What Is a Corrective Distribution?

A corrective distribution is a distribution made from a retirement plan to correct an error or imbalance in the plan. Corrective distribution can take different forms depending on the type of excess contribution or deferral.

For example, corrective distribution of excess contributions may involve returning the excess amount to the highly compensated employees (HCEs) with interest or allocating the excess to non-highly compensated employees (NHCEs) in the plan.

Excess contributions or deferrals can result from a variety of factors, including a mistake in calculating contributions, failing to limit elective deferrals to the maximum allowed by law, or a plan not meeting the actual deferral percentage (ADP) or actual contribution percentage (ACP) test.

Purpose of Corrective Distributions

Corrective distributions are used to manage retirement plans and ensure compliance with non-discrimination rules set by the Employee Retirement Income Security Act (ERISA) and Internal Revenue Service (IRS) regulations.

These rules require that contributions and benefits provided to highly compensated employees be proportionate to those provided to NHCEs.

In situations where HCEs receive excess contributions or deferrals, corrective distribution is necessary to return those excess funds to HCEs, thereby ensuring compliance with non-discrimination rules.

By ensuring compliance with non-discrimination rules, corrective distribution also helps to maintain the fairness and integrity of retirement plans. Failure to comply with non-discrimination rules can result in significant financial penalties and legal liabilities for the plan sponsor and trustees.

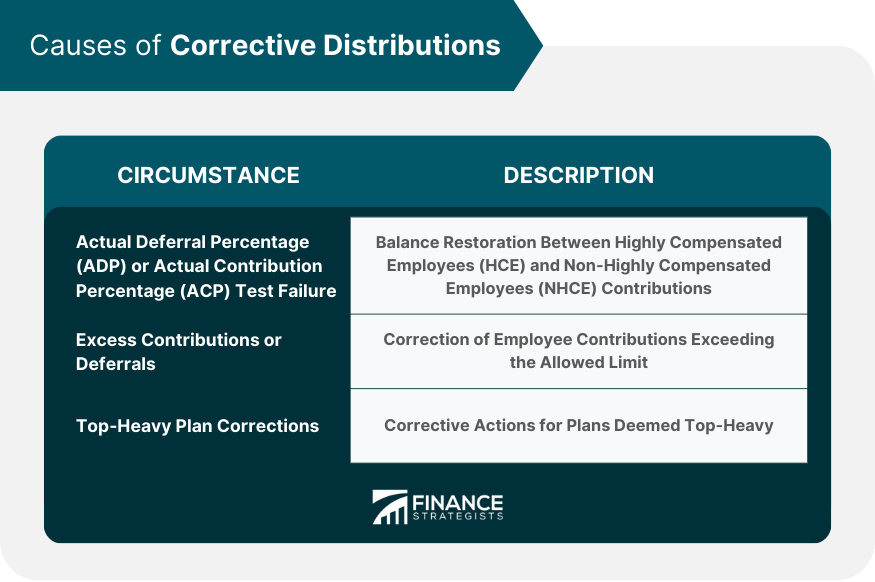

Causes of Corrective Distributions

Understanding the circumstances that lead to corrective distributions is crucial for plan administrators and participants alike.

Failure of ADP or ACP Tests

The Actual Deferral Percentage and Actual Contribution Percentage tests are compliance tests that ensure retirement plan contributions are proportionally distributed among all plan participants.

If a plan fails either of these tests, it means that highly compensated employees have contributed disproportionately more to the plan than non-highly compensated employees.

To restore balance between HCE and NHCE contributions, corrective distributions may be required. These distributions must be made to NHCEs and may be made in cash or in the form of additional contributions to their retirement accounts.

Excess Contributions or Deferrals

The Internal Revenue Service sets annual limits on the amount that employees can contribute to their retirement accounts.

If an employee exceeds these limits, corrective distribution may be necessary. This can occur when an employee has more than one retirement plan or when an employer makes contributions on behalf of an employee that exceed the annual limit.

Corrective distributions for excess contributions are subject to taxes and penalties and must be made by April 15th of the year following the plan year in which the excess contributions were made.

