A 403(b) loan refers to a loan taken out from an individual's 403(b) retirement account, which is typically provided to employees of public schools, certain non-profit organizations, and some members of the clergy. This retirement plan, which operates similarly to a 401(k) plan, allows participants to contribute pre-tax dollars towards retirement, which then grow tax-deferred until they are withdrawn. While many individuals associate retirement plans solely with providing financial security during retirement, they may also allow participants to borrow from their accumulated funds in times of financial need. However, a 403(b) loan should not be taken lightly as it could potentially impact your long-term retirement savings. Borrowing from a 403(b) plan follows specific rules and requirements, which we will discuss in detail in the following sections. To qualify for a 403(b) loan, you must be a participant in a 403(b) plan, which generally means you are an employee of a public school, a tax-exempt organization, or a minister. However, even if you meet these criteria, whether or not you can take out a loan from your 403(b) plan depends on the specific terms of your plan. Some plans may not allow loans at all, while others may have specific requirements that must be met before a loan can be made. Keep in mind that even if loans are permitted by your plan, they are generally intended for cases of financial hardship. Such hardships might include certain medical expenses, costs relating to the purchase of a primary residence, tuition and related educational fees, or payments necessary to prevent eviction or foreclosure on a primary residence. The Internal Revenue Service (IRS) has set specific limits on the amount you can borrow from your 403(b) account. Generally, the maximum loan amount is the lesser of $50,000 or half of your vested account balance. However, if your vested account balance is less than $10,000, you may be able to borrow up to that amount. Loan repayment terms for a 403(b) loan are also regulated by the IRS. Typically, a loan must be repaid within five years, and payments must be made at least quarterly. However, if the loan is used to purchase a primary residence, a longer repayment period may be allowed. Also, note that the interest paid on a 403(b) loan is not tax-deductible. One of the primary advantages of a 403(b) loan is that it gives you access to funds when you have pressing financial needs. Unlike withdrawing funds from your account, which can potentially trigger taxes and penalties, a loan allows you to use your own money without incurring these costs. It's a means of accessing your retirement savings on a short-term basis without permanently reducing your account balance. Moreover, since it's your money, the approval process is usually quicker and easier compared to traditional loans. As long as you meet your plan's requirements, you can typically access your money within a few days. Compared to credit cards and other personal loans, the interest rates on 403(b) loans are generally lower. This is because you're essentially borrowing from yourself, and the interest you pay goes back into your retirement account. It's worth noting, however, that the "interest" you pay yourself may be less than what your money could have earned if it had remained invested in your 403(b) account. Another advantage of a 403(b) loan is that it does not require a credit check. Traditional loans often necessitate a solid credit score for approval, but with a 403(b) loan, your credit history is irrelevant. This feature can make 403(b) loans a particularly attractive option for individuals with less-than-perfect credit. While a 403(b) loan might seem like a convenient source of funds, it does come with significant drawbacks. Primarily, taking a loan from your 403(b) account can have a negative impact on your retirement savings. Even though you're paying the loan back into your account, you're missing out on the potential growth that your money could have earned had it remained invested. Furthermore, many people reduce or stop their retirement plan contributions while they're repaying their loans. This reduction can further diminish your potential earnings and hinder your long-term retirement savings strategy. While you don't pay taxes or penalties on a 403(b) loan when you receive the money, potential tax issues may arise if you don't repay the loan as agreed. If you default on the loan, it is considered a distribution and is subject to income taxes. Furthermore, if you are under age 59 1/2, you may also be hit with a 10% early withdrawal penalty. There may also be tax implications if you leave your job while you have an outstanding loan. If you don't repay the loan within a specific period (usually 60 days), it may be considered a taxable distribution. Another drawback of a 403(b) loan relates to the opportunity cost. The interest you pay back into your account is often less than