The Actual Contribution Percentage (ACP) Test is a non-discrimination test that evaluates the fairness of contributions to employer-sponsored retirement plans such as 401(k) and 403(b) plans. The test ensures that the contributions made by and for Highly Compensated Employees (HCEs) are proportional to those made by and for Non-Highly Compensated Employees (NHCEs). The primary purpose of the ACP Test is to prevent employers from providing disproportionately large retirement plan benefits to HCEs at the expense of NHCEs. By ensuring contributions are equitable across the workforce, the ACP Test helps maintain the tax-advantaged status of employer-sponsored retirement plans. The ACP Test is a critical component of the nondiscrimination requirements set forth by the Internal Revenue Service (IRS) for qualified retirement plans. It works in conjunction with the Actual Deferral Percentage (ADP) Test to assess the overall fairness of employee deferrals and employer contributions. Section 401(m) of the Internal Revenue Code establishes the rules for the ACP Test. It outlines the criteria for determining HCEs, the types of contributions to be considered, and the permissible contribution ratios for passing the test. ERISA, enacted in 1974, provides protection for employees participating in retirement and health benefit plans. The Act sets minimum standards for plan administration, fiduciary responsibilities, and reporting and disclosure requirements. The ACP Test helps ensure that plans comply with ERISA's non-discrimination provisions. The IRS provides regulations and guidance on the ACP Test through publications, notices, and revenue rulings. These resources help plan sponsors and administrators understand and apply the test requirements correctly. HCEs are employees who either own more than 5% of the company or receive compensation above a specified threshold during the preceding year, as defined by the IRS. NHCEs are employees who do not meet the criteria for HCEs. Matching contributions are employer contributions made to an employee's retirement plan account based on the employee's elective deferrals. Employee after-tax contributions are voluntary contributions made by employees using after-tax dollars. The contribution ratio for each employee is calculated by dividing the sum of matching and after-tax contributions by the employee's compensation. The average contribution ratio for each group (HCEs and NHCEs) is calculated by dividing the sum of individual contribution ratios by the total number of employees in each group. The average contribution ratios for HCEs and NHCEs are compared to determine if the plan passes the ACP Test. The plan passes if it meets the requirements of the Actual Deferral Percentage (ADP) Test and falls within the permissible range specified by the IRS. The ADP Test evaluates the fairness of employee deferrals by comparing the average deferral percentages for HCEs and NHCEs. The plan must satisfy both the ADP and ACP Tests to maintain its tax-advantaged status. Safe harbor provisions provide an alternative way for plans to satisfy nondiscrimination requirements without conducting the ACP Test. By adopting certain plan designs and meeting specific contribution and notice requirements, a plan may be deemed to automatically satisfy the ACP and ADP Tests. If a plan fails the ACP Test, the employer must refund excess contributions made on behalf of HCEs. This corrective measure helps bring the plan back into compliance by reducing the HCEs' contribution ratios. Alternatively, employers can make additional contributions to the retirement accounts of NHCEs to increase their average contribution ratio, thereby bringing the plan into compliance. HCEs who receive excess contribution refunds must include those amounts in their taxable income for the year the refund is received. If a plan fails to correct ACP Test failures within the specified timeframe, it risks losing its tax-qualified status. This could result in adverse tax consequences for both the employer and the plan participants. Plan sponsors and administrators are required to perform the ACP Test annually to ensure ongoing compliance with non-discrimination requirements. Employers must maintain accurate records of plan contributions, employee compensation, and other relevant data to facilitate the annual ACP Test and demonstrate compliance to the IRS. Employers can adopt a safe harbor plan design that provides certain minimum contributions and meets notice requirements to avoid the need for annual ACP and ADP Tests. Incorporating automatic enrollment features into the plan can encourage broader employee participation and help balance contribution ratios between HCEs and NHCEs. Implementing appropriate vesting schedules for employer contributions can help encourage long-term employee commitment to the retirement plan, which can promote more equitable contribution ratios. Educating employees about the importance of saving for retirement and the benefits of participating in the employer-sponsored retirement plan can increase participation and help maintain compliance with the ACP Test. Providing employees with clear information about plan features, investment options, and the benefits of contributing can promote more balanced and consistent participation across the workforce. Conducting periodic plan reviews helps identify potential compliance issues and allows employers to make adjustments as needed to ensure ongoing ACP Test compliance. Working with experienced plan administrators and advisors can help employers stay up-to-date on regulatory changes, best practices, and strategies for maintaining compliance with the ACP Test. The ACP Test plays a critical role in ensuring fairness in retirement plan contributions and protecting the tax-advantaged status of employer-sponsored retirement plans. By adhering to the ACP Test requirements, plan sponsors demonstrate their commitment to providing equitable benefits for all employees. By maintaining compliance with the ACP Test, employers can foster a more inclusive and equitable retirement savings environment for their workforce, encouraging employee participation and helping to secure a better financial future for all. Regular monitoring, plan reviews, and adjustments as needed are essential for maintaining long-term ACP Test compliance. By staying proactive and engaging with experienced plan administrators and advisors, employers can navigate the complex regulatory landscape and ensure the continued success of their retirement plans. Definition of Actual Contribution Percentage (ACP) Test

