A solo 401(k) is a retirement plan for someone who owns a business. It can be used instead of a SEP IRA. Solo 401(k)s are very popular because they offer a lot of flexibility. In 2024, you can contribute up to $69,000 per year (plus an additional $7,500 if you are over 50 years old). This is much more than you can contribute to a SEP IRA. In the United States, a non-profit organization must be set up in order to establish a Solo 401(k). The organization can be a trade association, chamber of commerce, or other types of business leagues. You can find more information about setting up a Solo 401(k) on the IRS website. Deciding between a Solo 401(k) and a SEP IRA? Click here.

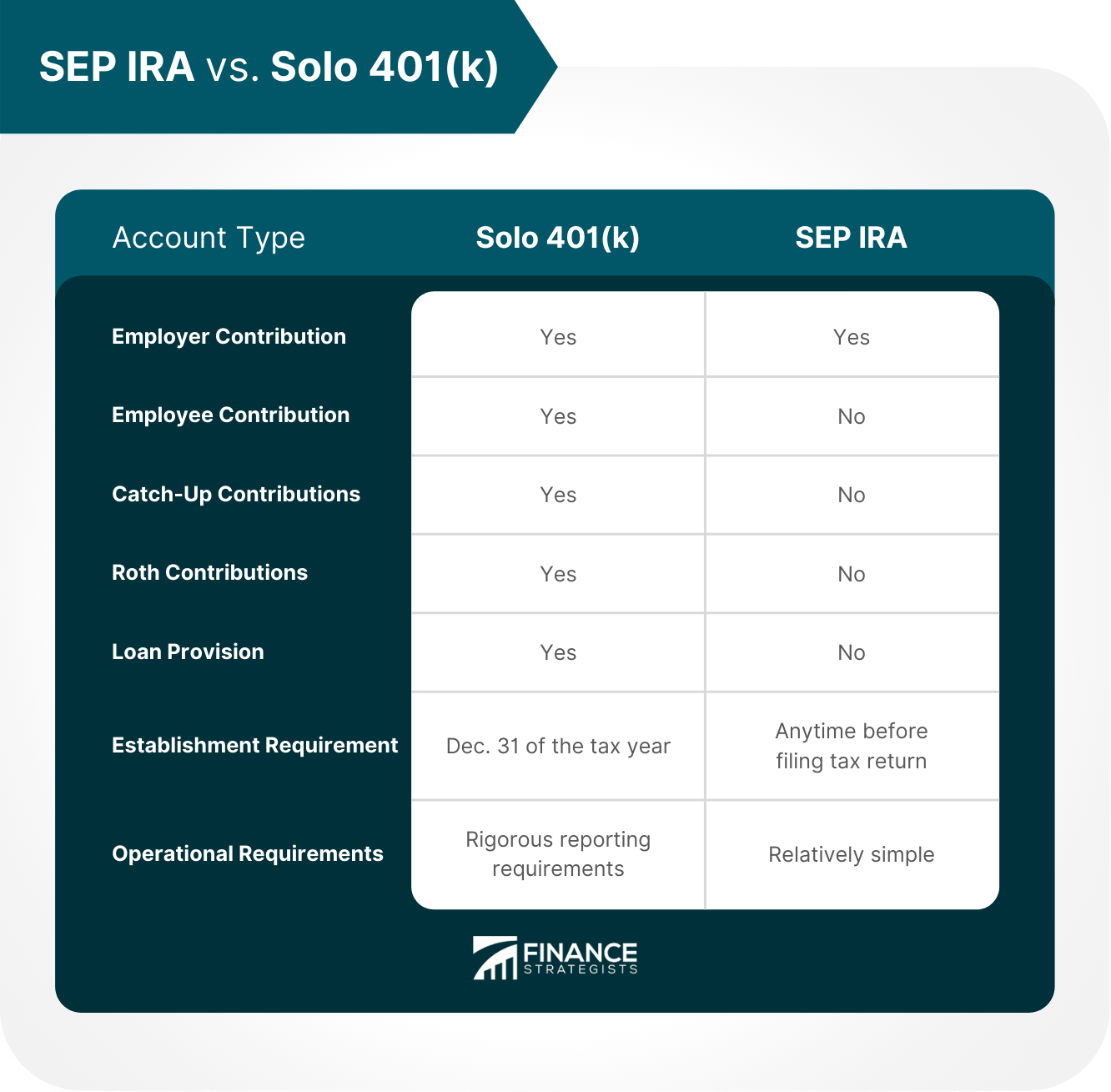

There are two ways to set up a Solo 401(k): The Solo 401(k) has the following pros: The only con in setting up a solo 401(k) is it is only worth it if you want to make large contributions and involve more paperwork. A SEP IRA is a retirement account for small business owners, sole proprietors, and independent contractors. You can contribute up to 25% of your income or $69,000 (whichever is less). This is much less than you can contribute to a Solo 401(k). In order to establish a SEP IRA, you must work with your financial institution. You will not need to create any new organizations like with the solo 401(k). You can open an account with nearly all brokerage firms. This is the easiest way to get started, and you will have a lot of investment options. IRS Form 5305-SEP is a formal written agreement required for you to set up a SEP IRA. However, most brokerage firms will take care of that. There are no annual fees and opening fees for most of the firms. SEP IRAs can benefit you by giving tax breaks for a given year if opened on or before April 15th. SEP IRA accounts usually have more options than 401(k)s, and they're much broader. However, be aware that these additional benefits come at the cost of reduced flexibility in investing your money and possible trading fees compared to other types of investment products. The SEP IRA has the following pros: The SEP IRA has the following cons: Deciding between a SEP IRA and Solo 401(k) will depend on your circumstances. If you want to make large contributions, then the Solo 401(k) is for you because it offers more investment options than a SEP IRA. However, this option has many additional rules that must be followed in order to contribute each year maximally. If you don't want to make large contributions, then the SEP IRA is a better option because there are no annual contribution