What Is the Top-Heavy Test?

The Top-Heavy Test is a regulation that applies to certain retirement plans in the United States, such as 401(k) plans.

The test is designed to ensure that highly compensated employees (HCEs) do not disproportionately benefit from the plan over non-highly compensated employees (NHCEs).

In essence, it determines whether a retirement plan is "top-heavy" by calculating the Top-Heavy Ratio, which is the total value of plan assets held by key employees (owners, officers, and highly compensated employees) divided by the total value of plan assets.

If the Top-Heavy Ratio exceeds 60%, the plan is considered top-heavy.

Understanding Top-Heavy Plans

A Top-Heavy Plan is a retirement plan where the total value of assets held by key employees (owners, officers, and highly compensated employees) exceeds 60% of the plan's total assets.

These plans are subject to additional requirements to ensure that non-key employees are adequately benefited. Key features of Top-Heavy Plans include eligibility, vesting, and contribution requirements.

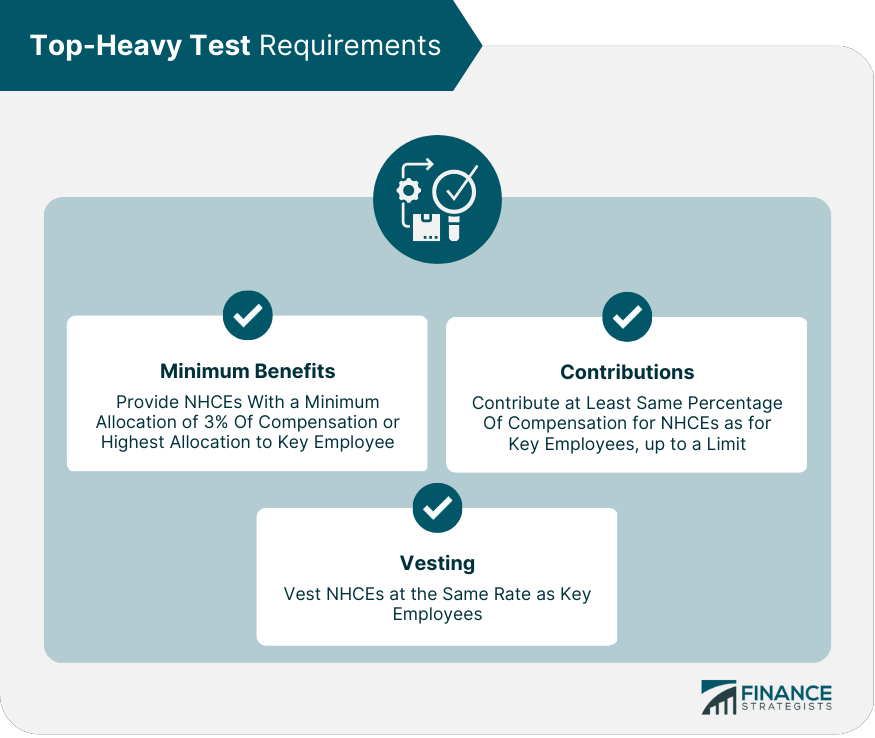

Top-Heavy Test Requirements

To determine whether a plan is top-heavy, the Top-Heavy Test must be performed annually. The test involves calculating the Top-Heavy Ratio, which is the total value of plan assets held by key employees divided by the total value of plan assets.

If the Top-Heavy Ratio exceeds 60%, the plan is considered top-heavy. The plan must also meet minimum benefit, vesting, and contribution requirements to avoid penalties.

Minimum Benefits Requirements

To satisfy the minimum benefits requirement, a top-heavy plan must provide NHCEs with a minimum allocation equal to the lesser of 3% of their compensation or the highest allocation provided to a key employee.

Vesting Requirements

Top-heavy plans must meet specific vesting requirements to ensure that NHCEs are not disadvantaged compared to key employees. A plan must vest NHCEs in their benefits at a rate that is at least as fast as key employees.

Contribution Requirements

Top-heavy plans must meet specific contribution requirements to ensure that NHCEs receive adequate contributions to their accounts. Plans must contribute at least the same percentage of compensation for NHCEs as for key employees, up to a certain limit.

Top-Heavy Plan Requirements

In addition to the Top-Heavy Test requirements, top-heavy plans must meet other plan requirements. These requirements include automatic enrollment features, matching contributions, safe harbor contributions, and employer contribution limits.

Automatic Enrollment Features

A plan must automatically enroll employees in the plan and set default contribution rates to encourage employee participation.

Matching Contributions Requirements

Employers may offer matching contributions to employees who make contributions to their retirement accounts. These contributions must be nondiscriminatory and satisfy the ADP and ACP tests.

Safe Harbor Contributions Requirements

Safe Harbor Contributions are another way to satisfy the Top-Heavy Test requirements. Employers can make safe harbor contributions, which are immediately vested and satisfy the minimum benefits requirements.

Employer Contribution Limits

Employers can contribute up to a certain limit to retirement plans each year. These limits vary depending on the type of plan.

Top-Heavy Plan and Nondiscrimination Testing

Nondiscrimination testing ensures that plans do not favor key employees over NHCEs. The two primary nondiscrimination tests are the ADP and ACP tests. These tests ensure that contributions to the plan are made on a nondiscriminatory basis.

ADP Testing

The ADP test ensures that elective deferrals made by HCEs are proportional to those made by NHCEs. If the test fails, corrective actions must be taken.

ACP Testing

The ACP test ensures that matching contributions and after-tax contributions are proportional between HCEs and NHCEs. If the test fails, corrective actions must be taken.

