An IRA rollover is an action taken by the investor, moving funds from one Individual Retirement Account (IRA) to another or from a previous employer's retirement plan to an IRA. This can be a pivotal step for many, whether they're looking to better manage their retirement assets or switch between different types of IRAs. While the term 'rollover' might seem straightforward, it's a nuanced action with specific guidelines that the IRS provides. Ensuring proper execution can mean the difference between a smooth transition and unexpected tax consequences. Taxes can take a substantial bite out of any investment growth if not carefully managed. As it pertains to IRAs, understanding the tax implications can help investors avoid unnecessary financial pitfalls. Especially when considering a rollover, where potential tax consequences can arise if not executed properly.

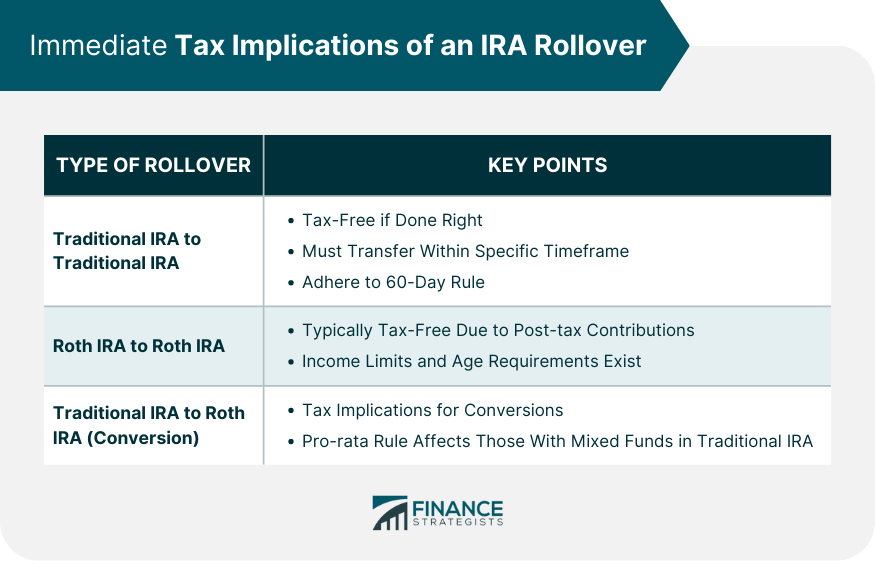

Typically, when you transfer funds from one Traditional IRA to another Traditional IRA, the process can be tax-free. This ensures that your savings continue to grow tax-deferred until you start making withdrawals in retirement. However, for a rollover to be tax-free, it must be done correctly. This means that the funds from the initial IRA must be deposited into the second IRA within a specific timeframe to avoid penalties or unexpected tax liabilities. The 60-day rule is a cornerstone of IRA rollovers. Once you receive the funds from your original IRA, you have precisely 60 days to deposit them into another IRA to avoid taxation. Miss this window, even by a day, and the distribution could be considered taxable income, potentially pushing you into a higher tax bracket. Additionally, if you're under the age of 59½ and fail to meet the 60-day deadline, a 10% early withdrawal penalty might apply. This is a clear testament to how vital timeliness is during this process. Roth IRAs offer post-tax contributions, which means the money you put in has already been taxed. Thus, when rolling over from one Roth IRA to another, the process should be tax-free, given the money has already met its tax obligation. But as with most financial processes, there are specific rules and steps to follow to ensure this tax-free status is maintained. One misstep and you could be looking at unnecessary complications. Roth IRAs, despite their tax-free withdrawal advantages, come with their own set of limitations. For instance, there are income limits for contributing to a Roth IRA, which may affect some high earners. While this doesn't directly impact rollovers, it's an essential consideration for comprehensive retirement planning. Additionally, for a Roth IRA withdrawal to be truly tax-free, the account needs to be at least five years old, and the account holder should be 59½ years or older. If you're rolling over assets into a new Roth IRA, it's crucial to keep these age and duration parameters in mind. Rolling over from a Traditional IRA to a Roth IRA, commonly known as a "Roth conversion," involves more complexities. The money in a Traditional IRA is pre-tax, meaning it has not yet been taxed. When you convert these funds to a Roth IRA, which operates on post-tax dollars, that money becomes taxable. This conversion can have immediate tax consequences, as the converted amount is treated as taxable income for the year of the conversion. However, the future tax-free withdrawals from the Roth might be worth the upfront tax hit, depending on your individual circumstances. The pro-rata rule is essential to understand when you have both pre-tax and post-tax dollars in your Traditional IRA. When converting to a Roth IRA, the IRS views all your Traditional IRAs as one. This means that you can't just convert the post-tax dollars (or non-deductible contributions) alone to avoid taxes. You'll pay a pro-rata amount based on the overall makeup of pre-tax and post-tax dollars in all your Traditional IRAs. For example, if 70% of your Traditional IRA funds are pre-tax and 30% are post-tax, and you decide to convert some funds to Roth, you'll owe taxes on 70% of the conversion amount, regardless of the source of the actual funds you converted. The IRS imposes a one-rollover-per-year rule on IRAs. This rule states that an individual