A Waiver of Annual Notice is a formal exemption granted to plan sponsors, allowing them to forego providing certain annual notices to plan participants under specific circumstances. The waiver aims to reduce administrative burdens and costs for plan sponsors when there have been no significant changes to the plan that would warrant providing updated information to participants. The waiver of annual notices is subject to various federal laws and regulations, including the Employee Retirement Income Security Act (ERISA) and Internal Revenue Code (IRC) provisions, which govern the requirements for providing annual notices. Summary Annual Reports (SAR): A summary of the financial status and activities of the retirement plan. Fee Disclosure Notices: Information on plan fees and expenses charged to participants. Qualified Default Investment Alternative (QDIA) Notices: Information about the plan's default investment option for participants who do not make an investment election. Safe Harbor Notices: Information about the plan's safe harbor provisions, which can affect employer contributions and vesting schedules. Annual notices provide plan participants with essential information about their retirement plan, helping them make informed decisions about their investments and understand their rights and responsibilities. Plan sponsors and administrators are responsible for providing accurate and timely annual notices to plan participants, ensuring compliance with applicable laws and regulations. A waiver of annual notice may be granted under certain conditions, such as: No significant changes in plan provisions since the last notice No plan amendments affecting participants' rights or benefits No material changes to the plan that would require updating participant information Waivers may not be granted in all cases, and specific regulations may require annual notices to be provided regardless of changes to the plan. If a plan sponsor is ineligible for a waiver and fails to provide required annual notices, they may face penalties, legal liability, and potential plan disqualification. Review plan documents and provisions: Ensure a thorough understanding of the plan's terms and conditions. Determine eligibility for waiver: Assess whether the plan meets the criteria for waiving annual notices. Prepare a waiver request: Develop a written request outlining the reasons for seeking a waiver. Submit the request to the appropriate regulatory authority: Provide the waiver request and any supporting documentation to the relevant governing body. Plan sponsors must provide documentation demonstrating their eligibility for the waiver, such as plan documents, prior notices, and evidence of no significant changes or amendments to the plan. The timeline for waiver approval may vary depending on the regulatory authority and the complexity of the request. Even when a waiver is granted, plan sponsors should maintain open communication with participants and promptly address any questions or concerns. Plan sponsors can utilize alternative methods to share plan updates or information, such as email communications, webinars, or online portals. Plan sponsors should ensure that plan documents and records are kept up-to-date, even if a waiver of annual notice is granted. Plan sponsors should conduct regular reviews of their retirement plan to ensure compliance with applicable laws and regulations, as well as to identify any changes that may require providing updated information to participants. Staying informed about changes in laws and regulations governing retirement plans is essential for plan sponsors to maintain compliance and avoid potential penalties. Plan sponsors must ensure that participants receive accurate and timely information about their retirement plan, even when a waiver of annual notice is granted. Failing to provide required annual notices or improperly implementing a waiver can result in penalties, legal liability, and potential disqualification of the retirement plan. If a waiver is granted but not properly implemented, plan sponsors may face increased scrutiny from regulatory authorities and potential legal action from plan participants. Maintaining transparency and open communication with plan participants is crucial for building trust and ensuring the long-term success of the retirement plan. Plan sponsors should maintain thorough and accurate records of their waiver requests, supporting documentation, and any communications with regulatory authorities and plan participants. Even when a waiver is granted, plan sponsors should communicate any relevant plan updates or changes to participants through alternative methods, ensuring they stay informed and engaged. Working with legal and financial professionals can help plan sponsors navigate the complexities of the waiver process and ensure they remain compliant with all applicable laws and regulations. Annual notices play a crucial role in informing plan participants about their retirement plan's status and provisions, while waivers can provide administrative relief for plan sponsors under certain conditions. Plan sponsors must strike a balance between meeting compliance requirements and minimizing administrative burdens by staying informed about regulatory changes and diligently monitoring their retirement plans. By staying informed about the waiver of annual notice process and proactively managing their retirement plans, plan sponsors can ensure the continued success of their plans while providing valuable benefits to participants.What Is a Waiver of Annual Notice?