General Nondiscrimination Testing

In addition to the ADP and ACP tests, general nondiscrimination testing ensures that benefits are provided on a nondiscriminatory basis. Plans must also meet coverage requirements, which ensure that a sufficient number of NHCEs are covered by the plan.

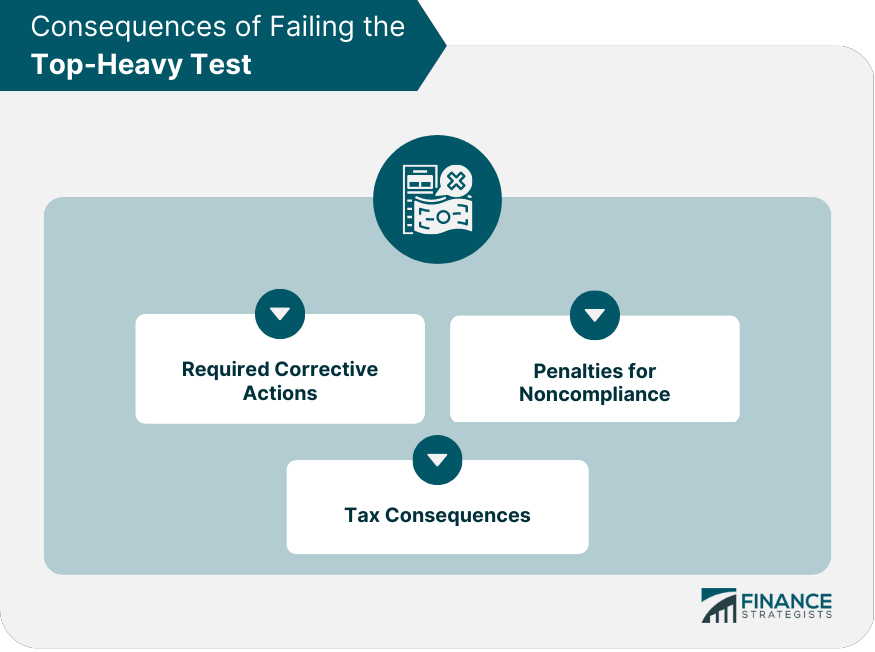

Consequences of Failing the Top-Heavy Test

Failing to satisfy the Top-Heavy Test requirements can result in penalties and negative tax consequences for employers. Consider the following:

Required Corrective Actions

If a plan fails the Top-Heavy Test, the employer must take corrective actions to ensure that the plan meets the requirements. Corrective actions may include increasing contributions for NHCEs or decreasing contributions for key employees.

Tax Consequences

The employer may be subject to negative tax consequences. For example, contributions made by highly compensated employees may become taxable, and the employer may lose tax deductions on certain contributions.

Penalties for Noncompliance

Employers who fail to comply with the Top-Heavy Test requirements may be subject to penalties. The Internal Revenue Service (IRS) may assess penalties of up to $100 per day for each affected employee until the plan is brought into compliance.

Top-Heavy Plan Compliance Strategies

Employers can take several steps to ensure compliance with the Top-Heavy Test and other plan requirements. Strategies include increasing benefits for NHCEs, making safe harbor contributions, and adjusting plan design.

Increasing Benefits for Non-key Employees

Employers can increase benefits for NHCEs to satisfy the minimum benefits requirement and improve plan participation.

Safe Harbor Contributions

Safe Harbor Contributions can help employers satisfy the minimum benefits requirement and avoid Top-Heavy status.

Plan Design Changes

Employers can make plan design changes, such as altering the vesting schedule or contribution structure, to meet Top-Heavy Test requirements.

Conclusion

The Top-Heavy Test is an essential component of retirement plan compliance that helps to ensure that all employees are adequately benefited. Employers must perform the test annually and meet specific requirements to avoid penalties and negative tax consequences.

Noncompliance with Top-Heavy Test regulations could lead to penalties, negative tax consequences, and potential legal action.

Therefore, it is essential for employers to stay up-to-date with the latest regulations and guidance to ensure plan compliance and avoid potential issues.

To comply with the Top-Heavy Test requirements, employers can take several steps, such as increasing benefits for NHCEs, making safe harbor contributions, and adjusting plan design.

Employers should consider working with a qualified retirement plan professional who can provide guidance on compliance and design strategies that will ensure that their retirement plans are effective and compliant.

With careful planning and compliance, employers can help their employees to achieve their retirement goals while also avoiding penalties and negative tax consequences associated with noncompliance.

Top-Heavy Test FAQs

The Top-Heavy Test is a requirement under the Internal Revenue Code that determines whether a qualified retirement plan is considered "top-heavy" based on the percentage of plan assets attributable to key employees.

Key employees for the Top-Heavy Test typically include officers, owners with more than 5% ownership interest in the company, and highly compensated employees. The definition of key employees may vary depending on the plan's terms and the applicable tax year.

If a plan fails the Top-Heavy Test, the plan may be required to make additional contributions to the accounts of non-key employees to bring the plan into compliance with the top-heavy rules. These contributions are often referred to as qualified non-elective contributions (QNECs) or qualified matching contributions (QMACs).

The Top-Heavy Test is calculated by determining the percentage of plan assets that are attributable to key employees as of the last day of the plan year. If this percentage exceeds 60%, the plan is considered top-heavy.

No, not all types of retirement plans are subject to the Top-Heavy Test. The test applies only to defined contribution plans, such as 401(k) plans, profit-sharing plans, and money purchase pension plans. Defined benefit plans are not subject to the Top-Heavy Test.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.