A Provident Fund, often referred to as a pension fund in some countries, is a government-managed savings scheme that aims to provide long-term financial security for workers upon their retirement. The structure of this fund involves regular contributions from both the employee and the employer, with the accumulated funds released to the employee upon retirement or under other specified circumstances. Although variations of retirement savings schemes exist worldwide, Provident Funds, as specifically defined are most commonly found in certain Asian countries. The primary purpose of a Provident Fund is to provide financial support to individuals when they reach retirement age. By mandating contributions during a person's working years, the fund serves as a form of forced savings. As a result, when the individual retires, they have a nest egg that can support their living expenses, medical costs, and other needs during their non-working years. In the context of a Provident Fund, the government plays a crucial role. It not only enacts legislation that makes participation compulsory for eligible workers but also oversees the management of the fund itself. The government sets the rules for contributions, withdrawal, and investment of the fund's assets. In some cases, a government-appointed board or agency is responsible for the day-to-day management of the fund. Both employees and employers contribute to the Provident Fund. The precise contribution rates may vary by country and sometimes by the individual's income level, but generally, both parties are required to contribute a fixed percentage of the employee's salary. The goal is to steadily build up the fund over the course of the employee's working life. There are established minimum and maximum contribution levels for Provident Funds. The minimum level is the least amount that must be contributed by both the employee and the employer. It ensures a basic level of savings for all participants. The maximum contribution level, on the other hand, often serves to prevent higher-income individuals from excessively benefiting from the fund's tax advantages. The funds accumulated in a Provident Fund are not left idle; they are invested to generate returns and grow the fund over time. The government or its appointed managing entity, typically makes conservative investments to minimize risk. The exact investment strategy can vary by country but often includes a mix of government securities, corporate bonds, and other low-risk investment instruments. The most significant benefit of a Provident Fund is the financial security it provides in retirement. The regular contributions made during the working years accumulate and compound, resulting in a substantial sum upon retirement. This sum serves as a reliable source of income that can support a retiree's living expenses and financial needs, reducing reliance on family support or government welfare. In many countries, contributions to a Provident Fund offer tax advantages. These might include deductions on income tax for the amount contributed or tax-free interest earned on the fund. Such incentives make participation in the Provident Fund not only a means of securing retirement but also an effective tax planning tool. Besides retirement savings and tax benefits, Provident Funds may offer other advantages. Depending on the country's specific rules, these could include loans against fund balance for specific purposes like housing or education, insurance coverage, or even family support benefits in the event of the contributor's demise. Some Provident Funds also offer disability benefits, providing financial assistance to members who become unable to work due to a disability. Despite the numerous benefits offered by Provident Funds, they are not completely immune to potential drawbacks. One significant criticism stems from the inherent vulnerability of Provident Funds to market risks. Since these funds actively invest a portion of the contributions in various financial instruments, their returns are subject to the ebb and flow of the market. During robust economic times, the fund may prosper, leading to the healthy growth of the retirement corpus. However, during economic downturns, the returns on these investments could dwindle, adversely affecting the fund’s growth. Therefore, the unpredictability of market conditions could pose a risk to the financial stability that Provident Funds are expected to provide. Another challenge associated