Individual retirement accounts (IRAs) are investment vehicles designed to help individuals save for retirement. IRAs offer tax advantages that can help money grow faster, and they come in two main types: traditional and Roth. A traditional IRA allows individuals to make contributions pre-tax, reducing current taxable income. The money is invested and then grows on a tax-deferred basis, meaning individuals only pay taxes when they start withdrawing it in retirement. On the other hand, Roth IRA contributions are made after tax. Contributions are computed as part of an individual’s current taxable income, meaning you pay taxes upfront. However, all their withdrawals in retirement can be completely tax-free.

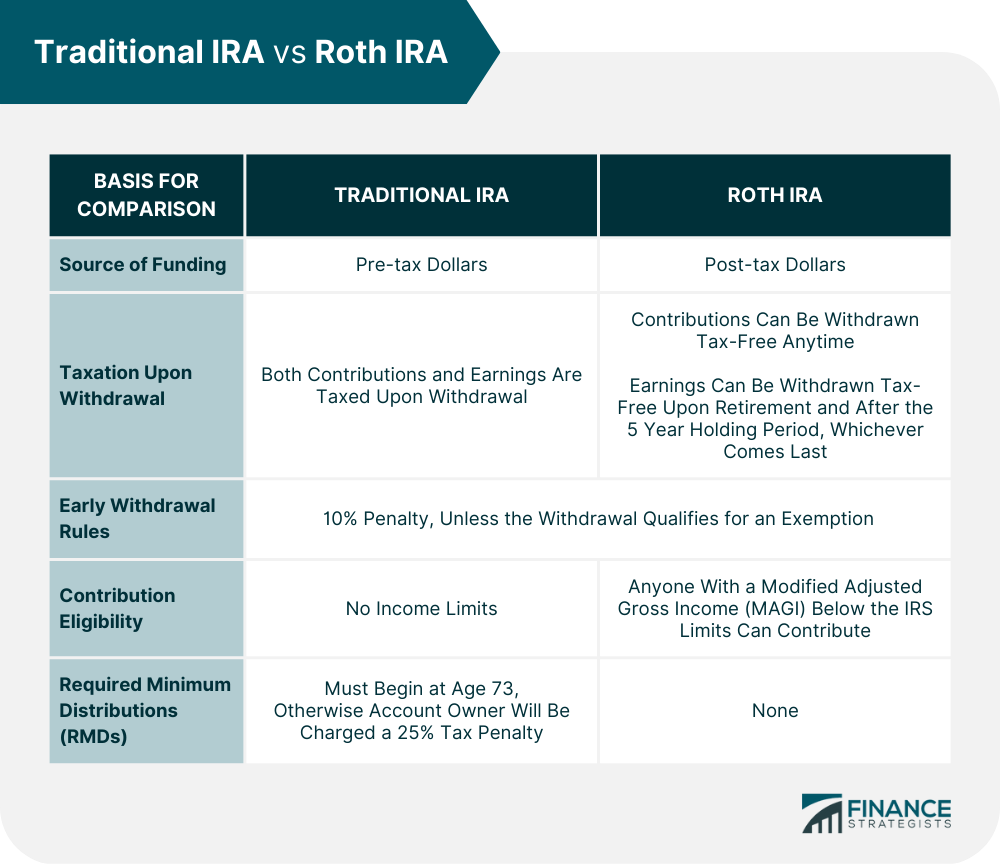

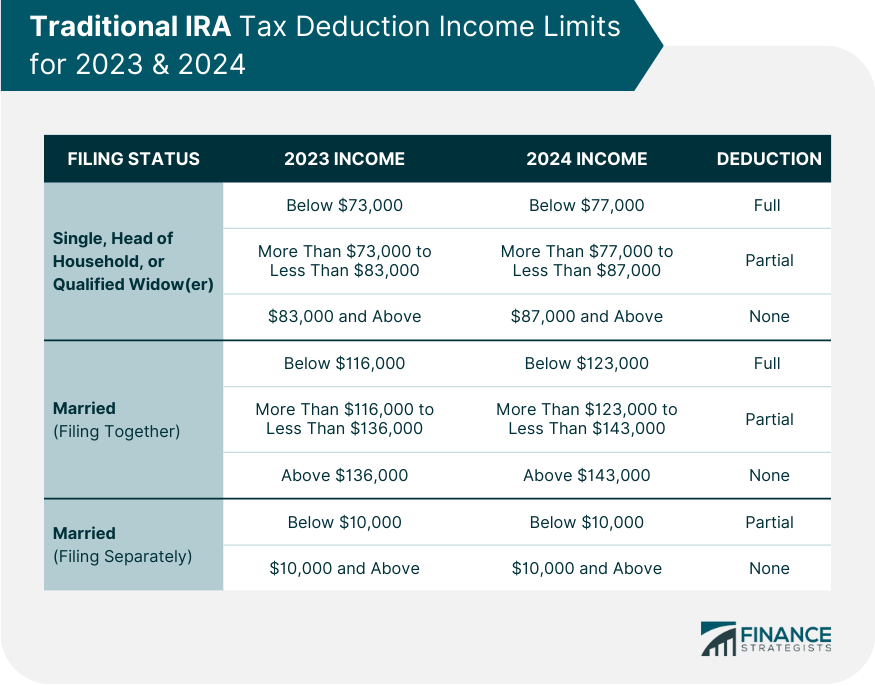

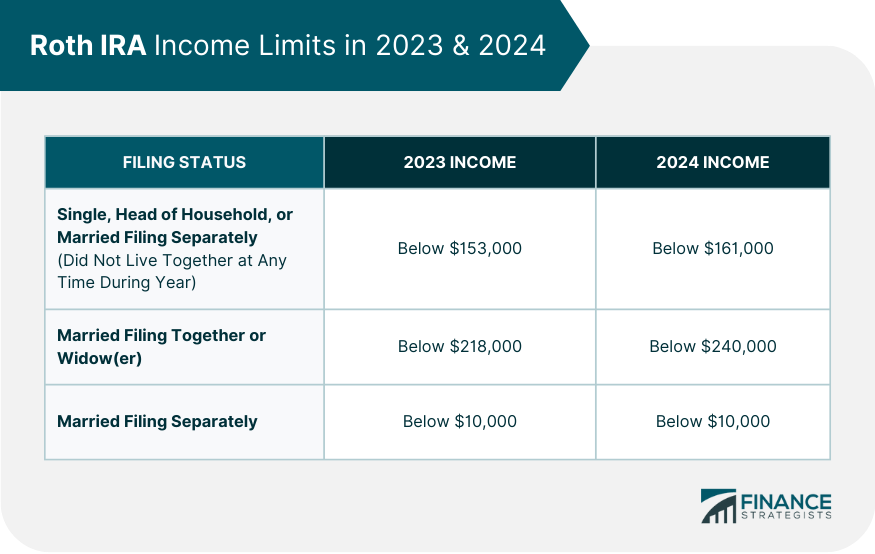

Established in 1974 by the Employment Retirement Income Security Act (ERISA), a traditional IRA is a tax-advantaged investment vehicle. Contributions to the account are tax-deductible, meaning they can be subtracted from taxable income in the year they were made. Contributions to a traditional IRA are then invested in a portfolio of assets like mutual funds and stocks. Any earnings within this account are also subject to taxes once the funds are withdrawn at retirement. Basically, traditional IRAs allow individuals to save on taxes in the short term. There are also some limits to traditional IRAs. For example, withdrawals before age 59½ may be subject to an early withdrawal penalty fee. In addition, any distributions taken before age 70½ will be taxed as regular income when filing with the Internal Revenue Service (IRS). The Roth IRA, named after Senator William Roth, was established by the Taxpayer Relief Act of 1997. It allows investors to save for their post-retirement needs using post-tax money, which means they do not have to pay taxes on contributions when they withdraw funds later. The amount of money that can be contributed to a Roth IRA annually depends on an individual’s income level and filing status. These contributions may be withdrawn tax-free at any time and can grow over the years without incurring any taxes or penalties. Unlike traditional IRAs, there is no age requirement for taking distributions from a Roth IRA. However, withdrawals of earnings before age 59½ and within the 5-year holding period are subject to a 10% penalty. There are several key differences between traditional IRAs and Roth IRAs, including the following: As mentioned above, traditional and Roth IRAs differ mainly in their specific treatment of taxes during the contribution and withdrawal phases. Traditional IRAs allow individuals to contribute pre-tax dollars into a retirement account, which reduces their taxable income in the current year. With Roth IRAs, individuals contribute post-tax money, meaning they pay higher income taxes today. In retirement, withdrawal of contributions and earnings from traditional IRAs will be taxed as ordinary income. On the other hand, withdrawal of contributions from Roth IRAs