Basics of SIMPLE IRAs

A Savings Incentive Match Plan for Employees Individual Retirement Arrangement (SIMPLE IRA) is a retirement savings account for self-employed individuals and small firms with 100 or fewer employees.

To qualify for a SIMPLE IRA, an employee must have earned at least $5,000 in pay during the past two calendar years and expect to earn at least that amount in the current year.

Qualified employees can make contributions, also known as elective deferrals, in cash or through salary deductions.

These contributions can be arranged as a fixed amount or a percentage of the employee’s salary.

While the Internal Revenue Service (IRS) does not compel employees to contribute, employers must make contributions regardless of whether an employee chooses to participate.

Like other retirement plans, SIMPLE IRAs have annual contribution limits, which participants must follow to avoid double-taxing and penalty fees.

A SIMPLE IRA combines some of the best features of a traditional IRA and a 401(k).

Its contribution limit falls somewhere between the two, higher than the latter but lower than the former.

Have questions about SIMPLE IRA Contribution Limits? Click here.

SIMPLE IRA Contribution Limits for 2024 and 2025

Below are the SIMPLE IRA contribution limits for employees and employers for 2024 and 2025:

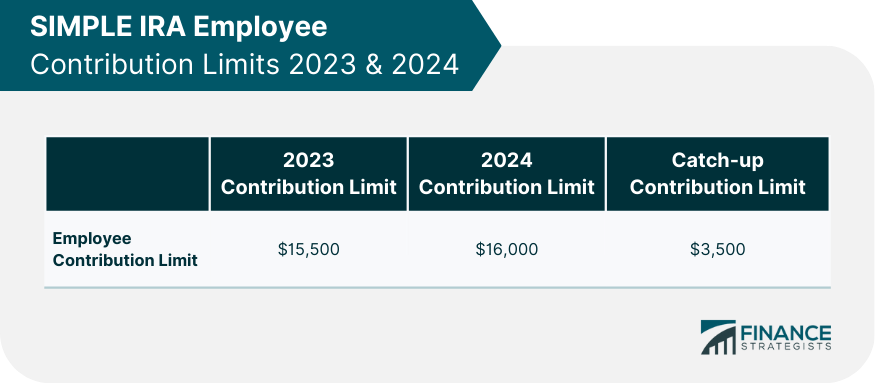

Employee SIMPLE IRA Contribution Limit

The SIMPLE IRA contribution limit for 2025 is $16,500.

This amount has slightly increased from the 2024 SIMPLE IRA contribution limit of $16,000.

If you are 50 or above and your SIMPLE IRA plan allows, you can make an additional catch-up contribution of up to $3,500 in for a total SIMPLE IRA contribution limit of $19,500 ($20,000 in 2025).

Suppose the employee participates in another employer-sponsored plan, such as a 401(k) plan, during the year.

In that case, the total amount that an employee can contribute to all these plans in 2024 is $23,000 ($23,500 in 2025).

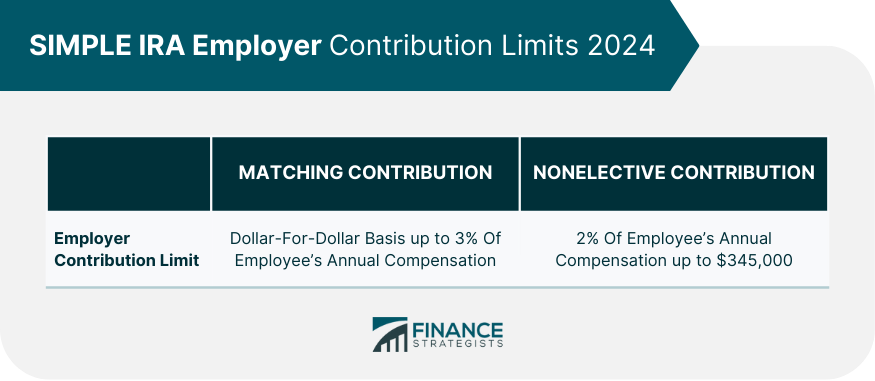

Employer SIMPLE IRA Contribution Limit

Employers may select between two options when contributing to their employee’s SIMPLE IRAS:

- A dollar-for-dollar match of the employee contributions that must not dip below 1% or exceed 3% of the employee's yearly compensation

- A nonelective contribution of at least 2% of an eligible employee's compensation that must not exceed $345,000, the maximum amount for 2024 ($350,000 for 2025)

It must also be noted that if employers choose the matching option, they may reduce their contribution to 1% but only for a maximum of two out of every five years.