can only perform one tax-free IRA rollover in a 12-month period, regardless of how many IRAs they own. This is designed to prevent abuses and overly frequent movements of retirement funds. Note that this rule applies to each type of IRA separately. For instance, if you roll funds from one Traditional IRA to another, you cannot make another tax-free rollover from any of your Traditional IRAs for 12 months. However, this doesn't impact your ability to roll funds between Roth IRAs within the same period. Failed rollovers can lead to dire tax consequences. If you don't adhere to the 60-day rule or any other IRS stipulation, the rolled-over amount can be treated as a distribution. This means it might be subject to regular income tax, and if you're below the age of 59½, an additional 10% early withdrawal penalty might apply. For those carefully building their retirement nest egg, these penalties can significantly hamper growth potential. Hence, ensuring every step is correctly executed is of paramount importance when considering an IRA rollover. The 60-day window is not merely a guideline; it's a hard rule. It's the period that the IRS allows for a tax-free rollover from the moment funds are withdrawn from one IRA until they're deposited into another. Adhering to this timeframe is pivotal to avoid unwanted tax implications. While there are very few exceptions to this rule, the IRS may waive the 60-day requirement if failing to do so would be against equity or good conscience, such as in the event of a casualty, disaster, or other events beyond a taxpayer's reasonable control. However, relying on exceptions is risky; it's always better to ensure the rollover is completed within the set window. The primary advantage of a successful rollover, particularly between Traditional IRAs, is the continuation of tax-deferred growth. This means that investments within the IRA can grow without the drag of annual tax consequences, allowing for potentially faster accumulation of wealth. Only when distributions are made during retirement does the taxman come into play. By then, many retirees find themselves in a lower tax bracket, making the eventual tax hit less significant than it would have been during their higher-earning years. A primary reason many investors opt for a rollover is to expand their investment opportunities. Different IRA custodians offer varying investment options. Moving funds might allow an investor access to different markets, funds, or investment strategies. Beyond just the breadth of investments, it's also about the depth. Some IRAs, especially those tethered to an employer, might have limited options or higher fees. Rolling over to an IRA with a broader selection and lower costs can significantly affect the growth potential of one's retirement savings. Consolidation can be a powerful tool. By rolling over multiple IRA accounts into one, you can simplify the management of your retirement assets. Instead of juggling statements, distribution rules, and beneficiaries for numerous accounts, there's only one set to manage. A more streamlined approach can make it easier to maintain a clear investment strategy and adjust allocations as needed. Additionally, a consolidated view can offer a clearer picture of overall retirement readiness, allowing for better-informed decisions as one approaches the golden years. Inherited IRAs have their own set of rules, especially when differentiating between spousal and non-spousal inheritors. A spouse who inherits an IRA has a choice: they can treat the IRA as their own or as an inherited IRA. Treating it as their own might be beneficial, especially if the surviving spouse is younger than the deceased, as it could allow for a longer tax-deferred growth period. On the other hand, non-spousal inheritors, like children or siblings, do not have the option to treat the IRA as their own. Instead, they typically have to take distributions over a certain period, which can carry its own tax implications. For both spousal and non-spousal inheritors, understanding the tax implications is essential. For Traditional IRAs, distributions are typically considered taxable income. However, with Roth IRAs, as long as the account has been open for at least five years, distributions