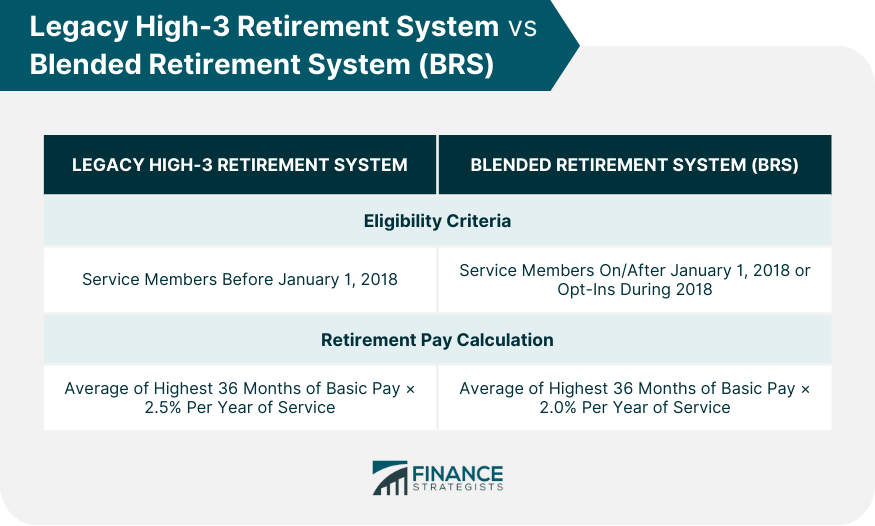

Military retirement pay and pension refer to the financial benefits provided to service members upon retiring from the United States Armed Forces. These benefits are designed to support military personnel after completing a successful career in the Army, Navy, Air Force, Marine Corps, or Coast Guard. The amount of retirement pay and pension depends on several factors, including the type of retirement (active duty, reserve, or disability), the years of service, and the retirement system chosen (Legacy High-3 or Blended Retirement System). In addition to the retirement pay, military retirees may be eligible for other benefits such as healthcare through TRICARE, access to commissaries and exchanges, and Survivor Benefit Plan (SBP) coverage for their dependents. To be eligible for active duty retirement, service members must meet specific time in service requirements. Generally, personnel must complete at least 20 years of service, although certain career fields may have different requirements. Additionally, age restrictions may apply, with mandatory retirement ages varying by service branch and rank. Reserve retirement differs from active duty retirement because eligibility is based on a point system. Reservists must accumulate a minimum of 20 "qualifying years" and at least 1,000 points to be eligible for retirement. Age restrictions also apply, with most reservists becoming eligible for retirement pay at age 60. Disability retirement is available to service members who become physically or mentally unfit to perform their duties due to a service-connected disability. The Medical Evaluation Board (MEB) process determines eligibility and a disability rating of at least 30% is required to qualify for disability retirement. The Legacy High-3 retirement system is available to service members who entered service before January 1, 2018. Under the High-3 system, retirement pay is calculated as the average of the highest 36 months of basic pay, multiplied by 2.5% for each year of service. For example, if a service member served 20 years, their retirement pay would be 50% of their highest 36-month average. High-3 retirement pay is subject to an annual cost of living adjustment (COLA) based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The Blended Retirement System (BRS) applies to service members who entered service on or after January 1, 2018 or those who opted into the system during the 2018 calendar year. The defined benefit component of the BRS is similar to the High-3 system, but with a 2.0% multiplier instead of 2.5%. This means that a service member with 20 years of service would receive 40% of their highest 36-month average. The BRS includes an automatic and matching contribution to the service member's Thrift Savings Plan (TSP) account. The government contributes 1% of the service member's basic pay, with an additional matching contribution of up to 4%. BRS participants may receive a one-time continuation pay bonus after completing 12 years of service, provided they agree to serve an additional four years. Under the BRS, service members can opt to receive a portion of their retirement pay as a lump sum at the time of retirement, with the remaining pay reduced accordingly. When comparing the High-3 and BRS systems, factors to consider include expected years of service, anticipated career earnings, and investment risk tolerance. The High-3 system provides a higher defined benefit, while the BRS offers additional benefits like TSP contributions and continuation pay. The choice between the two systems depends on individual circumstances and financial goals. The Survivor Benefit Plan is a government-sponsored insurance program designed to provide financial support to the surviving spouses or dependents of military retirees in the event of their death. Service members can enroll in SBP at the time of retirement or within a specified window after retirement. Various coverage options are available, including spouse-only, spouse and child, child-only, and former-spouse coverage. SBP premiums are based on the chosen coverage amount and are automatically deducted from the retiree's monthly retirement pay. Coverage amounts can range from a minimum of $300 per month up to the full amount of the retiree's retirement pay. SBP beneficiaries can include spouses, former spouses, dependent children, or other eligible persons. Specific rules apply to each beneficiary type, and marital or family status changes may impact coverage. Enrolling in SBP reduces the retiree's monthly retirement pay by the cost of the premiums. However, SBP