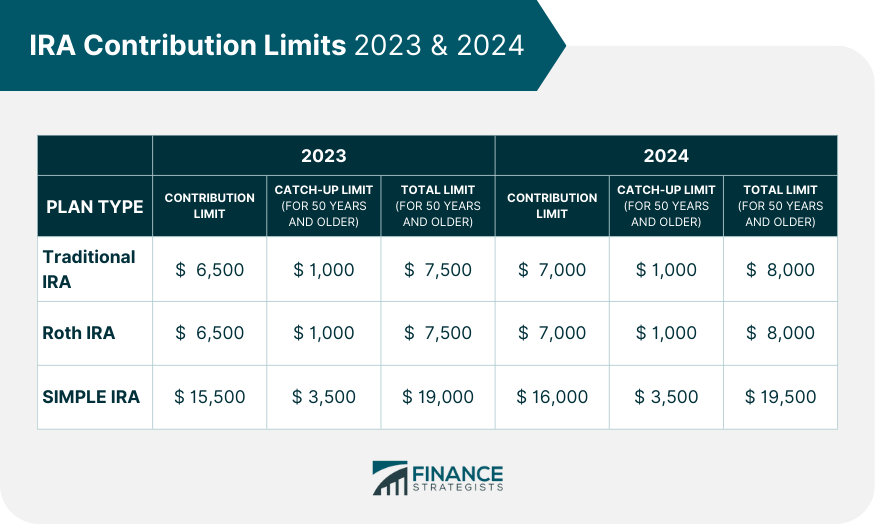

There are many different types of Individual Retirement Arrangements (IRAs) a person can have. Some of these IRAs are employer-sponsored, such as the SIMPLE (Savings Incentive Match Plan for Employees) IRA or the SEP (Simplified Employee Pension) plan IRA. There are also IRAs that any individual with an earned income can open without the need for a sponsoring employer. These are the traditional IRA and the Roth IRA. The Internal Revenue Service (IRS) does not limit how many IRAs you can have. For example, you can simultaneously open a traditional IRA and a Roth IRA or choose to have many IRAs of either type. However, all these IRAs are still subject to their respective contribution limits. Thus, even if you choose to have multiple retirement accounts, you still have to follow the annual contribution limit rules for each one. Have questions about IRAs? Click here. This portion of the article focuses on the limits for IRAs in which individuals can make contributions, whether or not a sponsoring employer also makes contributions. Other IRA types, such as the SEP IRA, where only employers can contribute, have not been included. For the tax year 2023, the IRS sets a limit of $6,500 for both traditional and Roth IRA contributions. However, individuals 50 years old and above can contribute an additional $500 as a catch-up contribution, making their total contribution limit $7,000. In 2024, there will be an increase in the traditional and Roth IRA contribution limit. The new limit is $7,000. There is an additional catch-up contribution of $1,000 for those 50 and older, making their total contribution limit $8,000. For SIMPLE IRA plans, the limit is $15,500 for 2023. There is a catch-up contribution of $3,500 for those aged 50 years and older, making their total contribution limit $19,000. In 2024, the contribution limit will increase to $16,000. The catch-up contributions for those aged 50 years and older is $3,500, making their total contribution limit $19,500. Individuals with SIMPLE IRAs may max out their contribution limit, accept additional employer contributions, and maintain any number of traditional or Roth IRAs. However, if they contribute more than the limit to all accounts combined, the IRS will charge them a 6% penalty tax. For example, Maria, aged 26, has a SIMPLE IRA sponsored by her current employer OW Restaurant. She also has other retirement accounts, composed of one traditional IRA and one Roth IRA, which she opened when she started earning income. In 2024, Maria contributed a maximum of $16,000 to her SIMPLE IRA and received an additional contribution from her employer of $1,000. In the same year, she also contributed $6,000 to her Roth IRA and $1,000 to her traditional IRA, for a total of $7,000. Since the combined contribution limit of all traditional and Roth IRA accounts must not exceed $7,000 for 2024, Maria will not be charged a 6% penalty tax. Individuals who do not have SIMPLE IRAs but instead have multiple IRAs, whether in the traditional or Roth variety, must also not exceed the contribution limit for all accounts combined. If they miscalculate and overcontribute, they will also be charged a 6% penalty tax. There are several advantages to having multiple IRAs: Having different types of IRAs allows you to enjoy different tax advantages. If you have a traditional IRA, you can enjoy tax-deductible contributions. At the same time, if you have a Roth IRA, contributions may not be tax-deductible now, but withdrawals in retirement may be tax-free. You can employ different investment strategies in each account. You can use one account for long-term investments and another for short-term trades. Having separate accounts also makes managing distributions from a particular account easier without affecting other accounts. Providing for different beneficiaries is easier when you have multiple IRAs. You may designate one account as an inheritance for your spouse, another for your children, and a third for charity. This can help prevent disagreements about who the money should go to upon your death. There are also disadvantages to opening multiple IRAs: Multiple IRAs can mean paying more in account fees and investment expenses. If this is not monitored closely, it can significantly impact the performance of your retirement savings and decrease the overall return on your investments. Managing multiple accounts will require you to track all of them separately and file separate forms for each one. For instance, you might have to provide different information on your IRS Form 5498. For most people, this can be a time-consuming and complicated process. Retirement planning may become complicated because you need to consider the different accounts and how they may be affected by changing tax rules and possible investment threats. You may have to operate different strategies and asset allocations to get a stable return. Having multiple IRAs can be advantageous in certain situations and disadvantageous in others. It all depends on your individual financial goals and retirement strategy. If you want to enjoy different tax advantages, wish to assign multiple beneficiaries, or prefer to try various investment strategies, then having multiple IRAs might suit you. However, having multiple IRAs might not be a good option if you do not want to deal with time-consuming paperwork, higher account fees, or a complex management process. It is also essential to consider if you have enough money to open and maintain multiple accounts. If not, you may want to prioritize one account and focus on maximizing its contribution limit. If you are considering multiple IRAs, you may contact a financial advisor and discuss if this is the best option for you, considering your retirement goals and current situation. The IRS does not stipulate any limitation on the number of IRAs a person can have. However, all IRAs you open must abide by their respective annual contribution limits. If you miscalculate and overcontribute, you will be charged a 6% penalty tax. Having multiple IRAs can increase tax diversification, enable varied investment strategies, and make it easier to have multiple beneficiaries. However, it can also increase account fees and investment expenses and result in time-consuming paperwork and a complex management process. Thus, it is important to consider your individual financial goals and retirement strategy before deciding if multiple IRAs are the right choice for you.How Many IRAs Can You Have?

