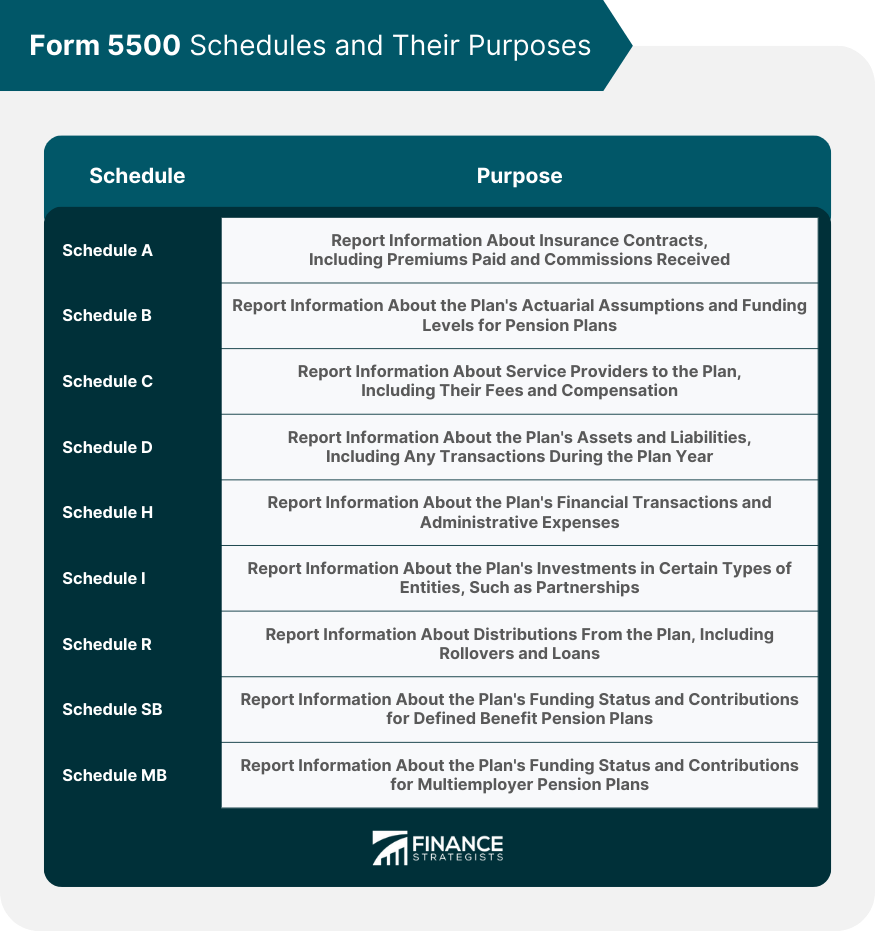

Form 5500 is a government-mandated annual report that must be filed by certain employee benefit plans, including pension plans, health plans, and welfare plans, with the Department of Labor (DOL) under the Employee Retirement Income Security Act (ERISA). It provides information about the plan's operations, financials, and basic plan information. The purpose of the form is to ensure compliance with ERISA regulations and to provide transparency to plan participants and the public. This report is crucial for ensuring transparency and compliance with the Employee Retirement Income Security Act. Employers, plan administrators, and other parties use Form 5500 to report financial details, including plan assets, liabilities, and participant data. The form also helps the Internal Revenue Service (IRS) and the Pension Benefit Guaranty Corporation (PBGC) enforce regulations and protect the interests of plan participants. Form 5500 must be filed by plan administrators and employers who offer pension or welfare benefit plans subject to ERISA. These plans typically include retirement plans, such as 401(k)s and defined benefit plans, as well as welfare plans that provide health, life, or disability benefits. Non-ERISA plans, such as certain church and government plans, are generally exempt from filing Form 5500. Small businesses with owner-only plans may be eligible to file the simpler Form 5500-EZ or Form 5500-SF, depending on specific plan characteristics and size. The Form 5500 series consists of three main forms, each tailored to specific types of plans or filers. Form 5500 is the standard form for most plans, while Form 5500-SF (Short Form) is available for small plans that meet certain criteria. Form 5500-EZ is designed for one-participant plans, such as those sponsored by sole proprietors or partnerships with no common-law employees. Each form in the series has its unique set of schedules and attachments that collect detailed information about plan operations, investments, and compliance with ERISA regulations. Filing the appropriate form is crucial for accurate reporting and avoiding penalties. Form 5500 filers may need to complete various schedules and attachments, depending on their plan's specific characteristics. Some common schedules include Schedule A (Insurance Information), Schedule B (Actuarial Information), Schedule C (Service Provider Information), and Schedule H (Financial Information). Other schedules, such as Schedule I (Financial Information for Small Plans), Schedule R (Retirement Plan Information), Schedule SB (Single-Employer Defined Benefit Plan Actuarial Information), and Schedule MB (Multiemployer Defined Benefit Plan and Certain Money Purchase Plan Actuarial Information), provide additional information on specific plan types or aspects. Form 5500 must be filed by the last day of the seventh month following the end of the plan year. For calendar-year plans, this means a filing deadline of July 31. Timely filing is essential to avoid penalties and maintain plan compliance with ERISA regulations. If a plan administrator or employer needs additional time to file, they can request an extension using Form 5558 (Application for Extension of Time to File Certain Employee Plan Returns) or take advantage of an automatic extension under specific circumstances. Form 5558 allows filers to request a one-time extension of up to 2.5 months for submitting Form 5500. To receive this extension, the request must be submitted before the original due date. Automatic extensions may be granted in certain situations, such as when an employer receives a filing extension for their federal income tax return. Failure to file Form 5500 on time can result in significant penalties from the DOL, IRS, and PBGC. To avoid these penalties, plan administrators and employers should file Form 5500 promptly and accurately, or request extensions when necessary. Some relief may be available for late filers through voluntary compliance programs, such as the Delinquent Filer Voluntary Compliance Program (DFVCP) and the Voluntary Fiduciary Correction Program (VFCP). Form 5500 plays a critical role in ensuring compliance with ERISA regulations. The information provided on the form and its schedules helps the DOL, IRS, and PBGC monitor plan operations, identify potential issues, and enforce applicable laws. Plan administrators and employers should carefully review their plans to ensure compliance with ERISA requirements, including fiduciary duties, reporting and disclosure obligations, and prohibited transactions. Failure to comply with ERISA can result in penalties, excise taxes, and even legal action. Certain large plans, typically those with 100 or more participants, are subject to annual audit requirements as part of the Form 5500 filing process. An independent qualified public accountant (IQPA) must perform these audits to verify the plan's financial information and adherence to ERISA regulations. There are some exceptions and waivers available for specific types of plans, such as those with fewer than 100 participants or those that hold certain types of investments. Understanding the audit requirements and