with Provident Funds relates to inflation. With the continuous rise in the cost of goods and services, the value of the savings in the fund may diminish over time. This phenomenon, known as the erosion of savings, could potentially render the accumulated corpus insufficient to cover the cost of living post-retirement. This issue becomes particularly poignant in countries experiencing high inflation rates, as the real value of the savings might decrease faster than anticipated. The effect is further compounded in regions with high living costs or if the contribution rates to the Provident Fund are insufficient to keep up with inflation. Finally, in some instances, the amount accumulated in the Provident Fund may not be adequate to sustain the retiree’s expenses. While the fund is designed to provide financial security post-retirement, the reality is that rising healthcare costs, longer life expectancy, and increasing living expenses can lead to a situation where the accumulated savings fall short. In countries where the contribution rates are not adequate, or in cases where individuals have not been able to contribute consistently, the resulting fund balance may not be sufficient to meet the financial demands of retirement. This underscores the need for careful retirement planning and consideration of multiple income streams post-retirement. Singapore's Provident Fund, known as the Central Provident Fund (CPF), is a comprehensive social security savings scheme that has been instrumental in meeting the retirement, housing, and healthcare needs of Singaporeans. Both employees and employers make mandatory contributions to the CPF, with rates varying based on wage bands and age groups. CPF has three accounts: Ordinary (housing, insurance, investment), Special (retirement, investment), and Medisave (hospitalization, medical insurance). The Employee Provident Fund (EPF) in India is a retirement benefits scheme that's available to all salaried employees. The EPF is maintained and overseen by the Employees Provident Fund Organisation of India (EPFO). Both the employee and employer contribute an equal amount (12% of the employee's basic salary and dearness allowance) to the fund, and interest is paid on the accumulated amount. Withdrawals can be made under certain conditions like retirement, buying a house, or serious illness. In many other developing countries, Provident Funds play a crucial role in ensuring the financial security of workers. For instance, Malaysia's Employees Provident Fund (EPF) is similar to Singapore's CPF, providing retirement benefits for its members through the management of their savings in an efficient and reliable manner. Meanwhile, countries like Kenya and Ghana have also instituted Provident Fund schemes to provide a safety net for their aging populations. While the fundamental concept of a Provident Fund remains the same across countries, the specific structures, benefits, and rules can vary. For instance, the CPF's three-account structure in Singapore is unique and offers a wider range of uses for the fund, while the EPF in India focuses primarily on retirement savings. However, all these schemes share the common goal of providing financial security to individuals upon retirement. A Provident Fund is a government-managed savings scheme designed to provide financial security upon retirement. The structure of a Provident Fund involves contributions from both the employee and employer, with the government setting the rules and overseeing the fund's operation. Benefits of Provident Funds extend beyond retirement security to include tax advantages and potential additional benefits, like loans against the fund balance or insurance coverage. However, it's essential to be aware of potential criticisms and challenges of Provident Funds, including market risks, management challenges, and their impact on low-income workers. Despite these challenges, the overall benefit of Provident Funds in providing a safety net for retirees is undeniable. The operation and structure of Provident Funds vary across different countries, each adapting the system to suit its unique socio-economic conditions. While Provident Funds serve as a crucial pillar of retirement planning, it's essential to supplement it with other financial planning strategies. Given the complexities involved in retirement planning, it might be beneficial to seek professional advice to ensure a secure and comfortable retirement. What Is a Provident Fund?

