A self-directed IRA custodian is a financial institution that holds and manages an individual's self-directed Individual Retirement Account (IRA). Self-directed IRAs offer investors greater control and flexibility over their retirement funds by allowing them to invest in alternative assets. These alternatives include real estate, precious metals, private equity, and cryptocurrency, beyond the traditional investment options of stocks, bonds, and mutual funds. A self-directed IRA custodian acts as a third-party administrator, responsible for holding and safeguarding the assets within the IRA, executing investment transactions on behalf of the account holder, and ensuring compliance with IRS regulations. Investing in a self-directed IRA can be more complex than traditional investments, which is why choosing the right self-directed IRA custodian is essential. Self-directed IRA custodians must have the expertise and qualifications to handle the unique investment options offered by self-directed IRAs. The IRS requires self-directed IRA custodians to be regulated financial institutions, such as banks, credit unions, and trust companies that have been granted approval to act as an IRA custodian. Additionally, self-directed IRA custodians must have experience and expertise in managing self-directed IRA accounts and the unique investment options available to investors. Self-directed IRA custodians should have a thorough understanding of the tax rules and regulations governing self-directed IRAs. They must be able to ensure that investors comply with the IRS rules and regulations to avoid penalties or disqualification of the IRA. Self-directed IRA custodians must also have the necessary resources to provide investors with adequate customer support, including responding to inquiries, executing transactions, and providing account statements. They should be knowledgeable about IRS regulations governing self-directed IRAs, including prohibited transactions, and be able to guide investors through the complexities of self-directed investing. Investors must carefully evaluate the qualifications of a self-directed IRA custodian before entrusting them with their retirement funds. By doing so, they can help ensure the success of their self-directed IRA investments while minimizing the risk of penalties or disqualification. Here are some examples of investment options that may be offered by a self-directed IRA custodian: Real Estate: Self-directed IRAs can invest in various types of real estate, including rental properties, commercial buildings, and undeveloped land. Precious Metals: Self-directed IRAs can invest in gold, silver, platinum, and palladium bullion or coins. Private Equity: Self-directed IRAs can invest in private companies, start-ups, and small businesses. Cryptocurrency: Self-directed IRAs can invest in various types of digital currency, including Bitcoin, Ethereum, and Litecoin. Loans: Self-directed IRAs can lend money to individuals or businesses, either directly or through a peer-to-peer lending platform. Promissory Notes: Self-directed IRAs can invest in promissory notes, which are debt instruments that promise to pay a fixed return to the investor. Tax Liens and Certificates: Self-directed IRAs can invest in tax liens and certificates, which are claims against property owners who have failed to pay their property taxes. Stock and Bonds: Self-directed IRAs can also invest in traditional stocks, bonds, and mutual funds, although this would not be considered a self-directed investment option. The following are the benefits of using self-directed custodians: By choosing to self-direct their IRA investments, investors have the opportunity to invest in non-traditional assets like real estate, precious metals, and private equity. This investment strategy can help to lower portfolio risk and potentially boost returns. Investors can choose from a wide range of investment options and can make investment decisions based on their own research, experience, and expertise. This allows investors to take a more active role in managing their retirement funds and potentially earn higher returns. Self-directed IRA investments have the potential for higher returns compared to traditional investments. This is because alternative assets, such as real estate and private equity, can generate higher returns than traditional assets. Additionally, investors can take advantage