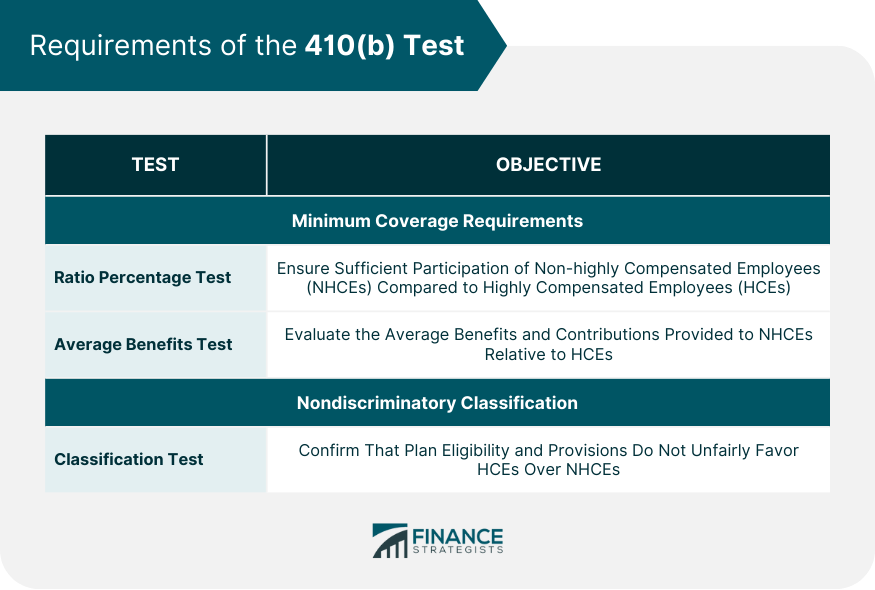

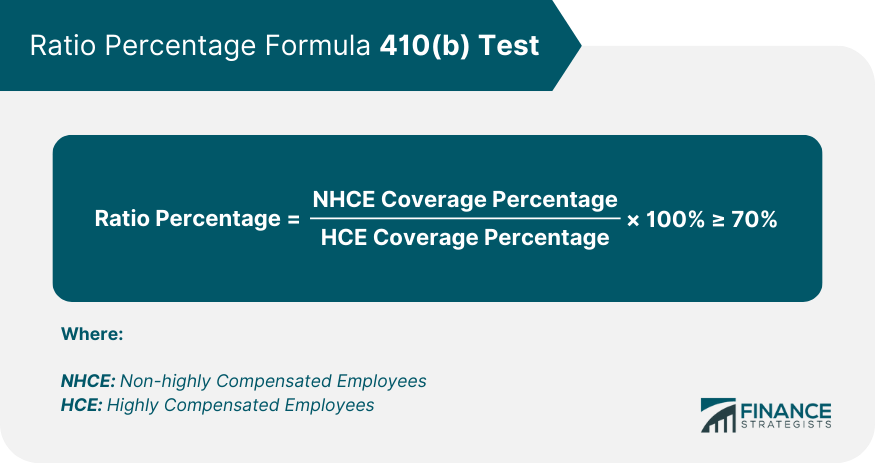

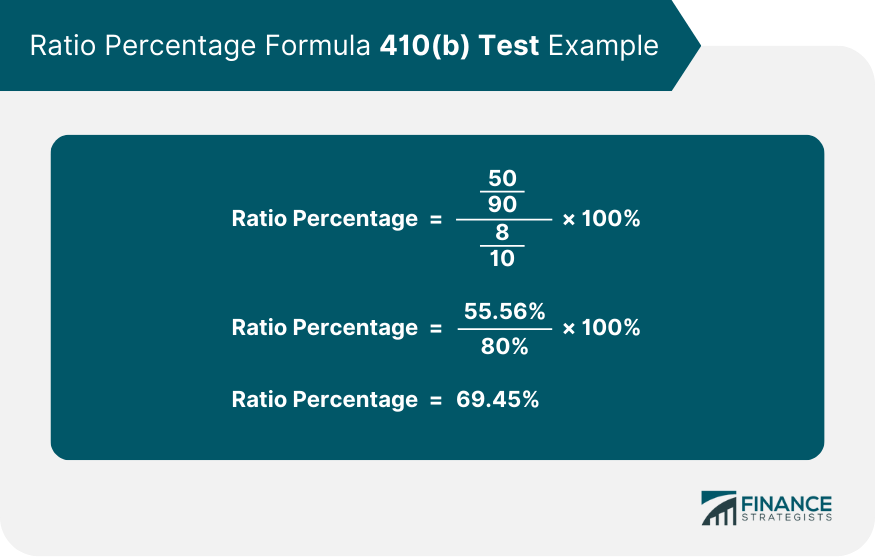

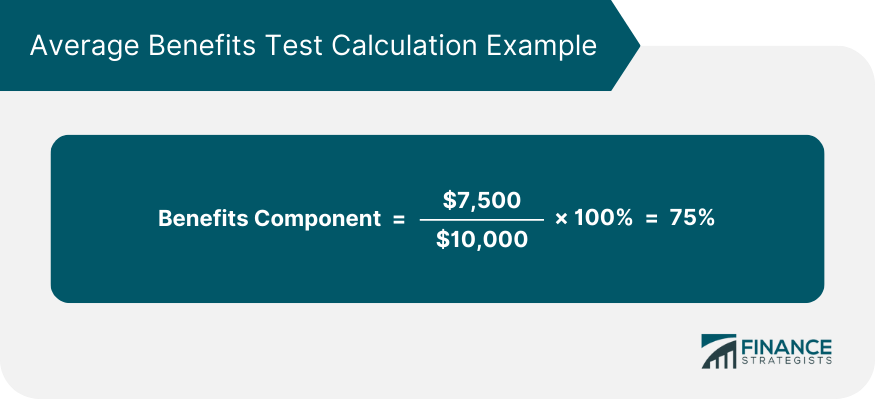

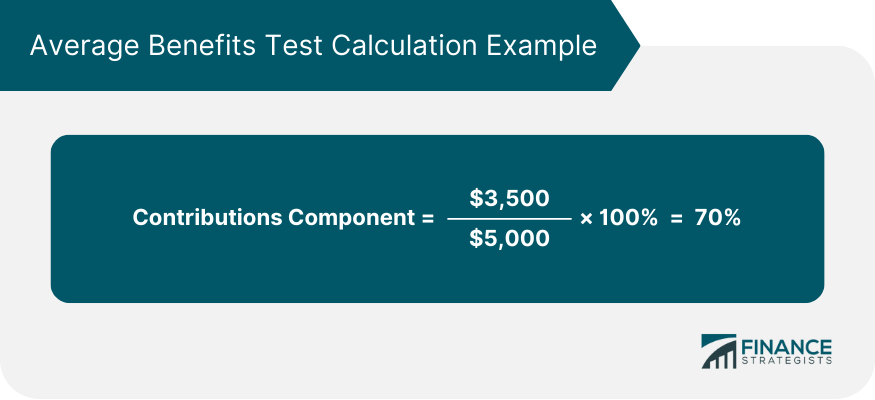

The 410(b) Test is a critical aspect of managing qualified retirement plans in the United States. Ensuring compliance with the Internal Revenue Code (IRC) Section 410(b) is essential to maintain the tax-qualified status of a retirement plan. The 410(b) Test promotes fairness in retirement plans by ensuring that plans do not disproportionately benefit HCEs at the expense of NHCEs. By complying with the 410(b) Test, employers and plan administrators can maintain the tax-qualified status of their retirement plans, preserving valuable tax benefits for both the employer and employees. The 410(b) Test helps protect the tax benefits associated with qualified retirement plans, which can lead to increased employee participation and better retirement outcomes for all employees. The 410(b) Test comprises two primary requirements that retirement plans must meet to be considered tax-qualified: minimum coverage requirements and nondiscriminatory classification. The minimum coverage requirements of the 410(b) Test ensure that a sufficient number of Non-highly Compensated Employees (NHCEs) participate in the plan relative to Highly Compensated Employees (HCEs). There are two tests under the minimum coverage requirements: the Ratio Percentage Test and the Average Benefits Test. The nondiscriminatory classification test ensures that the plan does not favor HCEs over NHCEs through its provisions and eligibility requirements. The Ratio Percentage Test is a quantitative comparison of the plan's coverage among NHCEs and HCEs. The test is satisfied if the following formula is met: Suppose an organization has 100 employees, with 10 HCEs and 90 NHCEs. If 8 HCEs and 50 NHCEs participate in the plan, the calculation would be: In this example, the plan fails the Ratio Percentage Test because the result is less than 70%. If the plan passes the Ratio Percentage Test with a result of 70% or higher, it satisfies the minimum coverage requirements for the 410(b) Test. The Average Benefits Test measures whether the average benefits provided to NHCEs are at least a certain percentage of the average benefits provided to HCEs. The test is composed of two components: the benefits component and the contributions component. The benefits component examines the benefits provided to NHCEs as a percentage of the benefits provided to HCEs. To pass this component, the plan must meet one of the following conditions: The average benefit for NHCEs is at least 70% of the average benefit for HCEs, or The average benefit for NHCEs is at least 80% of the average benefit for HCEs, and the plan meets a classification requirement (such as the Safe Harbor requirements) The contributions