A 403(b) hardship withdrawal refers to the early withdrawal of funds from a 403(b) retirement savings plan due to severe financial hardship. It's a provision designed to provide financial relief for plan participants facing immediate and substantial financial needs, such as medical expenses, costs related to buying a home, or tuition fees. However, such withdrawals can significantly impact individuals' retirement savings, as the withdrawn amount not only decreases the savings balance but also can't continue to earn interest or investment income. In the context of retirement planning, understanding 403(b) hardship withdrawals is crucial as it helps individuals make informed decisions while balancing immediate financial demands and long-term retirement savings goals. It underscores the importance of sound financial management and contingency planning in maintaining long-term financial stability. The IRS states that a hardship withdrawal must be due to an "immediate and heavy financial need." This requirement is often subjective and depends on an individual's circumstances. The IRS provides guidelines on what it considers an "immediate and heavy financial need." This could include expenses for medical care, costs related to the purchase of a primary residence, tuition and educational fees, and payments necessary to prevent eviction from or foreclosure of a principal residence. The hardship withdrawal must not exceed the amount necessary to satisfy the financial need. This rule may include taxes or penalties resulting from the distribution. A hardship withdrawal can only be made if the employee has no other resources available to meet the need. This includes assets of the employee's spouse and minor children. Before anything else, ensure that your 403(b) plan allows hardship withdrawals. Not all plans do, so this information can typically be found in your plan's summary plan description or by consulting with your plan administrator. The next step involves providing evidence of your financial hardship. The Internal Revenue Service (IRS) states that a hardship withdrawal must be due to an "immediate and heavy financial need. Once you have compiled your documentation, you'll need to complete an application form for a hardship withdrawal. This form will typically require you to detail your financial hardship and affirm that you have exhausted all other financial resources. After you have submitted your application and supporting documentation, your plan administrator will review your application. If your application is approved, the requested funds will be distributed to you. The withdrawn amount is considered taxable income in the year of withdrawal, potentially increasing your tax liability. A hardship withdrawal could also affect your future 403(b) contributions. Following a withdrawal, the IRS requires a suspension of contributions to the plan for at least six months. This regulation further impedes your ability to grow your retirement savings. While hardship withdrawals don’t require repayment, there are ways to get your retirement savings back on track. Unlike a loan from your 403(b) plan, a hardship withdrawal does not have to be repaid. However, you cannot return the withdrawn amount to your account once your financial circumstances improve. Following a hardship withdrawal, it's crucial to refocus on saving for retirement. When you're allowed to resume contributions, you may want to increase the amount you contribute if possible. Other strategies could include contributing to an IRA or adjusting your retirement strategy. It's essential to grasp the long-term impact of a hardship withdrawal. The reduction in your retirement savings and the potential penalties could delay your retirement or reduce your income in retirement. Many 403(b) plans allow loans, which must be repaid with interest but aren’t subject to taxes or penalties if repaid as agreed. If you have other types of retirement accounts, such as a 401(k), you may also be able to take a loan from these accounts. Personal savings, emergency funds, and assistance programs can be alternative sources of funds. There are also credit counseling services that can provide guidance and help negotiate payment plans for bills or debts. A 403(b) hardship withdrawal allows early access to retirement funds in a financial crisis, but it comes with strict eligibility criteria, tax implications, and potentially lasting effects on retirement savings. Understanding these elements, including what qualifies as an "immediate and heavy financial need," the application process, and post-withdrawal rebuilding strategies, is vital. The alternatives to a hardship withdrawal, such as 403(b) loans or non-retirement savings, should be considered to minimize the impact on future retirement security. In navigating these financial complexities, professional advice can provide invaluable guidance. Ultimately, the key takeaway is the need for thorough evaluation and planning - your retirement goals should remain a priority, even when dealing with immediate financial challenges. The resilience of your retirement plan depends on the informed choices you make today.What Is a 403(b) Hardship Withdrawal?

