The Joint Life Expectancy Table is designed to assist individuals in estimating the duration of their joint lives. It takes into account the ages of two individuals and provides an estimate of the average number of years they are expected to live as a couple. The table is constructed based on actuarial data and mortality rates, which are statistical measures of the likelihood of death at different ages. Actuaries use historical data on mortality patterns and other relevant factors to calculate life expectancies. The Joint Life Expectancy Table combines these factors to provide a projection of how long a couple is expected to live together on average. This statistical tool is particularly relevant for financial planning because it helps couples make informed decisions about their long-term financial arrangements and investments. There are several types of joint life expectancy tables, each with specific purposes and applications. The Internal Revenue Service (IRS) provides the Uniform Lifetime Table, which is primarily used to calculate Required Minimum Distributions (RMDs) for retirement accounts such as traditional Individual Retirement Arrangements (IRAs) and 401(k)s. The IRS also provides this table and is specifically used for calculating RMDs when the account holder's spouse is the sole beneficiary and is more than ten years younger than the account holder. Actuarial tables developed by private sector companies, such as insurance providers and financial institutions, often provide joint life expectancy information tailored to their specific products and services. Several factors can influence joint life expectancy, including: As individuals age, their life expectancy tends to decrease. However, joint life expectancy is usually higher than individual life expectancy because it considers the probability of either person surviving. Women generally have longer life expectancies than men, which may affect joint life expectancy calculations. Individuals with chronic conditions or severe illnesses typically have shorter life expectancies, which can impact joint life expectancy. Smoking, excessive alcohol consumption, poor diet, and lack of exercise can all negatively affect life expectancy. Advancements in medical technology and overall improvements in societal health can lead to increased life expectancies over time. Joint life expectancy tables play a crucial role in retirement planning, including: These tables help determine the amount to be withdrawn from retirement accounts each year, ensuring proper tax compliance and account longevity. Understanding joint life expectancy can help couples decide when to claim Social Security benefits, maximizing their lifetime income. Joint life expectancy data can be used to evaluate different pension payouts options, such as single life annuities or joint and survivor annuities. Joint life expectancy information can help determine the most suitable annuity product, considering factors such as guaranteed income, survivor benefits, and inflation protection. Joint life expectancy tables are also essential in estate planning, including: Understanding joint life expectancy can help create strategies to transfer assets and preserve wealth for future generations efficiently. Joint life expectancy data can assist in selecting the appropriate life insurance coverage, policy type, and payout options. Knowledge of joint life expectancy can help couples make informed decisions about charitable giving, considering potential gift tax implications. Joint life expectancy information can help determine the most suitable trust structures and distribution strategies for beneficiaries. Joint life expectancy tables can be used to develop tax planning strategies, such as: Understanding joint life expectancy can help couples determine the most tax-efficient ways to defer income, minimizing their overall tax burden. Joint life expectancy data can be useful in deciding the most suitable time to convert traditional IRAs to Roth IRAs, taking into account the tax implications and long-term benefits. Knowledge of joint life expectancy can help retirees determine the optimal timing for making Qualified Charitable Distributions (QCDs) from their retirement accounts, minimizing taxes while supporting their preferred charities. Understanding joint life expectancy can assist couples in developing tax-efficient withdrawal strategies, including sequencing withdrawals from various account types and considering the tax consequences. Joint life expectancy tables are essential in investment planning, including: Understanding joint life expectancy can help couples adjust their asset allocation and risk tolerance to meet their long-term financial goals and ensure financial security. Joint life expectancy data can be used to manage longevity risk, ensuring that couples have sufficient assets and income streams to last throughout their lifetime. Knowledge of joint life expectancy can help couples develop strategies to mitigate the sequence of returns risk, which can negatively impact their retirement portfolios. Joint life expectancy information can help couples evaluate the potential impact of inflation on their investment returns and purchasing power, guiding them in making appropriate adjustments to their investment strategies. Despite their usefulness, joint life expectancy tables have some limitations, including: Joint life expectancy tables are based on average population data and may not accurately predict the life expectancy of specific individuals or couples. Joint life expectancy tables rely on historical data, which may not accurately reflect future improvements in medical technology or societal health. The tables may not account for the effects of new medical advancements or significant societal changes, which could impact life expectancies in the future. In some cases, alternative approaches to joint life expectancy may be more suitable: These annuities provide guaranteed income for a specified period, which can be chosen based on individual life expectancy estimates or desired income duration. Longevity insurance policies provide income for life, starting at a predetermined age, and can help manage longevity risk without relying solely on joint life expectancy tables. Personalized life expectancy calculations can be more accurate for some individuals, considering specific factors such as family history, health status, and lifestyle choices. Monte Carlo simulations can help model potential financial outcomes using various assumptions about life expectancy, investment returns, and other variables, providing a range of possible scenarios rather than relying on a single joint life expectancy estimate. Joint life expectancy tables play a significant role in various aspects of financial planning for couples and partners, including retirement, estate, tax, and investment planning. Factors such as age, gender, health status, lifestyle, and mortality trends can impact joint life expectancy calculations. Despite their usefulness, these tables have limitations, such as inaccuracies due to individual variation and reliance on historical data. Alternative approaches can offer additional insights in certain situations, such as period-certain annuities, longevity insurance, individual life expectancy calculations, and Monte Carlo simulations. Individuals must consider their personal factors and seek professional guidance while periodically reviewing their financial plans to ensure long-term financial security and achieve their goals.What Is a Joint Life Expectancy Table?

