The IRA 60-Day Rollover Rule provides IRA account holders the opportunity to withdraw funds from their IRA and redeposit them into the same or another IRA without incurring tax penalties. However, this must be achieved within 60 days. If accomplished within this specified timeframe, the transaction is considered non-taxable. This 60-day window commences from the day the funds are withdrawn and not when they are received. It's a pivotal rule for individuals looking to move funds while avoiding potential pitfalls and unintended tax consequences. The IRA 60-Day Rollover Rule allows individuals to move funds between IRA accounts at different institutions without immediate taxes or penalties. This rule facilitates short-term fund access and institution changes while shielding consumers from potential tax complications.

Upon withdrawing funds from an IRA, a ticking clock starts, counting down from 60. These 60 days represent a grace period during which individuals can maneuver funds as they see fit, so long as they redeposit them into an IRA account. Should the 60 days lapse without redepositing, the withdrawal could be considered a distribution. Distributions, depending on one's age and account type, can incur penalties and taxes. This urgency underscores the rule's significance. While the 60-Day Rollover Rule is most commonly associated with Traditional IRAs, it's not exclusive to them. Roth IRAs, as well as other types of retirement accounts, fall under this provision. Each account type, be it Traditional, Roth, or others, carries with it unique tax implications and nuances. While the 60-day rule is a unifying provision, how it interacts with each account type can vary slightly, demanding diligence from account holders. Executing a successful rollover requires more than just moving money. Firstly, individuals need to ensure the receiving IRA is prepared to accept the funds. This often involves communication with the financial institution and ensuring the correct type of IRA is established. Next, it's crucial to complete the transaction within the 60-day window. Missing this window, even by a day, can have significant financial consequences. Therefore, prompt action combined with accurate execution is paramount. As with many financial regulations, exceptions exist. For instance, unforeseen hardships or back-to-back rollovers might be exempted from the rule's strictures under specific conditions. However, it's imperative to note that relying on exceptions is risky. It's always a safer bet to operate strictly within the rule's guidelines than to bank on an exception saving the day. The 60-Day Rollover Rule inherently promotes flexibility. By allowing a temporary movement of funds without penalty, individuals can adapt their strategies, even react to short-term financial needs, without derailing their long-term retirement plans. Such flexibility is often a godsend during unpredictable financial moments, offering a buffer that might not otherwise exist. Imagine needing funds for an emergency, but the only available liquidity is tied up in your IRA. The 60-Day Rollover Rule provides a temporary reprieve, allowing for the withdrawal of these funds without immediate tax implications. While not a strategy to rely on frequently, in dire circumstances, this provision can act as a lifeline. Sometimes, due to better investment options, reduced fees, or simply personal preference, one might wish to shift from one financial institution to another. The 60-Day Rollover Rule facilitates such transitions, enabling smooth transitions without the specter of penalties. This facilitates consumer choice, allowing individuals to shop around for the best possible financial custodians without feeling anchored to one due to punitive regulations. The freedom to move funds can also be leveraged to diversify investments. Whether it's seizing a timely market opportunity or reallocating assets to better fit an evolving financial strategy, the 60-Day Rollover Rule provides the space to make these shifts seamlessly. Diversification is often the key to risk mitigation in investments, and this rule indirectly champions such strategies. The most evident risk is missing the 60-day deadline. Time flies, and with the myriad responsibilities of modern life, it's conceivable to lose track. If the redeposit isn't completed within the timeframe, substantial penalties and taxes might await. Even with the best intentions, life's unpredictability can result in missed deadlines, turning a well-intentioned move into a financial mishap. Failed rollovers aren't just about missed opportunities; they can also bring about unwanted tax events. An unsuccessful rollover can be treated as a distribution, making it taxable income. Depending on the IRA type, early withdrawal penalties might also apply. Such events could lead to a hefty tax bill, completely negating the benefits that prompted the rollover attempt. While the 60-day rule offers flexibility, it's not without its limits. A key restriction is the once-per-year rule. This means that an individual can't perform multiple 60-day rollovers within a 365-day period, even across different IRAs. Such a limitation requires planning, ensuring that any rollovers are both strategic and sparse. Executing a rollover might seem straightforward, but it often comes with a maze of paperwork and reporting requirements. Both the distributing and receiving institutions typically have forms to fill out, each demanding precision. A misstep in this documentation can lead to confusion, possible penalties, and unexpected tax consequences. Documentation is a saver in the financial world. Keeping thorough records of all transactions, dates, amounts, and communications with financial institutions can be invaluable. Such records can clarify uncertainties, provide evidence in disputes, and assist during tax seasons. Moreover, in a landscape where regulations frequently evolve, having an archive of past transactions can offer insights and context for future financial decisions. The world of IRAs, while rewarding, can be intricate. It's often beneficial to lean on the expertise of financial advisors or tax professionals. These experts can provide guidance, ensure compliance with rules, and optimize financial moves for tax efficiency. Their insights can transform a complex task into a streamlined process, ensuring peace of mind and optimal outcomes. It's pivotal to always have the once-per-year rule at the forefront when considering a 60-day rollover. Planning is essential to avoid inadvertently violating this rule. By spacing out rollovers and being strategic about their timing, one can maximize the benefits while staying compliant. In today's digital age, leveraging technology can be a boon. Setting up alerts or reminders for the 60-day deadline ensures that the timeline is adhered to. Whether it's through calendar apps, specialized financial software, or even simple phone reminders, such alerts can be the difference between a successful rollover and a costly oversight. Remember, with the IRA 60-Day Rollover Rule, timing is everything. The IRA 60-Day Rollover Rule offers individuals a valuable financial tool, providing a window of opportunity to move funds between IRA accounts without incurring immediate tax penalties, as long as it's completed within a 60-day timeframe. While this rule brings about significant flexibility, enabling short-term access to funds and facilitating transitions between institutions, it's not without its challenges. There's the ever-present risk of missing the 60-day deadline, potential tax complications from unsuccessful rollovers, and the once-per-year limitation. Coupled with the intricate documentation and reporting processes, maneuvering within this rule demands diligence. Nonetheless, with proper planning, consultation with financial experts, and leveraging technology for timely reminders, individuals can maximize the benefits of this provision while minimizing potential pitfalls. It's a balance between seizing opportunities and being cautious of the constraints.What Is the IRA 60-Day Rollover Rule?

