An Individual Retirement Account (IRA) is one of the most popular retirement savings plans. It is a helpful, tax-advantaged way to save up retirement funds with higher potential earnings than basic savings accounts. There are several types of IRAs, including traditional and Roth IRAs. Traditional IRAs are funded with pre-tax dollars, whereas Roth contributions are made with after-tax dollars. The 2024 contribution limits for traditional and Roth IRA contributions are $7,000 for individuals under 50 and $8,000 for those who are 50 or older. This is an increase from the 2023 limits of $6,500 and $7,500, respectively. Individuals who make less than these limits can only contribute up to their annual taxable compensation. It is vital to note that these limits do not apply to rollover contributions or qualified reservist repayments. Have questions about IRA contributions? Click here.

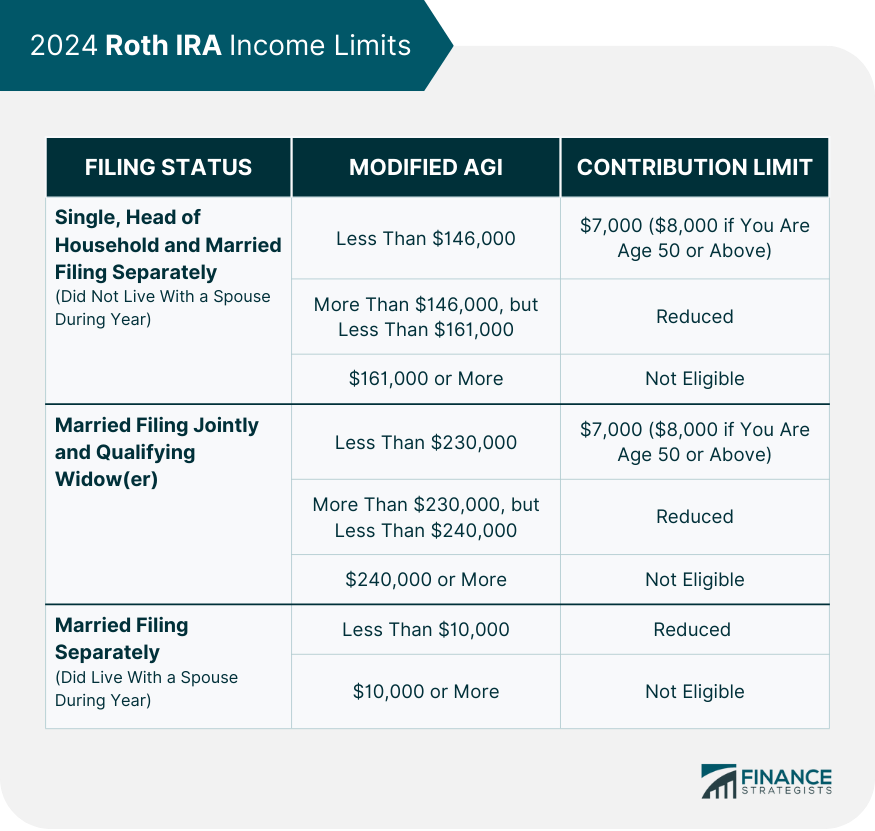

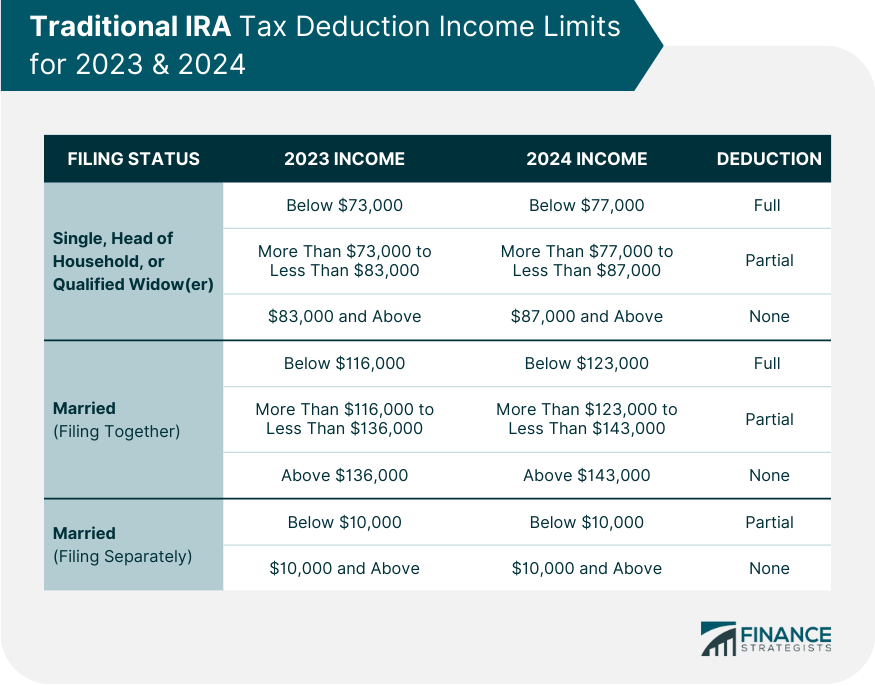

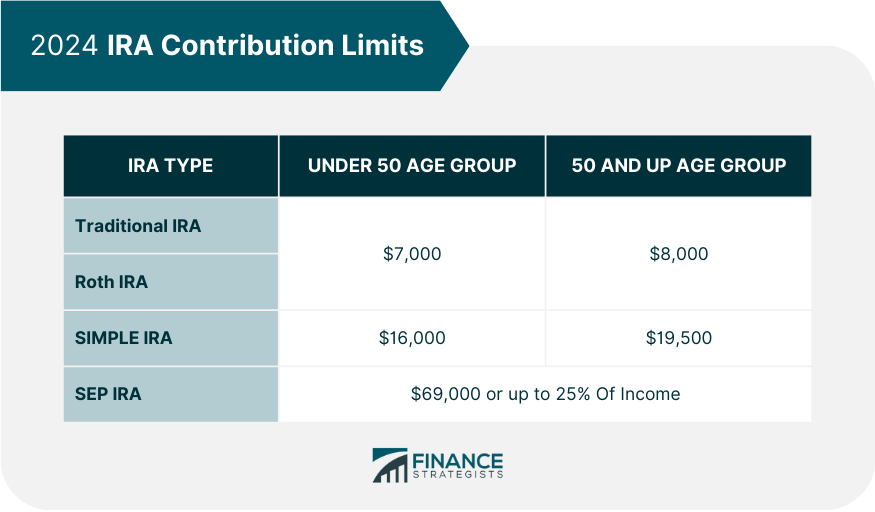

You must have enough earned income to contribute to an IRA. That is money that is earned through providing goods or services for pay. There are a few ways to earn income, including working for someone else or operating your own business or a farm. Whichever route you choose can be a great way of getting the earned income necessary to contribute to an IRA and help secure your future financial well-being. Earned income includes wages, salaries, tips, bonuses, commissions, and self-employment income. In addition to these sources, the IRS includes disability retirement benefits as earned income until individuals reach a certain age. This is crucial since it can help those with disabilities remain financially independent throughout their lives, providing autonomy and security. Although there are multiple income types, only some are considered earned income and, therefore, taxable. Some examples of income that do not count as earned income include: Retirement income Unemployment benefits Interest and dividends generated by investments Funds received while an inmate in a penal institution To contribute to an IRA, you must have earned enough income to cover your contributions. If you earn less than the contribution limit, you can only contribute as much as your earned income for the year. For example, if your earned income reached only $4,000 in 2024, then your contribution limit would be a maximum of $4,000, regardless of your age. Filing a joint return can have many advantages, especially if you plan to contribute to an IRA. For couples where one spouse earned taxable compensation and the other did not, both partners may be able to make contributions up to the current limit. The total of their combined contributions should not exceed the taxable compensation reported on their joint return - thus, it is essential to keep this in mind when calculating contributions. All contributions will be deductible for those not participating in a retirement plan at work. To help understand these rules further, see Publication 590-A for details about the Kay Bailey Hutchison Spousal IRA Limit. The IRS uses the MAGI to set the limits for IRAs, which is very similar to your AGI (Adjusted Gross Income). The MAGI includes some adjustments, such as adding back certain deductions like any of the following: Rental losses Student loan interest Passive income or loss Qualified tuition expenses Half of any self-employment taxes The exclusion of adoption expenses Losses from a publicly-traded partnership IRA contributions and Social Security payments The U.S. savings bonds exclusion and tuition and fees With these important deductions