component evaluates the contributions made on behalf of NHCEs as a percentage of the contributions made on behalf of HCEs. To pass this component, the plan must meet one of the following conditions: The average contribution for NHCEs is at least 70% of the average contribution for HCEs, or The average contribution for NHCEs is at least 80% of the average contribution for HCEs, and the plan meets a classification requirement (such as the Safe Harbor requirements). Suppose the average benefit for HCEs is $10,000, and the average benefit for NHCEs is $7,500. The calculation would be: In this example, the plan passes the Benefits Component of the Average Benefits Test because the result is more than 70%. Now, suppose the average contribution for HCEs is $5,000, and the average contribution for NHCEs is $3,500. The calculation would be: In this example, the plan passes the Contributions Component of the Average Benefits Test because the result is equal to 70%. If the plan passes both the Benefits Component and the Contributions Component of the Average Benefits Test, it satisfies the minimum coverage requirements for the 410(b) Test. The Nondiscriminatory Classification Test aims to ensure that the plan's eligibility requirements and provisions do not unfairly favor HCEs over NHCEs. To satisfy the Nondiscriminatory Classification Test, the plan must use a reasonable classification of employees that does not discriminate in favor of HCEs. A classification is considered reasonable if it is based on bona fide business criteria, such as job function, location, or years of service. A plan can satisfy the Nondiscriminatory Classification Test if it meets the Safe Harbor requirements outlined by the IRS. These requirements include specific coverage percentages and non-discrimination tests that ensure the plan is equitable for both HCEs and NHCEs. If a retirement plan fails the 410(b) Test, it risks losing its tax-qualified status. This disqualification can have significant consequences for both the employer and employees. If a plan loses its tax-qualified status, the employer may lose tax deductions for contributions made to the plan. Employees may also be subject to immediate taxation on their vested benefits and face additional taxes and penalties. If a plan fails the 410(b) Test, the employer and plan administrators can take corrective actions to bring the plan into compliance. These actions may include amending plan provisions, making additional contributions for NHCEs, or refunding excess contributions made by HCEs. The 410(b) Test plays a vital role in managing qualified retirement plans in the United States by ensuring fairness and equity between highly compensated employees (HCEs) and non-highly compensated employees (NHCEs). Complying with the test's requirements, which include minimum coverage requirements and nondiscriminatory classification, helps preserve the tax-qualified status of retirement plans and the associated tax benefits for both employers and employees. Employers and plan administrators should stay vigilant and periodically review their plans to ensure ongoing compliance. In cases where a plan fails the 410(b) Test, it is crucial to take corrective actions to restore compliance and safeguard the plan's tax benefits.Definition of 410(b) Test

