An IRA (Individual Retirement Account) rollover refers to the process of transferring funds from one retirement account into another, typically without incurring any immediate tax liabilities or penalties. This action can take place between two IRAs (like moving money from one Traditional IRA to another) or between different types of retirement accounts, such as a 401(k) or 403(b) into an IRA. The primary purpose of an IRA rollover is to consolidate retirement savings, often after a job change, or to move to a preferred investment platform or take advantage of specific account features. There are different methods of executing an IRA rollover. The most straightforward is a direct rollover (or trustee-to-trustee transfer), where the funds move directly between financial institutions without the account holder ever taking possession of the funds. Another method is the 60-day rollover, where an individual receives a distribution from one retirement account and then deposits it into another retirement account within 60 days. It's crucial to understand the specific rules and potential tax implications associated with each method to avoid penalties and ensure the smooth transition of retirement assets.

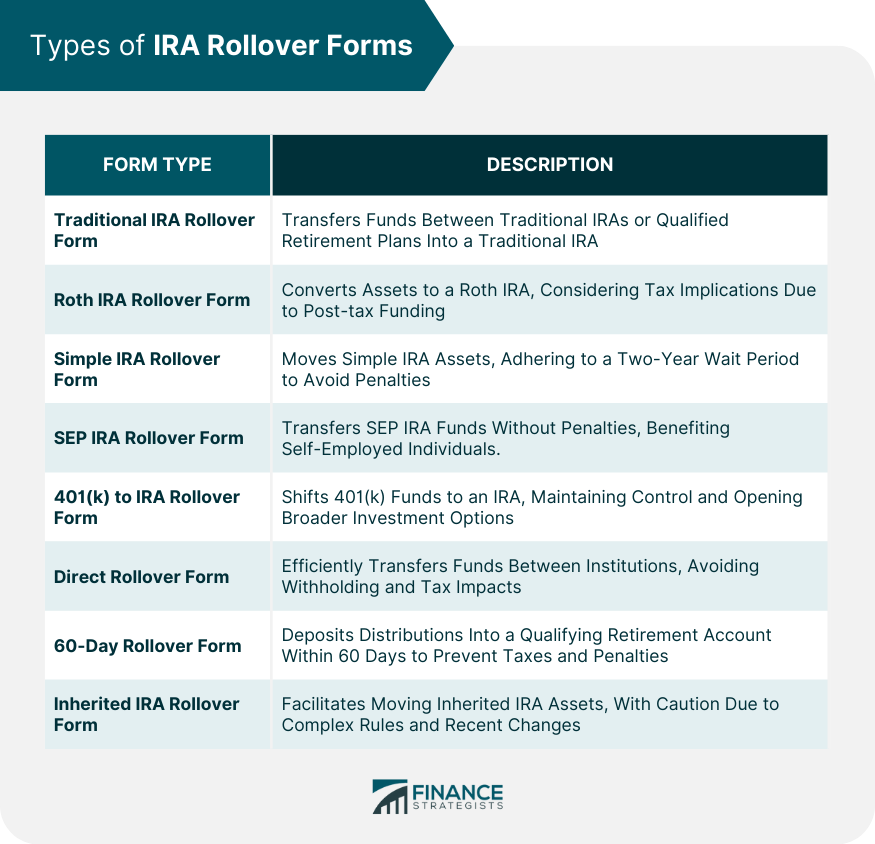

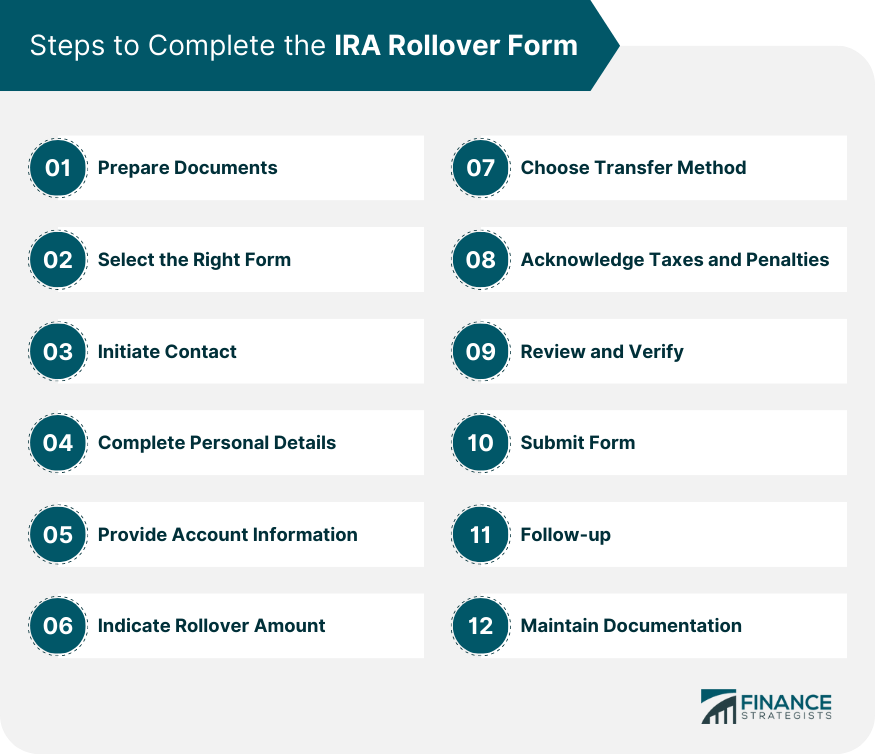

It's crucial to select the correct form for the specific rollover type and always consult with a financial advisor or tax services professional when navigating these processes to avoid potential pitfalls and penalties. These forms are not available on the web, but you may obtain them from your financial institution or plan administrator. This form is utilized when rolling over funds from a Traditional IRA to another Traditional IRA or from qualified retirement plans into a Traditional IRA. It ensures the transferred amount remains tax-deferred until withdrawal. Completing this form accurately is pivotal for maintaining the tax-advantaged status of the funds. Used when rolling over assets into a Roth IRA. This can be from another Roth IRA or, more commonly, when converting assets from a Traditional IRA or other pre-tax retirement plan into a Roth IRA. The conversion typically incurs a tax event since Roth IRAs are funded with post-tax dollars. Careful consideration and potential tax planning might be needed, especially when converting substantial amounts. For those with a Savings Incentive Match Plan for Employees (SIMPLE) IRA intending to roll their assets into another SIMPLE IRA or, after a two-year waiting period, into a Traditional or Roth IRA. The two-year rule is critical, and early rollovers outside of this window can lead to penalties. Always verify the age of your SIMPLE IRA before proceeding. This form facilitates the rollover process for Simplified Employee Pension (SEP) IRAs. Often, individuals might move funds from a SEP IRA to a Traditional IRA or another SEP IRA without incurring penalties. This flexibility is beneficial for self-employed individuals or small business owners looking to consolidate or change their retirement savings structure. Specifically designed for individuals transitioning from a 401(k) plan to an IRA, ensuring that they can move their retirement savings without triggering a taxable event. This transition often happens after a job change, retirement, or when seeking a broader range of investment options. It's a way to maintain control and continuity of your retirement funds. Often used for trustee-to-trustee transfers, this form ensures a direct movement of funds between institutions. This type of rollover prevents any withholding or immediate tax implications as the funds are never distributed directly to the account holder. It's one of the simplest and most efficient ways to move retirement assets between institutions. This form is typically accompanied by a distribution. It acknowledges that the account holder has taken a distribution and has the intention (and obligation) to deposit it into another qualifying retirement account within 60 days to avoid taxes and penalties. Timing is crucial, as missing the 60-day window can result in significant tax liabilities and penalties. For beneficiaries of an IRA, this form facilitates the process of moving inherited IRA assets into a beneficiary IRA, ensuring they adhere to the unique rules governing inherited accounts. Given the complexities surrounding inherited