A waiver of plan termination is a legal document that allows a retirement plan to continue operating even if the plan sponsor decides to terminate it. Typically, when a plan sponsor wants to terminate a retirement plan, the plan must distribute all assets to plan participants or transfer them to another qualified plan. However, a waiver of plan termination allows the plan to continue to operate, even if the plan sponsor has decided to terminate it, and avoid the costly process of distributing or transferring assets. A waiver of plan termination can be granted by the IRS under certain circumstances, such as when the plan sponsor experiences financial hardship or when the plan is required by law to continue operating. It is important to note that a waiver of plan termination does not waive any other requirements of the plan, such as the requirement to make contributions or file annual reports. Standard termination occurs when a pension plan is fully funded and the plan sponsor decides to terminate it. In such cases, all accrued benefits are distributed to the participants. This type of termination is typically due to a change in business strategy or the end of the company's operations. Distress termination arises when a financially troubled company can no longer maintain its pension plan. In these situations, the Pension Benefit Guaranty Corporation (PBGC) steps in to ensure that participants receive their guaranteed benefits. However, the PBGC's involvement may result in reduced benefits for some plan participants. Involuntary termination is initiated by the PBGC when a pension plan fails to meet legal requirements or poses a risk to the pension insurance system. The PBGC takes over the plan and ensures that participants receive their guaranteed benefits. ERISA is the primary legislation governing pension plans in the United States. It sets out the rules and responsibilities of plan sponsors, including funding, disclosure, and fiduciary duties. ERISA also establishes the PBGC as the federal agency responsible for ensuring the payment of guaranteed benefits in the event of plan termination. The PBGC is a government agency responsible for protecting the pension benefits of private-sector workers in the United States. It monitors pension plans, enforces compliance with ERISA, and steps in to pay guaranteed benefits when a plan is terminated. Plan sponsors may request a waiver of plan termination for various reasons, including financial hardship, temporary circumstances, or a change in business conditions. Each request is evaluated on a case-by-case basis, taking into account the specific circumstances of the plan sponsor and the potential impact on plan participants. To submit a waiver request, plan sponsors must provide the PBGC with a comprehensive application, including all relevant documents and evidence supporting their request. This may include financial statements, actuarial reports, and other information demonstrating the necessity of the waiver. The PBGC evaluates waiver requests based on several criteria, including the plan sponsor's financial condition, the impact on plan participants, and the potential risk to the pension insurance system. The review process may take several months, and the PBGC may approve, deny, or request additional information before making a decision. If the PBGC grants a waiver, the plan sponsor must agree to certain conditions, such as increased reporting requirements or additional funding obligations. The PBGC monitors the plan sponsor's compliance with these conditions and may take enforcement action if the sponsor fails to meet its obligations. A waiver of plan termination can provide continued benefit coverage for plan participants. However, it may also create uncertainty about the future of the plan, as the waiver is typically granted on a temporary basis and may be subject to ongoing review. For plan sponsors, a waiver can provide much-needed financial relief and allow them to continue operating the pension plan. However, the waiver may come with additional obligations and responsibilities, such as increased reporting requirements and funding obligations. Waivers of plan termination can contribute to the stability of the pension system by allowing plans to continue providing benefits to participants. However, they may also have ripple effects on other businesses, as waivers can affect the overall health of the pension insurance system and potentially lead to increased premiums for other plan sponsors. Instead of seeking a waiver, plan sponsors may consider amending or redesigning their pension plan. Changes in plan provisions, such as altering benefit formulas or employee contribution rates, can help address financial challenges while still providing benefits to participants. However, plan sponsors must carefully consider the impact of any changes on both participants and the plan's overall financial health. Another alternative to a waiver is merging or consolidating pension plans. Combining plans can lead to administrative efficiencies and cost savings, potentially improving the financial stability of the combined plan. However, plan sponsors must weigh the benefits and risks associated with mergers and consolidations, including potential legal and regulatory challenges. In some cases, plan sponsors may choose to freeze or partially terminate their pension plan. A plan freeze can take several forms, such as closing the plan to new participants or stopping the accrual of benefits for current participants. While a freeze can provide financial relief to the plan sponsor, it can also have significant implications for plan participants and their retirement security. To obtain a waiver of plan termination, you will need to demonstrate that you are experiencing financial hardship. Providing detailed financial information, including current financial statements and projections, will help the IRS evaluate your request and make a decision. The IRS wants to see that you have made a good faith effort to maintain the plan and meet your obligations as the plan sponsor. This includes making required contributions and filing all necessary reports. Be sure to explain the reasons why you are seeking a waiver of plan termination. This could include changes in business strategy, unforeseen economic circumstances, or other factors beyond your control. The IRS is also interested in ensuring that plan participants are not unfairly impacted by a waiver of plan termination. Showing a commitment to your employees, such as by offering alternative retirement benefits, can help improve the likelihood of a successful waiver. Finally, it's important to work with a qualified financial advisor or attorney who has experience with plan terminations and waivers. They can help guide you through the process and ensure that all necessary steps are taken to increase the likelihood of success. Navigating the complex landscape of waiver of plan termination is critical for both plan sponsors and participants. By understanding the process, implications, and alternatives, parties involved can make informed decisions and better manage the challenging aspects of pension plan management. Learning from case studies and best practices is essential, as it equips plan sponsors with the necessary tools and strategies to improve their chances of obtaining a waiver, thereby ensuring the continued provision of benefits to plan participants. The importance of proactive communication and cooperation with the PBGC, as well as seeking expert advice from legal, actuarial, and financial professionals, cannot be overstated. This collaborative approach increases the likelihood of a successful waiver request and helps maintain the stability of the pension system. Ultimately, a thorough understanding of the waiver of plan termination process and its implications contributes to the financial security and well-being of both plan sponsors and participants in the long run.What Is a Waiver of Plan Termination?