is entirely tax-free, while withdrawal of earnings is only tax-free after the 5-year holding period. If individuals withdraw money from a traditional IRA before age 59 ½, they will be subjected to a 10% penalty. However, exceptions exist, such as paying for qualified higher education expenses or buying their first home. In contrast, withdrawal of contributions from a Roth IRA can be made even before age 59 ½ anytime without a penalty. However, withdrawal of Roth IRA earnings is subject to a 10% penalty if done before age 59 ½ or within the 5-year holding period. For Roth IRA accounts five years and older, early withdrawals of earnings can be exempted from the 10% penalty if used for a first home, education expenses, and other qualifying exceptions. Traditional and Roth IRAs both have different eligibility requirements for contributions. Traditional IRA contributions are open to all individuals with earned income. On the other hand, Roth IRA contributions can be made by anyone with a modified adjusted gross income (MAGI) below the IRS limits set for each filing status. In 2023, this limit is $153,000 for singles and $228,000 for married couples filing together. There are no age restrictions for contributing to both traditional and Roth IRAs, but maximum contributions are higher for people aged 50 and up. This helps them catch up and save more for their retirement. Individuals cannot keep funds in any IRA forever. Required Minimum Distributions (RMDs) are mandatory withdrawals individuals must take from their accounts. With a traditional IRA, they must start taking distributions from your account at age 73. The RMD amount is determined by dividing the IRA balance by a life expectancy factor found in the IRS-published Single Life Expectancy Tables. Failing to take an RMD can result in a 25% penalty. For Roth IRAs, no RMD is required since all contributions were already taxed before the deposit, and there is no set timeline for withdrawing funds. However, after the original IRA owner’s death, beneficiaries of the Roth IRA are subject to RMDs. The IRS sets limits for traditional IRA tax deductions and Roth IRA contribution eligibility. These limits are usually based on the account owner’s income and may be changed annually. Below are the limits for both 2023 and 2024 There are no income limits for traditional IRAs, meaning anyone can contribute as long as they have earned income. However, the IRS sets specific parameters on the potential tax deductions you can avail of depending on your income and status. Single contributors can avail of a full deduction up to the contribution limit if their annual income is less than $73,000 in 2023 and less than $77,000 in 2024. For married contributors filing together, a full deduction can be availed if annual income is less than $116,000 in 2023 and less than $123,000 in 2024. Check the table below for further details: Roth IRA is not a retirement savings vehicle that is available for everyone. The IRS sets certain income limits on who can make Roth IRA contributions based on their