A Qualified Longevity Annuity Contract (QLAC) allows you to defer required minimum distributions (RMDs) from retirement accounts until you reach the age set in your contract. With a QLAC, you can fund the annuity with investments from your qualified retirement account, such as 401(k), 403(b), or an Individual Retirement Account (IRA). This annuity is purchased through a qualified use by the IRS, commonly known as tax-advantaged funds. The amount of your QLAC purchase can be deducted from the value of your retirement account balance, which is used to compute your RMD. Consequently effectively reducing your tax bill. The annuity contract component of QLAC provides a guaranteed income stream, ensuring you do not outlive your money. A QLAC can safeguard your funds from market changes, increase the financial stability of your retirement, and provide potential advantages to your spouse and other beneficiaries. Have questions about QLACs? Click here. A QLAC is sold by financial service companies and is financed from an eligible employer-sponsored qualified plan, like 401(k) and 403(b), or a traditional IRA turned into an annuity. Qualified annuities have met the government's requirements for accounts bought with retirement funds. These annuities receive special treatment. The 401(k)s and most IRAs offer preferential tax treatment. But by age 73, the owner must start withdrawing a yearly minimum amount from the account, taxed as ordinary income. QLACs are not subject to RMD rules. With a QLAC, you can push back RMDs until age 85 (or later, depending on your specific QLAC contract), thus the term longevity. The purpose of this program is to allow people to use their retirement savings to create an annuity fund that will generate a guaranteed income for later retirement years. The regular income payments will be based on the following: Thus, the longer the waiting period, the higher the payments. Individual contributions from all sources should be at most $200,000. This limit for QLAC premiums is a lifetime limit from all funding sources; however, periodical adjustment is made to correspond with inflation. Previously, contributions from a company-sponsored retirement account or 401(k) plans and IRAs should only be at most 25% of the total account. For instance, the retiree has a $200,000 IRA balance; an equivalent of 25% or $50,000 can be used to purchase a QLAC. The 25% limit is applied to each employer plan separately but aggregates to IRAs. Starting 2024, the 25% limit will be eliminated and the maximum allowable amount increased to $200,000. A QLAC purchased today can start paying out income at any time in the future indicated in the contract. Aside from that, there are other advantages. You will receive a guaranteed income stream since QLAC is composed of an annuity contract. The financial or insurance company will send regular income payments based on the amount invested in the annuity, the guaranteed percentage growth, and the payout dates. The more deferred the payments, the higher the payments will be received from the QLAC provider. QLACs have special treatment in the tax code. In fact, a portion of RMDs can be deferred until age 85. Individuals can lower the number of their assets subject to the RMD computation by moving money from their qualified pre-tax retirement savings plan into a QLAC. The savings will become a pension-like stream of guaranteed income by the QLAC, which begins between the ages of 73 to 85. A QLAC secures future payments, shielding your retirement funds from market fluctuations later in life. Your monthly payment may lose value over time unless you purchase an inflation rider. There are options for selecting death benefits and other nominations to ensure that your savings are handed to your loved ones in the case of your death. You can accomplish this by naming your spouse as a joint annuitant. A QLAC has no hidden requirements and has a straightforward framework. You only need to tell the insurance provider how much you are willing to invest, and