of market inefficiencies to earn a higher return on their investments. Tax advantages can help investors save money on taxes. Contributions to a self-directed IRA are tax-deductible, and earnings on the investments are tax-deferred. This means that investors do not have to pay taxes on their investment gains until they withdraw the funds from the IRA. There are drawbacks to using self-directed IRA custodians, including: One of the drawbacks of using a self-directed IRA custodian is that they typically charge higher fees compared to traditional custodians. Self-directed IRA custodians offer more investment options and require additional paperwork and documentation. Unlike traditional custodians, self-directed IRA custodians may not offer extensive investment advice or support. Investors who choose to self-direct their IRA investments may have to rely on their own research and expertise to make investment decisions. This can be a challenge for investors who lack the necessary knowledge or experience. Self-directed IRA investments are not regulated by the Securities and Exchange Commission (SEC), which means that investors may be at a higher risk of fraud or scams. The lack of oversight may make it easier for unscrupulous individuals to take advantage of investors. This risk underscores the importance of carefully vetting the self-directed IRA custodian and conducting due diligence on potential investment opportunities. Violations must be reported properly. Below are steps to finding the right self-directed IRA custodian: Investors should start by looking for custodians that are regulated financial institutions and have experience managing self-directed IRA accounts. They can then compare the services and fees of different custodians to identify those that best meet their needs. Check the qualifications and credentials of the self-directed IRA custodian. They should ensure that the custodian is licensed, insured, and has a good reputation in the industry. Investors can check the custodian's credentials with regulatory authorities or industry associations. They should be knowledgeable about the risks and potential returns associated with each investment option. Investors should also consider their own investment goals and risk tolerance when evaluating the investment options offered by the custodian. Investors should review the fees and charges associated with the Self-Directed IRA Custodian. These may include account set-up fees, transaction fees, and annual maintenance fees. Investors should also consider any other costs associated with self-directed IRA investments, such as legal fees or appraisal fees. They should ensure that the custodian is responsive to inquiries and provides adequate support for account holders. Investors may also want to consider the custodian's online platform and user interface. Finally, investors must ensure that the self-directed IRA custodian is compliant with IRS regulations governing self-directed IRA investments. Custodians should be knowledgeable about the rules and regulations that govern self-directed IRA investments and provide investors with guidance and support to ensure compliance. Investors should ensure that the custodian follows all applicable regulations to avoid penalties or disqualification of the IRA. A self-directed IRA custodian is a financial institution that manages an individual's self-directed IRA. Self-directed IRAs offer investors greater control and flexibility over their retirement funds by allowing them to invest in alternative assets beyond traditional investments. Self-directed IRA investments can be more complex than traditional investments, which is why choosing the right self-directed IRA custodian is essential. To ensure success with self-directed IRA investments, investors should research and compare different custodians, check their qualifications and credentials, and understand their investment options. While there are many benefits to using a self-directed IRA custodian, including diversification of the retirement portfolio, greater control over investment decisions, the potential for higher returns, and tax advantages, there are also some drawbacks. These drawbacks include higher fees, limited support, risk of fraud, and complexity. Investors must carefully consider these factors and conduct due diligence before selecting a custodian.What Is a Self-Directed IRA Custodian?

