn additional interest based on the performance of a specific stock market index. Immediate annuities are another type of annuity that begins providing payments immediately after purchase. Immediate annuities are often used by those who need to supplement their income immediately during retirement. Deferred annuities are designed to begin providing payments at a later date, often years after purchase, which allow individuals to accumulate tax-deferred earnings. Converting an Individual Retirement Account (IRA) to an annuity can provide several benefits for retirees. One key benefit is the guarantee of a fixed and consistent income stream throughout retirement, which can help individuals plan their finances with greater certainty. This can provide retirees with financial stability and peace of mind. Unlike traditional retirement accounts that may be subject to market fluctuations, annuities offer a fixed rate of return that is guaranteed by the insurance company that issues the annuity. Individuals can rely on a consistent income stream that is not impacted by market volatility. With an annuity, individuals can receive predictable payments that are often higher than what they might receive from traditional retirement accounts. Annuities offer a fixed rate of return that can provide consistent payments for the life of the annuitant. This is beneficial for retirees who rely on a fixed income and need to plan for their expenses and financial obligations. This can help retirees to manage their finances with greater confidence, as they can anticipate the exact amount of income that they will receive each month or year. Many annuities offer a death benefit that can provide financial security for beneficiaries in the event of the annuitant's death. This benefit can help individuals ensure that their loved ones receive financial support even after their passing. This benefit typically guarantees that a specific amount of money will be paid to the annuitant's designated beneficiary in the event of their death. The amount of the death benefit can vary based on the type of annuity and the terms of the contract. An annuity can help retirees avoid the need to monitor their investments or make adjustments to their portfolios based on market fluctuations or other factors that can impact their retirement income. This is particularly helpful for individuals who are not experienced in managing investments or who do not have the time or inclination to do so. Retirees can enjoy a simplified and hassle-free retirement, knowing that their income is guaranteed and requires minimal effort to manage. While converting an IRA to an annuity can offer many benefits, there are also some potential drawbacks to consider. If the individual passes away prematurely, the remaining balance of the annuity will stay with the insurance company instead of being passed down to their heirs. In addition, annuities may not be the best option for those who anticipate needing to access their savings in the near future. They cannot spend their money because once an annuity contract is signed, the individual is committed to receiving a fixed income stream, which may not allow for the flexibility to withdraw funds as needed. Another potential drawback is the cost of being passive. Unlike actively managed investments, annuities typically come with higher fees and less flexibility. These fees can eat into the returns and reduce the overall value of the investment. Annuities are generally less flexible than other types of investments, which can limit individuals' ability to make changes to their investment strategy. This lack of flexibility may leave them feeling stuck with their annuity investment, even if it is no longer the best option for their needs. While the fixed income stream provided by an annuity can be advantageous for budgeting and planning, it does not provide protection against inflation. If the cost of living increases over time, the purchasing power of the income stream may be reduced. This potentially leads to financial hardship for the annuitant. It is important for individuals to consider the potential impact of inflation when deciding whether or not to convert their IRA to an annuity. Below are some ways for individuals to convert an IRA to an annuity. One option is a direct transfer, which involves moving the funds from the IRA directly into the annuity. This method can be straightforward and efficient, as it eliminates the need for individuals to handle the funds themselves. The process of converting an IRA to an annuity is mostly managed by the financial institutions in charge of the individual's funds and typically requires