they will tell you what return they can provide. QLACs can improve retirement readiness. However, they are only suitable in some situations. These are the drawbacks of using a QLAC: As with all fixed annuities, after you pay the premium to the insurance provider, you lose access to the lump payout. Depending on your risk tolerance, investing the money in your retirement account could help it generate more than the QLAC distributions. Annuities are not investments; they are insurance. If you die earlier than expected, you may not be able to recover more than what you paid. Certain QLACs have a return of premium option that will pay out to beneficiaries. However, if you choose this option, your payouts will be less while you live. QLACs lack true liquidity. You are exchanging a portion of your retirement funds for a guaranteed income. Some argue it is not worth giving up control of $200,000 spent to purchase a QLAC over tax deferrals that may not be worth much. Some retirement experts are not even impressed with QLACs. Investors forgo the opportunity for better growth through alternative ways in favor of locking in growth at a low fixed rate. QLAC investors will be left with less money in the long run. The following are three ways to manage the risks associated with the QLAC: One way to control this risk is by laddering QLACs, which means buying a series of smaller QLACs throughout multiple years in case rates go up. Laddering is particularly advantageous because the older you purchase one, the larger the reward. Even assuming interest rates do not change, buying a QLAC at age 65 to begin paying at age 75 will result in a lower payout than purchasing one at age 66 to start a payout at age 76. COLAs can be added at the time of purchase to benchmark the annuity against inflation. This feature, however, frequently lowers the initial payment. Remember that this is typically a product for retirement income. Thus, the benefit of including a COLA may not outweigh the expense. The financial strength of the issuing corporation is a concern, as it is with any financial instrument that guarantees payouts in the future. Annuities, unlike banking products, are not insured by the Federal Deposit Insurance Corporation (FDIC). Mitigating risk by purchasing QLACs from more than one provider is advisable. This way, the investor is spreading out the risk among multiple sources. People who are 72 years old can consider purchasing a QLAC since they can soon withdraw from their retirement plans. Risk-averse retirees who wish to manage taxes and secure a lifetime income stream may invest in QLACs. Especially those with a sufficient retirement income and who only need a portion of their assets. It can help avoid market risks, provide lifetime income, and allow you to put off mandatory minimum distributions. Retirees can benefit from purchasing QLACs to reduce taxes and prepare for retirement goals. However, spouses will get the most benefit if the insured will pass away before your QLAC matures. A Qualified Longevity Annuity Contract is a deferred fixed annuity that can be purchased with funds from certain retirement accounts. The regular income payments will be based on the amount invested in the annuity, the guaranteed percentage growth, and the preferred date to start receiving payments. The longer the waiting period, the higher the computed payments. Risk-averse retirees wishing to manage taxes and secure a lifetime income may invest in QLACs. QLACs should be considered in one’s retirement plan as it offers a guaranteed long-term income stream with RMD deferred up to age 85. It has a simple structure and ensures that principal savings are protected. However, one should consider its risks as well. QLAC owners have limited control over their funds, thus affecting liquidity. Also, as an insurance product, it does not guarantee the return of premiums. Therefore, QLACs are not meant for all, and getting a QLAC should be a personal decision.What Is a Qualified Longevity Annuity Contract (QLAC)?

