A Plan Committee Meeting in retirement planning typically refers to a gathering of individuals responsible for overseeing a retirement plan. The committee may consist of plan sponsors, trustees, or other designated fiduciaries who have a legal responsibility to act in the best interest of plan participants. During a Plan Committee Meeting, the group may review and discuss the plan's investment performance, fees, and administrative procedures. They may also consider changes to the plan, such as adding new investment options or modifying the employer contribution structure. The goal of the meeting is to ensure that the retirement plan is being managed effectively and in compliance with regulatory requirements. By regularly reviewing and assessing the plan's performance, the committee can help ensure that participants are provided with the tools and resources they need to save and invest for their retirement. Plan committee members should consist of a diverse range of individuals who have a vested interest in the success of the company's retirement planning efforts. This may include members from various departments and levels within the organization. Inviting financial advisors to the meeting can provide invaluable expert insights and recommendations for the committee to consider when evaluating and updating retirement plan offerings. Human resources representatives play a crucial role in managing employee benefits, including retirement plans. Their input on employee needs and feedback is essential in making informed decisions. Including company executives in the meeting can ensure alignment with broader organizational goals and provide the necessary support for any proposed changes to the retirement plan. The meeting should begin with a formal call to order, followed by an overview of the meeting's objectives and agenda. Review and approval of the minutes from the previous meeting ensure accurate documentation of decisions and actions taken. Committee members should discuss any recent changes in the regulatory environment, market trends, and employee feedback that may impact retirement planning efforts. Financial advisors can provide valuable information on retirement planning best practices, risk management strategies, and recommendations for plan adjustments. A comprehensive review of the existing retirement plan options, such as 401(k) plans, pension plans, IRAs, and other investment vehicles, will help the committee identify areas for improvement. Committee members should engage in a robust discussion of potential plan improvements, including enhancing employer matching contributions, expanding investment options, and implementing automatic enrollment features. The committee should explore various strategies to educate employees on retirement planning, such as online resources, on-site workshops, and one-on-one financial counseling. The meeting should conclude with a clear list of action items and next steps, including assigning responsibilities and establishing timelines for completion. Staying abreast of changes in retirement plan regulations is crucial for ensuring compliance and avoiding potential legal issues. The committee should discuss any recent or upcoming regulatory changes that may impact the company's retirement plan offerings and make necessary adjustments. Understanding market trends and the performance of investment options can help the committee make informed decisions about plan adjustments. Financial advisors can provide expert analysis of current trends and recommend changes to optimize investment returns for employees. Addressing employee feedback and concerns is essential for maintaining a successful retirement plan. Human resources representatives can share insights from employees, allowing the committee to address any issues and make improvements where necessary. Financial advisors should present information on retirement planning best practices, including strategies for maximizing investment returns, diversification, and risk management. This information can help the committee make informed decisions about potential plan adjustments. To ensure employees have a secure financial future, it is essential to discuss risk management strategies. Financial advisors can present various approaches to managing risk within retirement plans, such as rebalancing portfolios, investing in low-risk assets, and offering target-date funds. Based on their expert analysis, financial advisors can provide specific recommendations for plan adjustments. The committee should carefully consider these recommendations and determine which adjustments are best suited for the company and its employees. The