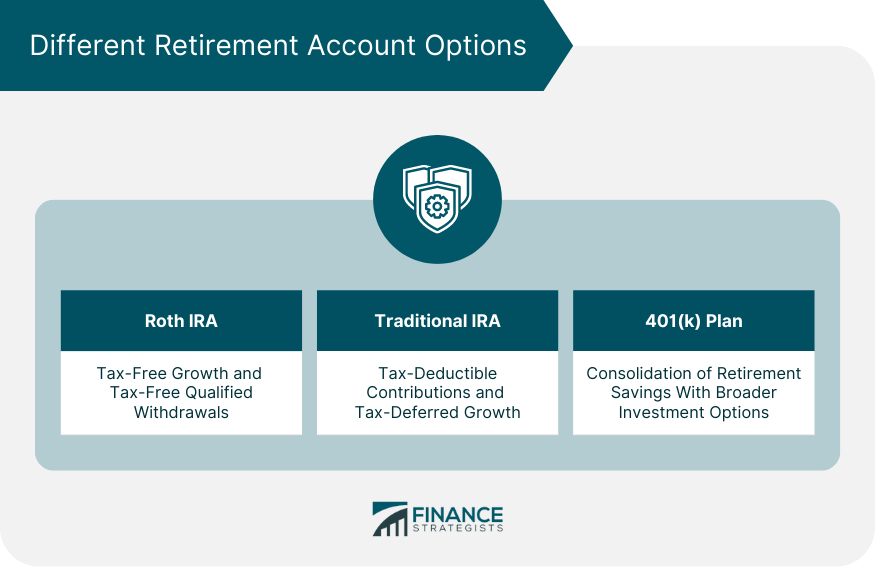

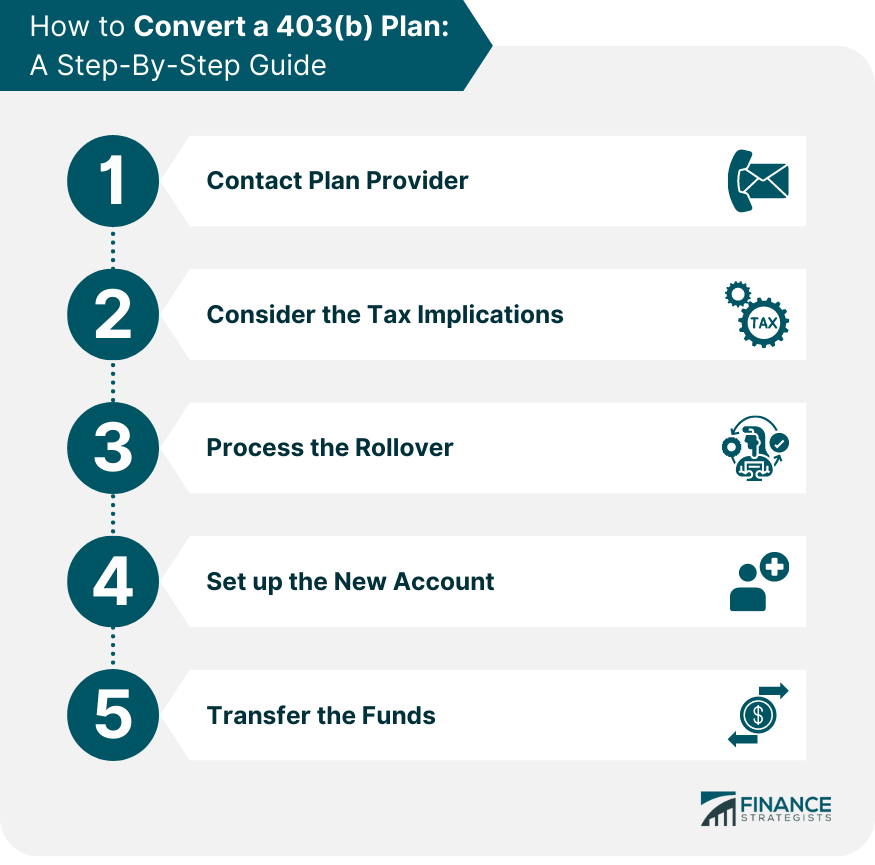

The 403(b) plan conversion process involves transferring funds from a 403(b) plan to another retirement account, such as a Roth IRA or Traditional IRA. The 403(b) plan is a tax-advantaged retirement savings plan designed for certain public school employees, tax-exempt organization employees, and ministers. The purpose of such a conversion can be to diversify tax exposure, capitalize on different benefits offered by different accounts, or consolidate multiple accounts. It's important for readers to understand that this process involves crucial considerations, such as potential tax implications and possible penalties. The context of a 403(b) plan conversion is typically long-term financial planning, and it can significantly impact the amount of money individuals have available when they retire. Hence, it requires careful thought and potentially professional advice to ensure optimal financial outcomes. When considering a conversion from a 403(b) plan, individuals have various retirement account options available to them. One popular choice is the Roth IRA, which offers tax-free growth and tax-free qualified withdrawals in retirement. By converting funds from a 403(b) plan to a Roth IRA, individuals can potentially enjoy tax advantages in the future. Another option is a Traditional IRA, where contributions are typically tax-deductible, and investment earnings grow tax-deferred until withdrawals are made in retirement, at which point they are subject to taxation. Additionally, individuals may consider converting their 403(b) funds to a 401(k) plan if they have changed employers. This conversion can consolidate retirement savings into one account and potentially offer a broader range of investment options. It's important to carefully evaluate each retirement account option based on personal financial goals, tax considerations, and individual circumstances before making a decision about a 403(b) plan conversion. Seeking guidance from a financial advisor can help individuals navigate the complexities and make informed choices regarding their retirement savings. The conversion process begins by reaching out to your 403(b) plan provider. They can give you specific details about the conversion process, including any forms you need to fill out. The tax implications of a 403(b) plan conversion can be significant. Since contributions to a 403(b) are made with pre-tax dollars, converting these funds into an account funded with after-tax dollars (like a Roth IRA) will trigger a taxable event. Once you've decided to proceed with the conversion and are prepared for the tax implications, the next step is to process the rollover. This involves transferring the funds from your 403(b) to the new account. Depending on the specifics of your plan and provider, this could be a straightforward or slightly complex process. If you don't already have a Roth IRA, you'll need to open one before you can roll over your 403(b). When choosing a provider, consider factors like investment options, fees, and customer service. Once the new account is set up, you can then initiate the transfer of funds. It's crucial to ensure the transfer is handled correctly to avoid any unnecessary early distribution penalties. Before you proceed with a 403(b) plan conversion, it's crucial to understand the concept of taxable income. In essence, taxable income refers to the portion of your income that is subject to taxation. When converting a 403(b) plan to a Roth IRA, the pre-tax contributions