what you could have earned if your funds had remained invested in the market. This means that while you might benefit from short-term access to cash, you could be missing out on significant investment growth over the long run. Repayment of a 403(b) loan is typically made through payroll deductions. This means your employer automatically deducts the loan payments from your paycheck and sends them to your 403(b) account. This arrangement makes it easy to stay on track with your repayments and ensures that your loan is paid off within the required time frame. It's important to note that the interest you pay on your loan is not tax-deductible. This is because your loan payments are made with after-tax dollars. While most 403(b) loans are repaid through regular payroll deductions, some plans may allow you to repay your loan in a lump sum. This might be an option if you receive a windfall or have other funds available. Paying off your loan early can help minimize the impact on your retirement savings by reducing the amount of time your money is out of the market. However, before making a lump-sum payment, check with your plan administrator. Some plans might have penalties or fees for early repayment. If you fail to repay your 403(b) loan according to the agreed-upon terms, your loan may go into default. This can have serious consequences. The outstanding loan balance will be considered a distribution and will be taxable. Additionally, if you're under age 59 ½, you may also be subject to a 10% early withdrawal penalty. A loan default can also impact your credit score. While taking out a 403(b) loan does not require a credit check, defaulting on the loan can be reported to credit bureaus, potentially damaging your credit rating. Applying for a 403(b) loan generally requires completing a loan application through your plan administrator. This application will typically require you to provide details about the loan amount you're requesting, the reason for the loan, and your proposed repayment plan. In addition to the application, you may also need to provide documentation supporting the need for your loans, such as medical bills, real estate contracts, or tuition invoices. Your plan may have additional documentation requirements as well. Once you've submitted your application and any required documents, your plan administrator will review your request. Approval generally depends on whether you meet your plan's requirements for loans and whether the reason for your loan is considered a qualifying event under IRS rules. If your loan is approved, the funds are typically disbursed directly to you, either by check or direct deposit. The entire process can take anywhere from a few days to a few weeks, depending on your plan's procedures. Before considering a 403(b) loan, it's worth exploring other options that might help you address your financial needs without tapping into your retirement savings. A good starting point is to revisit your budget and look for areas where you might be able to reduce expenses or increase income. Financial planning can help you manage your money more effectively and potentially avoid the need for a loan. Another alternative to a 403(b) loan is to establish and maintain an emergency fund. This is a savings account that you keep separate from your other funds and that you can tap into in case of financial emergencies. While it takes time and discipline to build an emergency fund, it can be a valuable resource when unexpected expenses arise. Depending on your specific needs and circumstances, other types of loans might be more appropriate than a 403(b) loan. For example, if you're buying a home, a mortgage might be a better option. For education expenses, student loans might be more beneficial. Personal loans and home equity loans or lines of credit might also be worth considering. Be sure to compare the terms and costs of these alternatives to those of a 403(b) loan before making a decision. A 403(b) loan refers to a loan taken out from an individual's 403(b) retirement account, which is typically provided to employees of public schools, certain non-profit organizations, and some members of the clergy. It provides access to funds for financial needs, lower interest rates compared to traditional loans, and does not require a credit check. However, there are significant disadvantages to consider. Taking a loan from a 403(b) account can negatively impact long-term retirement savings by missing out on potential investment growth. Tax implications and penalties may arise if the loan is not repaid as agreed, and the interest paid on the loan is not tax-deductible. Additionally, the limited investment growth potential of the funds used for the loan can result in missed long-term earnings. When considering a 403(b) loan, individuals should carefully weigh the advantages and disadvantages against their financial needs and long-term retirement goals. What is a 403(b) Loan?