MAGI. Singles can contribute up to the annual limit if their MAGI is less than $153,000 in 2023 and less than $161,000 in 2024. Before they can contribute up to the annual limit, married couples filing together must have a MAGI of less than $218,000 in 2023 and less than $240,000 in 2024. See the table below for further information: Regardless of the type of IRA, the contribution limit set by the IRS is at a maximum of $6,500 in 2023. This was raised to $7,000 in 2024. An additional catch-up contribution worth $1,000 is allowed for individuals aged 50 and above. Thus, their total contribution limit is $7,500 in 2023 and $8,000 in 2024. As mentioned above, a Roth IRA’s contribution limits are influenced by the contributor’s filing status and MAGI. Thus, only certain individuals can maximize the full contribution limits for this type of IRA. When deciding between a traditional or Roth IRA, the best option depends on your financial situation. Your income level, tax rate, and retirement goals will all play a role in helping you determine what type of account is right for you. Generally, if you expect to be in a higher tax bracket by the time you retire, it might make sense to contribute to a Roth IRA. Since your contributions are taxed upfront, your withdrawals during retirement, including any investment earnings, will be completely tax-free. On the other hand, if you anticipate being in a lower tax bracket when you retire than you are now, then contributing to a traditional IRA could be beneficial for lowering your taxes today. You can save on taxes now and use those for other expenses. You may also choose a Roth IRA if you want more versatility in accessing your money for emergencies. This is because you can make early withdrawals from Roth IRA without penalties or taxes, depending on the parameters. If you are still trying to decide between a traditional IRA and a Roth IRA, you can consult a financial advisor for guidance regarding these retirement planning options. IRAs are excellent investment vehicles to help you prepare for retirement. Traditional IRAs allow you to enjoy tax deductions today in exchange for tax payments upon retirement. In contrast, Roth IRAs offer tax-free withdrawals later in life at the cost of paying higher taxes now. The maximum contribution limit for both types of IRAs is the same. However, the amount an individual can contribute to a Roth IRA is influenced by their filing status and income level. Similarly, these factors also influence the allowed tax deduction for a traditional IRA. Since traditional IRAs and Roth IRAs offer different tax advantages, you may consider opening one of each account. However, if such an option is not possible, you can select the retirement savings account which best suits your needs. Generally, traditional IRAs benefit those who want to lower their present-day tax liability or individuals whose income exceeds the limits set by Roth IRAs. Meanwhile, a Roth IRA may be more suitable who individuals who prefer tax-free withdrawals.Traditional vs Roth IRA: Overview