securing a qualified auditor is essential for maintaining plan compliance and avoiding penalties. If a plan administrator or employer discovers an error on a previously filed Form 5500, they must file an amended return to correct the mistake. This process involves submitting a new Form 5500 with the corrected information and marking the "Amended Return" box on the form. Amended returns should be filed as soon as the error is discovered to avoid potential penalties and ensure the plan remains in compliance with ERISA regulations. It is crucial for plan administrators and employers to review their filings carefully and promptly address any errors or discrepancies. The DOL and IRS offer voluntary correction programs for plan administrators and employers who discover errors in their Form 5500 filings or other compliance issues. The Delinquent Filer Voluntary Compliance Program (DFVCP) allows late filers to avoid or reduce penalties by submitting overdue forms and paying a reduced penalty. The Voluntary Fiduciary Correction Program (VFCP) enables plan fiduciaries to correct certain ERISA violations and avoid potential penalties or enforcement actions. Participating in these programs can help plan administrators and employers maintain compliance and minimize the impact of errors or late filings. The DOL, IRS, and PBGC provide comprehensive instructions for completing Form 5500 and its associated schedules. These instructions are an essential resource for plan administrators and employers to ensure accurate reporting and compliance with ERISA regulations. Understanding the requirements and using the instructions as a guide can help plan administrators and employers avoid common errors, reduce the risk of penalties, and maintain plan compliance. The EFAST2 Help Desk is a valuable resource for plan administrators and employers who have questions or need assistance with the electronic filing of Form 5500. The Help Desk provides support for technical issues, filing requirements, and troubleshooting. By utilizing the EFAST2 Help Desk, plan administrators and employers can ensure a smooth filing process and avoid potential issues or delays in submitting their Form 5500. Working with experienced ERISA consultants and advisors can help plan administrators and employers navigate the complex world of employee benefits and ensure compliance with applicable laws and regulations. These professionals can provide guidance on plan design, administration, and reporting, as well as assistance with audits and corrections. By engaging with knowledgeable ERISA consultants and advisors, plan administrators and employers can proactively address potential issues, maintain plan compliance, and protect the interests of plan participants. These experts can be invaluable assets in managing the various responsibilities and obligations associated with offering pension and welfare benefit plans subject to ERISA. Form 5500 is a crucial tool for ensuring compliance with the Employee Retirement Income Security Act and promoting transparency in employee benefit plans. Its components, which include basic plan information, financial statements, and schedules, provide a comprehensive overview of the plan's operations, financials, and other details. Plan administrators must ensure that they file the appropriate form and schedules on time, as failure to do so can result in significant penalties and legal action by the Department of Labor. The filing deadlines for Form 5500 vary depending on the type of plan, but all must be filed electronically using the EFAST2 system. Compliance with ERISA regulations and timely and accurate filing of Form 5500 is crucial for protecting plan participants and avoiding penalties.What Is Form 5500?

Parties Required to File Form 5500

Components of Form 5500

Form 5500 Series

Schedules and Attachments

Form 5500 Filing Deadlines and Extensions

Standard Filing Deadline

Extension Requests and Penalties for Late Filing

The Role of Form 5500 in Compliance and Auditing

Compliance With ERISA

Audit Requirements for Large Plans

Amending and Correcting Form 5500

Amended Returns

Correction Program

Resources and Assistance Related To Form 5500

Form 5500 Instructions

EFAST2 Help Desk

ERISA Consultants and Advisors

Final Thoughts

Form 5500 FAQs

Form 5500 is a government-mandated annual report that employee benefit plans must file with the Department of Labor (DOL).

All employee benefit plans that fall under the Employee Retirement Income Security Act (ERISA) must file Form 5500, including pension plans, health plans, and welfare plans.

Form 5500 has three main components: the basic plan information, the financial information, and the schedules, which provide additional details about the plan's operations.

The deadline for filing Form 5500 depends on the type of plan and its size. Generally, the deadline is the last day of the seventh month after the end of the plan year.

Failure to file Form 5500 can result in substantial penalties and fines, as well as potential legal action by the Department of Labor. It is important to ensure timely and accurate filing to avoid these consequences.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.