The Plan Entry Date in retirement planning refers to the date when an individual begins participating in a retirement plan, such as a 401(k) or a pension plan. This date is important because it determines when the individual can start making contributions to the plan and when they become eligible for certain benefits, such as employer-matching contributions. For example, if an individual's plan entry date is January 1st and their employer has a matching contribution policy, the individual would be eligible to receive matching contributions for any contributions made after that date. It is important to understand your plan entry date when creating a retirement plan because it affects how much time you have to save for retirement and when you will become eligible for certain benefits. Several factors may influence the decision of when to enter a retirement plan, including personal financial situation, age, retirement goals, and market conditions. Individuals must carefully consider these factors to select an appropriate Plan Entry Date that aligns with their unique circumstances and objectives. Before deciding on a Plan Entry Date, individuals should review their current financial situation, including income, expenses, and existing savings. This assessment helps identify any financial gaps that need to be addressed before beginning retirement savings contributions. Market conditions and economic trends can also impact the choice of a Plan Entry Date. Individuals should consider factors such as interest rates, inflation, and market performance when determining the best time to start contributing to their retirement plan. Starting retirement savings early offers the advantage of a longer investment horizon, allowing for greater compounding and potentially higher returns. However, it may also involve sacrificing current spending and lifestyle choices. Late entry, on the other hand, may require larger contributions and higher investment risks to catch up on lost time. Weighing these factors is essential when choosing a Plan Entry Date. The earlier an individual starts saving for retirement, the more time their investments have to grow through compounding. This means that even small contributions made early can lead to significant wealth accumulation over time. The Plan Entry Date can also impact tax benefits and contribution limits associated with various retirement savings plans. Starting early can maximize tax advantages, while late entry may limit the ability to take full advantage of available tax benefits and contribution limits. A well-chosen Plan Entry Date can also affect the level of investment risk and potential return. An early entry allows individuals to invest more conservatively, as they have a longer time horizon to reach their retirement goals. Conversely, a late entry may necessitate taking on higher investment risks in an attempt to accelerate wealth accumulation and make up for lost time. As life circumstances change and retirement goals evolve, individuals may need to adjust their Plan Entry Date. Regularly reviewing and updating the retirement plan ensures that it remains aligned with an individual's financial situation and objectives. Major life events, such as a job change, marriage, or the birth of a child, can significantly impact an individual's financial situation and retirement goals. In such cases, adjusting the Plan Entry Date may be necessary to ensure a successful retirement plan. Unexpected events, such as job loss, health issues, or market fluctuations, can also impact the choice of a Plan Entry Date. Being prepared for such contingencies and having a flexible retirement plan can help individuals navigate these challenges and maintain their retirement savings progress. After selecting a Plan Entry Date and starting contributions, it is essential to regularly monitor retirement savings progress. Tracking investment performance and assessing the adequacy of savings can help individuals make adjustments to their retirement plans if needed. Over time, an individual's investment portfolio may become unbalanced due to market fluctuations and changing risk tolerance. Periodically rebalancing investments and reassessing risk levels can help maintain an appropriate asset allocation and ensure a successful retirement plan. As retirement approaches, individuals should focus on fine-tuning their retirement plans and preparing for a smooth transition. This may involve consolidating investments, reviewing withdrawal strategies, and developing a post-retirement budget. The Plan Entry Date plays a crucial role in retirement planning as it sets the foundation for future contributions, investment returns, and overall retirement savings. Choosing an appropriate Plan Entry Date involves considering the personal financial situation, market conditions, and retirement goals. Starting early can offer the advantages of a longer investment horizon and the power of compounding, while late entry may require higher investment risks to catch up on lost time. Regularly reviewing and adjusting the retirement plan, monitoring savings progress, and managing investment risk further ensure a successful and comfortable retirement. By following these strategies, individuals can make informed decisions about their Plan Entry Date and achieve their retirement goals with confidence.What Is a Plan Entry Date?