limits, and it is easier to set up than the Solo 401(k). However, you will be limited to investing in certain types of funds. Remember that both accounts offer tax breaks for contributing early, so decide which option is most beneficial for you. Both the solo 401(k) and SEP IRA are good accounts to save money in if you want a tax break or have a small business that qualifies as a sole proprietorship. The Solo 401(k) will benefit those who make large contributions by being able to invest in a wider range of options, but it is more difficult to set up and follow the rules. The SEP IRA is easier to set up and offers more flexibility than the solo 401(k), but you are limited to investing in certain types of funds. Make sure you consult with a financial advisor to see which option is right for you.What Is a Solo 401(k)?

How to Set Up a Solo 401(k)?

Some providers even let you invest in alternative assets like real estate, precious metals, private equity, or tax liens.Pros and Cons of the Solo 401(k)

What Is a SEP IRA?

How to Set Up a SEP IRA?

Pros and Cons of a SEP IRA

Which Should You Choose? SEP IRA vs Solo 401(k)

Final Thoughts

Solo 401(k) vs SEP IRA FAQs

The Solo 401(k) is a retirement account for self-employed individuals. It's similar to the traditional 401(k), but it allows people with no employees who are over 50 years old to catch up on contributions every year.

A SEP IRA is a simplified employee pension plan. It's an Individual Retirement Account (IRA) that allows self-employed individuals and their employees to contribute money on a tax-deductible basis. Employers can make contributions for their employees, and employees can also make voluntary contributions.

The SEP IRA has no annual fees or opening fees for most firms. You are also able to contribute more money than you can with a Solo 401(k). Additionally, the SEP IRA is easier to set up than a Solo 401(k). However, you are limited in your investment options and must start taking RMDs at age 72.

The Solo 401(k) offers more investment options than a SEP IRA. It can be used by self-employed individuals who do not have employees.

The difference between a Solo 401(k) and a SEP IRA is the level of control over investments. With a Solo 401(k), you have more flexibility and decision-making power, as you can choose your own investments. With a SEP IRA, you must defer to the custodian and their investment options. Also, Solo 401(k)s allow for taking a loan from your retirement plan, whereas SEP IRAs do not.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.