A plan document restatement is a process of revising and updating an employer-sponsored retirement or welfare benefit plan document to reflect changes in laws, regulations, or plan provisions. This process is essential for maintaining compliance with legal and regulatory requirements, as well as ensuring that the plan remains effective and serves the best interests of the participants. Plan document restatements are often necessary due to changes in federal or state laws and regulations governing retirement and welfare benefit plans. As laws and regulations evolve, plan sponsors must update their plan documents to remain compliant and ensure that their plans meet current legal standards. Amendments to a plan, such as changes in eligibility requirements, benefit structures, or investment options, may necessitate a restatement. A restatement ensures that the plan document accurately reflects the amended provisions and provides clear guidance to plan administrators and participants. When a company acquires or merges with another company, its retirement or welfare benefit plans may need to be combined or otherwise restructured. A restatement of the plan documents can help establish the new plan provisions and maintain compliance with applicable laws and regulations. Mistakes or inconsistencies in previous plan documents may be discovered during regular reviews or audits. Restating the plan documents allows for the correction of these errors and ensures that the plan remains compliant and properly administered. A restatement can improve the clarity and consistency of plan documents, making them easier for plan administrators and participants to understand and navigate. A full restatement involves completely rewriting the plan document to incorporate all changes, updates, and corrections. This type of restatement is typically required when there are extensive changes or the plan document is outdated or contains numerous errors. A partial restatement involves revising specific sections of the plan document to address particular changes or updates. This type of restatement is appropriate when the plan document is generally compliant and accurate but requires specific modifications. The first step in the restatement process is recognizing the need for a restatement, whether due to legal or regulatory changes, plan amendments, mergers or acquisitions, errors, or clarity and consistency concerns. Plan sponsors should gather all relevant documentation and data, such as current plan documents, plan amendments, applicable laws and regulations, and participant information. Working with legal counsel, benefits consultants, or third-party administrators can provide valuable expertise and guidance during the restatement process. The restated plan document should be carefully drafted to incorporate all required changes, updates, and corrections while maintaining compliance with applicable laws and regulations. The restated plan document should be thoroughly reviewed by legal counsel, benefits consultants, or third-party administrators to ensure its accuracy and compliance. Plan sponsors should then approve the restated plan document. Once approved, the restated plan document should be implemented and communicated to plan administrators and participants. To maintain tax-qualified status, certain types of retirement plans may require IRS approval of their restated plan documents. Plan sponsors should consult with legal counsel or other professionals to ensure that their restated plan documents meet IRS requirements. Restated plan documents must also comply with DOL regulations governing retirement and welfare benefit plans. In addition to IRS and DOL requirements, restated plan documents should comply with any other applicable federal and state laws governing retirement and welfare benefit plans. Plan sponsors should regularly review and update their plan documents to ensure compliance with current laws and regulations, as well as to address any changes in plan provisions or participant needs. Maintaining clear and accurate records of plan documents, amendments, and relevant legal and regulatory materials is essential for ensuring compliance and facilitating the restatement process. Communicating changes in plan documents to participants is crucial for maintaining trust and promoting understanding of the plan's provisions. Plan sponsors should provide clear, concise, and timely information about any restatements and their implications for participants. Regular audits and assessments can help identify potential issues with plan documents, such as errors, inconsistencies, or noncompliance with laws and regulations. These reviews can also help ensure that the plan remains effective and meets the needs of its participants. Failure to maintain compliant plan documents can result in legal penalties and fines from federal and state agencies, such as the IRS or DOL. Noncompliant plan documents can jeopardize a retirement plan's tax-qualified status, which can have significant financial consequences for both plan sponsors and participants. Plan participants may bring lawsuits against plan sponsors for failure to maintain compliant plan documents, potentially resulting in significant legal costs and damages. Failure to maintain compliant plan documents can damage a company's reputation, potentially affecting its ability to attract and retain employees, customers, and investors. Plan Document Restatement is a crucial process that involves revising and updating retirement or welfare benefit plan documents to ensure compliance with laws, regulations, and plan provisions. This process is necessary when there are changes in legal requirements, plan amendments, mergers or acquisitions, errors in previous documents, or a need for enhanced clarity and consistency. Organizations must prioritize timely and accurate restatement processes to maintain compliant and effective benefit plans. By adhering to best practices such as regular reviews, maintaining accurate records, effective communication with participants, and conducting periodic audits, organizations can protect their interests and ensure the continued success of their benefit plans. Failure to do so can result in legal penalties, loss of tax-qualified status, participant lawsuits, and reputational damage.Definition of Plan Document Restatement