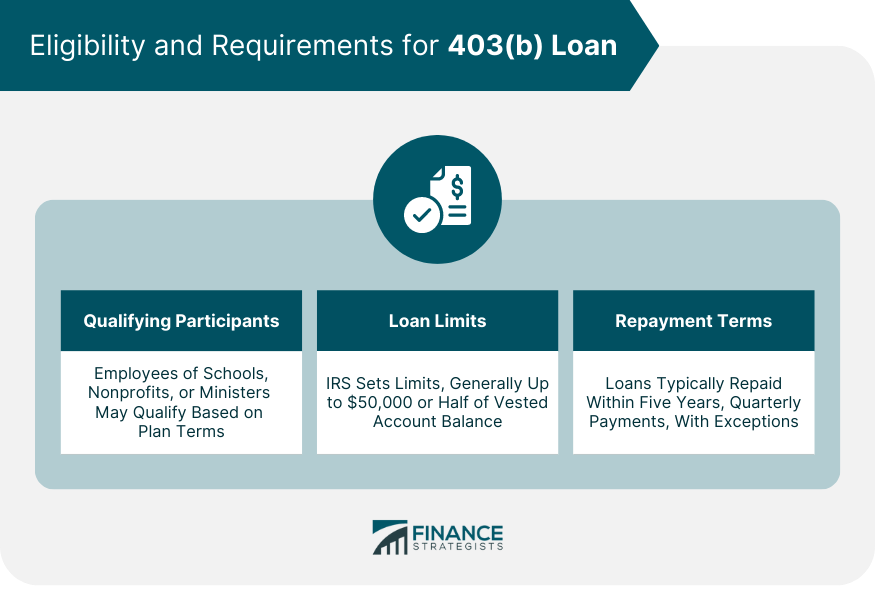

Eligibility and Requirements for 403(b) Loan

Qualifying Participants

Loan Limits

Repayment Terms

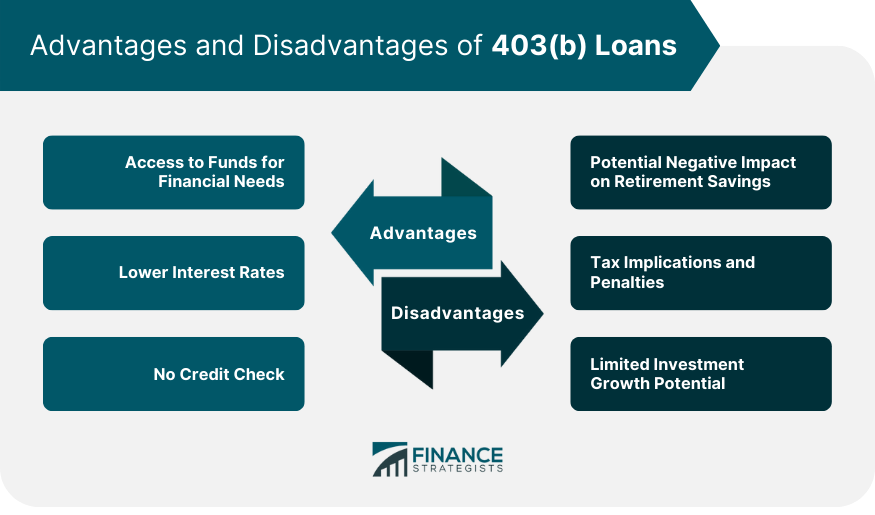

Advantages of 403(b) Loans

Access to Funds for Financial Needs

Lower Interest Rates

No Credit Check

Disadvantages of 403(b) Loans

Potential Negative Impact on Retirement Savings

Tax Implications and Penalties

Limited Investment Growth Potential

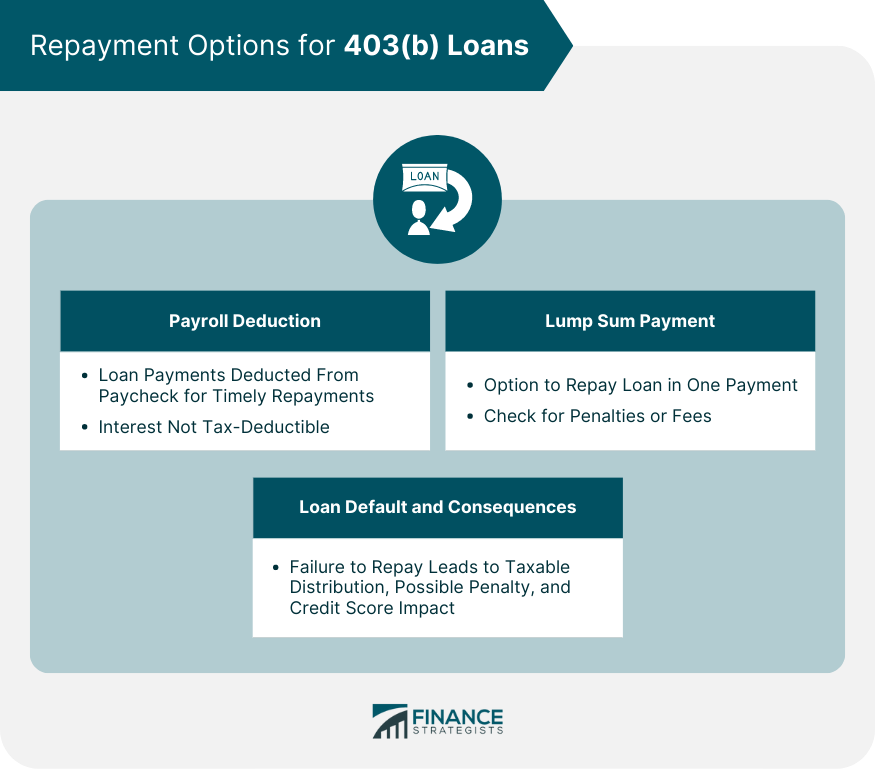

Repayment Options for 403(b) Loans

Payroll Deduction

Lump Sum Payment

Loan Default and Consequences

Application Requirements for 403(b) Loan

Documentation and Forms

Loan Approval and Disbursement

Alternatives to 403(b) Loans

Financial Planning and Budgeting

Emergency Funds

Other Loan Options

Conclusion

403(b) Loan FAQs

Not everyone. Only participants in a 403(b) plan are eligible, and even then, the specific plan must allow loans. Participants usually include employees of public schools, certain non-profit organizations, and members of the clergy.

The maximum amount you can borrow is the lesser of $50,000 or half of your vested account balance. If your vested balance is less than $10,000, you may borrow up to that amount.

If you fail to repay your 403(b) loan as agreed, it can go into default. This has several consequences: the outstanding balance is considered a distribution and is taxable; if you're under age 59 ½ , you may also be hit with a 10% early withdrawal penalty; and the default can be reported to credit bureaus, which could harm your credit rating.

This depends on your specific plan. While some plans may allow early repayments without any penalties, others might charge fees for early repayment. Check with your plan administrator for details.

Before resorting to a 403(b) loan, consider other options such as revising your budget, using an emergency fund, or looking into other types of loans like personal loans or home equity loans. It's always a good idea to consult with a financial advisor before making such a significant decision.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.