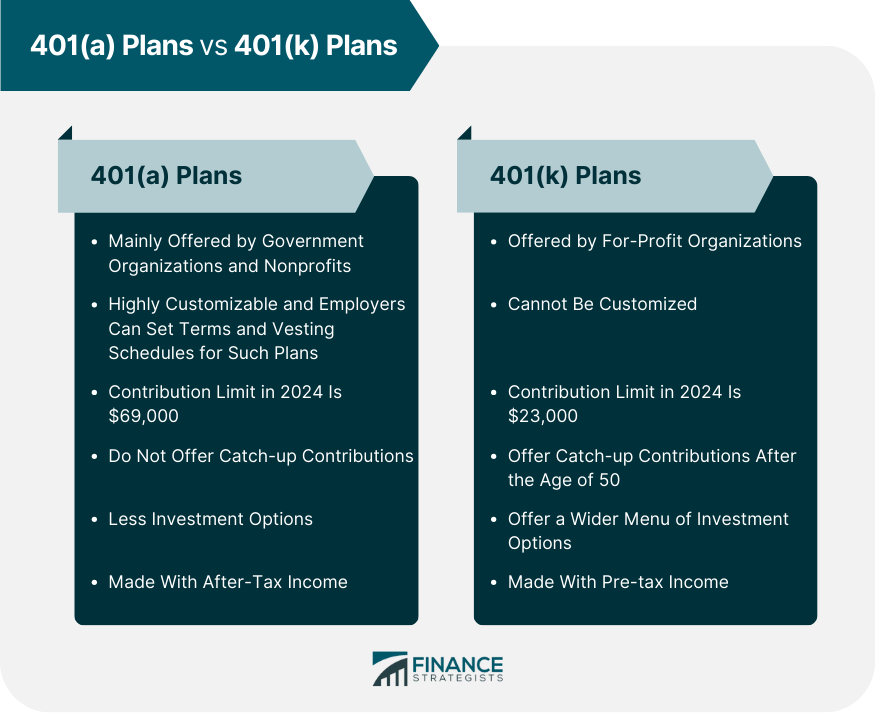

401(a) plans are employer-sponsored retirement plans available to employees of government organizations and nonprofit organizations. In a 401(a) plan, employers can make a dollar or percentage-based contribution to the employee’s retirement plan. 401(a) plans are similar to 401(k) plans and also offer tax deferral benefits. Unlike 401(k) plans, however, 401(a) plans offer greater control to employers to define the terms and investing choices available in the plan. Need help with 401(a) Plans? Click here. 401(a) plans are defined contribution plans in which employee contributions are voluntary. They are mainly offered to government workers at educational institutions and to nonprofit employees as an incentive to retain employees. Employers make a dollar or a percentage-based contribution equal to up to 25% of an employee’s salary to the plan. Employees can choose to make a contribution and their contribution limits for 2023 and 2024 are $66,000 and $69,000 respectively. You can also rollover funds from other retirement plans into your 401(a) plans or vice versa. Withdrawals from a 401(a) plan can be made in any one of the following two formats: 401(a) plans function much like other retirement plans. They have a menu of investment choices and offer tax-deferral benefits. Employer contributions are always made pre-tax while employee contributions are made with after-tax income. Withdrawals from the plan are taxed as ordinary income tax after the age of 59.5 years and there is a 10% penalty, if withdrawals are made before that age. Account holders may be required to take Required Minimum Distributions (RMDs) after the age of 72 depending on the plan’s terms. Mandatory employer contributions mean that they are able to set the terms and vesting schedules for 401(a) plans. Employers can offer multiple types of 401(a) plans to employees based on different sets of criteria. For example, they can offer one based on pay grade or another one based on years of service. In each plan, employers can define different contribution limits and vesting schedules. The Internal Revenue Service (IRS) has provided few guidelines for the design of such plans, meaning that employers have considerable latitude in designing them. They can opt for a profit-sharing plan design in which they share a percentage of the profits made by the company. Or, they can design a money purchase pension plan in which they contribute cash or a set percentage of the employee’s salary to the account. Like other retirement plans, employees can specify beneficiaries or survivors who will receive money held in the account upon the owner’s death. While they appear similar, 401(a) plans are, in fact, different from 401(k) plans. Here are some key points of differences between both plans: Employees can be enrolled in 401(a) and 401(k) plans simultaneously. Basics of 401(a) Plans

How Do 401(a) Plans Work?

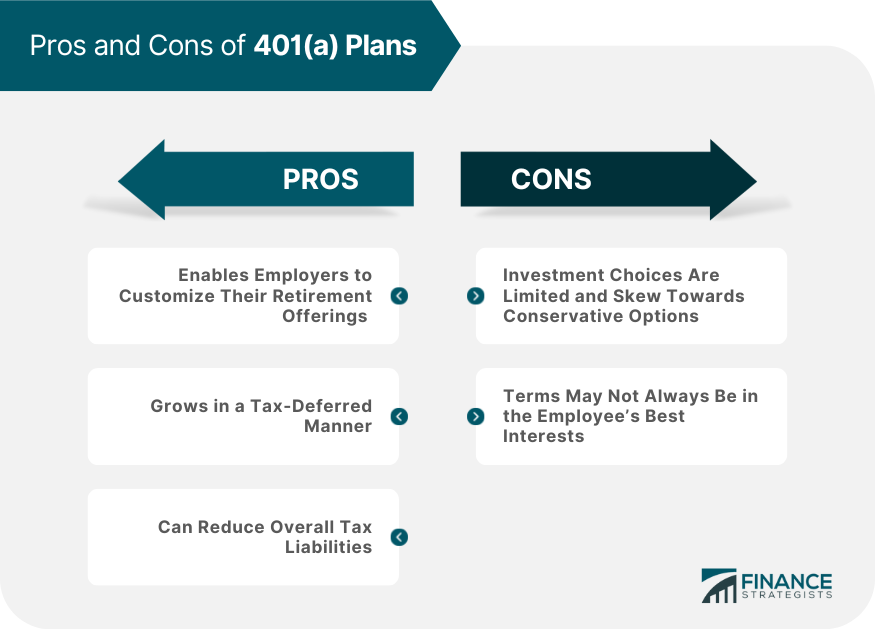

Pros and Cons of 401(a) Plans

The Advantages of 401(a) Plans Are:

The Disadvantages of 401(a) Plans Are:

401(a) Plans vs 401(k) Plans

401(a) Plans FAQs

401(a) plans are employer-sponsored retirement plans available to employees of government organizations and nonprofit organizations. In a 401(a) plan, employers can make a dollar or percentage-based contribution to the employee’s retirement plan.

Employers make a dollar or a percentage-based contribution equal to up to 25% of an employee’s salary to the plan. Employees can choose to make a contribution and their contribution limits for 2023 and 2024 are $66,000 and $69,000 respectively.

Money inside a 401(a) plan grows in a tax-deferred manner. Because mandatory employer contributions are made with pre-tax income, 401(a) plans can reduce overall tax liability.

The menu of investment choices available are limited and skew towards conservative options, such as government bonds. Also, employee contributions made with after-tax income means less money for spending.

401(k) plans allow catch-up contributions after the age of 50 and offer more investment options. With a 401(k) plan, contributions are always in pre-tax dollars, unlike a 401(a) where the employer makes that determination.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.