only the individual's completion of some forms and authorization. Another option is to take a qualifying withdrawal from the IRA and use the funds to purchase an annuity. This approach may be suitable for individuals who want to retain some control over their investment or who have specific requirements for the annuity. This is applicable if they prefer selecting a specific insurance provider. However, it is essential to note that this approach can have tax implications, and individuals should consult with a financial advisor before proceeding. Any pre-tax contributions to the IRA are subject to income tax when they are distributed. The annuity payments received will be treated as ordinary income and taxed accordingly. The amount of the annuity payments received may push individuals into a higher tax bracket. This can result in a higher overall tax bill. Additionally, if the IRA funds are rolled over into an annuity using a non-qualified annuity, any earnings from the annuity payments will be subject to capital gains tax. However, if a qualified annuity is used, any earnings will continue to grow tax-deferred until they are distributed. In addition, using an indirect rollover is a more complex process compared to a direct rollover and increases the likelihood of incurring unintended tax consequences. In an indirect rollover, the retirement funds are liquidated, but the federal government withholds 20% of the gross amount for taxes. To avoid taxes and penalties, individuals must roll the gross amount of the liquidated retirement account into an annuity within 60 days. Deciding to convert an IRA to an annuity can be a complex decision that depends on a variety of factors. Some individuals may choose to convert their IRA to an annuity to ensure that they have a steady stream of income in retirement. An important factor to think about when deciding whether or not to convert an IRA to an annuity is retirement goals. An annuity can provide a predictable stream of income, which provides individuals with a reliable source of income in retirement. If an individual is comfortable managing his investments and prefers a more flexible approach to retirement planning, an annuity may not be the best option. Another important consideration is their risk tolerance. For an investor with a long investment horizon, an appetite for short-term market fluctuations, and the ability to generate income from other investment types, an annuity rollover may not be the best choice. Individuals who prioritize stability over high returns may find annuities to be a suitable choice. However, those who are willing to take on more investment risk and prefer higher potential returns may want to explore alternative investment options. In addition to investment goals, an individual's current financial situation should also be considered. An annuity may be a good choice for individuals with a significant amount of retirement savings who want to ensure a guaranteed income stream in retirement. However, if an individual has other sources of income or significant debt, an annuity may not be the most practical choice. Ultimately, individuals should carefully consider their unique circumstances before making any decisions. Annuities are financial products that provide a guaranteed stream of income during retirement. There are several types of annuities available, including fixed, variable, indexed, immediate, and deferred annuities, each with unique features and benefits. Converting an IRA to an annuity can provide several benefits, such as a guaranteed income stream, predictable payments, and reduced management requirements. However, it is essential to weigh the potential drawbacks, such as limited access to your funds, fees, and inflation risk. In order to convert an IRA to an annuity, account owners can opt for either a direct or indirect rollover. A direct rollover allows the funds to be transferred directly from one account to another without any taxation or penalties. An indirect rollover involves liquidating the retirement funds and can result in taxes and penalties if done incorrectly. This requires taking a qualifying withdrawal from the IRA and using the funds to purchase an annuity. It is necessary to carefully consider the potential tax implications before converting an IRA to an annuity to ensure that the decision aligns with one's long-term financial goals and retirement plans. Ultimately, deciding whether or not to convert an IRA to an annuity is a personal decision that depends on individual goals, risk tolerance, and financial situation. Working with a financial advisor or tax professional can help.What Is an Annuity?