included in an individual's MAGI calculation, their MAGI amount can be significantly different from their AGI amount. Calculating your Modified Adjusted Gross Income might seem intimidating, but it can be done with some careful and thorough calculations. Start by getting your Adjusted Gross Income from last year's tax return which should be located on line 11 of Form 1040. That number is the basis for the MAGI calculation, then proceed to use IRS Publication 590-A, Appendix B, Worksheet 1 to modify that AGI for IRA purposes. While this might initially require more effort or time than most people want to put in, a properly calculated MAGI can help an individual or a couple determine how much they can contribute to their respective IRAs for the year. When determining whether or not you are eligible for Roth IRA contributions, it is essential to be mindful of your filing status and modified adjusted gross income. For example, single filers with a MAGI above $138,000 up to $153,000 will be able to contribute a reduced amount during the 2023 tax year. However, if you make equal to or more than $153,000 as a single filer for that tax year, unfortunately, you will not be able to contribute anything. For the following year, in 2024, however, these amounts increased slightly to $146,000 and $161,000, respectively. This table shows that married couples filing jointly with a MAGI of up to $228,000 in 2023 are eligible to make contributions. However, those with an income above $228,000 will have to look at other options because they are no longer eligible to contribute. Traditional IRAs have one significant advantage over Roth IRAs. There are no income limits for eligibility, meaning anyone can take advantage of the tax breaks associated with investing in these accounts. If you and your spouse are not participating in any retirement plans at work, you can also deduct your contributions in full. The catch, however, is that the deduction may be reduced or eliminated if another retirement plan at work covers either of you. For those contributing to an IRA in 2023 and 2024, it is essential to become acquainted with the IRA deduction limits to take advantage of full savings opportunities. Below is a table summarizing the different deduction limits for each filing status. Aside from the traditional and Roth IRAs, there are two other IRA types: the SEP IRA and the SIMPLE IRA. Unlike the traditional and Roth IRAs, these plans are employer-sponsored. Thus, they are governed by their own contribution limits. SEP IRAs are funded purely by employer contributions but are also open to self-employed individuals. Generally, these contributions can be at most 25% of an employee's total yearly compensation. There is also a dollar limit that changes annually; for 2023, that figure is $69,000. While compensation up to $345,000 is considered when determining this amount, contributions must be made in cash, not property. Special calculations apply when figuring out your contribution amount if you are self-employed. Unlike the SEP IRA, both employers and employees can contribute to a SIMPLE IRA. Employers must at least contribute a fixed 2% equal to each participant's annual compensation or match an employee's contributions of up to 3%. In 2024, the employee contribution limit for a SIMPLE IRA is $16,000 for those under age 50 and $19,500 for those 50 and older. If you have a SIMPLE IRA and are also covered by another employer-sponsored retirement plan (such as a 401(k)), you can only contribute a total of $23,000 to both plans in 2024. In 2023, the contribution limit for a SIMPLE IRA increased to $15,500 for people under age 50 and $19,000 for those 50 and older. Meanwhile, the overall contribution limit for those who are also covered by another employer-sponsored retirement plan increases to $23,000. Below is a table summarizing the 2023 contribution limits for all types of IRAs mentioned in this article. Here are some ways to correct an over-contribution to your IRA: It is highly recommended to address any excess contributions to an IRA before filing taxes, as it can reduce a hefty 6% penalty and significantly lessen work. To rectify such a situation, the first step is to contact the plan administrator and inform them of the over-contribution. Afterward, withdrawing the excess contribution and earnings from the account should follow suit but must be done by April's tax-filing deadline to avoid penalties. Paying taxes on any earnings from an IRA should be taken seriously. As all withdrawals are deemed taxable income, understanding the applicable tax rules for each situation is critical. The "net income attributable" formula is used to calculate if there have been earnings or losses depending on how the account has performed. Additionally, it is essential to recognize that individuals under 59½ may be subject to a 10% taxation penalty on any withdrawn earnings, so consulting a plan administrator or tax professional ahead of time can save time and money in the long run. Making an excess contribution to an IRA or 401(k) plan can, unfortunately, lead to a costly mistake in the form of a 6% penalty from the IRS. However, it is possible to avoid this outcome by taking certain corrective measures. If you contact your plan administrator and file an amended tax return before the October extension deadline, you can remove the excess contribution and associated earnings and avoid owing any additional fees. Alternatively, carrying the excess amount into the new tax year can also help alleviate financial consequences; although you will pay a 6% penalty initially, this may help avoid future penalties. Finally, if you have contributions to both a traditional and Roth IRA account, transferring your excess contribution plus earnings to just the traditional IRA—called a "recharacterization" under IRS rules—can save you money without having to submit additional paperwork. Any action must be taken timely before tax day to take full advantage of these options; fortunately, extensions are available if your IRS filing was completed on time. With the start of a new tax year comes a necessary review of all retirement savings plans. It is important to know the contribution limits for your traditional and Roth IRA contributions as they vary yearly. For the 2024 tax year, you can contribute up to $7,000 if you are under the age of 50 or $8,000 if you are 50 or older. However, it is also possible to contribute whatever amount is lower than your taxable compensation if you make less than these limits. Aside from the traditional and Roth IRAs, there are two other IRA types: the SEP IRA and the SIMPLE IRA. Unlike the traditional and Roth IRAs, these plans are employer-sponsored. Thus, they are governed by their own contribution limits. It is crucial to remember that anyone exceeding contribution limits for any type of IRA will be subject to a 6% excise tax. Therefore, it is important to stay within the specified limitations when contributing to an IRA or risk excessive financial burden further down the line. If you need support to determine the maximum amount you can contribute to your IRA, given your filing status, or if you have other related concerns, consider the expertise of a retirement planning professional.Traditional & Roth IRA Contribution Limits