committee should evaluate the effectiveness of the company's 401(k) plan, including investment options, fees, and employer-matching contributions. If the company offers a pension plan, the committee should review its funding status, investment performance, and any potential risks associated with the plan. Discuss the role of individual retirement accounts (IRAs) within the company's retirement planning strategy, including the potential benefits and drawbacks of offering a company-sponsored IRA option. The committee should consider other investment vehicles that may enhance employees' retirement planning options, such as annuities, real estate investment trusts (REITs), or exchange-traded funds (ETFs). Implementing online resources and webinars can help educate employees about retirement planning and empower them to make informed decisions about their financial future. Offering on-site workshops and seminars can provide employees with in-depth information about retirement planning, investment options, and risk management strategies. Providing access to one-on-one financial counseling can help employees address their unique financial needs and develop personalized retirement planning strategies. Keeping employees informed about changes to the company's retirement plan offerings and providing regular updates on investment performance can encourage ongoing engagement in retirement planning efforts. After identifying the necessary adjustments to the company's retirement plan offerings, the committee should assign responsibilities to specific individuals or departments for implementing these changes. The committee should establish realistic timelines for completing action items, ensuring that necessary adjustments are implemented efficiently and effectively. Regular follow-up meetings can help the committee monitor the progress of action items, address any challenges that arise, and make additional adjustments as needed. By conducting a comprehensive plan committee meeting focused on retirement planning, companies can optimize their retirement plan offerings and ensure employees have the necessary resources and support to achieve a secure financial future. To ensure the ongoing success of the company's retirement plan offerings, the committee should establish key performance indicators (KPIs) to track and evaluate the effectiveness of the plan. These may include: Participation rates Employee satisfaction Investment performance Plan fees and costs The committee should regularly monitor these KPIs and report on their progress at each meeting. By keeping a close eye on these metrics, the committee can identify areas for improvement and take timely action to address any issues. It is crucial for the committee to compare the company's retirement plan offerings to industry standards and best practices. This benchmarking process can help identify potential gaps in the plan and inform decisions about plan adjustments and enhancements. To maintain a competitive and effective retirement plan, the committee should stay informed of industry trends and best practices. This may involve attending industry conferences, subscribing to relevant publications, and consulting with financial advisors and other experts. The committee should be prepared to adapt the company's retirement plan offerings in response to changing employee needs and demographics. As the workforce evolves, it is essential to ensure that the plan remains relevant and supportive of employees' retirement planning goals. The committee should explore the use of technology to improve employees' retirement planning experience. This may include offering online tools and resources, utilizing digital communication platforms, or implementing robo-advisory services to provide personalized investment advice. A successful Plan Committee Meeting for retirement planning requires a structured approach, including key sections for attendees, agenda items, and specific discussion points. By reviewing retirement planning updates, receiving expert insights from financial advisors, evaluating current retirement plan options, and discussing potential plan improvements, the committee can create an effective retirement plan that meets employees' needs. The committee should also monitor and evaluate the success of the retirement plan, continuously adapt to changing trends and employee needs, and leverage technology to improve the retirement planning experience. By following these best practices, companies can provide a supportive retirement planning environment that contributes to employees' financial well-being and a stronger overall organization.Definition of Plan Committee Meeting