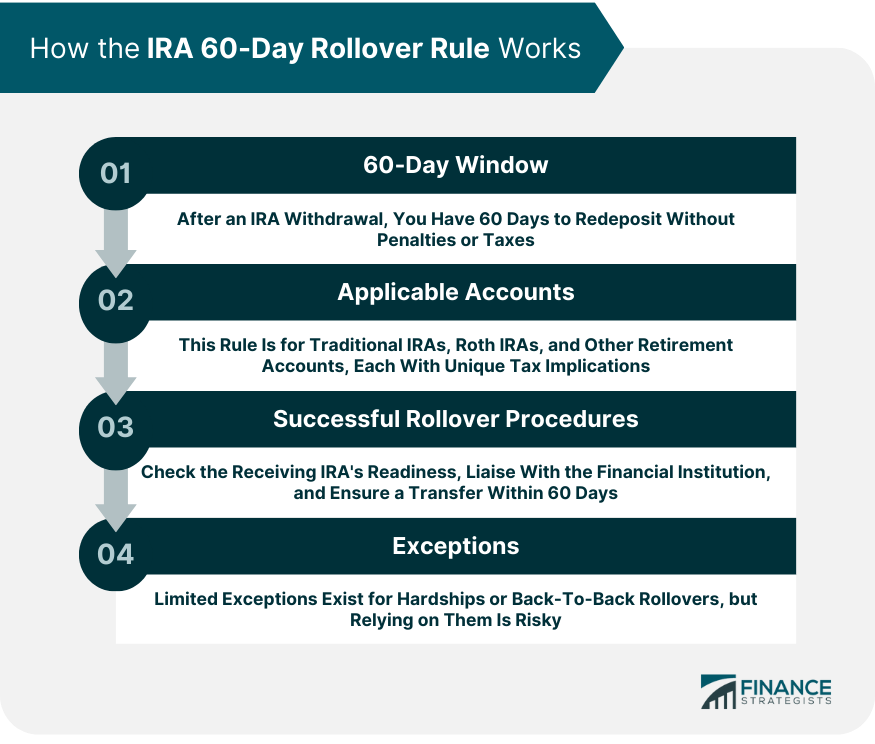

How the IRA 60-Day Rollover Rule Works

Timeline: The 60-Day Window

Applicable Accounts: Traditional IRA, Roth IRA, and Others

Procedures for Executing a Successful Rollover

Exceptions to the Rule

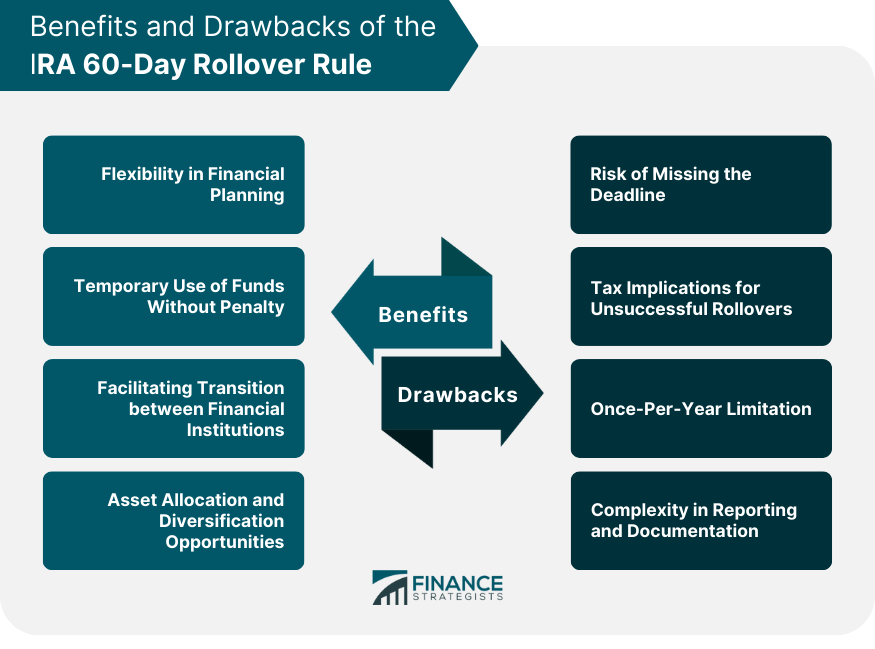

Benefits of the IRA 60-Day Rollover Rule

Flexibility in Financial Planning

Temporary Use of Funds Without Penalty

Facilitating Transition Between Custodians or Financial Institutions

Asset Allocation and Diversification Opportunities

Drawbacks of the IRA 60-Day Rollover Rule

Risk of Missing the Deadline

Tax Implications for Unsuccessful Rollovers

Once-Per-Year Limitation

Complexity in Reporting and Documentation

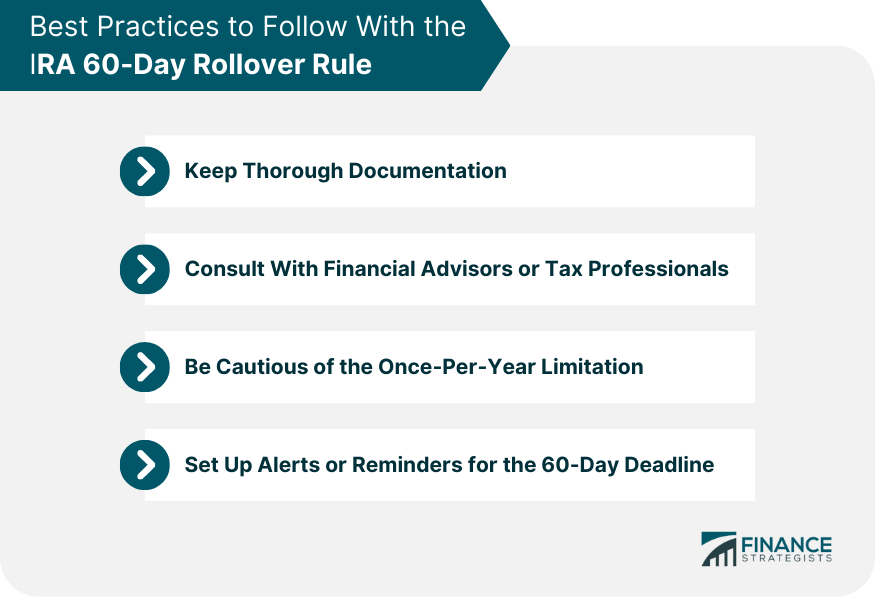

Best Practices to Follow With the IRA 60-Day Rollover Rule

Keep Thorough Documentation

Consult With Financial Advisors or Tax Professionals

Be Cautious of the Once-Per-Year Limitation

Set Up Alerts or Reminders for the 60-Day Deadline

Final Thoughts

IRA 60-Day Rollover Rule FAQs

It's a provision allowing IRA funds withdrawal and redeposit within 60 days without tax penalties.

It provides flexibility, allowing temporary fund usage without penalties and facilitates transitions between financial institutions.

Yes, risks include missing the 60-day deadline, potential tax implications, the once-per-year limitation, and complex reporting requirements.

No, there's a once-per-year limitation, preventing multiple rollovers within a 365-day period across different IRAs.

Maintain thorough documentation, consult financial advisors, be cautious of the once-per-year rule, and set reminders for the 60-day deadline.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.