Purpose of the ACP Test

Relation to Non-Discrimination Requirements for Retirement Plans

Legal and Regulatory Framework

Internal Revenue Code Section 401(m)

ERISA (Employee Retirement Income Security Act)

IRS Regulations on ACP Test

Calculation of ACP Test

Employee Classifications

Highly Compensated Employees (HCEs)

Non-Highly Compensated Employees (NHCEs)

Contribution Types Considered

Matching Contributions

Employee After-Tax Contributions

Calculation Steps

Determining Contribution Ratios for Each Employee

Averaging Ratios for HCEs and NHCEs

Comparing the Average Ratios

Passing the ACP Test

Actual Deferral Percentage (ADP) Test Requirements

Safe Harbor Provisions

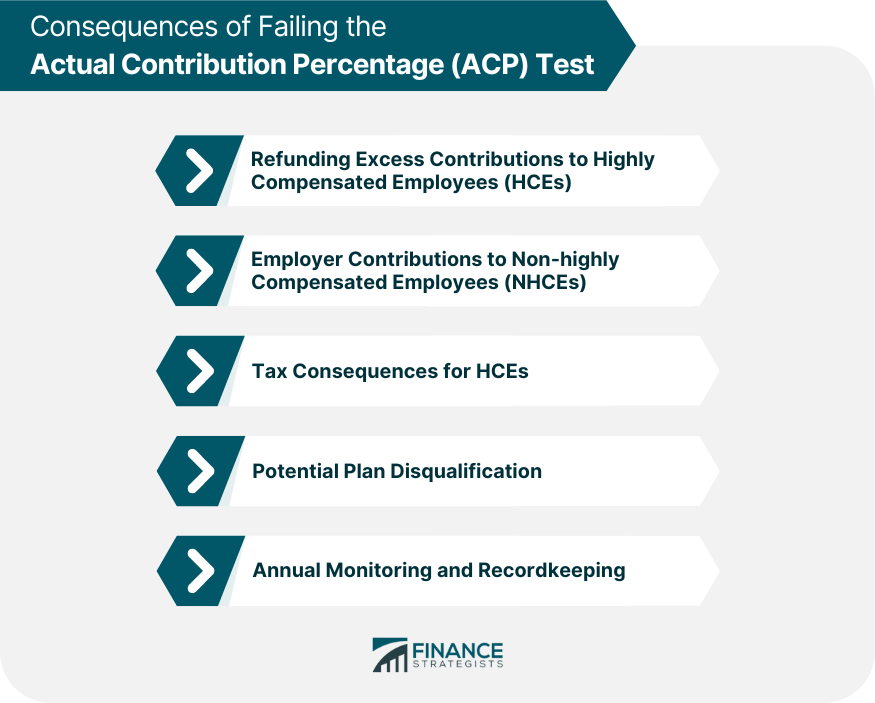

Consequences of Failing the Actual Contribution Percentage (ACP) Test

Corrective Actions

Refunding Excess Contributions to HCEs

Employer Contributions to NHCEs

Penalties and Tax Implications

Tax Consequences for HCEs

Potential Plan Disqualification

Monitoring and Compliance

Annual Testing

Recordkeeping Requirements

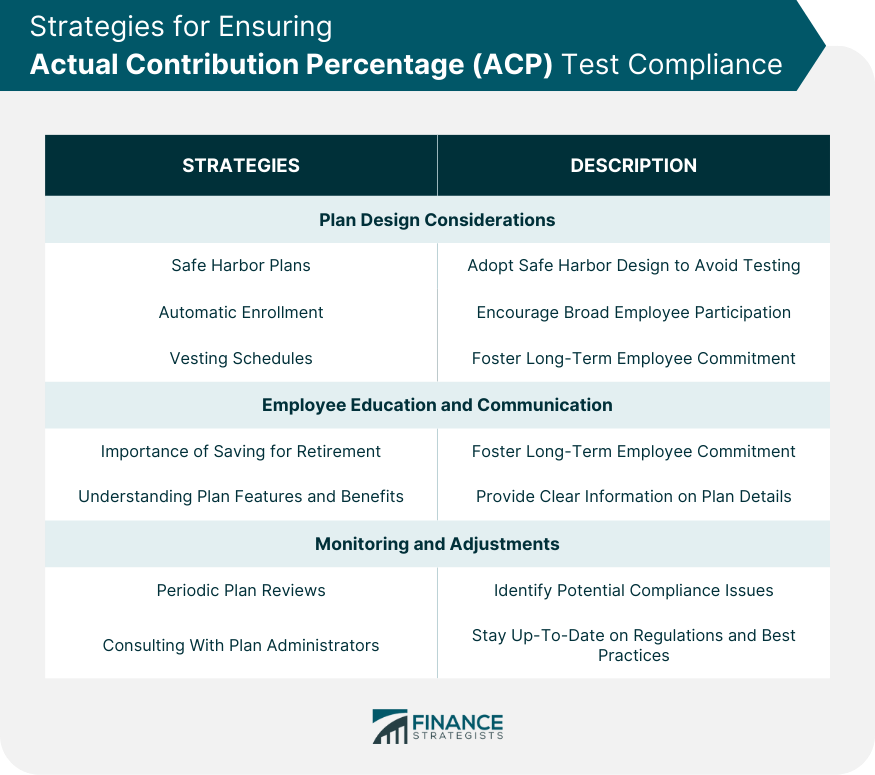

Strategies for Ensuring ACP Test Compliance

Plan Design Considerations

Safe Harbor Plans

Automatic Enrollment

Vesting Schedules

Employee Education and Communication

Importance of Saving for Retirement

Understanding Plan Features and Benefits

Monitoring and Adjustments

Periodic Plan Reviews

Consulting with Plan Administrators and Advisors

Conclusion

Actual Contribution Percentage (ACP) Test FAQs

The Actual Contribution Percentage (ACP) Test is a non-discrimination test used to evaluate the fairness of contributions made to employer-sponsored retirement plans, such as 401(k) and 403(b) plans. It ensures that contributions made by and for Highly Compensated Employees (HCEs) are proportional to those made by and for Non-Highly Compensated Employees (NHCEs), maintaining the tax-advantaged status of these plans.