If employers want to lower the matching amount, they must provide employees with adequate notice before the 60-day election period for that calendar year.

SIMPLE IRA Contribution Deadlines

Salary-reduction contributions to a SIMPLE IRA plan that are taken out of an employee's paycheck are due 30 days after the month they received their pay.

For example, contributions taken from an employee's pay in September must be placed into the SIMPLE plan by October 30 of the same year.

In cases where the SIMPLE IRA is set up for a self-employed individual, and there are no other employees, any contributions that come in the form of reduced pay must be deposited within 30 days of the end of the year or by January 30 of the following year.

On the employer's part, contributions are due by the federal income tax return deadline for that year.

Maximizing Contributions to a SIMPLE IRA

Individuals may also contribute to both a SIMPLE IRA and a traditional or Roth IRA simultaneously, enabling them to save even more for retirement.

This option is great if they already max out their SIMPLE IRA contributions.

However, self-employed people can only fund a traditional IRA or Roth IRA, not a SEP IRA (Simplified Employee Pension Individual Retirement Arrangement), at the same time.

Individuals younger than 50 can contribute a maximum of $7,000 to a traditional IRA or Roth IRA for both 2024 and 2025. Those age 50 or older can make an additional $1,000 catch-up contribution.

Participants must note that Roth IRAs have income limits, so the amount they can contribute begins to phase out once an individual’s modified adjusted gross income hits a certain amount.

In 2024, the maximum amount employees can contribute to a Roth IRA begins to decrease after the modified adjusted gross income reaches $146,000 ($150,000 in 2025) for single taxpayers and $230,000 ($236,000 for 2025) for joint filers.

There is no tax deduction for Roth IRA contributions since it is funded by after-tax dollars, while pre-tax dollars fund traditional IRAs and SIMPLE IRAs.

Traditional IRA contributions are tax-deductible. However, this benefit phases out if the taxpayer also contributes to an employer-sponsored plan at work and their income exceeds a certain threshold.

For single filers, the phase-out range begins when the modified adjusted gross income (MAGI) exceeds $77,000 ($79,000 for 2025).

For joint filers, when both spouses have employer-sponsored retirement plans aside from the traditional IRA, they must earn $123,000 or less ($126,000 or less, for 2025) to get the maximum tax deduction.

If, on the other hand, only one spouse has an employer-sponsored retirement plan aside from the traditional IRA, the deduction is removed once MAGI hits $230,000 or more.

Final Thoughts

The SIMPLE IRA is a great way to save for retirement, especially for those who are self-employed or work for a small business with 100 or fewer employees.

It has annual contribution limits, which participants must follow to avoid double-taxing and penalty fees.

The SIMPLE IRA contribution limit for employees in 2024 is $16,000 ($16,500 in 2025). Employees who are 50 and above can make an additional catch-up contribution of up to $3,500 for a total limit of $19,500 ($20,000 for 2025).

Employers may select two options when contributing to their employee's SIMPLE IRAS.

They may provide a match of the employee's contributions that must not dip below 1% or exceed 3% of the employee's yearly compensation.

Alternatively, they may make a nonelective contribution of at least 2% of an eligible employee's compensation that must not exceed $345,000, ($350,000 for 2025) the maximum amount for 2024.

SIMPLE IRA contribution deadline for employees' salary deduction is 30 days after the month they received their pay.

Meanwhile, the employer's deadline is the same as their federal income tax return deadline.

Participants may maximize their retirement savings by contributing in full to their SIMPLE IRAs and opening a traditional or Roth IRA as well.

SIMPLE IRA Contribution Limit FAQs

Employers may match contributions of up to 3% of an employee’s yearly compensation. Alternatively, they may make a nonelective contribution of at least 2% of an eligible employee's compensation that must not exceed $345,000, ($350,000 for 2025) the maximum amount for 2024.

SIMPLE IRA rules allow catch-up contributions of up to $3,500 for employees over 50, which brings up their contribution limit to $19,500 ($20,000 in 2025).

Employees cannot contribute to a SIMPLE IRA plan for any calendar year in which they make or receive contributions to another employer-sponsored plan such as a 401(k).

Since they have different limits, SIMPLE IRA contributions will not affect the amount individuals can contribute to either a traditional IRA or Roth IRA.

Participants have the option of making one large contribution to their SIMPLE IRA or smaller contributions throughout the year. These smaller payments could be made daily, bimonthly, monthly or quarterly.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.