IRAs, especially after recent legislative changes, beneficiaries should approach rollovers with caution and informed guidance. Before you begin the process, gather all the relevant documents you'll need. This typically includes recent statements from your existing IRA or other retirement accounts, your personal identification, and any pertinent tax documents. Additionally, take some time to familiarize yourself with the specific rules and deadlines associated with rollovers, particularly if you're contemplating a 60-day rollover. Your next step is determining the specific type of rollover you're looking to execute, be it from a Traditional IRA to a Roth IRA, a 401(k) to an IRA, or any other combination. Once you've made this determination, ensure you have the appropriate form in hand for your intended transaction. Reach out to your current IRA provider or retirement plan administrator to inform them of your intention to roll over the funds. Some providers may have their own set of procedures or additional paperwork that you'll need to attend to before proceeding. Start filling out the form by entering all the necessary personal information. This will usually include your name, address, Social Security number, and date of birth. Ensuring this section's accuracy is crucial for a smooth transfer. Detail the specifics of your current IRA or retirement account, including things like your account number, its type, and the name of the institution. You will also need to provide information about the receiving institution and account where you intend to transfer your funds. Decide if you're rolling over the entire balance of your account or just a specific portion. Make sure you're aware of any limits, whether minimum or maximum, that might apply to your rollover. If the form provides an option, you'll need to choose between a direct, trustee-to-trustee transfer and a 60-day rollover. A direct transfer is typically the simpler choice, as it involves moving funds directly between institutions and avoids potential tax withholding. It's essential to be fully aware of, and acknowledge, any potential tax implications of your rollover, especially if you're converting assets from a Traditional IRA to a Roth IRA. Also, be on the lookout for early withdrawal penalties that could apply if the rollover isn't conducted correctly. Before you submit your form, take a moment to double-check all the information you've provided. Ensure that you've filled out every section as required and that all details are accurate. Depending on your financial institution, you might have options on how to submit your form: online, by mail, or even in person at a branch. Whichever method you choose, always keep a copy of the completed form for your records. After you've sent in your form, stay proactive by periodically checking in with the receiving institution. Confirm that they've received and processed the funds. Likewise, verify that your original account reflects the deducted amount or shows that it has been closed if you've transferred the entire balance. Upon successful completion of the rollover, store all related documents in a secure place. This should include the rollover form itself, any transaction receipts, and any correspondence between you and both the sending and receiving institutions. Such documents can prove invaluable for tax considerations and addressing any potential issues down the road. An IRA rollover is a strategic financial maneuver that facilitates the transfer of retirement funds from one account to another, often without immediate tax implications. Key points to remember are the types of IRA rollover forms, each tailored to specific scenarios. From Traditional and Roth IRA rollovers to Simple, SEP, 401(k) to IRA, and even Inherited IRA rollovers, understanding the appropriate form for your situation is critical. Executing a successful rollover involves meticulous steps; preparing documents, selecting the right form, initiating contact, providing accurate personal and account details, choosing the transfer method, and acknowledging potential taxes and penalties. After careful review and verification, submitting the form and maintaining communication with the receiving institution is essential. Navigating IRA rollovers with informed guidance ensures a smooth transition and maximizes the benefits of your retirement assets.What Is an IRA Rollover?

