A SIMPLE IRA, or Savings Incentive Match Plan for Employees Individual Retirement Arrangement, is a savings option for small firms with 100 or fewer employees. It is governed by many of the same regulations as traditional individual retirement accounts (IRAs) but with a higher contribution limit. It also has some benefits of an employer-sponsored plan, like a 401(k). Under this setup, eligible employees can invest a portion of their pre-taxed salary into their retirement fund. Aside from this, employers are required to contribute to these employees' accounts regularly. There are two different ways for an employer to make a contribution to the SIMPLE IRA of an employee. In this method, an employer matches an employee's contribution to their SIMPLE IRA. However, the employer match cannot be more than 3% of the employee's annual salary. For example, Alex, whose annual salary is $20,000, puts $2,000 into his SIMPLE IRA every year. His employer can match that contribution only up to a maximum of $600 (3% of $20,000). Employees can also stop making contributions at any time, but their employer's matching contributions will also stop. Employers are still required to contribute even if an employee decides not to make a personal contribution to their SIMPLE IRA. This nonelective contribution may be equivalent to 2% of the employee's salary, provided that it does not exceed the annual limit, which for 2024 is $345,000 ($350,000 in 2025). For example, Bob receives an annual salary of $20,000 but decides not to contribute to his SIMPLE IRA plan. Despite this, his company will continue to contribute to his plan. The contribution may be as much as $400 per year (2 % of $20,000). Employees and employers have separate contribution limits for SIMPLE IRA. In 2024, the maximum SIMPLE IRA employee contribution limit is $16,000 ($16,500 in 2025). Employees who are 50 or above are also eligible to make an additional catch-up contribution if their SIMPLE IRA plan permits it. The catch-up contribution limit is $3,500, meaning a worker who is 50 or older could contribute a maximum of $19,500 in 2024 ($20,000 in 2025). Employers can match employee contributions dollar-for-dollar up to 3% of each employee's annual compensation. They can also contribute 2% of each employee's salary if it does not exceed the 2024 limit of $345,000 ($350,000 in 2025). The rollover process for a SIMPLE IRA is a little more complicated than the rollover process for a traditional IRA. For the first two years of their plan, the only way for employees to avoid paying penalty fees on a rollover is to conduct it as a trustee-to-trustee transfer to another SIMPLE IRA plan. After two years, an employee is entitled to undertake a trustee-to-trustee rollover from a SIMPLE IRA to a traditional IRA without penalty. The trustee-to-trustee arrangement protects the employee from early withdrawal charges because funds are transferred directly from one retirement account provider to another. The SIMPLE IRA has several advantages over other types of retirement plans. SIMPLE IRAs enable workers to defer a portion of their pre-tax income into the plan. This arrangement allows savings to accumulate faster since the funds will only be taxed when withdrawn at retirement. Unlike other employer-sponsored plans, SIMPLE IRAs do not require complicated processes like non-discrimination tests or plan-level tax reporting. They are reasonably simple to establish and administer without hiring specialized personnel to manage them. Employer-sponsored retirement plans, such as 401(k)s, typically come with a vesting schedule that requires employees to remain with the company for a defined number of years before acquiring full ownership of their matching contributions. With the SIMPLE IRA, the employee immediately owns all matching contributions, regardless of tenure. The SIMPLE IRA also comes with some disadvantages. SIMPLE IRAs are only available to businesses with 100 or fewer employees. If you intend to develop your firm above this threshold, you will need to switch retirement plans in the future. Employers must contribute to their employees' SIMPLE IRA accounts, regardless of whether the business is profitable. This arrangment can be a burden during tough economic times. Unlike other types of IRAs or other employer-sponsored plans, employees may not borrow funds from their SIMPLE IRA accounts. This setup may limit an individual's ability to access funds in an unexpected financial emergency. Here are a few steps employers need to take once they have decided to set up a SIMPLE IRA plan for their business: When establishing a plan for a SIMPLE IRA, employers have the option of filling in either Form 5304-SIMPLE or Form 5305-SIMPLE. If they prefer to let their employees choose the financial institution which will receive the SIMPLE IRA payments, they will need to use Form 5304-SIMPLE. If they intend to designate a financial institution, they will need to complete Form 5305-SIMPLE instead. The employer and a representative from the financial institution must sign the filled-in document. The original copy of this form must be kept with the employer and not filed with the Internal Revenue Service (IRS). Before the beginning of the election period, each employee participating in the plan must be informed of the following: Typically, the election period is the sixty days preceding January 1 of each calendar year (November 2 to December 31 of the previous year). If the plan has been established in the middle of the year, the dates of this period are adjusted. This adjustment is also applicable if the 60-day period occurs before the first day an employee is eligible to participate in the plan. Employers may also complete the notification requirement by providing each employee with a copy of the signed Form 5304-SIMPLE or Form 5305-SIMPLE. A SIMPLE IRA must be formed for each qualifying employee, and the initial contributions must be transferred. Then, employees may select among the different investment alternatives the chosen financial institution offers. At the onset, they will receive a statement about their investments from the financial institution. They will also receive a yearly update on their investments and a detailed explanation of any fees or charges imposed on the plan. SIMPLE IRAs are retirement savings accounts available to small businesses and their employees. It is an easy and cost-effective way for small business owners to offer retirement benefits to their employees. SIMPLE IRAs work by employees contributing a portion of their salary into the account, which the employer then matches. Employees may opt to stop their contributions at any time, but employers are required to contribute regardless. SIMPLE IRAs have their unique contribution limits and rollover rules. They also have their advantages and disadvantages. The drawbacks include mandatory employer contributions and the inability to borrow funds before retirement. However, these are outweighed by the benefits, which include tax-deferred savings and the ease of managing this retirement savings option. Setting up a SIMPLE IRA plan involves completing some paperwork and providing employees with notice of all relevant information. Then, the initial contributions are deposited, and investment choices are made. Before undergoing this process, employers are advised to consult with a financial advisor to see if a SIMPLE IRA is the best retirement savings plan for their small business.What Is a SIMPLE IRA?