Top-Heavy Plan Corrections

A plan is considered top-heavy when more than 60% of the plan assets are held by HCEs. In this situation, corrective actions may be necessary to ensure that the plan benefits NHCEs as well.

These actions may include increased employer contributions, distribution of excess funds to NHCEs, or making contributions to a separate plan on behalf of NHCEs. Top-heavy plan corrections are subject to strict deadlines and failure to comply with these deadlines can result in penalties.

Tax Rules Behind Corrective Distributions

Understanding the tax implications of corrective distributions is crucial for plan administrators and participants alike.

Taxation for HCEs

HCEs who receive a corrective distribution must include the distributed amount in their gross income for the year in which the distribution is received.

The taxable portion of the distribution is subject to income tax in the year it is distributed, even if the excess contribution or deferral was made in a previous year.

HCEs may also be subject to an additional 10% penalty tax on the taxable portion of the distribution if they are under the age of 59½, unless an exception applies.

Tax Implications for Employers

Employer contributions made to correct plan failures may be tax-deductible, depending on the specific correction method used.

However, employers who fail to make corrective distributions within the 2½-month deadline may be subject to a 10% excise tax on the excess contributions. This tax penalty applies in addition to any income tax or penalties imposed on HCEs.

Other Methods for Correcting Plan Failures

There are several corrective actions that can be taken to address excess contributions, as well as imbalances in the plan.

Employer Contributions

Employers can make additional contributions to the retirement accounts of NHCEs to restore the balance between HCE and NHCE contributions. These contributions are not subject to the annual contribution limit and can be made in the form of a qualified non-elective contribution (QNEC) or a qualified matching contribution (QMAC).

A QNEC is a contribution made by the employer that is not based on employee contributions, while a QMAC is a contribution that matches employee contributions up to a certain percentage of their compensation.

Employer contributions are a tax-efficient way to correct plan imbalances and can be made in addition to regular contributions made by employees.

Plan Recharacterization

Excess contributions can be recharacterized as after-tax contributions if the plan allows. This means that excess contributions are treated as if they were made as after-tax contributions, and the earnings on those contributions are also taxed as such.

Recharacterization is an option for correcting plan imbalances and is particularly useful when there is a significant difference between the contribution limits for HCEs and NHCEs.

Plan Amendment

If a plan fails to meet the required tests for contributions, the plan can be amended to include a QNEC or QMAC to correct the failure. This allows the employer to make additional contributions to NHCEs to bring their contribution levels closer to those of HCEs.

Plan amendment is a proactive way to address potential plan imbalances and can help to prevent future corrective actions.

Conclusion

Corrective distribution is an important aspect of retirement plans that helps maintain compliance with non-discrimination rules set by the Employee Retirement Income Security Act (ERISA) and Internal Revenue Service (IRS) regulations.

Corrective distribution is necessary when there is an error or imbalance in the plan, such as when highly compensated employees (HCEs) receive excess contributions or deferrals, or when a plan fails compliance tests.

By implementing best practices, proactively addressing potential issues, and monitoring plan contributions, employers can prevent the need for corrective distributions and ensure a fair and equitable retirement plan for all employees.

Failure to comply with non-discrimination rules can result in significant financial penalties and legal liabilities, making it crucial for plan administrators to understand the causes and methods of corrective distribution.

Corrective Distribution FAQs

A corrective distribution is a type of distribution from a retirement account that is made to correct an error, such as an excess contribution or a failure to take a required minimum distribution (RMD).

A corrective distribution can be made when an error has been made in a retirement account, such as an excess contribution, a missed RMD, or a prohibited transaction.

If you don't take a corrective distribution for an excess contribution, you may be subject to a 6% excise tax on the excess amount for each year it remains in the account.

Generally, a corrective distribution cannot be rolled over to another retirement account because it is made to correct an error, not for a legitimate rollover.

A corrective distribution is generally reported on Form 1099-R, and any taxable portion of the distribution is subject to ordinary income tax in the year it is received.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.