An annuity is a financial instrument that is designed to generate a steady income. Annuities can be either fixed or variable and they usually pay out either monthly or annually. Annuities were initially conceived as a way to protect widows and orphans from destitution by providing them with a guaranteed source of income. Deciding between IRA and Annuity? Click here. This is one of the key benefits of annuities – regardless of market conditions, an annuity will continue to pay out the predetermined amount every month or year. With few exceptions, annuities are protected from creditors. There is little risk that an annuity will be seized by a creditor and used to pay off debts and expenses (for example: medical bills or credit card debt). When you purchase an annuity contract, your money goes into a fund which is managed by the insurance company. They invest your money in stocks, bonds and other investment products with the goal of generating returns on their investment. These earnings (along with any interest payments) go to you as income each month or year without further action on your part. Annuities are a tax-deferred investment. This means that the earnings go into a separate account rather than being added to your regular income and taxed at your standard tax rate. In addition, annuity payments are not subject to Federal or State income taxes unless they are considered to be early withdrawals. In general, an early withdrawal refers to a request for payment before you reach age 59 1/2 years old (in some cases, this threshold can be lowered). If you take money from an annuity prior to reaching this milestone birthday then the earnings will be subject to both federal and state income taxes plus a 10% penalty in most cases. Generally speaking, annuities allow you to choose how you want your payments structured. For example, an annuity may allow you to take a single payment following the end of each year or it might let you choose between receiving monthly payments for the rest of your life or annual payments for 20 years (with larger payouts during the early years and smaller ones later on). An IRA, or Individual Retirement Account is a retirement vehicle that you can use to save money when you are still employed. The money in an IRA is invested in one of several different types of investment products (stocks, bonds, mutual funds etc.) with the goal of generating returns on their investments. The earnings from these investments go entirely towards your retirement savings and are not taxed until they are withdrawn at age 59 1/2 years old (or later). The earnings that accumulate within your IRA account do so without being subject to taxes. If you are planning to retire early or are facing a financial emergency then one of the most attractive features of an IRA is that withdrawals can be taken out penalty free before you turn 59 1/2 years old. Perhaps the biggest difference between an annuity and IRA is how much you can save. An IRA limits your contributions to a particular amount per year. Any additional funds would have to be placed in a separate investment vehicle (such as a regular brokerage account). Annuities generally do not place any limits on how much you contribute beyond the initial purchase price (although some may limit the size of monthly payments that they are willing to make). When it comes time to withdraw money from an IRA or other type of retirement plan (including 401(k)), earnings will be subject to Federal and State income taxes plus a penalty if taken out before age 59 1/2 years old. This removes a great deal of flexibility from the investment. Conversely, annuity earnings are not subject to Federal or State income taxes until they are withdrawn as well as being free from penalties if taken out early (except in some cases where they may be subject to a 10% penalty). One of the biggest differences between an IRA and annuity may be how each is intended to be used. IRAs are often for early savings and investments so that one may have a larger nest egg for retirement. Annuities are often marketed towards people who are retired and need an additional source of income (in addition to Social Security or other forms of investment income). Another key difference between annuities and IRAs is in their respective costs. Annuities pay large commissions to salespersons which drive up the cost of their investments. IRAs are often lower cost investments since they need to only cover the costs associated with operating their respective investment vehicles (e.g., mutual funds, stocks etc.) The right choice for you may vary depending upon your circumstances and personal preferences. However, in general annuities tend to be better suited for investors who need a reliable source of income without having to worry about making withdrawals while IRAs are better for those who intend to leave their money invested until retirement age or beyond. While it might seem like an easy choice between one or the other, there is very rarely an option that is perfect for everyone's circumstances; doing some extra research and thinking about your personal circumstances can help you to make a more informed decision. Due to their tax treatment, annuities can be a great way for someone who is interested in converting some of his or her retirement investments into an additional income stream. IRAs are quite often preferred by those who want more flexibility on how they choose to withdraw their money since you have the choice to take it out early without penalty. It's important to do some research before making a final decision so that you can find something that will best fit with your needs and desires.What Is an Annuity?

Today they are primarily used as an investment vehicle for those who want to guarantee themselves a regular, reliable stream of income in retirement.Features of an Annuity

Guaranteed Income

Protection From Creditors

Automatic Investment

Tax-Deferred Earnings

Tax-Free Earnings Upon Withdrawal

Multiple Payments Options

What Is an IRA?