The ACP Test is calculated by first determining the contribution ratios for each employee, which is done by dividing the sum of matching and after-tax contributions by the employee's compensation. Next, the average contribution ratios for both HCEs and NHCEs are calculated by dividing the sum of individual contribution ratios by the total number of employees in each group. Finally, the average contribution ratios for HCEs and NHCEs are compared to determine if the plan passes the ACP Test according to the IRS requirements.

If a plan fails the ACP Test, the employer must take corrective actions, such as refunding excess contributions to HCEs or making additional contributions to NHCEs' accounts. Failing the ACP Test may also result in tax consequences for HCEs who receive excess contribution refunds and potential disqualification of the plan, which could lead to adverse tax consequences for both the employer and the plan participants.

Strategies for ensuring ACP Test compliance include adopting a safe harbor plan design, incorporating automatic enrollment features, implementing appropriate vesting schedules, educating employees about the importance of saving for retirement, providing clear information about plan features and benefits, conducting periodic plan reviews, and consulting with experienced plan administrators and advisors.

Yes, a retirement plan can avoid the ACP Test by adopting a safe harbor plan design that provides certain minimum contributions and meets notice requirements. By doing so, the plan is deemed to automatically satisfy the ACP and ADP Tests, ensuring compliance with non-discrimination requirements without conducting the tests annually.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.