can be tax-free. Understanding these nuances can help inheritors make informed decisions about when and how much to withdraw, ensuring they maximize the financial benefits of their inheritance. When rolling over funds from an employer-sponsored plan, like a 401(k) or 403(b), to an IRA, there are two primary methods: direct and indirect rollovers. A direct rollover involves funds moving directly from the employer plan to the IRA, never touching the hands (or bank accounts) of the individual. This method is typically the safest and most straightforward, ensuring no tax implications. Conversely, an indirect rollover involves the funds being distributed to the individual, who then has the responsibility to deposit them into an IRA. This method brings the 60-day rule into play, and if not executed properly, can result in a taxable event. For indirect rollovers from employer plans, another layer of complexity arises: tax withholding. When an employer distributes retirement funds, they're typically required to withhold 20% for federal taxes. Even if an individual plans to roll over the entire distribution to an IRA, they'll only receive 80% of their funds, with the onus on them to make up the difference when depositing into the IRA. If they don't, the missing 20% can be considered a taxable distribution, resulting in potential taxes and penalties. Hence, it's often advised to opt for a direct rollover whenever possible to sidestep these complications. The landscape of IRA rollovers, with its myriad of rules and potential pitfalls, can be daunting. One of the most sensible steps to take before initiating any rollover is to consult with a tax professional. They can provide clarity, guide the process, and help individuals understand the tax implications of their actions. Beyond just the immediate tax consequences, a tax professional can help strategize for long-term tax efficiency. Whether it's deciding between a Traditional or Roth IRA, understanding the nuances of conversions, or planning for future distributions, their expertise can be invaluable. Paperwork is the bane of many financial transactions, and IRA rollovers are no exception. Each financial institution will have its own set of forms and procedures. Understanding these requirements upfront can help ensure a smooth transaction, free from unnecessary delays or complications. Especially when moving significant sums, which is often the case with retirement savings, ensuring every "i" is dotted and every "t" crossed is paramount. Proper documentation not only facilitates the rollover but provides a paper trail, should any questions or issues arise in the future. Clear communication is the linchpin of any successful financial transaction. When initiating an IRA rollover, it's essential to have open lines of communication with both the relinquishing and the receiving financial institutions. Each will have its own requirements, timelines, and procedures. By maintaining clear communication, you can ensure that all parties are on the same page, minimizing the chances of mistakes or misunderstandings. Moreover, it allows for quicker resolution should any issues arise, ensuring that your funds are efficiently and effectively transferred, preserving their tax-advantaged status. An IRA rollover refers to the process of transferring funds between IRAs or from an employer's retirement plan to an IRA. The tax implications vary depending on the type of transfer. Traditional IRA to Traditional IRA transfers can be tax-free if executed correctly, adhering to the 60-Day Rule. Roth IRA rollovers, based on post-tax contributions, are typically tax-free. Yet, converting a Traditional IRA to a Roth IRA can lead to immediate tax consequences due to the nature of pre-tax and post-tax funds. Also, the IRS imposes a one-rollover-per-year rule, limiting the frequency of tax-free transfers. Mistakes, like failing to adhere to the 60-day rule, can result in significant tax penalties. Benefits of a well-executed rollover include continued tax-deferred growth and streamlined retirement asset management. Given the intricate rules and potential tax pitfalls, consulting a tax professional before undertaking a rollover is highly advisable.Overview of an IRA Rollover