Qualifications of a Self-Directed IRA Custodian

Investment Options Offered by a Self-Directed IRA Custodian

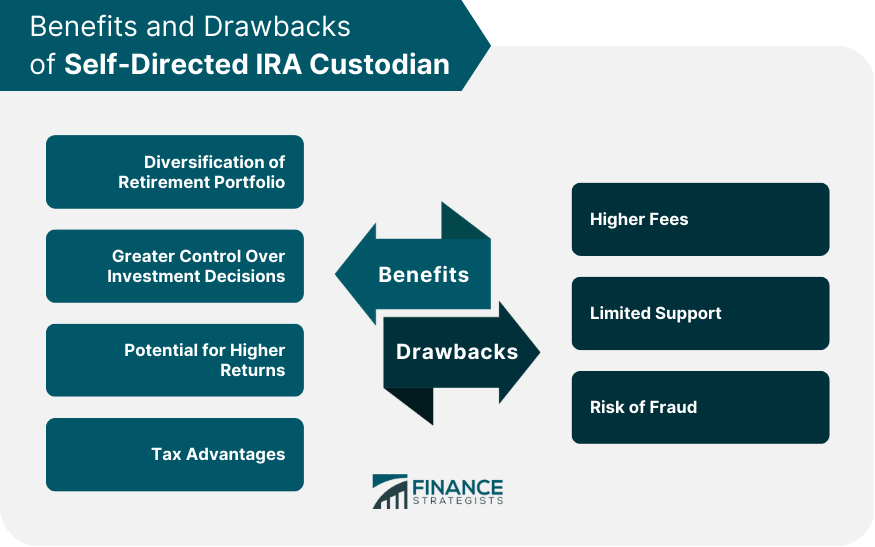

Benefits of Using Self-Directed IRA Custodian

Diversification of Retirement Portfolio

Greater Control Over Investment Decisions

Potential for Higher Returns

Tax Advantages

Drawbacks of Using Self-Directed IRA Custodian

Higher Fees

Limited Support

Risk of Fraud

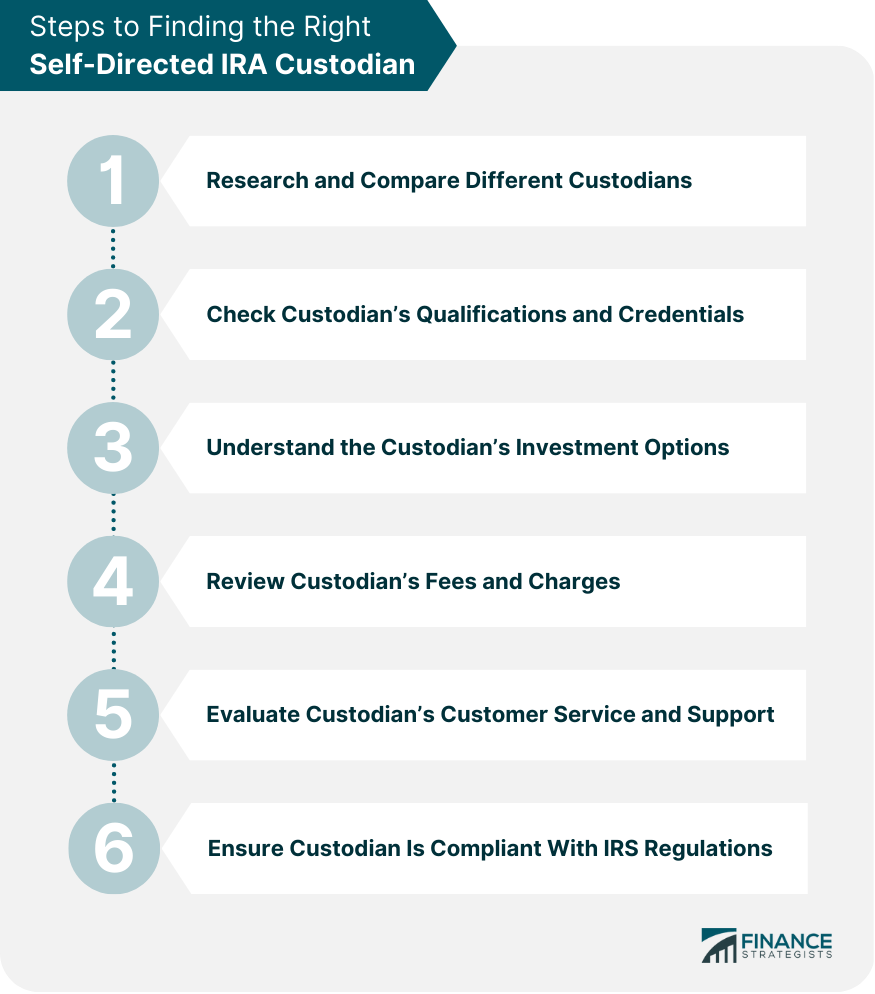

Steps to Finding the Right Self-Directed IRA Custodian

Research and Compare Different Custodians

Check Custodian’s Qualifications and Credentials

Understand the Custodian’s Investment Options

Review Custodian’s Fees and Charges

Evaluate Custodian’s Customer Service and Support

Ensure Custodian Is Compliant With IRS Regulations

Bottom Line

For more support in retirement planning matters, it is best to consult a financial advisor.

Self-Directed IRA Custodian FAQs

A Self-Directed IRA Custodian is a financial institution that manages self-directed Individual Retirement Accounts that allow investors to invest in alternative assets beyond traditional investments like stocks and bonds.

A Self-Directed IRA Custodian offers a range of alternative investment options, including real estate, precious metals, private equity, cryptocurrency, loans, promissory notes, tax liens, and certificates.

The benefits of using a Self-Directed IRA Custodian include diversification of the retirement portfolio, greater control over investment decisions, the potential for higher returns, and tax advantages.

The drawbacks of using a Self-Directed IRA Custodian include higher fees, limited support, risk of fraud, and complexity.

To find the right Self-Directed IRA Custodian, investors should research and compare different custodians, check their qualifications and credentials, understand their investment options, review their fees and charges, evaluate their customer service and support, and ensure compliance with IRS regulations.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.