Reasons for Plan Document Restatement

Changes in Laws and Regulations

Plan Amendments

Plan Mergers or Acquisitions

Correcting Errors in Previous Plan Documents

Enhancing Clarity and Consistency

Types of Plan Document Restatement

Full Restatement

Partial Restatement

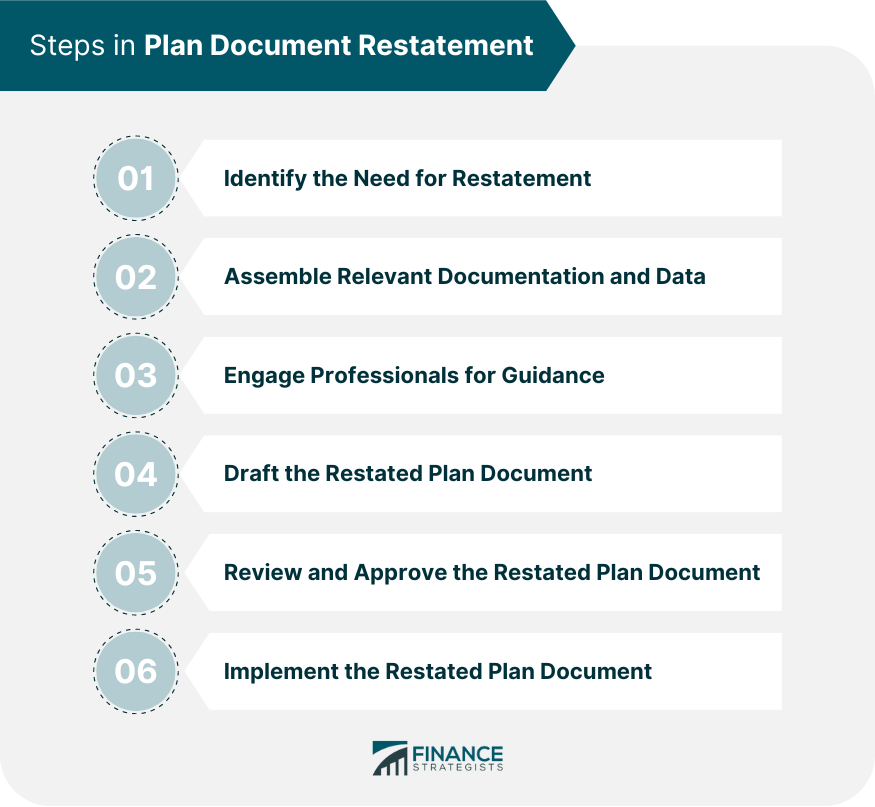

Restatement Process

Identifying the Need for Restatement

Assembling Relevant Documentation and Data

Engaging Professionals for Guidance

Drafting the Restated Plan Document

Reviewing and Approving the Restated Plan Document

Implementing the Restated Plan Document

Compliance Considerations

Internal Revenue Service (IRS) Approval

Department of Labor (DOL) Regulations

Other Applicable Federal and State Laws

Best Practices for Plan Document Restatement

Regularly Reviewing and Updating Plan Documents

Maintaining Clear and Accurate Records

Ensuring Effective Communication with Participants

Conducting Periodic Audits and Assessments

Potential Consequences of Not Conducting Plan Document Restatement

Legal Penalties and Fines

Loss of Tax-Qualified Status

Participant Lawsuits

Reputation Damage

Final Thoughts

Plan Document Restatement FAQs

A Plan Document Restatement is the process of revising and updating an employer-sponsored retirement or welfare benefit plan document to reflect changes in laws, regulations, or plan provisions. It is essential for maintaining compliance with legal and regulatory requirements and ensuring that the plan remains effective and serves the best interests of the participants.

A Plan Document Restatement should be performed when there are changes in federal or state laws and regulations governing retirement and welfare benefit plans, plan amendments, plan mergers or acquisitions, errors discovered in previous plan documents, or when enhancing clarity and consistency in the plan documents.

The key steps in the Plan Document Restatement process include identifying the need for restatement, assembling relevant documentation and data, engaging professionals for guidance, drafting the restated plan document, reviewing and approving the restated plan document, and implementing the restated plan document.

Organizations can ensure compliance by regularly reviewing and updating plan documents, maintaining clear and accurate records, engaging legal counsel or benefits consultants for guidance, and submitting the restated plan documents for approval by relevant authorities, such as the Internal Revenue Service (IRS) and the Department of Labor (DOL).

The potential consequences of not conducting a Plan Document Restatement when necessary include legal penalties and fines, loss of tax-qualified status, participant lawsuits, and damage to the organization's reputation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.