Attendees of the Plan Committee Meeting

Plan Committee Members

Financial Advisors

Human Resources Representatives

Company Executives

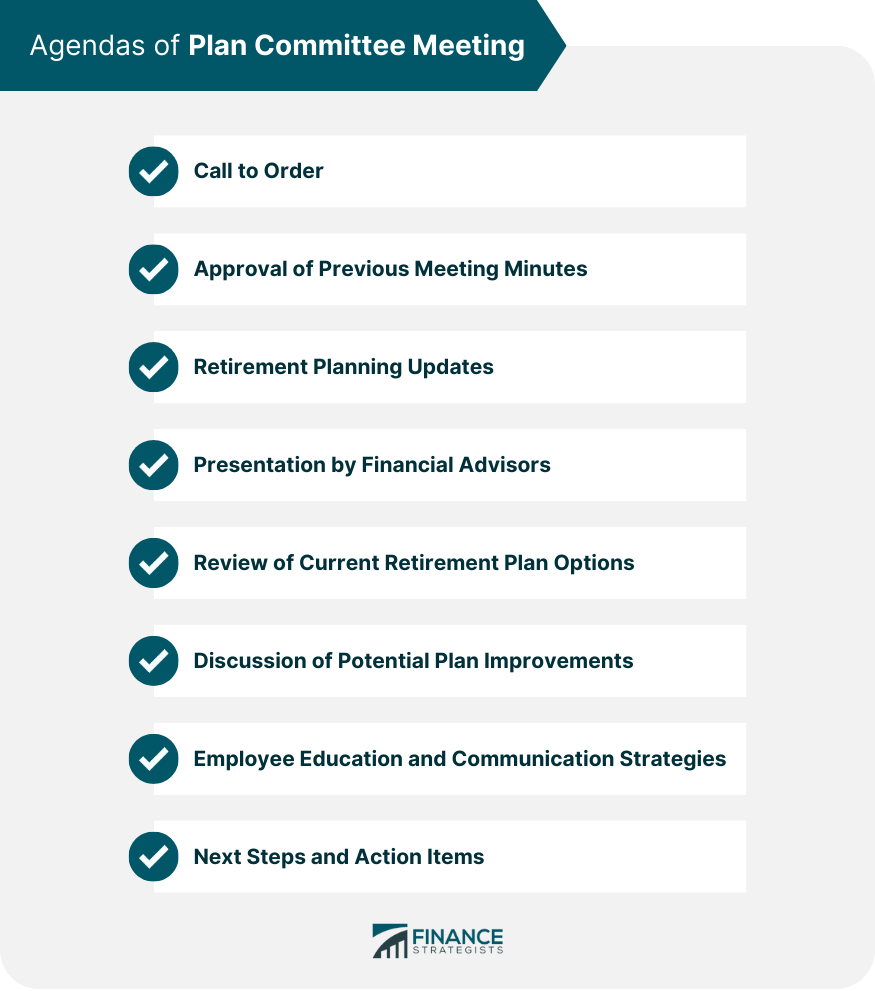

Agendas of Plan Committee Meeting

Call to Order

Approval of Previous Meeting Minutes

Retirement Planning Updates

Presentation by Financial Advisors

Review of Current Retirement Plan Options

Discussion of Potential Plan Improvements

Employee Education and Communication Strategies

Next Steps and Action Items

Retirement Planning Updates of Plan Committee Meeting

Changes in the Regulatory Environment

Market Trends and Investment Performance

Employee Feedback and Concerns

Presentation by Financial Advisors in Plan Committee Meeting

Overview of Retirement Planning Best Practices

Risk Management Strategies

Recommendations for Plan Adjustments

Review of Current Retirement Plan Options in Plan Committee Meeting

401(k) Plans

Pension Plans

IRAs

Other Investment Vehicles

Employee Education and Communication Strategies in Plan Committee Meeting

Online Resources and Webinars

On-Site Workshops and Seminars

One-On-One Financial Counseling

Regular Updates and Announcements

Next Steps and Action Items in Plan Committee Meeting

Assigning Responsibilities for Implementing Changes

Establishing Timelines for Completion

Scheduling Follow-up Meetings

Monitoring and Evaluation of Retirement Plan Success

Key Performance Indicators

Regular Monitoring and Reporting

Benchmarking Against Industry Standards

Continuous Improvement and Adaptation of Plan Committee Meeting

Staying Informed of Industry Trends and Best Practices

Adapting to Changing Employee Needs

Leveraging Technology to Enhance Retirement Planning

Conclusion

Plan Committee Meeting FAQs

To structure Plan Committee Meeting Minutes effectively, include key sections such as attendees, agenda items, retirement planning updates, presentation by financial advisors, review of current retirement plan options, discussion of potential plan improvements, employee education, and communication strategies, and next steps with action items.

The retirement planning updates section of the Plan Committee Meeting Minutes should cover changes in the regulatory environment, market trends and investment performance, and employee feedback and concerns related to the company's retirement plan offerings.

Financial advisors can provide valuable insights in Plan Committee Meeting Minutes by presenting information on retirement planning best practices, risk management strategies, and specific recommendations for plan adjustments based on their expert analysis of the company's retirement plan options.

Plan Committee Meeting Minutes should document various employee education and communication strategies, such as online resources and webinars, on-site workshops and seminars, one-on-one financial counseling, and regular updates and announcements about the company's retirement plan offerings.

Plan Committee Meeting Minutes can help track progress by documenting the next steps and action items, assigning responsibilities for implementing changes, establishing timelines for completion, and scheduling follow-up meetings to monitor progress and make additional adjustments as needed.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.