premiums are typically tax-deductible, which may offset some of the financial impact. Military retirement pay is generally considered taxable income at the federal level. Retirees should consult a tax services professional to determine their specific tax liabilities and potential deductions or credits. State income tax treatment of military retirement pay varies by state. Some states fully exempt military retirement pay from taxation, while others offer partial exemptions or tax credits. Retirees should research their state's tax laws or consult a tax professional for guidance. Tax planning strategies for military retirees may include maximizing deductions, utilizing tax-advantaged investment accounts, and considering residency in a tax-friendly state. TRICARE is the primary healthcare program for military retirees and their eligible dependents. Various TRICARE options are available, including TRICARE Prime, TRICARE Select, and TRICARE for Life. Military retirees and their eligible dependents must enroll in a TRICARE plan within a specified enrollment period to receive coverage. Enrollment can be completed online, by phone, or by mail. TRICARE costs and coverage depend on the chosen plan, with variables such as premiums, copayments, and deductibles. Retirees should review their options to determine the best fit for their needs and budget. Dental and vision coverage is available to military retirees and their eligible dependents through the Federal Employees Dental and Vision Insurance Program (FEDVIP). In addition to TRICARE, military retirees may be eligible for healthcare benefits through the Department of Veterans Affairs (VA), particularly if they have a service-connected disability. Military retirees maintain access to commissaries and exchanges, offering discounted groceries, merchandise, and services. Retirees can access various Morale, Welfare, and Recreation (MWR) facilities, such as fitness centers, golf courses, and recreational lodging. Space-Available (Space-A) travel allows military retirees to fly on military aircraft when space permits, often at a significantly reduced cost or even for free. Veterans Service Organizations (VSOs), such as the American Legion and Veterans of Foreign Wars (VFW), provide valuable resources, support, and advocacy for military retirees and their families. Military retirees can access various educational and employment resources, including tuition assistance, vocational training, and job placement services. A well-thought-out retirement budget is essential to ensure financial stability during your retirement years. Consider all sources of income, such as military retirement pay, Social Security, and investment income, as well as expenses, including housing, healthcare, and leisure activities. Developing a diversified investment portfolio and employing a long-term savings strategy can help ensure your financial security in retirement. Consider consulting a financial advisor to tailor an investment plan to your specific needs and goals. Estate planning is crucial to ensure your assets and wishes are protected and properly executed after your death. A comprehensive estate plan includes a will, power of attorney, healthcare proxy, and trust arrangements. Reducing debt and maintaining a healthy credit score are important components of a sound financial plan. Strategies may include debt consolidation, refinancing, or implementing a debt repayment plan. Long-term care planning ensures you receive the necessary care and support in your later years. Consider long-term care insurance, establishing a dedicated savings account, or researching assisted living and nursing home options. Navigating military retirement pay, pensions, and benefits is crucial for securing a stable financial future. Planning for military retirement is essential to secure a stable financial future. By understanding and maximizing the benefits and resources available, you can make informed decisions shaping your retirement years. Seeking professional financial advice can help you navigate the complexities of military retirement pay, pensions, and other benefits, ensuring you are well-prepared for the next chapter of your life.Overview of Military Retirement Pay and Pension

Eligibility Criteria for Military Retirement

Active Duty Retirement

Reserve Retirement

Disability Retirement

Military Retirement Plans

Legacy High-3 Retirement System

Eligibility Criteria

Retirement Pay Calculation

Cost of Living Adjustments (COLA)

Blended Retirement System (BRS)

Eligibility Criteria

Defined Benefit Component

Thrift Savings Plan (TSP)