Factors Affecting the Choice of Plan Entry Date

Strategies for Choosing a Plan Entry Date

Assessing Personal Financial Situation and Goals

Considering External Factors and Market Conditions

Weighing the Advantages and Disadvantages of Early vs Late Entry

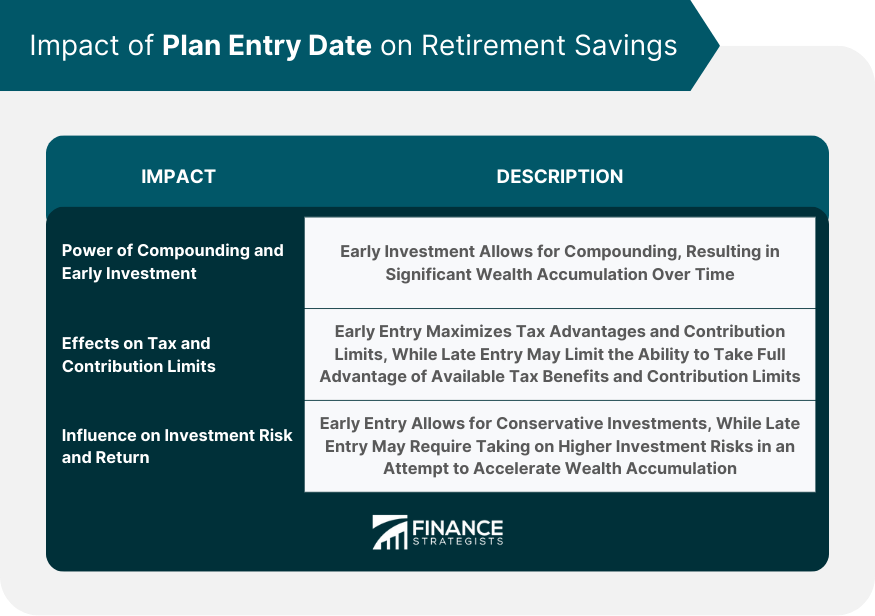

Impact of Plan Entry Date on Retirement Savings

Power of Compounding and Early Investment

Effects on Tax and Contribution Limits

Influence on Investment Risk and Return

Adjusting the Plan Entry Date

Periodic Reviews and Updates

Making Changes in Response to Life Events

Preparing for Unforeseen Circumstances

Post-Plan Entry Date Considerations

Monitoring Retirement Savings Progress

Rebalancing Investments and Managing Risk

Ensuring a Successful Transition into Retirement

Conclusion

Plan Entry Date FAQs

The Plan Entry Date is the date when an individual starts contributing to their retirement savings plan. It is crucial in retirement planning as it sets the foundation for future contributions, investment returns, and overall retirement savings. The earlier the Plan Entry Date, the more time an individual has to accumulate wealth and benefit from the power of compounding.

The Plan Entry Date affects the growth of retirement savings through the power of compounding. An earlier entry allows more time for investments to grow and compound, leading to potentially higher returns and wealth accumulation. Conversely, a late entry might require larger contributions and higher investment risks to catch up on lost time.

To choose the right Plan Entry Date, you should consider your personal financial situation, retirement goals, and market conditions. Assess your current income, expenses, and savings, and weigh the advantages and disadvantages of early vs. late entry. Additionally, consider external factors, such as interest rates, inflation, and market performance, to determine the best time to start contributing to your retirement plan.

Yes, you can adjust your Plan Entry Date as needed to accommodate changes in your life circumstances and financial goals. Regularly reviewing and updating your retirement plan, making adjustments in response to significant life events, and being prepared for unforeseen circumstances can help you maintain your retirement savings progress.

After choosing a Plan Entry Date and starting your retirement savings plan, you should regularly monitor your savings progress, rebalance investments, and manage risks. Ensure a successful transition into retirement by fine-tuning your plan, consolidating investments, reviewing withdrawal strategies, and developing a post-retirement budget.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.