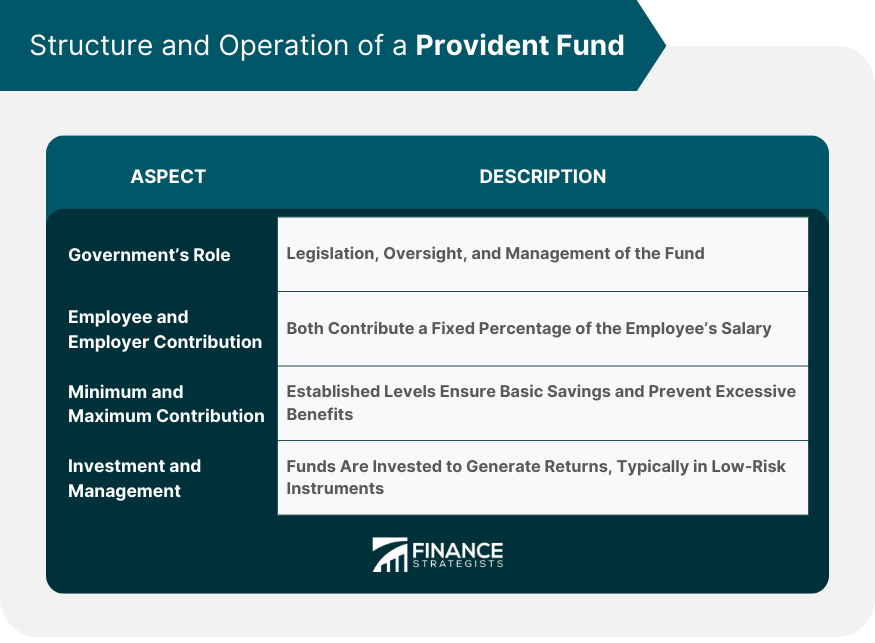

Structure and Operation of a Provident Fund

Role of the Government in Managing the Fund

Contribution From the Employee and Employer

Minimum and Maximum Contribution Levels

How the Funds Are Invested and Managed

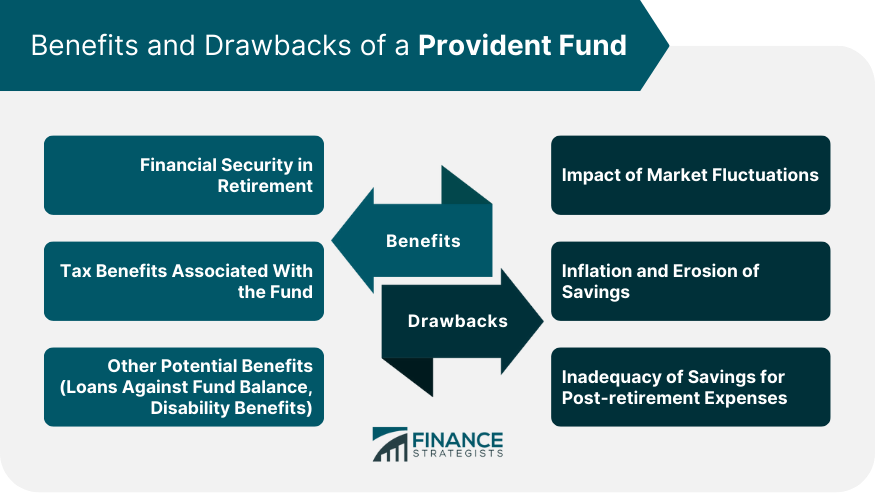

Benefits of a Provident Fund

Financial Security in Retirement

Tax Benefits Associated With the Fund

Other Potential Benefits

Drawbacks of Provident Funds

Impact of Market Fluctuations

Inflation and Erosion of Savings

Inadequacy of Savings for Post-retirement Expenses

Comparison of Provident Fund Systems in Different Countries

Provident Fund in Singapore

Provident Fund in India

Provident Fund in Other Developing Countries

Key Differences and Similarities

Final Thoughts

Provident Fund FAQs

A Provident Fund is a government-managed retirement savings scheme that mandates regular contributions from both the employee and employer during the employee's working years. The accumulated funds are then provided to the individual upon retirement or under other specified circumstances.

Contributions to a Provident Fund are typically made by both the employer and employee. These contributions are often a fixed percentage of the employee's salary. The government usually sets minimum and maximum contribution levels to ensure a basic level of savings for all participants and to limit the fund's tax advantages for higher-income individuals.

Provident Funds provide retirement financial security through forced savings, offering tax advantages and additional benefits like loans and insurance coverage.

Provident Funds are managed by the government or a government-appointed entity. They are responsible for setting the rules for contributions, withdrawal, and investment of the fund's assets. Typically, the funds are invested in conservative, low-risk assets to generate returns and grow the fund over time.

Critics of Provident Funds often point to potential market risks, the impact of inflation, and issues with management and governance. Additionally, low-income workers might not benefit as much from Provident Funds due to their lower contribution capacity and the possible need to withdraw funds early for emergencies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.