Importance of the 410(b) Test

Ensuring Fairness in Retirement Plans

Compliance with IRS Regulations

Protecting Tax Benefits for Employers and Employees

Requirements of the 410(b) Test

Minimum Coverage Requirements

Nondiscriminatory Classification Test

Ratio Percentage Test

Definition and Formula

Example of Ratio Percentage Test Calculation

Passing the Ratio Percentage Test

Average Benefits Test

Definition and Components

Benefits Component

Contributions Component

Example of Average Benefits Test Calculation

Passing the Average Benefits Test

Nondiscriminatory Classification Test

Purpose and Overview

Reasonable Classification

Safe Harbor Requirements

Consequences of Failing the 410(b) Test

Disqualification of the Plan

Tax Implications for the Employer and Employees

Corrective Actions and Amendments

Conclusion

410(b) Test FAQs

The 410(b) Test aims to ensure that qualified retirement plans do not disproportionately favor highly compensated employees (HCEs) over non-highly compensated employees (NHCEs). This test helps maintain the tax-qualified status of retirement plans, protecting valuable tax benefits for both employers and employees.

The minimum coverage requirements of the 410(b) Test consist of two tests: the Ratio Percentage Test and the Average Benefits Test. These tests evaluate the participation and benefits provided to NHCEs compared to HCEs, ensuring that retirement plans are fair and equitable for all employees.

A plan passes the Ratio Percentage Test if the coverage ratio, calculated as (NHCE Coverage Percentage / HCE Coverage Percentage) x 100%, is equal to or greater than 70%. This demonstrates that the plan's coverage among NHCEs is sufficient relative to its coverage among HCEs.

If a retirement plan fails the 410(b) Test, it risks losing its tax-qualified status, which can have significant consequences for both the employer and employees. Employers may lose tax deductions for plan contributions, and employees may face immediate taxation on their vested benefits and additional taxes and penalties.

To correct a plan that has failed the 410(b) Test, the employer and plan administrators can take corrective actions, such as amending plan provisions, making additional contributions for NHCEs, or refunding excess contributions made by HCEs. These actions can help bring the plan back into compliance and maintain its tax-qualified status.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.