The 415(c) limit refers to the maximum amount of contributions that can be made to a defined contribution retirement plan in a calendar year. This limit is established under Section 415(c) of the Internal Revenue Code (IRC) and is intended to prevent excessive retirement savings and ensure equitable tax treatment. The main purpose of the 415(c) limit is to regulate the amount of money that individuals can contribute to their retirement plans, preventing excessive savings and ensuring that everyone has an equitable opportunity to benefit from tax-advantaged retirement savings. The 415(c) limit was initially established under the Employee Retirement Income Security Act (ERISA) of 1974, which created the Internal Revenue Code Section 415. Over the years, the limit has been adjusted for inflation and modified through various amendments to better align with changing economic conditions and policy goals. The primary reasons for implementing the 415(c) limit are to prevent individuals from accumulating excessive retirement savings in tax-advantaged plans and to ensure equitable tax treatment for all taxpayers. By limiting the amount of contributions, the government aims to balance the need for individuals to save for retirement while maintaining a fair tax system. The 415(c) limit is subject to annual adjustments based on changes in the cost of living. As of 2024, the annual limit for contributions to a defined contribution plan is $69,000. This limit may be increased in future years to account for inflation. Several factors can affect the 415(c) limit, including the type of retirement plan, the participant's age, and the specific plan provisions. In some cases, exceptions or special rules may apply, allowing for higher contribution limits. The 415(c) limit primarily affects defined contribution plans, such as 401(k) plans, profit-sharing plans, and money purchase pension plans. These plans allow employees to contribute a portion of their income to a tax-advantaged retirement account, with contributions and investment earnings growing tax-deferred until withdrawal. The 415(c) limit also applies to 403(b) plans, which are similar to 401(k) plans but are designed for employees of public schools, non-profit organizations, and certain churches. In addition to the above, the 415(c) limit affects 457 plans, which are non-qualified deferred compensation plans offered by state and local governments and certain non-governmental entities. Participants aged 50 or older may be eligible to make catch-up contributions in addition to the standard 415(c) limit. These contributions allow older workers to save more for retirement, recognizing that they may have fewer years to accumulate savings. In some cases, the 415(c) limit may be adjusted based on the participant's age. For example, in 403(b) plans, participants with at least 15 years of service may be eligible for a higher contribution limit. In certain circumstances, the 415(c) limit may require the aggregation of contributions across multiple plans, such as when an individual participates in both a 403(b) and a 457 plan. The 415(c) limit plays an important role in helping individuals balance their retirement savings with the constraints imposed by tax regulations. By understanding and adhering to these limits, individuals can optimize their retirement savings strategy while staying compliant with the law. To make the most of the 415(c) limit, individuals may need to adjust their contribution strategies, such as by increasing contributions to non-tax-advantaged accounts, seeking professional advice, or reassessing their investment mix. Employers and plan sponsors are responsible for ensuring compliance with the 415(c) limit and associated reporting requirements. Failure to adhere to these limits can result in penalties and tax consequences for both the employer and the employee. The 415(c) limit also influences how employers and plan sponsors design their retirement plans. By understanding and working within these limits, employers can create retirement plans that offer competitive benefits while maintaining compliance with tax laws. Some critics argue that the 415(c) limit unnecessarily restricts individuals' ability to save for retirement, particularly for high-income earners who may face lower limits relative to their income. Another critique of the 415(c) limit is its potential impact on high-income earners, who may be more likely to hit the limit and face additional tax consequences. This may lead to calls for reform or adjustments to the limit for this group. Various proposals have been made to reform the 415(c) limit, such as increasing the limit or indexing it to wage growth. These changes could potentially provide more flexibility for individuals to save for retirement while still maintaining a fair tax system. Another area of potential reform involves changing the types of plans that are subject to the 415(c) limit or introducing new types of tax-advantaged plans that may offer more flexibility for individuals to save for retirement. The 415(c) limit is a regulation that sets the maximum amount of contributions that can be made to a defined contribution retirement plan in a calendar year. Established under the Employee Retirement Income Security Act (ERISA) of 1974, the limit prevents excessive retirement savings and ensures equitable tax treatment. The 415(c) limit is adjusted annually based on inflation and factors such as the type of plan, participant age, and plan provisions. The limit primarily affects defined contribution plans, 403(b) plans, and 457 plans. To make the most of the 415(c) limit, individuals may need to adjust their contribution strategies. Employers and plan sponsors must ensure compliance with the 415(c) limit and associated reporting requirements. Some critiques of the 415(c) limit include restrictions on personal savings choices and its impact on high-income earners. Proposals for reform include changes to contribution limits or affected plans.Definition of 415(c) Limit