Immediate Tax Implications of an IRA Rollover

Traditional IRA to Traditional IRA Rollover

General Rule for Tax-Free Transfers

The 60-Day Rollover Rule

Roth IRA to Roth IRA Rollover

Tax-Free Transfer Characteristics

Limitations to Be Aware Of

Traditional IRA to Roth IRA Rollover (Conversion)

Tax Implications of Conversions

The Pro-Rata Rule

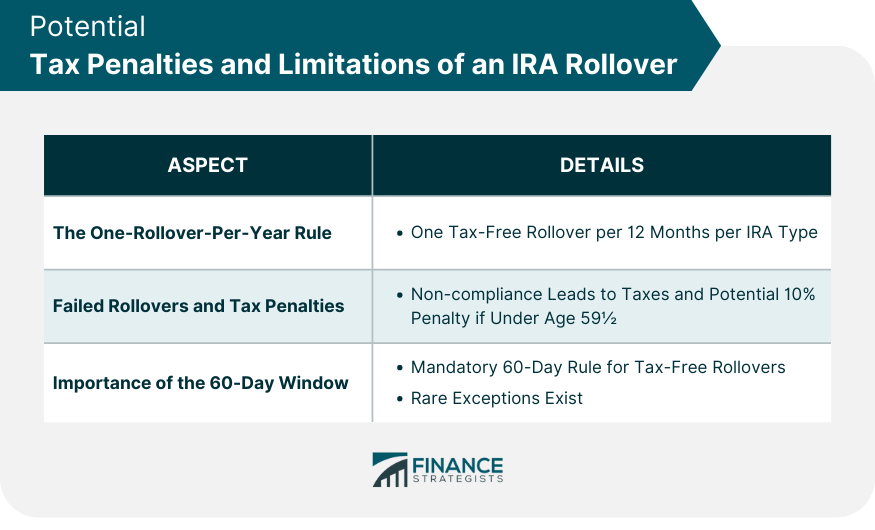

Potential Tax Penalties and Limitations of an IRA Rollover

The One-Rollover-Per-Year Rule

Failed Rollovers and Tax Penalties

Importance of the 60-Day Window

Benefits of a Properly Executed Rollover

Continued Tax-Deferred Growth

Expansion of Investment Opportunities

Simplification of Retirement Assets

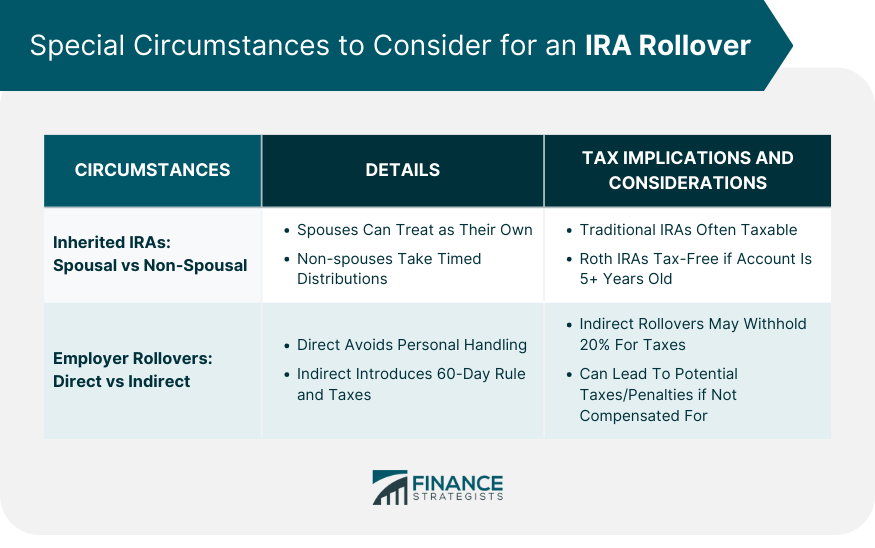

Special Circumstances to Consider for an IRA Rollover

Inherited IRAs

Spousal vs Non-Spousal Inheritors

Tax Implications for Different Inheritors

Employer Plan Rollovers to IRAs

Direct vs Indirect Rollovers

Tax Withholding Considerations

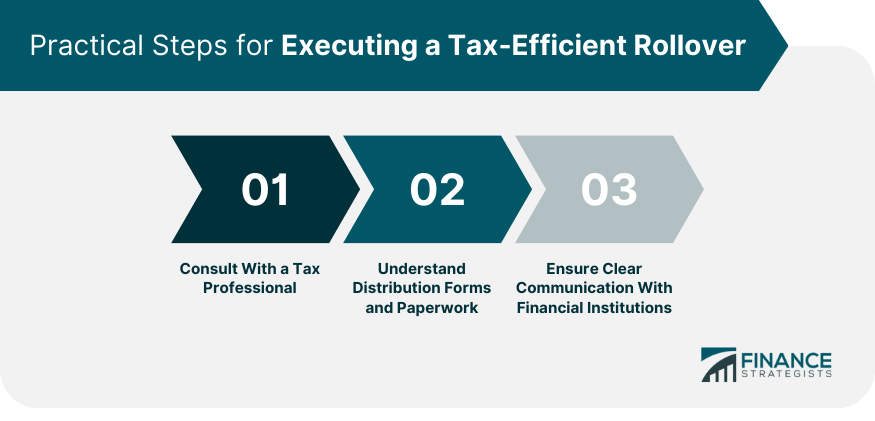

Practical Steps for Executing a Tax-Efficient Rollover

Consult With a Tax Professional

Understand Distribution Forms and Paperwork

Ensure Clear Communication With Financial Institutions

Bottom Line

Is an IRA Rollover Taxable? FAQs

When done correctly, transferring funds between similar IRAs (Traditional to Traditional or Roth to Roth) can be tax-free. However, converting from a Traditional IRA to a Roth IRA will have immediate tax consequences.

The 60-day rule mandates that funds withdrawn from one IRA must be deposited into another IRA within 60 days to avoid taxation and potential penalties.

No, converting from a Traditional IRA to a Roth IRA results in the converted amount being treated as taxable income for that year.

You can only perform one tax-free IRA rollover in a 12-month period, regardless of the number of IRAs you own.

Yes, there are two methods: direct and indirect rollovers. Direct rollovers are usually simpler and avoid potential tax withholding complications associated with indirect rollovers.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.