Continuation Pay

Lump Sum Option

Comparing High-3 and BRS

Factors to Consider When Choosing a Plan

Pros and Cons of Each System

Survivor Benefit Plan (SBP)

Definition and Purpose of SBP

Enrollment Process and Options

Premiums and Coverage Amounts

Beneficiary Types and Rules

Effects on Retirement Pay

Federal and State Tax Implication of Military Retirement Pay and Pension

Federal Income Tax on Military Retirement Pay

State Income Tax Considerations

Tax Planning Strategies for Military Retirees

Healthcare Benefits for Military Retirees

TRICARE

Overview of TRICARE Options

Eligibility and Enrollment Process

Costs and Coverage

Dental and Vision Coverage

Veterans Affairs (VA) Healthcare Benefits

Additional Benefits and Resources for Military Retirees

Commissary and Exchange Access

Morale, Welfare, and Recreation (MWR) Facilities

Space-Available Travel

Veterans Service Organizations (VSOs)

Educational and Employment Resources

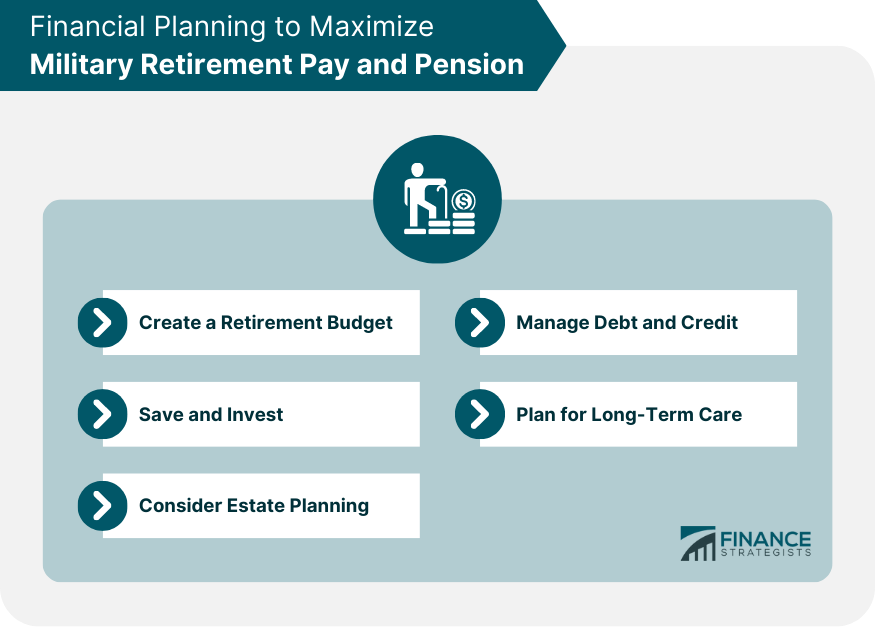

Financial Planning to Maximize Military Retirement Pay and Pension

Create a Retirement Budget

Save and Invest

Consider Estate Planning

Manage Debt and Credit

Plan for Long-Term Care

Conclusion

Military Retirement Pay and Pension FAQs

Military retirement pay and pension under the Legacy High-3 Retirement System is calculated as the average of the highest 36 months of basic pay, multiplied by 2.5% for each year of service.

The Legacy High-3 system has a higher defined benefit, with a 2.5% multiplier, while the BRS has a 2.0% multiplier. Additionally, the BRS includes benefits such as Thrift Savings Plan (TSP) contributions, continuation pay, and a lump sum option.

Military retirement pay is generally subject to federal income tax. State income tax treatment varies by state, with some states offering exemptions or tax credits for military retirement pay.

Enrolling in the SBP will reduce your monthly military retirement pay by the cost of the premiums. However, SBP premiums are typically tax-deductible, which may offset some of the financial impact.

Military retirees are eligible for healthcare benefits through TRICARE, with various options such as TRICARE Prime, TRICARE Select, and TRICARE for Life. Additionally, retirees may access dental and vision coverage through the Federal Employees Dental and Vision Insurance Program (FEDVIP). They may be eligible for healthcare benefits through the Department of Veterans Affairs (VA). Healthcare costs and coverage depend on the chosen plan and can impact a retiree's overall budget when considering military retirement pay and pension.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.