Background and History of the 415(c) Limit

Legislative Origins

Rationale for Implementing the 415(c) Limit

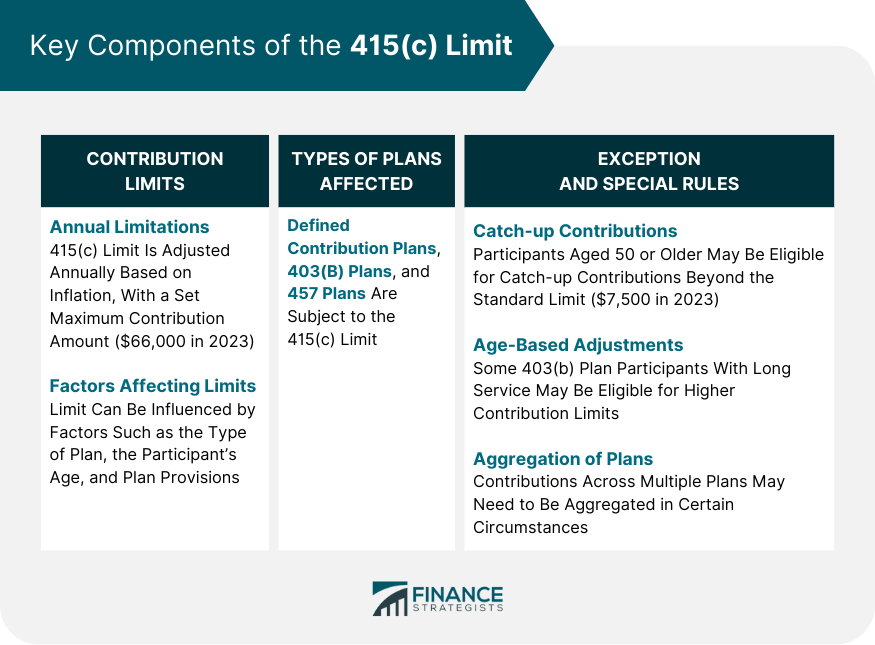

Key Components of the 415(c) Limit

Contribution Limits

Annual Limitations

Factors Affecting Contribution Limits

Types of Plans Affected

Defined Contribution Plans

403(b) Plans

457 Plans

Exceptions and Special Rules

Catch-Up Contributions

Age-Based Adjustments

Aggregation of Plans

Impact of the 415(c) Limit on Retirement Savings

Effect on Individual Retirement Planning

Balancing Savings and Limitations

Adjusting Contribution Strategies

Effect on Employers and Plan Sponsors

Compliance and Reporting Requirements

Designing Retirement Plans Within Limits

Potential Issues and Controversies

Critiques of the 415(c) Limit

Limitations on Personal Savings Choices

Impact on High-Income Earners

Proposals for Reform

Changes to Contribution Limits

Alterations to Affected Plans

Conclusion

415(c) Limit FAQs

The 415(c) limit is the maximum amount of contributions that individuals can make to a defined contribution retirement plan in a calendar year, as per Section 415(c) of the Internal Revenue Code. This limit aims to prevent excessive retirement savings and ensure equitable tax treatment for all taxpayers.

The 415(c) limit is subject to annual adjustments based on changes in the cost of living. This ensures that the limit remains relevant and reflects the evolving economic conditions.

The 415(c) limit primarily affects defined contribution plans, such as 401(k) plans, profit-sharing plans, and money-purchase pension plans. It also applies to 403(b) plans for employees of public schools, non-profit organizations, and certain churches, as well as 457 plans for state and local government employees.

Yes, there are several exceptions and special rules related to the 415(c) limit, including catch-up contributions for participants aged 50 or older, age-based adjustments for certain 403(b) plan participants, and aggregation of plans when an individual participates in multiple retirement plans.

Individuals should monitor their contributions to ensure they do not exceed the 415(c) limit, while employers should design retirement plans that adhere to the limit and ensure accurate reporting. Both individuals and employers can benefit from seeking professional advice to navigate the complexities of retirement savings and tax regulations.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.