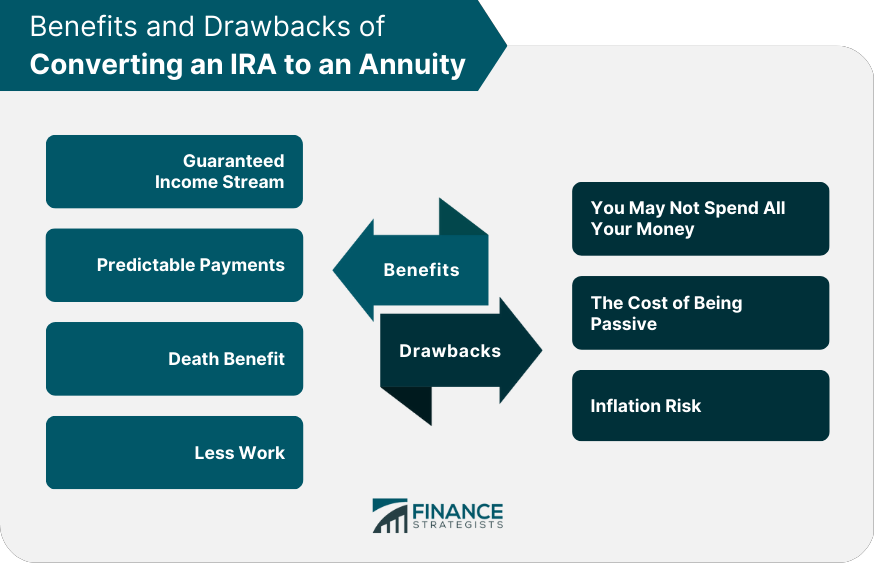

Benefits of Converting an IRA to an Annuity

Guaranteed Income Stream

Predictable Payments

Death Benefit

Less Work

Drawbacks of Converting an IRA to an Annuity

You May Not Spend All Your Money

The Cost of Being Passive

Inflation Risk

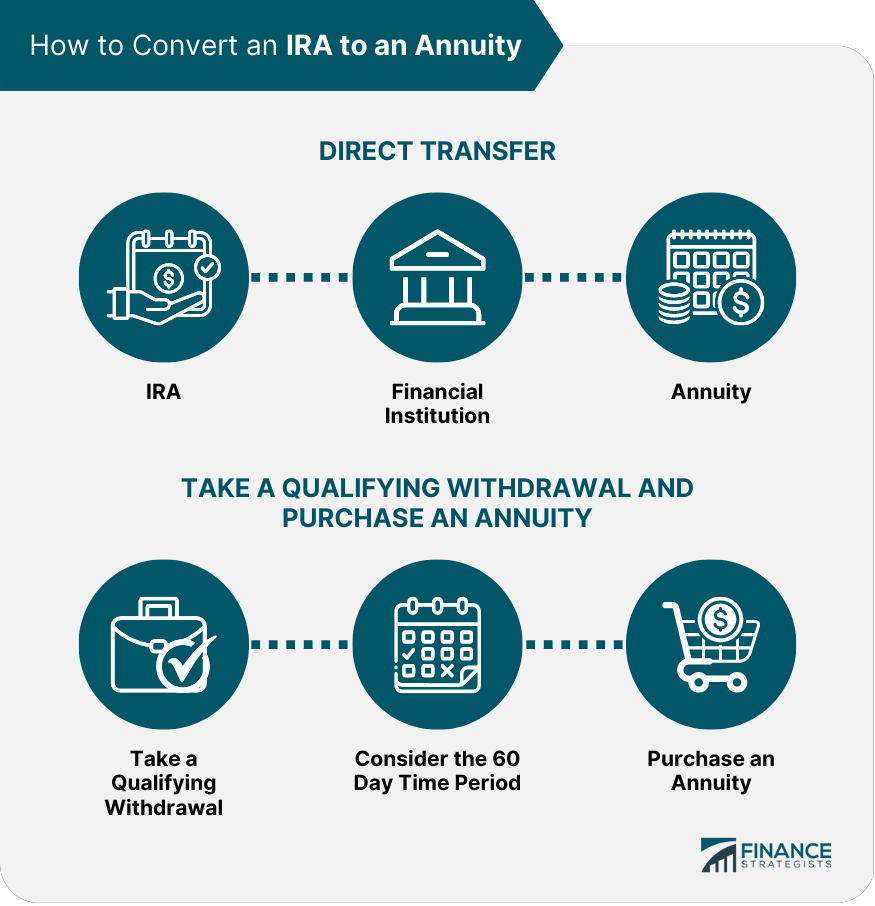

Ways to Convert an IRA to an Annuity

Direct Transfer

Take a Qualifying Withdrawal & Purchase an Annuity

Tax Implications of Converting an IRA to an Annuity

When Does Converting an IRA to an Annuity Make Sense?

The Bottom Line

Converting IRA to Annuity FAQs

It is possible to convert a Roth IRA to an annuity. The process of converting may incur potential tax implications.

The fees associated with converting an IRA to an annuity can vary based on the type of annuity and the provider. Annuities can come with higher fees than other types of investments, and these fees can impact the overall value of the investment. Some common fees associated with annuities include administrative fees, mortality and expense fees, and surrender charges if the annuity is canceled or withdrawn before the end of the contract period.

You can use the funds from an inherited IRA to purchase an annuity. The rules and regulations surrounding inherited IRAs can be complex, and there may be tax liabilities associated with the conversion of an inherited IRA to an annuity.

Choosing the right annuity involves several considerations, such as the type of annuity that suits your investment goals and risk tolerance, the fees that come with annuities including annual maintenance fees and investment management fees, different payout options like single-life, joint-life or period-certain annuity payments, the financial strength of the insurance company, and tax implications that vary based on on the type of annuity and how it is funded. It is essential to understand these factors before purchasing an annuity.

In most cases, once you have purchased an annuity with funds from your IRA, you cannot change the payment structure or terms of the annuity. This is because annuities are contracts that typically cannot be altered after purchase. However, some annuities may offer riders or options that allow for changes to be made to the payment structure or terms.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.