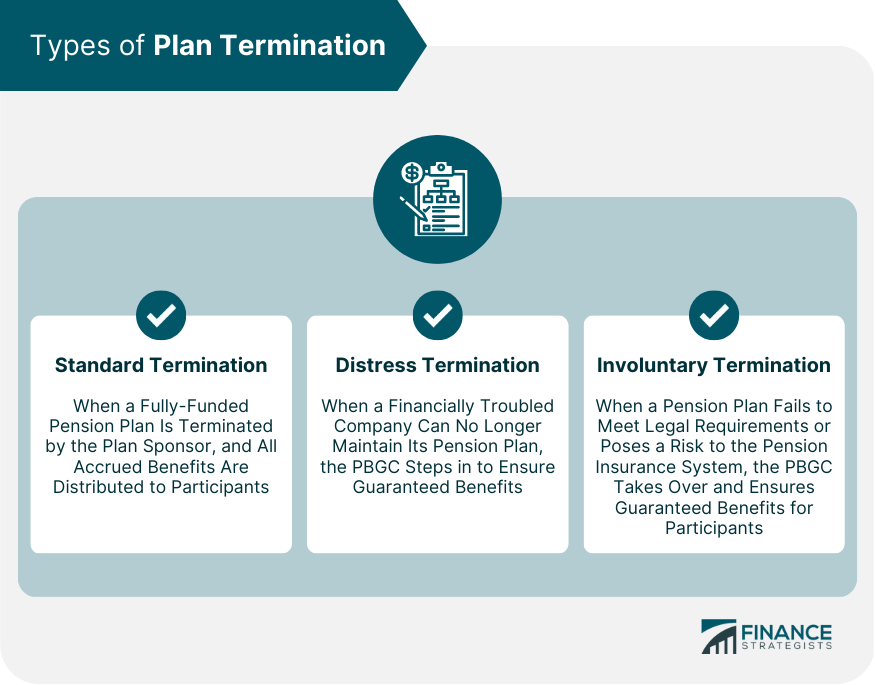

Types of Plan Termination

Standard Termination

Distress Termination

Involuntary Termination

Legal Framework

Employee Retirement Income Security Act (ERISA)

Pension Benefit Guaranty Corporation (PBGC)

Waiver of Plan Termination Process

Grounds for a Waiver Request

Application and Documentation

Review and Decision-Making Process

Waiver Conditions and Monitoring

Implications of Waiver of Plan Termination

Impact on Plan Participants

Impact on Plan Sponsors

Impact on the Industry and Economy

Alternatives to Waiver of Plan Termination

Plan Amendment or Redesign

Plan Mergers and Consolidations

Freeze or Partial Termination

Strategies for Improving the Likelihood of a Successful Waiver Request

Provide Detailed Financial Information

Show a Good Faith Effort to Maintain the Plan

Explain the Reasons for the Termination

Demonstrate a Commitment to Employees

Work With a Qualified Professional

Conclusion

Waiver of Plan Termination FAQs

A waiver of plan termination is a request made by a plan sponsor to the Internal Revenue Service (IRS) to delay or suspend the termination of a retirement plan.

A plan sponsor may request a waiver of plan termination if there are extenuating circumstances that make it difficult or impractical to terminate the plan, such as pending litigation or unresolved benefit claims.

To request a waiver of plan termination, the plan sponsor must file Form 5310-A with the IRS, providing details about the reasons for the waiver request and any relevant supporting documentation.

No, a waiver of plan termination is not guaranteed to be granted. The IRS will consider each request on a case-by-case basis and may deny the request if it determines that the reasons for the waiver are not sufficient.

Failing to properly terminate a plan or obtain a waiver of plan termination can result in penalties, fees, and legal liabilities for the plan sponsor. Additionally, participants may not receive the benefits they are entitled to, and the plan may not be in compliance with applicable regulations.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.