and any earnings will be considered taxable income. Therefore, it's important to estimate these potential tax liabilities ahead of time to avoid any unpleasant surprises. A thoughtful strategy can help manage the tax implications of conversion. For instance, you could consider spreading the conversion over several years to avoid bumping yourself into a higher tax bracket. Consult with a tax advisor to determine the best strategy for your situation. Proper record keeping is crucial after converting your 403(b) plan. This includes keeping track of any paperwork related to the conversion, such as forms and statements. Good records can help you accurately report the conversion on your tax return. If the conversion process is mishandled, it can result in early withdrawal penalties. Understanding these penalties can help you avoid them and ensure a smooth conversion process. After the conversion, you may continue making contributions to your new account. The rules for these contributions will be based on the new account type. Converting a 403(b) plan to a different retirement account, like a Roth or Traditional IRA, can be a strategic move within one's financial planning. The process, while complex, can offer tax diversification and potential benefits unique to each account type. However, it's crucial to understand the tax implications and possible penalties to avoid unpleasant surprises. Analyzing the differences between a 403(b) and a Roth IRA, like the tax treatments and withdrawal rules, is an essential part of the process. As you navigate this transition, remember the importance of contacting your plan provider, correctly processing the rollover, and maintaining diligent records. Furthermore, keep in mind that this process should align with your long-term retirement goals and overall financial circumstances. Given the complexities involved, seeking professional advice may be beneficial for an optimal outcome.What Is 403(b) Plan Conversion Process?

Different Retirement Account Options

Roth IRA

Traditional IRA

401(k)

How to Convert a 403(b) Plan: A Step-by-Step Guide

Contact Plan Provider

Consider the Tax Implications

Process the Rollover

Set up the New Account

Transfer the Funds

Tax Implications of a 403(b) Plan Conversion

Concept of Taxable Income

Potential Tax Liabilities

Considerations After a 403(b) Conversion

Record Keeping

Potential Penalties

Continuing Contributions After Conversion

Conclusion

403(b) Plan Conversion Process FAQs

The first step in the 403(b) plan conversion process is contacting your 403(b) plan provider. They can give you specific details about the conversion process and provide the necessary paperwork.

The main tax implication to consider is that converting your 403(b) plan to a Roth IRA creates a taxable event. This means the pre-tax contributions and any earnings in your 403(b) will be taxed as income in the year of conversion.

Yes, after the 403(b) plan conversion process, you can continue making contributions to your new account according to the rules of that account.

If the conversion process is mishandled, you could face early withdrawal penalties. Understanding these potential penalties and ensuring the transfer of funds is handled correctly can help you avoid them.

In the 403(b) plan conversion process, a Traditional IRA can act as a bridge between the 403(b) plan and the Roth IRA. Funds can be rolled over from the 403(b) to the Traditional IRA without incurring immediate taxes, and then later converted to a Roth IRA.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.