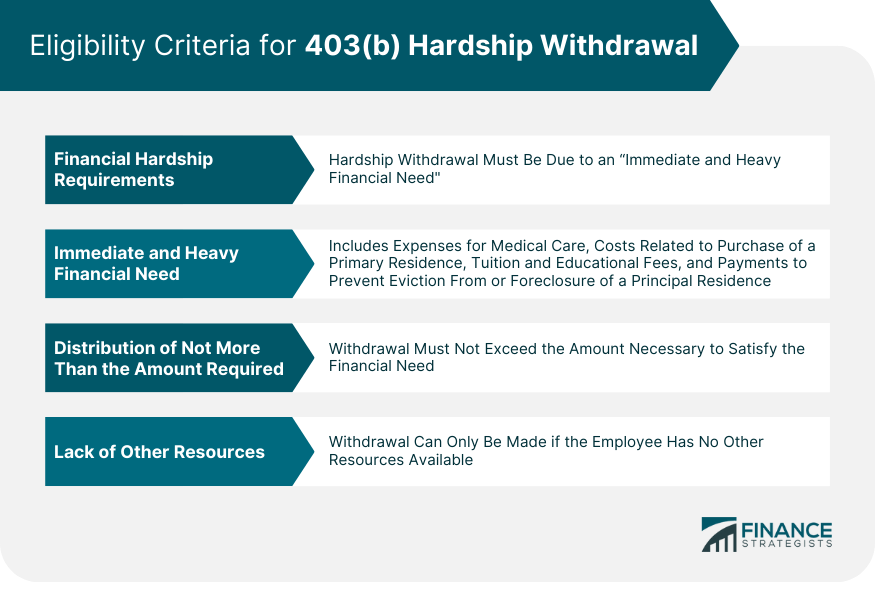

Eligibility Criteria for 403(b) Hardship Withdrawal

Financial Hardship Requirements

Immediate and Heavy Financial Need

Distribution of Not More Than the Amount Required

Lack of Other Resources

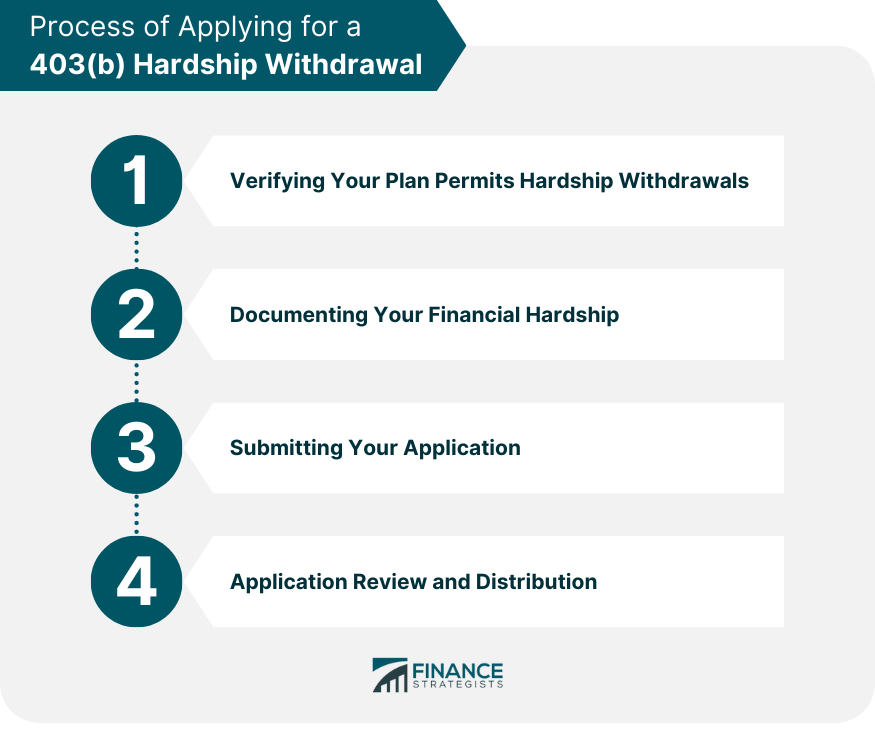

Process of Applying for a 403(b) Hardship Withdrawal

Verifying Your Plan Permits Hardship Withdrawals

Documenting Your Financial Hardship

Submitting Your Application

Application Review and Distribution

Tax Implications of a 403(b) Hardship Withdrawal

Income Taxes

Impact on Future Contributions

Repayment and Rebuilding After a Hardship Withdrawal

Repayment Rules

Strategies to Rebuild Retirement Savings

Understanding the Long-Term Impact

Alternatives to Hardship Withdrawal

Loans From a 403(b) Plan

Other Types of Retirement Plan Loans

Non-retirement Savings and Assistance Programs

Conclusion

403(b) Hardship Withdrawal FAQs

A 403(b) hardship withdrawal is a provision that allows individuals to withdraw funds early from their 403(b) retirement plan due to immediate and severe financial need. This can include situations like significant medical expenses, costs related to the purchase of a home, or tuition fees.

Eligibility for a 403(b) hardship withdrawal is based on strict criteria. The individual must be facing an immediate and substantial financial need, and the withdrawal should not exceed the amount necessary to meet that need. The individual should also have exhausted all other available financial resources.

Applying for a 403(b) hardship withdrawal involves verifying your plan allows such withdrawals, documenting your financial hardship, submitting your application with supporting documentation, and awaiting review and approval from your plan administrator.

The amount withdrawn from a 403(b) plan due to hardship is considered taxable income in the year of withdrawal. If you are under 59.5 years old, a 10% early withdrawal penalty may also apply.

Unlike a loan from your 403(b) plan, a hardship withdrawal does not need to be repaid. However, you cannot return the withdrawn amount to your account once your financial situation improves. After a hardship withdrawal, it's essential to focus on rebuilding your retirement savings.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.