It is vital for individuals to understand the differences between these two accounts so that they can select which retirement account best suits their needs. Traditional IRA

Roth IRA

Key Differences Between Traditional & Roth IRA

Taxation Rules

Early Withdrawal Rules

Contribution Eligibility

Required Minimum Distributions (RMDs)

IRA Income Limits 2023 & 2024

Traditional IRA Tax Deduction Income Limits for 2023 & 2024

Roth IRA Income Limits in 2023 & 2024

IRA Contribution Limits 2023 & 2024

Traditional vs Roth IRA: Which Is Better For You?

The Bottom Line

Traditional vs Roth IRA FAQs

Yes, you can contribute to a traditional IRA and a Roth IRA in the same tax year. However, your contribution amount is limited to the total contribution limit for that year. Also, depending on your income level and filing status, you may not be eligible to contribute to a Roth IRA.

If you can afford to contribute the total amount within your IRA contribution limits for that year, then contributing the maximum amount may be beneficial. With this, you will get the most out of tax advantages offered by both IRA types and grow your retirement funds faster.

Traditional IRAs offer tax-deferred growth of your retirement contributions. This means that you will pay taxes on the money when it is withdrawn in retirement, allowing you to save now and pay taxes later.

Roth IRAs offer no current tax deductions on contributions. This means you will have to pay taxes on the money you contribute now. Additionally, your income may limit eligibility for Roth IRA contributions.

Whether or not you should have both a traditional and a Roth IRA depends on your financial situation. Please take a look at your income and filing status, as well as your general financial situation and retirement goals. It is beneficial to talk to a financial advisor for expert guidance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.