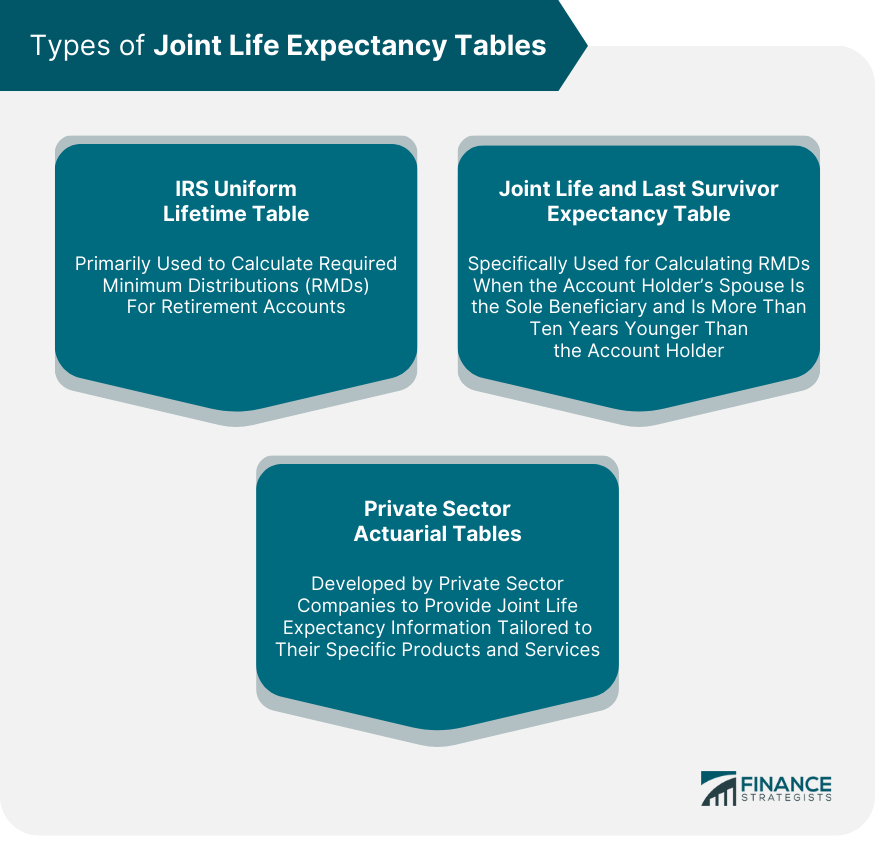

Types of Joint Life Expectancy Tables

IRS Uniform Lifetime Table

Joint Life and Last Survivor Expectancy Table

Private Sector Actuarial Tables

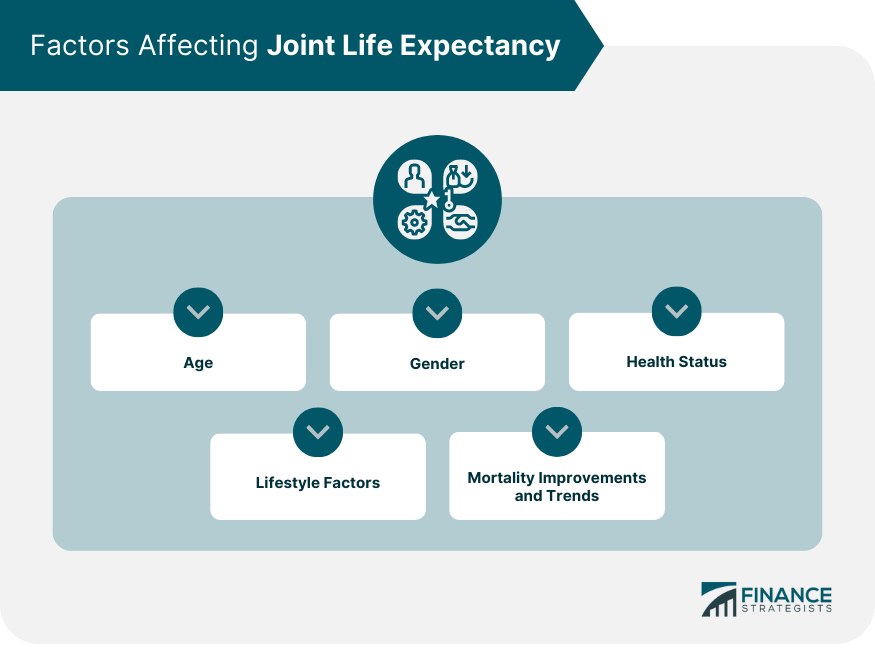

Factors Affecting Joint Life Expectancy

Age

Gender

Health Status

Lifestyle Factors

Mortality Improvements and Trends

Usage of Joint Life Expectancy Table in Retirement Planning

Required Minimum Distribution (RMD) Calculations

Social Security Benefits Optimization

Pension Payout Options

Annuity Purchase Considerations

Usage of Joint Life Expectancy Table in Estate Planning

Transfer of Assets and Wealth Preservation Strategies

Life Insurance Coverage and Policy Selection

Charitable Giving and Gift Tax Implications

Trust Planning and Beneficiary Considerations

Usage of Joint Life Expectancy Table in Tax Planning

Income Tax Deferral Strategies

Roth IRA Conversions

Qualified Charitable Distributions (QCDs)

Tax-Efficient Withdrawal Strategies

Usage of Joint Life Expectancy Table in Investment Planning

Asset Allocation and Risk Tolerance Adjustments

Longevity Risk Management

Sequence of Returns Risk

Inflation and Investment Return Considerations

Joint Life Expectancy Table Limitations

Inaccuracies Due to Individual Variation

Dependence on Historical Data

Impact of Medical Advancements and Societal Changes

Joint Life Expectancy Table Alternatives

Period-Certain Annuities

Longevity Insurance

Individual Life Expectancy Calculations

Monte Carlo Simulations

Conclusion

Joint Life Expectancy Table FAQs

Joint life expectancy refers to the time that two people in a relationship, typically married, will live together.

Joint life expectancy is calculated based on a number of factors, including the age, health, and lifestyle of both individuals.

Joint life expectancy is important for retirement planning because it helps couples estimate how long their retirement savings will need to last.

Joint life expectancy is a key factor in determining the amount of Social Security benefits that a married couple can receive over their lifetime.

While there is no guaranteed way to increase joint life expectancy, individuals can improve their health and reduce their risk of disease, potentially increasing their chances of living longer together.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.