How Do SIMPLE IRAs Work?

Matching Contributions

Nonelective Contributions

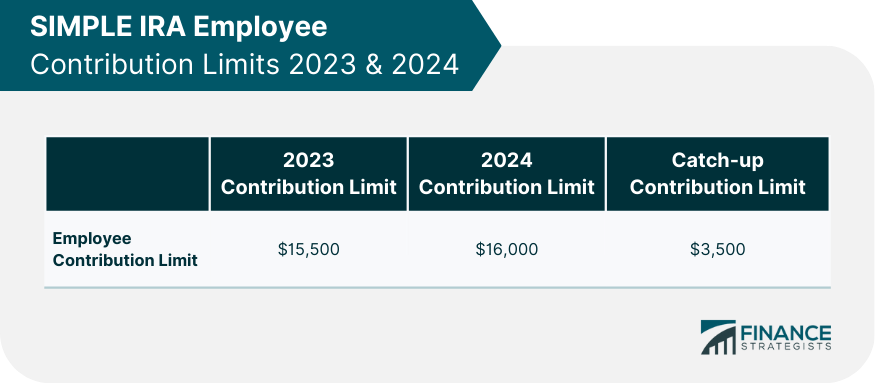

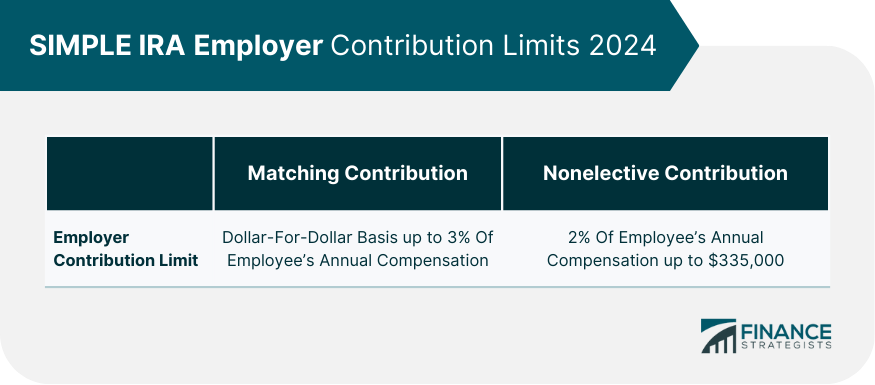

SIMPLE IRA Contribution Limits

Employee Contribution Limit

Employer Contribution Limit

SIMPLE IRA Rollover

Advantages of SIMPLE IRA

Tax-Deferred Savings

Administratively Easier

Instant Vesting

Disadvantages of SIMPLE IRA

Employee Limitations

Mandatory Employer Contributions

No Fund Borrowing

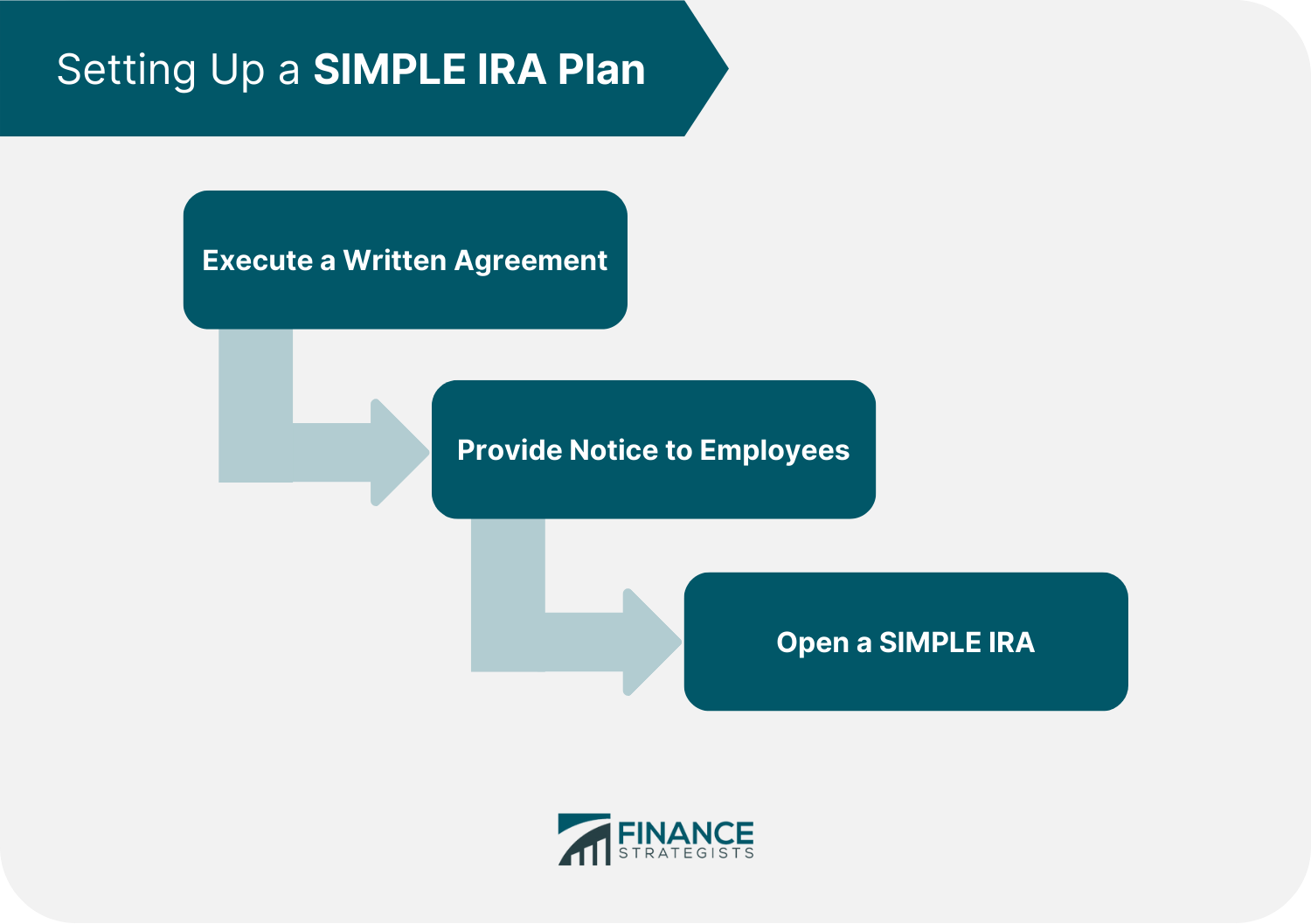

Setting Up a SIMPLE IRA Plan

Execute a Written Agreement

Provide Notice to Employees

Open a SIMPLE IRA

The Bottom Line

SIMPLE IRA FAQs

SIMPLE IRAs are retirement savings accounts available to small businesses and their employees.

SIMPLE IRA plans offer tax-deferred savings and are easy to set up and maintain. The employee also immediately owns the SIMPLE IRA account and has various investment options to choose from.

SIMPLE IRA plans have some drawbacks, such as the mandatory employer contribution, the lack of ability to borrow funds before retirement, and employee limitations.

In 2024, the employee contribution limit is $16,000 ($16,500 in 2025). Employees who are 50 or above can make an additional catch-up contribution of up to $3,500. Employers can opt to make matching contributions of up to 3% of the employee's annual compensation or nonelective contributions of up to 2% of each employee's salary, provided it does not exceed the 2024 limit of $345,000 ($350,000 in 2025).

SIMPLE IRA plans offer tax-deferred savings, meaning that employees will not pay taxes on their contributions or earnings until they withdraw the funds during retirement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.