Understanding Annual Notices

Types of Annual Notices

Importance of Annual Notices for Plan Participants

Responsibilities of Plan Sponsors and Administrators

Eligibility for a Waiver of Annual Notice

Criteria for Waiving Annual Notices

Limitations and Exceptions

Consequences of Ineligibility

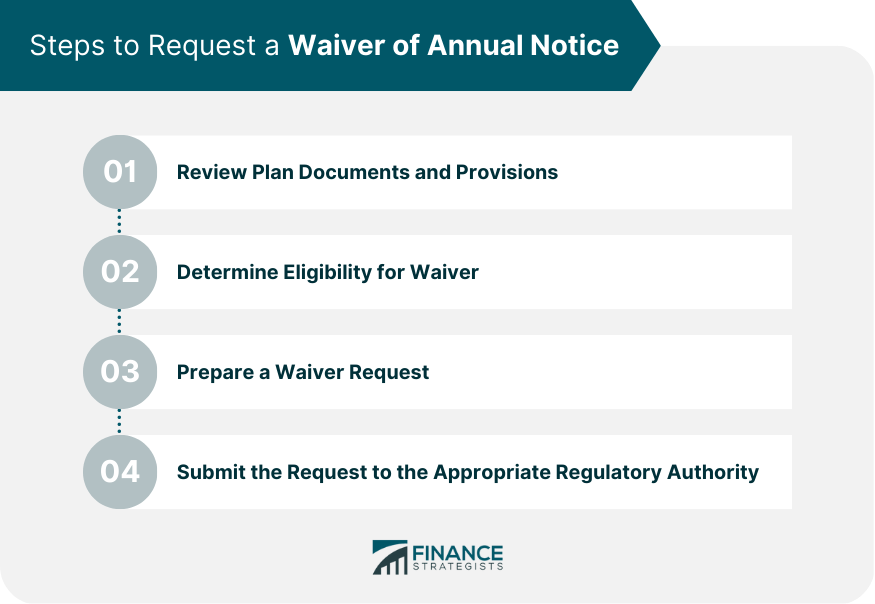

Requesting a Waiver of Annual Notice

Steps to Request a Waiver

Required Documentation and Supporting Materials

Timeline for Waiver Request Approval

Implementing a Waiver of Annual Notice

Communication With Plan Participants

Alternative Methods of Providing Plan Information

Updating Plan Documents and Records

Ongoing Compliance and Monitoring

Regular Plan Reviews

Monitoring Regulatory Updates

Ensuring Accurate and Timely Communication With Plan Participants

Potential Risks and Consequences

Risks of Non-compliance

Consequences of Improper Waiver Implementation

Importance of Maintaining Transparency With Plan Participants

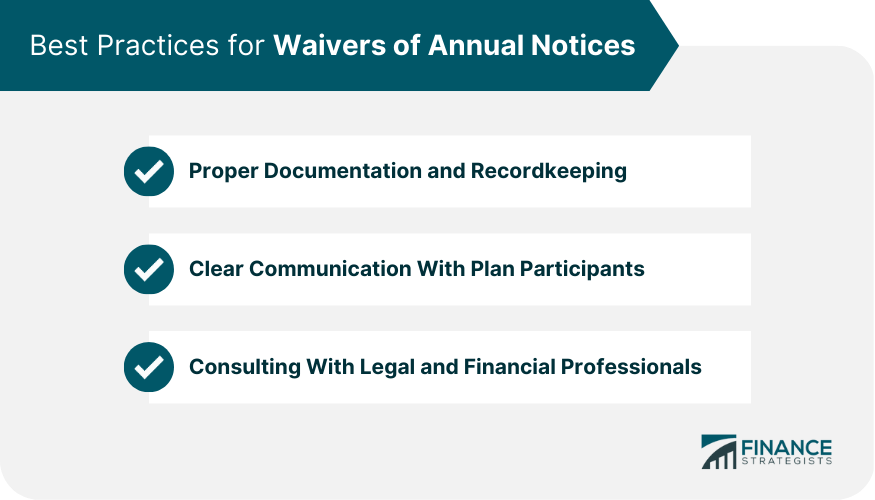

Best Practices for Waivers of Annual Notices

Proper Documentation and Recordkeeping

Clear Communication With Plan Participants

Consulting With Legal and Financial Professionals

Conclusion

Waiver of Annual Notice FAQs

A waiver of annual notice is an option that allows plan sponsors to avoid sending certain annual notices to plan participants and beneficiaries under certain circumstances.

The most common annual notices that can be waived are the safe harbor notice and the qualified automatic contribution arrangement (QACA) notice.

A plan sponsor can waive an annual notice if the plan meets certain conditions, such as using a safe harbor design, making a QACA contribution, or amending the plan to comply with certain rules.

To request a waiver of annual notice, the plan sponsor must include a statement to that effect in the plan document or in a separate notice to participants. The statement must explain the conditions under which the notice will be waived and the consequences of the waiver.

Yes, there are some risks and drawbacks to waiving an annual notice. For example, waiving a safe harbor notice could result in the plan losing its safe harbor status and becoming subject to more stringent testing requirements. Additionally, participants may not be fully informed about the plan's provisions and could miss out on certain benefits or opportunities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.