Earned Income Requirements for IRA Contributions

Spousal IRAs

Using Modified Adjusted Gross Income (MAGI) to Determine Income Limits

Roth IRA Income Limits

Below is a table summarizing the 2024 Roth Income limits for individuals and couples of different filing statuses.

Traditional IRA Deduction Limits

SEP IRA & SIMPLE IRA Contribution Limits

SEP IRA

SIMPLE IRA

In 2024, there was an increase in the contribution limits for each type of IRA. The changes are summarized in the table below.

What to Do if You Contribute Too Much to Your IRA

Before Filing Taxes

After Filing Taxes

Final Thoughts

IRA Contribution Limits FAQs

Contributions to a traditional or Roth IRA must be made by the tax filing deadline for the year in which you want to deduct your contribution. For the 2023 tax year, the deadline is April 15, 2024.

In 2024, the maximum amount that an individual may contribute to a traditional or Roth IRA is $7,000 ($8,000 if age 50 or over). This is an increase from the 2023 limits of $6,500 and $7,500, respectively.

When your modified adjusted gross income exceeds certain limits set by the IRS, you are no longer allowed to contribute to a Roth IRA. In contrast, traditional IRAs have no income limits for eligibility, meaning anyone can take advantage of the tax breaks associated with investing in these accounts.

If you contribute more than the limit for your filing status, you will be subject to a 6% excise tax on the excess. You may also be subject to added penalty fees if your excess contributions remain in the account until after the tax filing deadline for that year.

Eligibility for contributing to an IRA depends on several factors, including your income, your filing status, and whether or not a retirement plan at work covers you (or your spouse). A qualified tax professional or financial advisor can help determine if you meet the requirements for contributing.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.