Types of IRA Rollover Forms

Traditional IRA Rollover Form

Roth IRA Rollover Form

Simple IRA Rollover Form

SEP IRA Rollover Form

401(k) to IRA Rollover Form

Direct Rollover Form

60-Day Rollover Form

Inherited IRA Rollover Form

Steps to Complete the IRA Rollover Form

Prepare Documents

Select the Right Form

Initiate Contact

Complete Personal Details

Provide Account Information

Indicate Rollover Amount

Choose Transfer Method

Acknowledge Taxes and Penalties

Review and Verify

Submit Form

Follow-up

Maintain Documentation

Conclusion

IRA Rollover Form FAQs

An IRA Rollover Form is a document used to facilitate the transfer of funds from one retirement account to another, ensuring a smooth transition of assets while managing potential tax implications.

Select the appropriate IRA Rollover Form based on the specific type of rollover you're planning, whether it's from a Traditional IRA to a Roth IRA, a 401(k) to an IRA, or another scenario.

An IRA Rollover Form typically requires personal details like name, address, and Social Security number. Additionally, you'll need to provide account information for both the transferring and receiving institutions.

Yes, many financial institutions offer the option to complete an IRA Rollover Form online. However, depending on the institution's policies, you can also submit the form by mail or in person.

Maintaining documentation is crucial for future reference. It includes the completed form, transaction receipts, and any correspondence between institutions. These documents help address potential issues and ensure accurate tax reporting.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.