IRA Contribution Limits 2023 & 2024

How Does Having Multiple IRAs Work?

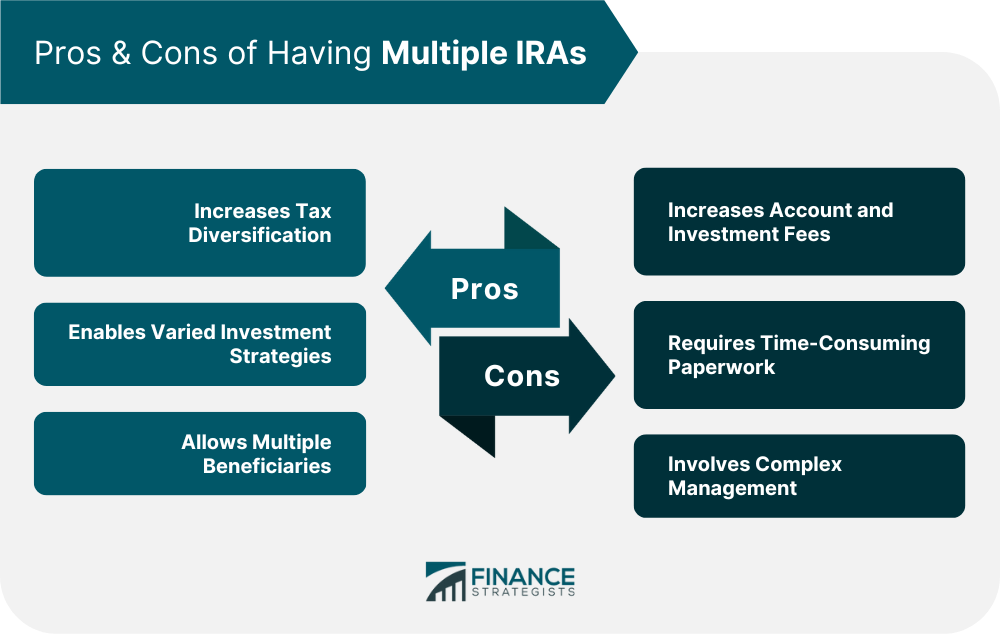

Advantages of Having Multiple IRAs

Increases Tax Diversification

Enables Varied Investment Strategies

Allows Multiple Beneficiaries

Disadvantages of Having Multiple IRAs

Increases Account and Investment Fees

Requires Time-Consuming Paperwork

Involves Complex Management

Should You Have Multiple IRA Accounts?

Final Thoughts

How Many IRAs Can You Have? FAQs

Yes, you can have multiple IRAs. The IRS does not restrict the number of IRA accounts you can open. However, each account must be subject to its respective annual contribution limits. If you miscalculate and overcontribute, you will be charged a 6% penalty tax.

If tax diversification is important or you want to assign multiple beneficiaries, then opening multiple IRAs can be beneficial. However, one IRA may be preferable if you do not want to pay additional account fees or deal with time-consuming paperwork.

The advantages of having multiple IRAs include increased tax diversification, the ability to apply varied investment strategies, and the simplicity of assigning multiple beneficiaries.

The disadvantages of having multiple IRAs include increased account fees, time-consuming paperwork, and the complexity of managing multiple accounts.

For a traditional IRA, all withdrawals before age 59 1/2 incur a 10% early withdrawal penalty. Exceptions are allowed, such as when the money is withdrawn for qualified medical expenses. In contrast, Roth IRA contributions can be withdrawn penalty-free anytime, while earnings can be withdrawn penalty-free after the account has been open for at least five years.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.