Features of an IRA

Tax-Deferred Earnings

Tax-Free Withdrawals

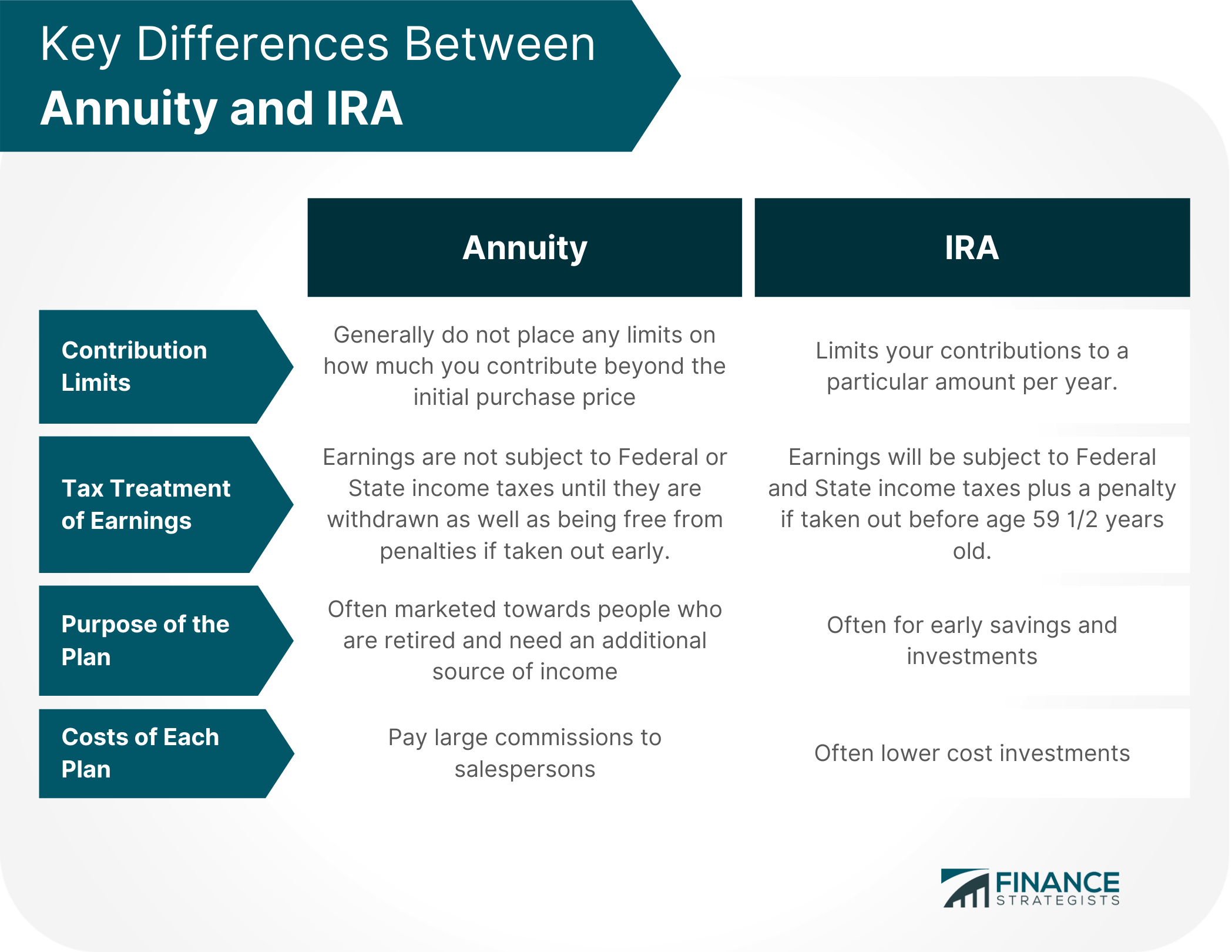

Key Differences Between Annuity and IRA

Contribution Limits

Tax Treatment of Earnings

Purpose of the Plan

Costs of Each Plan

Which One Is Right for You?

The Bottom Line

IRA vs Annuity FAQs

Yes. There is no prohibition against investing in both annuities and IRAs.

No. As long as you have earned income from a job or a business you can invest in a fixed, variable, or equity-indexed annuity regardless of age.

No, your IRA cannot be used as collateral for a loan. IRAs function like 401ks in that there is no way to withdraw money from them without incurring taxes and penalties (except under certain circumstances such as death, disability or attainment of age 59 1/2).

The main reason that annuities are more costly than IRAs is because the former involves commissions to salespeople involved which could be added to the underlying costs of the investment itself.

An annuity allows multiple payment options because it is an insurance product; since it involves a contract (between yourself and the insurance company), all of your wishes must be honored.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.