How Does a QLAC Work?

1. The amount invested in the annuity

2. The guaranteed percentage growth

3. The preferred date to start receiving payments

QLAC Contribution Limit Rules 2024

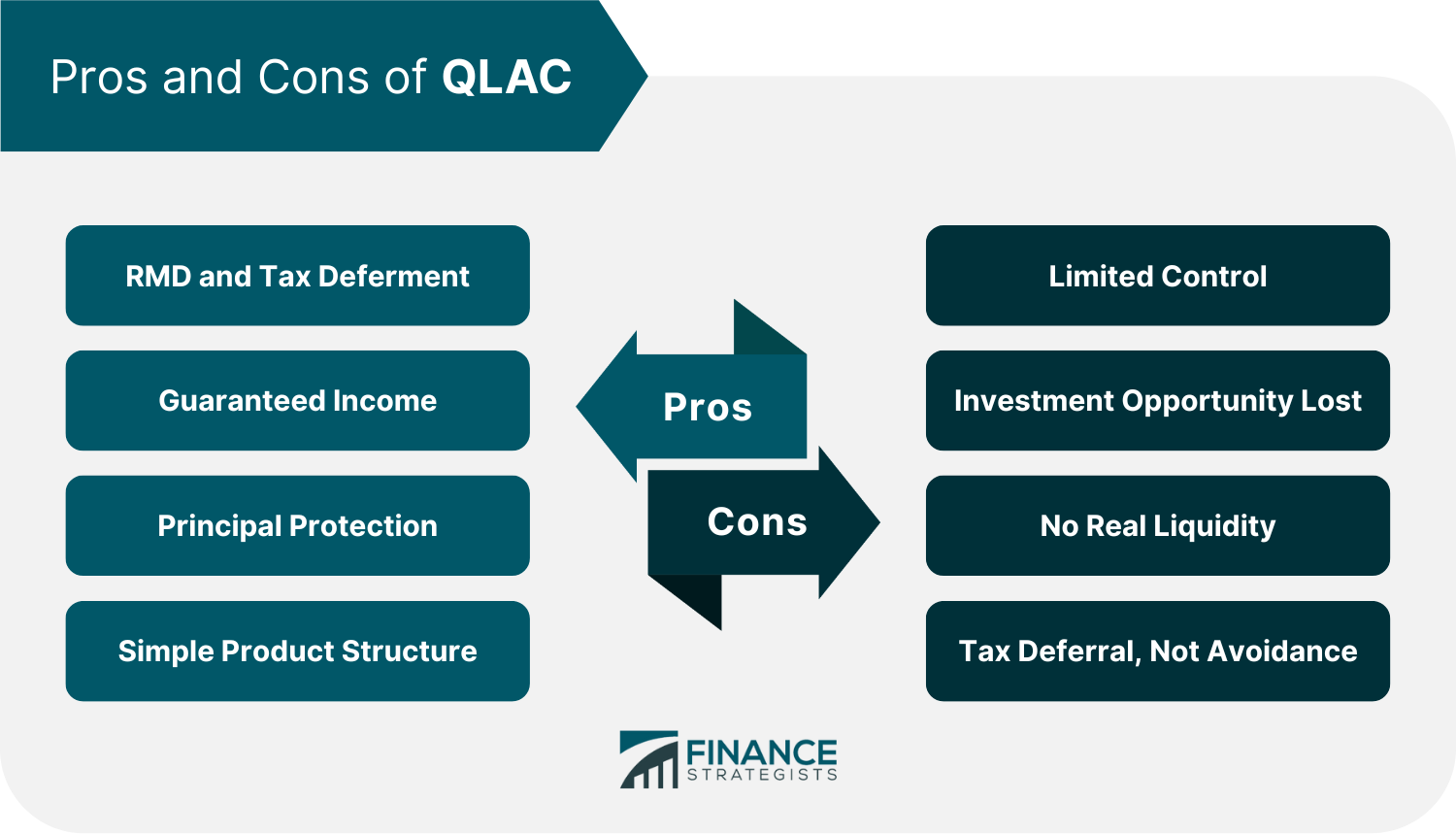

Benefits of Using QLAC

Guaranteed Income

RMD and Tax Deferment

Principal Protection

Simple Product Structure

Drawbacks of Using QLAC

Limited Control

Investment Opportunity Lost

No Real Liquidity

Tax Deferral, Not Avoidance

How to Manage Risks of QLAC

Laddering Multiple QLACs

Cost-of-Living Adjustments (COLAs)

Security in the Firm's Financial Strength

Who Should Use a QLAC?

The Bottom Line

Qualified Longevity Annuity Contract (QLAC) FAQs

When the retiree turns 72, he can consider getting a QLAC. But ideally, they can purchase later to get higher payouts.

QLAC contributions should be less than $155,000 or no more than $200,000.

QLAC offers RMDs and taxes to be reduced or deferred, although only partially avoided.

The IRS mandates that you take RMDs from your QLAC no later than age 85. A QLAC essentially offers an RMD tax relief to anyone between the ages of 73 and 85. RMDs and taxes are being postponed, not wholly avoided.

Multiple QLAC purchases are allowed as long as the cumulative premiums will be at most $200,000. Most insurance companies are now eyeing IRAs as QLAC premiums. QLACs are considered single premium policies, so purchasing QLACs over time means acquiring multiple policies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.